(Plan) B Student

Here’s the thing. If you’re going to break into a house you don’t ring the doorbell. You’ll need to try a side or back door. Shit you might even need to pry open a window and slide through. But the Financial World security system is tight. I’m talking infrared motion detectors and lasers, real life Mission Impossible stuff. You need someone who knows how to disarm the alarm… someone who knows the code.

In other words, YOU NEED TO MEET PEOPLE, people who own some kind of influence in your desired profession. Even if you don’t know anyone who works on Wall Street, or wherever you want to work for that matter, if you look hard enough you have to know someone who knows someone. I don’t care… become friends with a stripper, I’m sure she could make some great introductions for you. The second thing you have to know is, once you meet someone of influence in your desired profession, don’t immediately ask for a job or even an interview. Just tell them you want to come in and sit on the desk, that you want to learn as much as you can. Plant seeds, water when needed and then watch it grow.

I was a B student from Ohio University with a journalism degree and a 970 SAT—impressive I know—sitting in conference rooms all over Wall Street. In the interest of full disclosure, my uncle worked in the business and got me the meetings. But what I quickly realized was that my uncle could get me interviews, but not necessarily employed. What I also realized was that the most important factor to all of these auditions was not if I was right for the job, but did they want to spend twelve hours a day sitting next to me. Was I annoying? Was I a know-it-all? Would I be someone they’d want to get a drink with after work? Oh and was I capable?

Another thing I learned along the way is what I call “the diminishing degree.” With each year you’re in the business, where you went to school becomes less and less important, even if you went to Harvard (Harvard alums are the last to realize this). But once you get your seat, whether it’s in the back office or on the desk, no one gives a shit what it says on your college ring. On the desk or at the desk you’re judged solely on performance. Sure there are a lot of politics and bullshit that comes along with Corporate America, but your diploma is about as relevant as what you were for Halloween in the 5th grade (I was a Killa Klown if you were wondering.)

Another thing you have to know is the interview, audition, or whatever you want to call it, is never over. From my first introduction on Wall Street, I maintained and cultivated every relationship I ever made. I took the time (and it wasn’t a lot) to follow up and thank people who were willing to try and help me. I kept people in the loop. It’s that sweet spot between annoying and forgettable. But I didn’t stop there. Once I got settled into my first job at Morgan Stanley I reached out to everyone I interviewed with across the street and let them know where I landed. Some appreciated my update and took interest in my new career and others just said congratulations and have a nice day. A year later or so I reached out to all of them again just to say hi and update them on my career, but always remaining grateful for what they had done for me in the past. Though the press and Main Street would like you to think otherwise, honor, integrity and gratitude is rewarded on Wall Street. Even five years after I left Morgan Stanley, and went over to the Galleon Group, I reached out to everyone at my first banking job and let them know of my big move. And at a certain point in my career I was even able to return the favors.

And I’ve seen it from both sides. I’ve had countless people contact me and sit by my side on the desk looking to get in. You’d be shocked at the number of them who disappeared when they didn’t get immediate gratification.

I don’t know this for sure, but my presumption is the six or seven students who came up to greet me after my talk at Marist College are already ahead of the rest of the room, even if they’re just B students like I was. Because guess what? If they reach out to me in a few months looking for help or an introduction I’m going to do my best to help them.

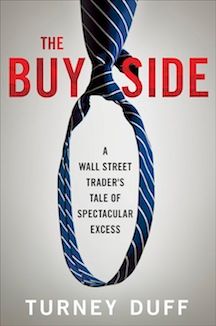

Turney Duff, New York Times bestselling author of The Buy Side

@"Turney Duff" - don't worry, if you make it to WSO Con 2014 you'll have many more than 7 students coming up to say hi :-)

How's Raj? If I were you, I wouldn't waste time talking to kids at those schools. You have better things to do. The truth is they were probably offered extra credit to attend by their Finance professors, and they don't have a clue what Wall Street really is.

I agree with you that your school doesn't matter once you've made it, but we all know that you only made it to FO because you were smart enough to get (or could have gotten) your MBA from HBS.

You can't possibly suck as much as this post implies, could you?

do i need to work on my troll game? i though the 'how's Raj' part really set the tone.

Turney, I would agree the ability to hustle and reach out is the key to breaking in. I am a quant at a BB and I'm keen on getting into a trading or structuring role. Given that I'm not actively in revenue generation, being called to drinks and networking are somewhat difficult. But that is where forums like WSO and discussions like yours play a key role!

OK i admit that i didn't read the book but wasnt it about how you blew up your wall st career through heavy drug use general irresponsibility? if so, why would anyone come up and ask you for a job or career advice? ...just saying...

really solid book - one of the best I've read in a while. (guy can write incredibly well)...

Regardless of past, whether or not your statement is true or not ignores the fact that he reached a level of success most can only dream of...for that alone, I think his persepctive is valuable, no?

agree he has valuable prerspective and had i been a student i would most certainly have attended the event. It just doesnt surprise me that most saw it more as interesting/entertaining as opposed to an opportunity to make a career contact.

Reminds me of Jared Dillian...

Nobody followed me into the bathroom afterwards and asked me how to snort lines of cocaine... Just saying... I respect everyone's opinion - I totally get it if someone doesn't think I can help.

He still made it bigger than 95% of Wall Streeters.

Awesome story thank you

Great post. How long would you say that you would have to know a student to be comfortable with letting them sit in on your desk? Just trying to get an idea, thanks.

Great article. Loved the book.

Is it common for people in the industry to continue to update others they met through networking and interviewing later on in their careers or is this rare?

Anyways, great post and insight, thanks

It worked for me... but I think most people didn't expect it... so it worked to my benefit.

This word "friends" has really lost its meaning since FB, social media. "Friends with benefits", that sounds truer to a woman's soul.

If, [as a student/graduate] you can make a stripper buy you lunch, you got what it takes to make it.

You, have to realize that kids in college have no idea what the real world is like, it doesn't matter if you have done 3 summer internships. From being told from birth that they can do anything and are the best, many kids feel like real work isn't required.

great post. and an excellent book. great insight into wall street and being a trader

I'm reading your book right now, and I'm really enjoying it. Your post-graduation struggle reminds me of where I'm at right now, though I do not have an uncle like yours.

Any advice you have on networking and improving my resume would be greatly appreciated by this aspiring monkey.

I'd say instead of looking directly for a Wall Street connection - maybe try for an indirect connection. Identify a particular interest outside of Wall Street - golf would be ideal, but it could be alum, sports, hunting, politics, a group or organization - whatever - and start to network within that area and make phone calls trying to seek out a Wall Street connection within that world - you'd be amazed at how willing people are to offer help when you share a similar passion.

Thanks a lot Turney!

I've been reaching out to alums, and they've so far been very receptive. Not sure I'm looking to be in NYC (San Fran is more my speed), but I'm sure that your advice is applicable anywhere.

Gr8 post. I agree with all the stuff mentioned above by the OP.

Turney Duff,

I am not as great of a story teller as Lloyd Blankenfein so I’m not going to sit here and state that I am a 4.0 student or have a BS Degree from Harvard (Might've come close if I spent less time playing cards in AC or chasing females). I am neither an actor like Jim Carrey from one of my favorite movies: The Mask -- and I might not be as intelligent as Warren Buffet so this B student out of Rutgers Business School is looking to implement that Plan B. It’s obvious to me that it’s more of “who you know”, rather than “what you know”, and If you Get Organized and make connections, i’m sure it’s possible to put on a disguise, disarm the alarm, and make a clean entrance.

Recently i’ve been noticing a lot of companies (Goldman Sachs, Cantor Fitz, etc.) come to Rutgers to discuss Sales & Trading with students’ nearing graduation. It looks to me that Sales & Trading might be the way to go. Wall Street might be in sort-of a slump at the moment, but perhaps these talks will allow companies to Rejigg their Sales & Trading strategies as more New Grads begin throwing their savings at The Dealer, and perhaps make the Financial District what it once was – Lucrative.

Now I’ve only made 4 or 5 trades in my life – One being after the oil-spill in Mayflower, Arkanses: I through my money on a Green Group (FSLR). So I can’t state that i’m a professional trader, however for a guy looking to break out and learn the ropes, I definitely find your post helpful.

I don’t really know many guys on Wall Street, but I’m definitely on the look out for a handler/mentor. I’m sure there are guys out there willing to help, and I’m sure that I would definitely owe anyone who helped me break out a yearly cut of my salary.

-Kermit gurmitbhatiacom

Who you know is the key if you don't have a resume in the 1% - and you most definitely don't have to be a seasoned trader entering your first job. I know A LOT of senior guys who actually prefer to hire someone who doesn't already have their way of doing things - they want to train you to do it their way... Being teachable is HUGE on Wall Street.

Sed deleniti optio molestiae qui cum. In beatae reiciendis enim quod ut id. Reprehenderit ipsa qui quod architecto. Consectetur eos voluptate odit voluptatem harum.

Sunt qui et et magni itaque explicabo ex mollitia. Voluptatibus et voluptatem delectus eum sunt consequatur qui. Consequuntur temporibus blanditiis molestias eaque et tenetur.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Magni explicabo provident itaque aspernatur. Eaque exercitationem esse eveniet rerum repellat.

Eos est magni qui fugiat. Quasi ea qui neque temporibus ut minus. Vel voluptas et et in. Dolorum deleniti possimus maxime eius.