Arbor Advisors Overview

The Overall Ranking is a score from 1 star (very bad) to 5 stars (excellent) generated based on the Company Reviews of current and former employees at this company, taking everything into account.

The number you see in the middle of the donut pie chart is the simple average of these scores. If you hover over the various sections of the donut, you will see the % breakdown of each score given.

The percentile score in the title is calculated across the entire Company Database and uses an adjusted score based on Bayesian Estimates (to account for companies that have few reviews). Simply put, as a company gets more reviews, the confidence of a "true score" increases so it is pulled closer to its simple average and away from the average of the entire dataset.

- 5 Stars

- 4 Stars

- 3 Stars

- 2 Stars

- 1 Star

Company Details

M&A

The bank's M&A practice is focused on middle market companies that are growing and profitable. In its sell-side M&A advisory, it assists companies interested in exploring a sale or merger of all or part of their business.

When approaching a transaction, the bank considers the full-range of client interests including price, structure, tax and legal treatment, and ongoing management and employee interests.

Private Capital Raising

Arbor has extensive experience in raising capital for middle market companies. The Arbor Principals have experience raising money for their own companies and are sensitive to all of the issues and complexities involved in fundraising.

Strategic Financial Advise

Arbor's primary mission is to help clients make informed decisions when accessing the capital markets. Its relationships are long-term in nature, and they never push clients into transactions before they are ready. Planning for and conducting a transaction involves a series of choices, and the firm works alongside clients and advises them in these decisions.

Valuation and Fairness Opinions

The bank provides thorough and independent financial valuations for its clients. Often an independent valuation is important to either a board of directors or a third party, and Arbor is equipped to provide this service.

Locations

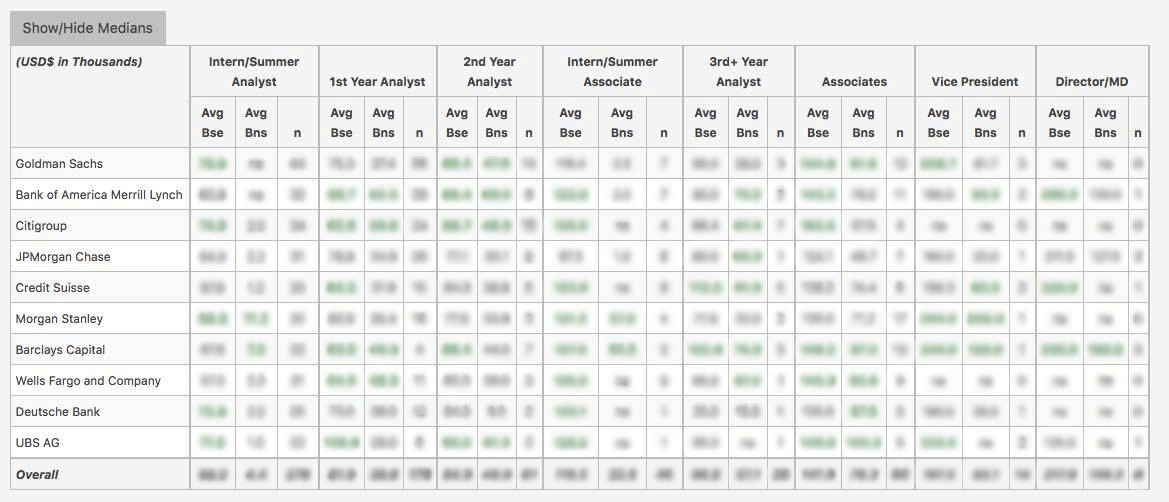

WSO Company Database Comparison Table

Arbor Advisors Interview Questions

or Want to Sign up with your social account?