Possible, Plausible and Probable: Big markets and Networking effects

Mod Note (Andy) - This was originally posted on 7/16/14

I do not know Bill Gurley personally, but I do know of him, and I was surprised, sitting in Vienna airport waiting for a connection home on Friday morning, to get an email from him. In the email, he graciously gave me a heads-up that he was planning to post a counter to my Uber valuation and that it would not pull punches. A little while later, I started getting messages from those who had read the post, with some seeking my response and some seeming to view this as the first volley in some valuation battle. I read the post a few minutes later and the first person I wrote to after I read it was Bill Gurley and I told him that I absolutely loved his post, even though it was at complete odds with my assessment of the company, for two reasons.

- Like anyone else, I like being right, but I am far more interested in understanding Uber's valuation, and the post provided the vantage point of someone who not only is invested in the company but knows far more about it than I do. Rather than berating me for not getting "it" (technology, the new economy, progress) or abusing valuation as a tool from the middle ages, the post focused on specifics about Uber and the basis for its high value.

- In this earlier post of mine, I argued that good investing/valuation is the bridge between numbers and narrative and that neither the numbers nor the narrative people have an automatic right to the high ground. Bill Gurley's post brought home that message by laying out a detailed and well-thought-through narrative, backed up by numbers.

Mr. Gurley's narrative lends itself well to a more grounded discussion of Uber as a company and I am grateful to him for providing it. As a teacher, I am constantly on the lookout for "teachable moments", even if they come at my expense, and I plan to use his post in my classes.

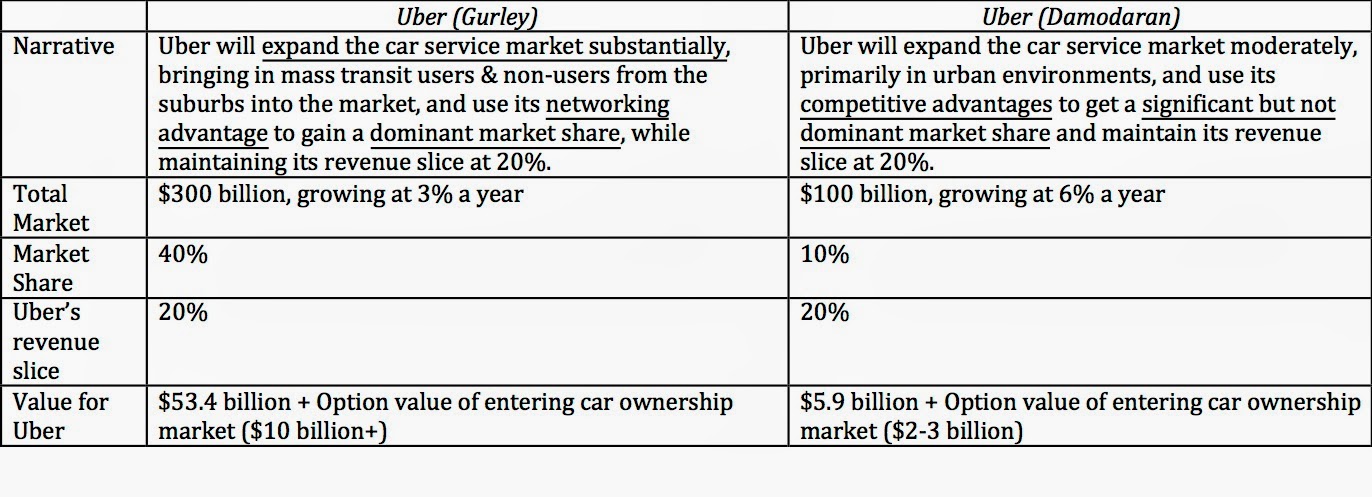

You can download the valuations by clicking here. (Uber (Gurley) and Uber (Damodaran)).

Given that the values delivered by the narratives are so different, the question, if you are an investor, boils down to which one has a higher probability of being closer to reality. If you had to pick one right now, I think Mr. Gurley's has the advantage over mine for at least three reasons. The first is that as a board member and insider, he knows far more about Uber's workings than I do. Not only are his starting numbers (on revenues, operating income and other details) far more precise than mine but he has access to how Uber is performing in its test markets (with the new users that he lists). The second is that as an investor in Uber, he has skin in the game, and more at stake than I do and should therefore be given more credence. The third is that he not only has experience investing in young companies, but has been right on many of his investments.

- Reason to switch: Uber has to provide users with good reasons to switch from their existing services to Uber. For taxi services, the benefits from using Uber are documented well in the Gurley narrative. Uber is more convenient (an app click away), more dependable, often safer (because of the payment system) and sometimes cheaper than taxi service. However, the trade off gets murkier as you look past taxi services. Since mass transit will continue to be cheaper than Uber, it is comfort and convenience that will be the reasons for switching. With car rentals, Uber may be cheaper and more convenient in some senses (you don't have to worry about picking up a rental car, parking it or worrying about it breaking down) and less convenient in others (especially if you have multiple short trips to make). With suburban car service (the aged parents, the dating couple and school bound kids), the problem that Uber may face is that a car is usually more than just a transportation device. Any parent who has driven his or her kids to school will attest that in addition to being a driver, he or she has to play the roles of personal assistant, private investigator, therapist and mind reader. As for date nights, whether Uber succeeds will be largely a function of how much , especially with younger couples.

- Overcome inertia: Even when a new way of doing things offers significant benefits, it is difficult to overcome the unwillingness of human beings to change the way they act, with that inertia increasing with how set they are in their ways. It should come as little surprise that Uber has been most successful with young people, not yet set in their ways, and that it has been slower to make inroads with older users. That inertia will be an even stronger force to overcome, as you move beyond the car service market. The articles that point to young people owning fewer cars are indicative of larger changes in society, but I am not sure that they can be taken as an indication of a sea change in car ownership behavior. After all, there have been almost as many articles on how many young people are moving back in with their parents, and both phenomena may be the results of a more difficult economic environment for young people, who come out of college with massive student loans and few job prospects.

- Fight off the status quo: The empire, hobbled and inefficient though it may be, will fight back, since there are significant economic interests at stake. As both Uber and Lyft have discovered, taxi service providers can use regulations and other restrictions to impede the new entrants into their businesses. Those fights will get more intense as car rental and car ownership businesses get targeted.

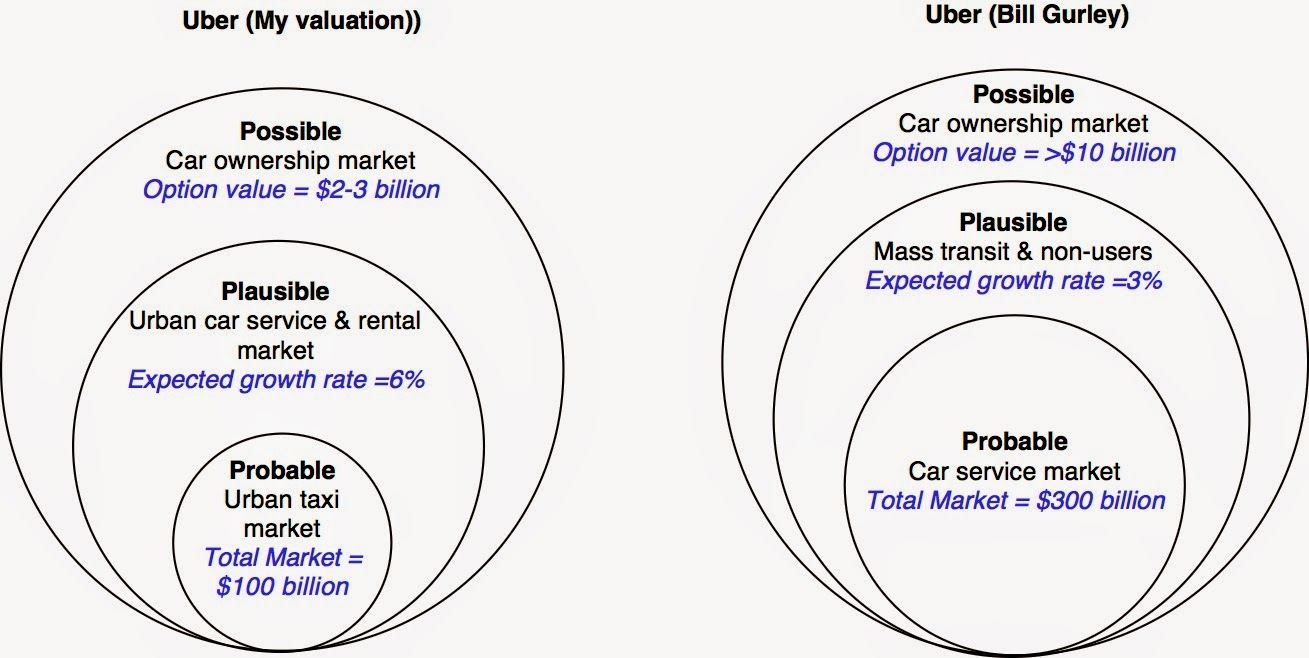

In summary then, the difference in market size in the narratives boils down to a simple calculus of what is probable, what is plausible and what is possible, a distinction that to me is at the center of value:

I think Bill Gurley and I agree on the car ownership market more than we disagree. I see it as a possibility right now and attach an option value of about $2-3 billion to it, partly because it is in the more distant future and partly because Uber's business model in this market is unformed. From Bill Gurley's description of the market, I think he sees it as a possibility as well, though I think he attaches a larger value to it than I do. The reason for the higher value is that it is a conditional possibility, with the likelihood of it happening increasing with the success that Uber has in the car service market.

you, as a user of a product or service, benefit from other people using the

same product and service. If the networking effect is strong enough, it can

lead to a dominant market share for the company that creates it and potentially

to a ‘winner take all’ scenario. The

arguments presented in his post for the networking effects, i.e., pick up times, coverage density and utilization, all seem to me to be point more to a local networking effect rather than a global networking one.

In other words, I can see why the largest car service provider in New York may

be able to leverage these advantages to get a dominant market share in New

York, but these advantages will not be of much use in Miami. There are global networking advantages listed, such as stored data that can be accessed by users in a new city and partnerships with credit car, smartphone and car companies, but they seem much weaker.

market could very quickly devolve into a city-by-city trench warfare among the

different players, with different winners in different markets. Thus, it is possible that Uber becomes the dominant car service

company in San Francisco, Lyft in Chicago and a yet-to-be-created company has

the largest market share in London. For the Gurley Uber narrative to hold, the

global networking advantages have to become front and center and here again, it

is possible that I am unaware of a management initiative designed to do exactly

this.

You suck his dick because he took the time to counter your Uber valuation? Cmon I actually liked and respected your original post. This whole post is a load of bullshit and you just fanboying Gurley for acknowledging your existence.

That was an incredibly asinine comment to make towards a very highly regarded professor who probably couldn't give two shits about how much you like or respect his posts.

I can't ever see this picking up in the suburbs really. Who is willing to give up their car that is next door to call a taxi TWICE to go to the grocery store and back? It is a replacement for taxi and car rental services, which do most of their business in the city, necessarily limiting the market size.

Outstanding rebuttal from Prof. Damodaran : unbiased and well argued. Bill Gurley, of course, wrote a self serving marketing piece where you can drill crater sized holes: probable, plausible and possible are not the same thing.

Vero quidem suscipit voluptatem minima rerum. Nulla autem recusandae itaque temporibus sint sit eius consequuntur.

Nisi dolorem animi voluptate maxime illo. Dolorum aliquid exercitationem voluptatem perferendis.

Quis commodi harum commodi beatae nisi ut. Quam provident tempore magnam vel rem.

Debitis quis magni nostrum quod similique cumque velit. Ut fuga consequuntur repellat laudantium corporis occaecati provident recusandae. Sit earum ut et quibusdam. Quasi id et nostrum temporibus id omnis. Ex velit quo accusamus recusandae doloremque suscipit dolorem. A qui nostrum vel autem laudantium cum et id. In possimus facilis enim est sint ratione repudiandae quia.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...