On July 15, Janet Yellen made news with her semiannual policy testimony to Congress, with her views on interest rates, bubbles and the debt market. After making clear her intentions to continue with

quantitative easing (QE) and keep rates low, she also provided her thoughts on

whether the Fed’s policies were creating a market bubble. While she said that valuations were not in bubble-territory for stocks overall, the Fed report that was released in conjunction with her testimony suggested that “

valuation metrics in some sectors appear substantially stretched– particularly those for smaller firms in the social media and biotechnology industries”. While the Fed (or

any central bank) does sometimes make generic (and opaque) statements about overall market valuations, it is unusual for it to be this specific about individual sector valuations. In my view, it not only over stepped its bounds but strayed far from its expertise, which is not valuation.

Is social media over valued?

Those who have been readers of this blog know that I am fascinated with both the valuation and pricing of social media stocks. On Facebook, I thought the stock was priced too high at the initial offering, friended it after the market overreacted to early negative earnings reports and unfriended it after a price run up (and perhaps too early). On Twitter, I have been consistently skeptical about the reach of the company's business model, arguing that their advertising model restricted them to being a lesser player (even if successful) in the overall online advertising market.

My “conservative” valuations of Twitter and Facebook should make clear that I am not a social media company cheerleader, but I was perplexed by the Fed’s contention that the valuation metrics it was looking at suggested that social media and biotech stocks were over valued. What are the metrics that are being used to make the judgment? Clearly, they cannot be the conventional pricing ratios that investors use, such as

PE ratios or an

EBITDA multiples, since neither is particularly effective at assessing companies in a young sector. Perhaps, it is some version of a revenue multiple (

EV to Sales or Price to Sales), but there again looking at what multiple of current revenues a company trades at, when those revenues can double or triple over the next two years is not indicative of valuation. As I see it, the only metric that consistently explains differences in market prices across social media companies is the number of users at each of these companies, and

I used this relationship to explain why Facebook would pay $19 billion for Whatsapp. It is possible that the Fed has come up with a creative way of explaining what the “right” value per social media user should be, but creativity in valuation has never been (and will never be) the Fed’s strong suit.

There is a case to be made that social media company are collectively being over valued and that case does not rest on valuation metrics or multiples. It stems from a common phenomenon in young sectors, where investors in individual companies price their companies on overall market potential but either misassess or ignore the fact that the overall market is not big enough to support all of them (and new entrants). This is the point

I was trying to make in my post on micro and macro mistakes, where I used the pricing of social media and young tech companies that are in the online advertising space to back out implied future revenues and argued that if the market is right on each individual company, the collective market share of these companies would be well in excess of the total online advertising market a decade from now. Note that even if you buy into this argument, you may still invest in an individual social media company (Facebook, Twitter or Linkedin), since the winners in this sector can yield superlative returns, even if the sector goes through a correction. The analogy would be to

investing in Amazon during the dot-com boom and holding through the carnage of the dot-come bust; an investor

who bought Amazon at is absolute peak in late 1999 and held through 2014 would have quadrupled her money and generated a compounded

annual return of over 11% a year. With biotechnology companies, making judgments about overall valuation is even more fraught with danger because the pricing of these companies is a probabilistic exercise (dependent upon the drugs that are working their way through the FDA pipeline and their blockbuster potential) and comparing pricing across time is close to useless.

In short, the Fed’s solicitude for investors in these high growth sectors is touching but investors in social media and biotechnology companies are grown ups, playing at a grown up game, i.e., trying to pick the winners in a sector that they may believe is over valued. They may be suffering from all of the behavioral quirks that get in the way of investment success, including over confidence and a

herd mentality, but it is their choice to make.

The Fed as Market Guru and Sector Prognosticator

Some of the fundamental parameters (interest rates, the term structure,

economy growth) that drive both

asset allocation and security selection are affected by Fed policy, with changes creating winners and losers among investors. If you view investing as a sport, the Fed’s role is closer to that of an umpire or a referee than it is to being a player. Thus, statements about specific sectors, such as those made in the most recent Fed reports on social media and biotechnology, come dangerously close to game interference. In fact, if you buy into the Fed’s contentions that the overall market is not over valued, but that social media and biotechnology are, is there not an implicit message that there must be some other sectors that are under valued? If investors believe the Fed, should they be selling their social media and biotech holdings and buying stocks in other sectors?

Even if you accept that the Fed should be doling out investment advice, I think that it is on particularly shaky ground at this junction in history, where there are many who believe that it has kept interest rates at “abnormally” low levels for the last five years (with QE1, QE2, QE3..). I have disagreed with those who attribute monumental powers to the Fed

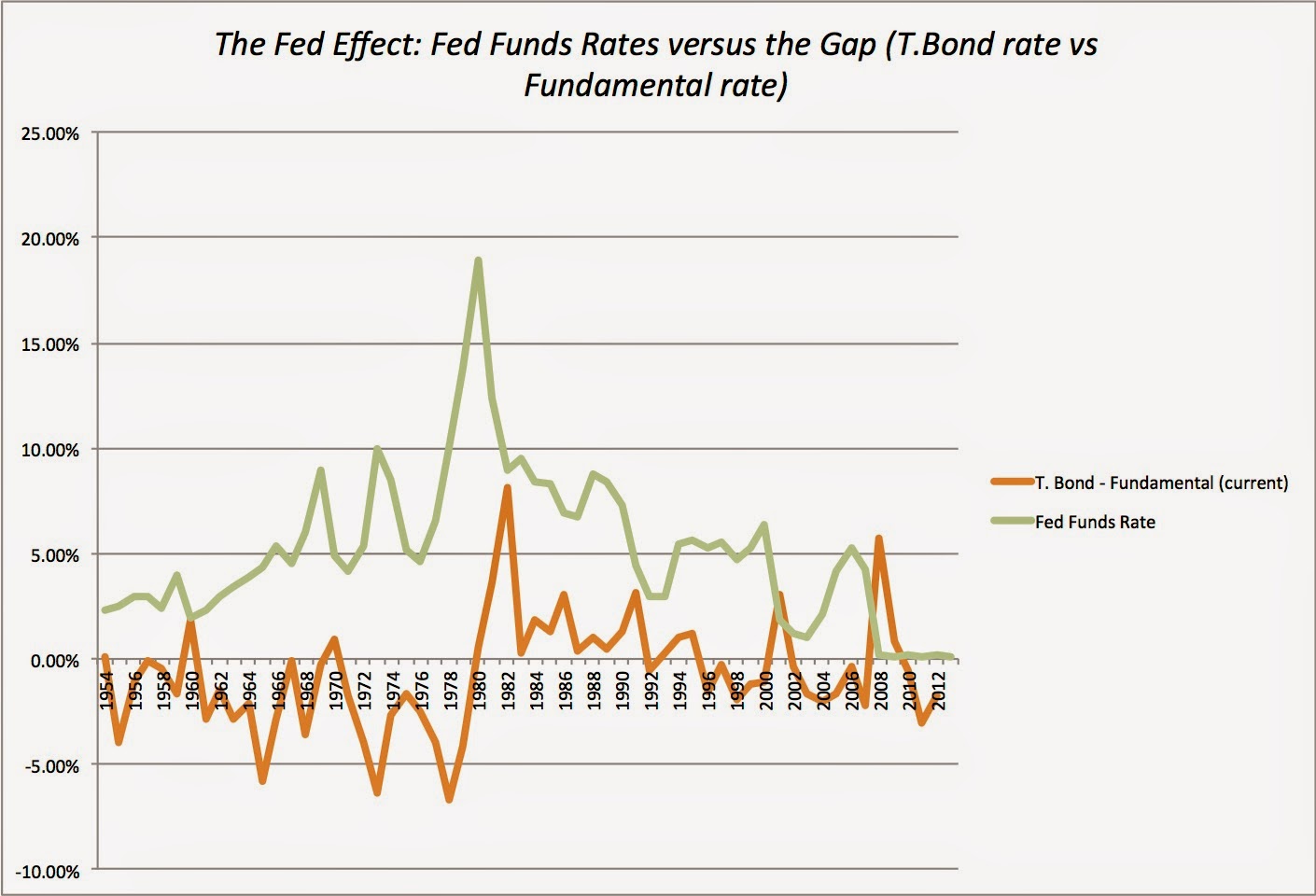

in an earlier post where I compared the Fed Chair to the Wizard of Oz, and argued that rates have been low for the last five years more because of the fundamentals, i.e., anemic growth and low inflation, than because of Fed policy. The crux of this argument is captured in the graph below, where I compare the actual ten-year bond rate to a

fundamental interest rate, computed as the sum of real

growth in GDP and expected inflation:

|

| Ten-year T.Bond rate versus Fundamental Interest rat (GDP Growth + Inflation) |

As you can see, the Fed’s role over the past five decades has been more as a tweaker of interest rates than as a setter of rates, but it is undeniable that the Fed can affect rates

at the margin. In particular, the Fed’s

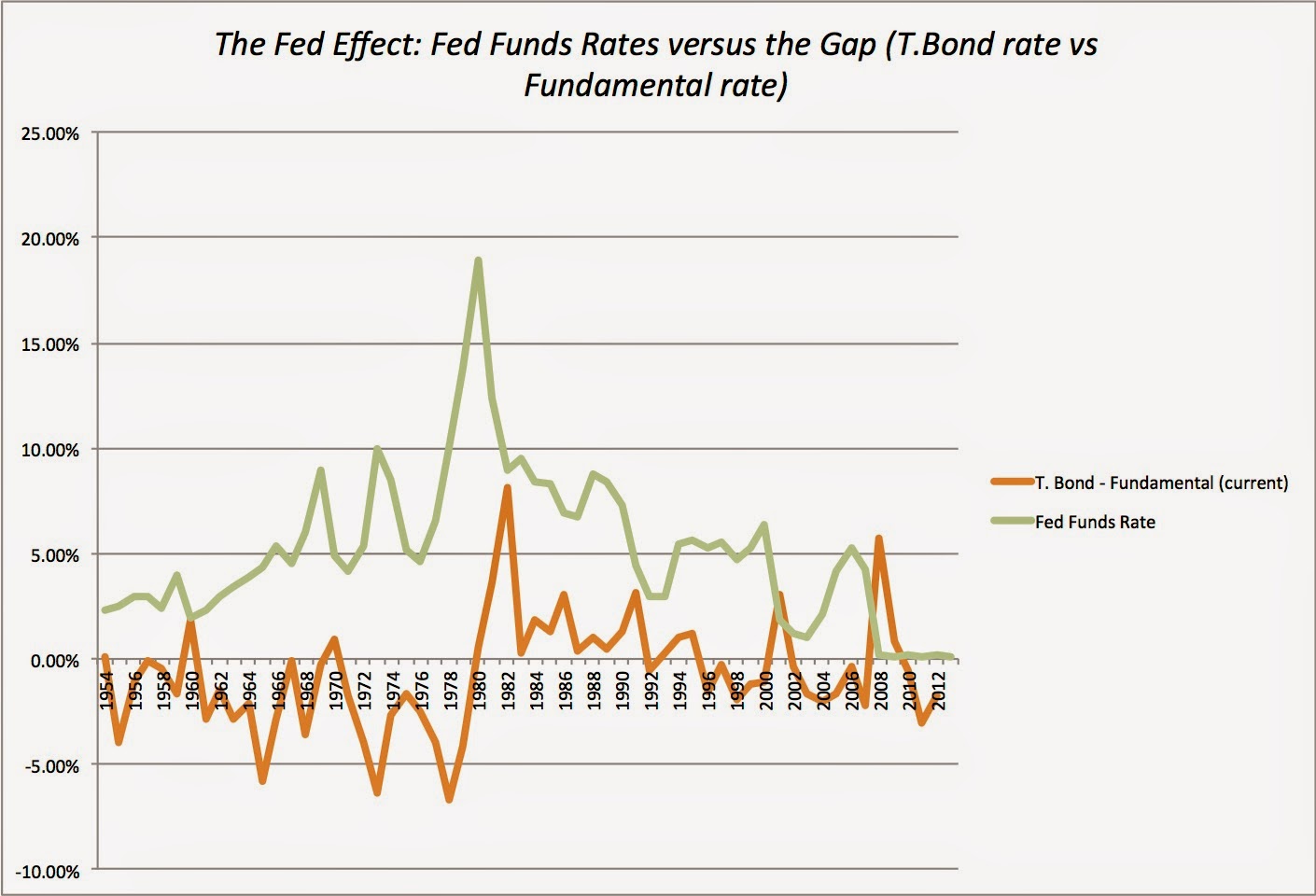

quantitative tightening (in 1980 and 1981) and easing (in both the 2002-06 and 2010-13 timing periods) have had an effect on interest rates. In the figure below, I try to capture the Fed effect by looking at the difference between nominal 10-year T.Bond rates and the fundamental interest rate:

|

| The Fed Effect = T.Bond rate - Fundamental (Negative = Fed Easing, Positive = Fed Tightening) |

Note that negative values are loosely indicative of a "easy money" and a positive values with a "tight money Fed" and you can make the argument that the Fed's actions have kept rates lower than they should be, at least for the last three years.

If you accept the notion that the Fed controls interest rates (that many investors believe and Fed policy makers promote) or even my lesser argument that the Fed has used its powers to keep rates below where they should be for the last few years, the consequences for valuation are immediate. Those lower rates will push up the valuations of all assets, but the lower rates will have a higher value impact on cash flows way into the future than they do on near-term cash flows, making the over valuation larger at higher growth companies. Consequently, a reasonable argument can be made that the Fed has been an active participant in, and perhaps even the generator of, any bubbles, real or perceived, in the market. In

my post on market bubbles, I did agree with Ms. Yellen on her overall market judgment (that traditional metrics are sending mixed messages on overall market valuation) and

used the ERP for the market, as she did, to back my point. In particular, I noted that the implied equity risk premium for the market at about 5% was high by historical standards (rather than low, which would be a

indicator of overvalued stocks). However, breaking the ERP down into an expected stock market return and a

risk free rate does point to an overall disquieting trend:

|

| The Fed's role in Equity Risk Premium Expansion |

Note that all of the expansion in ERP in the last five years has come from the risk free rate coming down and not the return on stocks going up. In fact, the

expected return on stocks of 8% at the end of 2013 is a little lower than it was pre-crash in 2007 and if the risk free rate reverts to pre-2008 levels (say 4%), the ERP would be in the danger zone. Put differently, if there is a market bubble, this one is not because stock market investors are behaving with abandon but because the Fed has kept rates too low and the over valuation will be greatest in those sectors with the highest growth.

Given this history, a Fed (Chair, Governor or Staff report) complaining about frothy valuations and exuberant investors is akin to a bar-owner, who has been serving free beer all day, complaining about all the drunks on the premises. If the Fed truly believes that it has the power to keep interest rates low and that there is a market bubble, the solution is within its reach. Stop the quantitative easing, let interest rates find their natural level and the bubbles (if they exist) will take care of themselves.

The Fed as Economic Custodian

There have been a few commentators who have argued it is in fact the Fed's job to not only keep its eye on market and sector valuations and actively manage bubbles. I disagree for two reasons.

- The Fed does not have a great history as a bubble detector. I am sure that I will be reminded of Alan Greenspan’s comment on irrational exuberance in markets, but few remember that the comment was not made in 1999 or 2000, at the peak of the boom but in 1996. Investors who listened to Greenspan and got out of the market then would have been net losers even a year after the crash.

- Even if the Fed is in the business of bubble detection, let me pose the same question that I did in my earlier post on bubbles: what’s so bad about a bubble? The bursting of the dot-com bubble created losses for those who invested in the stocks, but looking back at the 20 years since these companies entered the market, not only have dot-com companies created substantial value (for themselves and the economy) but have changed our day-to-day lives. It is true that the 2008 market crash created much larger economic costs and damage, but it was less because it was a bubble bursting and more because it was the bubble was centered in the financial services sector. Banks, investment banks and other financial service companies are creatures of the Fed and it is the one sector where the Fed does have both better information than the rest of the market (on the assets and risk in banks), and a clear economic interest in monitoring pricing and behavior. Even within this sector, though, I think that the Fed should be less concerned about pricing bubbles and more concerned with banking behavior. The Fed and banking regulators already have the capacity to monitor and restrict the investment (through risk constraints), financing (through regulatory capital needs) and dividend policies of banks (with veto power over dividend and buyback decisions) and I think that they should continue to do so. As for the rest of the market, is should be neither the Fed’s role nor its responsibility to keep investors from mispricing securities and facing losses, if they do.

The Fed as Nanny

The argument of whether the

Federal Reserve should allow interest rates to rise in the face of a bubble is an age-old one that gets refought every generation.

Benjamin Strong, the governor of the New York Federal Reserve from 1914 to 1928, is said to have argued against letting interest rates rise in his time, using the analogy of investors as children and saying that raising interest rates to puncture a bubble would be like punishing all the kids because a few are misbehaving. That quote may be dated but I think it captures the mindset of many of today's Fed policy makers, with investors being viewed as children and the Fed acting as a super nanny, keeping its unruly and undisciplined charges from misbehaving. It is time for the Fed to stop playing Mary Poppins and started treating investors as grown-ups, capable of making mistakes and living with the consequences, and for investors to stop looking to the Fed for guidance and counsel.

Chairman Yellen here. Let's iron some things out. First off, I don't think you fully understand what occurs behind closed doors over here at the Fed. We're not going through CPK rates for Facebook or Twitter to arrive a perfect valuation. The Zuck and I talked it over, and for his options to fully vest, FB needs to hit certain price targets. Like magic, I say tech is overvalued, people like you disagree, and boom, FB pops $70 a share. Zuck and I are doing cellys with bottle service at Boom Boom Room.

Second point: I'm the BSD around here now. I'm the rainmaker. Not you.

Last point: I hear everyone around here saying "Don't fight the Fed." Completely disagree. Here's my challenge to you: Fight the fed, I dare you :)

P.S. Mine is not only bigger than yours, its WAY bigger.

Eos accusamus praesentium nulla at nesciunt. Debitis nam aliquid voluptatum cumque maxime. Et rem distinctio voluptas voluptas sunt eligendi atque. Ut voluptatem ea magni. Enim similique ut velit maxime.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...