Private Equity vs Venture Capital - Differences and Similarities

There's a fine line between private equity and venture capital firms. Many get them confused because they both invest in private companies and attempt to sell that equity at a profit down the road.

Yet there are several critical differences between the two. Venture capital and private equity firms differ in investing structure, strategy, compensation, and more. Here’s what you need to know.

What is the Difference Between a Private Equity Firm and a Venture Capital Firm?

There are several characteristics of a private equity firm that set it apart from a venture capital firm.

- Invest in established companies.

- Work with companies on operations.

- The goal is to improve efficiency, which then improves the bottom line.

- Typically acquire 100%, or at least a majority, of the companies they invest in.

- Invest in a wide variety of companies. If a company's processes can be improved, then it has a distinct appeal to private equity firms.

Private equity firms, unlike venture capital firms, invest in established companies that are somehow struggling. They then work with the companies over a period of time, which varies, to streamline the business, improving efficiency and, as a result, profits. They can do this because they acquire 100% or a majority stake of the company.

Private equity firms, unlike venture capital firms, invest in established companies that are somehow struggling. They then work with the companies over a period of time, which varies, to streamline the business, improving efficiency and, as a result, profits. They can do this because they acquire 100% or a majority stake of the company.

What is a VC Firm?

Here’s what separates venture capital firms from private equity firms:

- Invest in startups

- Invest in less than a majority of equity in a company

- Prefer to diversify across a broad array of startups as they are unpredictable and often fail

- Venture capital firms invest in startups in technology, clean technology, and biotechnology

Venture capital firms invest in companies with both a high risk and a high reward. Because of this, they spread their investments more to prevent a failed investment from significantly impacting the fund. While private equity firms invest in a wide array of different types of companies, venture capital firms invest in startups in technology, clean technology, and biotechnology.

Venture capital firms invest in companies with both a high risk and a high reward. Because of this, they spread their investments more to prevent a failed investment from significantly impacting the fund. While private equity firms invest in a wide array of different types of companies, venture capital firms invest in startups in technology, clean technology, and biotechnology.

Compensation in Venture Capital vs. Private Equity

The compensation structures in private equity and venture capital are quite similar. A lot depends on the success of the firm and how long you’ve been there - these factors determine your carry. Typically, pay in private equity is more than in venture capital. To illustrate a point, an associate in private equity typically makes around $245k all-in while an associate in venture capital can expect to make anywhere from $130-250k.

As you climb the ladder towards higher roles, the pay gap tends to increase between private equity and venture capital in favor of private equity.

Private Equity Venture Capital Hours

Here’s some insight from @More Leverage", a venture capital vice president, regarding the hours and work-life balance in both private equity and venture capital.

It's very hard to answer this question because hours vary so much from firm to firm. Some firms will grind you to the bone and continue to do so for a long time. Others are more laid back and allow you to have a life.

A few generalities I've found to be somewhat (though not always) accurate: my perception is VC typically has slightly better hours (though I have only worked in PE so I'm not 100% sure); bigger firms usually work longer hours; you will almost always work at the very least 50 hours per week regardless of the firm unless you own the place; majority of firms will fall between 55-75 from what I've seen and heard.

I'm speaking of a typical work week. All bets are off, regardless of firm, if you are closing a deal (but some firms do a better job of managing this process without staying til midnight than others).

I'm speaking of a typical work week. All bets are off, regardless of firm, if you are closing a deal (but some firms do a better job of managing this process without staying til midnight than others).

While it absolutely varies on a firm-to-firm basis - in general - private equity firms have fewer hours.

Recruiting and Exit Opps for PE and VC

So how does one go about getting a job at either of these types of establishments? First, it’s important to understand that both employ a different type of recruiting process.

In most cases, private equity firms recruit on-cycle. On-cycle recruiting is an accelerated process which begins in January. They quickly evaluate you based on mostly technicals and your academic background. On-cycle recruiting for private equity firms often starts as soon as six months into your first investment banking job. That’s another thing: private equity recruits mostly from current investment bankers and MBA candidates.

Venture capital firms recruit off-cycle, which is typically a slower process. Because it’s off-cycle, there isn’t a set time that most venture capital firms recruit. Unlike private equity, venture capital recruits from a wide array of backgrounds. They evaluate you based on your qualities more than your technicals - networking, sales, market knowledge, etc.

PE vs VC - Exit Opportunities

Exit opportunities between private equity and venture capital firms vary quite a bit. Here’s some insight from @ews09" regarding venture capital exit opportunities.

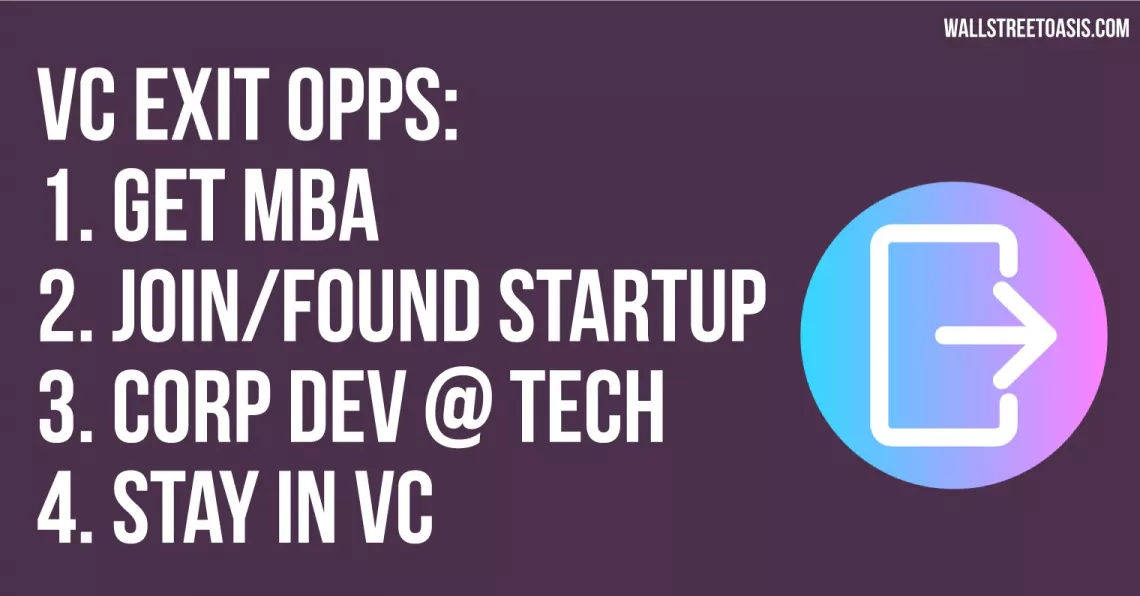

In terms of exit opps, the main ones are:

In terms of exit opps, the main ones are:

- Get an MBA.

- Join/found a startup.

- Go into a corp dev role at a tech company.

- Stay in VC.

The first is by far the most common path. After a few years as a VC analyst, you should be well positioned to get into b-school, and then you'll have a ton of opportunities.

You could also join a startup. I know some ex-analysts who go on to either create or become an early employee at one of their firm's portfolio companies. You should only do this if you really believe in a particular startup.

The third option is to do corp dev at a tech company. Pretty self-explanatory.

And finally, you can try staying in VC. This basically requires getting an MBA though, because non-MBAs are generally not put on the partner track.

As for your last question, yes, in some ways, you will be locking yourself in a niche. You can't transition easily to other finance careers like PE or HF. You'll be limited to the domain of technology/entrepreneurship. But that's a very broad domain, and within that, there are tons of options.

Should I Pursue PE or VC?

Which one is better? The two different firms offer different types of work, different opportunities, and different lifestyles. There is no universal "better" choice; it’s entirely up to you to decide which one might suit you.

Interested in Private Equity - Here's What You Need to Break In

Private equity is recruiting is ten times more cut-throat than anything you've ever experienced before. If you want to break into private equity, you need to be well-practiced in the technical aspects of the interview. The package is worth well more than the $299 price; the job prospects you set yourself up for are worth far more than $299.

...

It's very hard to answer this question because hours vary so much from firm to firm. Some firms will grind you to the bone and continue to do so for a long time. Others are more laid back and allow you to have a life. A few generalities I've found to be somewhat (though not always) accurate: my perception is VC typically has slightly better hours (tho I have only worked in PE so not 100% sure); bigger firms usually work longer hours; you will almost always work at the very least 50 hours per week regardless of the firm unless you own the place; majority of firms will fall between 55-75 from what I've seen and heard. I'm speaking of a typical work week. All bets are off regardless of firm if you are closing a deal (but some firms do a better job of managing this process without staying til midnight than others).

One thing I would add is just in reaction to your being "willing" to work for firms in these industries. You may be willing but they have no shortage of people who are willing to fill these seats in many cases. You will have to work hard, have a good track record, and still need some luck to get into one of these firms. Furthermore, you likely won't have multiple spots to choose from, particularly if you are just coming in after 2 years as an IB analyst. You take what you get to some extent and make the best of it. Over time you can work to move toward certain firms or industries or strategies, but there is always some level of "take what you get" in this industry all the way up to partner. These jobs are few and far between and it is not easy to switch firms (particularly once you have carry that vests over 5-10 years and are tied up under a non-compete).

Impossible for an exact answer because every firm is different. But in general, VC has less hours and is much less modeling and diligence intensive than PE. PE is the most granular. However, PE typically pays more base and bonus, esp at the more the junior levels.

Fucking millenial opinion of oneself being special and willing to work somewhere. You'll be lucky if they'll have you.

If English isn't your native language I apologize in advance.

I can only answer for VCs/growth equity and it really depends on the structure/hierarchy of the VC. If you are the lone analyst in a 10 member team with 8 senior level people then there would be some late nights. But if you are in a group of 5 analysts and 3 associates, 2 principals and 3 partners then it would be different. But the former is much more common.

I've worked in VC, Growth and PE, all at firms with at least $1B in in AUM, and one with $5B+.

Hours: PE > Growth > VC

Pay: PE > Growth > VC

Important thing to think about: There are limited spots and there are literally 100 kids willing to not have a life if it means they get the job over you.

For those in the industry, if one wanted to pursue pharma/biotech would the work be more interesting in PE or VC?

Why PE over VC? (Originally Posted: 11/28/2016)

There is a lot of focus on the obvious IB --> PE path, with PE as the ultimate end goal. But why? And specifically to my question, why private equity versus venture capital investing, which may seem to some more "trendy" and perhaps more exciting and does not necessitate 2 years of IB hell.

My guess would be, that it is far easier to make a ton of money in PE than it is in VC.

Private Equity vs. Venture Capital (Originally Posted: 02/15/2018)

I generally know the difference between PE and VC, but I'm wondering if PE firms invest in new startups like VC firms ever or if they only do full-fledged companies and/or well-established startups.

Hi joedaddy179, whoops, looks like nobody chimed in here.... maybe one of these discussions below is relevant:

No promises, but thought I'd mention a few relevant users that work in the industry: threepoints Cathy6792 marcoswp

You're welcome.

VC or PE internship to IB (Originally Posted: 04/08/2012)

Hi

If ones goal is to work in IB for at least 2 years FT, would a VC internship be as helpful as an IB internship in securing the FT role? What about a PE internship.

Purely hypothetical.

Thanks.

IB internship better

I did a lot of PE internships and they didn't help me much with IB. They hurt me alot actually because all my interviews focused on why IB, and I didn't 'fit' well with some great firms because they felt like I would jump to PE way too soon.

But. My PE internships were 10x better than IB. Better hours, more interesting work, less pitcing.

what type of work were you given in your PE internships? i am looking at some shops in LA but already have a summer offer at a boutique IB and wanted to weigh the options against each other for some lower tier BB banks or HLHZ LA for FT recruitment if possible...

thoughts? thanks.

Some modeling, some market DD, even M&A DD for to manage the portfolio companies.

Only made 1 pitchbook within 4 PE internships.

Does PE or VC Have Greater Influence On Your Life? (Originally Posted: 11/14/2013)

Wall Street Journal reporter Becky Pritchard, based in London, is currently living ‘Private-Equity-Free Week.’ This means for this week she will completely avoid products and services fully or partially owned by PE or VC firms.

Sound easy? She’s having a bit of trouble thus far already. Can’t go into the WSJ office, as Dow Jones is partially-owned by Blackstone. Can’t go to the local pharmacy Boots (KKR) or eat at the local Pret a Manger (Bridgepoint). You get the idea.

But it begs the question, does PE or VC have more influence over products you encounter in your daily life? Sure, Miss Pritchard cannot go to her office even, or eat at a favorite restaurant, or shop at her usual drug store, but neither can she use Facebook (Greylock), Twitter (Benchmark), Spotify (Wellington), or WhatsApp (Sequoia). At the risk of over-simplifying the situation, it seems as though PE firms directly affect her physical world while VCs influence her digital persona. So which will she care about more by the end of the week? I’m eager to find out.

Yes, although it’s a rather silly experiment that only a journalist really searching for a spin could come up with, it makes you think:

Would your life be more affected without PE or VC-funded organizations?

this is retarded

I read the OP and when I scrolled down I literally lost it at this comment. So true.

This has to be the dumbest thought experiment of all time.

By definition, the shareholders of every business in the United States are either private or public. It makes virtually no difference to anyone other than - you know - the shareholders.

" I also threw real estate into the mix, so The Wall Street Journal’s office in London where I work, which is part of the Broadgate Estate and is partially owned by Blackstone, is a no-no."

Ha, looks like this whole private equity free week thing is simply an elaborately lame ploy by Ms Pritchard so she can avoid going to work for a week. While Ms Pritchard, as a naive young journalist can be forgiven for not knowing any better, I am puzzled that her editor, who is presumably older and wiser, thinks that this is somehow a good idea and deemed it worthy of publishing by the WSJ.

"I’m not doing this because I think private equity is bad. But I want to get a feel for how the world of high finance fits with my everyday life... it all feels disconnected from everyday life."

Perhaps for Ms Pritchard's next assignment she can do an immigrants-free week by avoiding all businesses that are owned by/employ immigrants or non-white people. She won't be doing this because she thinks colored people are bad obviously, but just so she can gain a better feel for how the world of people migration fits with her everyday life.

+1

Debitis ipsa ipsa voluptas exercitationem laudantium repellat deserunt. Iste corporis aut cumque. Molestiae dolorem consequatur eveniet quas dolores pariatur numquam. Dignissimos est sit in nostrum in quo itaque. Numquam repellat ut et et repellendus saepe officiis officia. Consequuntur asperiores consequatur laboriosam dolorum.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Veritatis placeat ex aut similique nulla ut facilis. Ut similique nulla necessitatibus. Earum laboriosam voluptate dolorem magnam. Totam tempora omnis et aut.

Qui commodi velit ut magni est consequatur. A eligendi alias assumenda qui. Voluptatem laudantium voluptatem consectetur.

Quo qui sunt aut excepturi. Vel consequatur voluptas qui ipsum libero repellat. Error quidem alias ipsam adipisci delectus at. Minima quas eius iste amet vel sunt.

Quia consequatur aut consequatur. Accusantium itaque dicta labore perspiciatis dolor. Quasi nisi eligendi blanditiis beatae. Veritatis iste sunt doloribus assumenda. Voluptatum qui totam sit facilis nihil. Adipisci placeat tempore dicta voluptatem maiores voluptates.