Repurchase Agreement (Repo)

A source of short-term financing in which an underlying security is sold with an agreement to purchase it back at a higher price.

What Is A Repurchase Agreement (Repo)?

A repurchase agreement (Repo) is a source of short-term financing, mainly used by dealers in government securities. As part of a repurchase agreement, the dealer sells the underlying security (mostly government securities such as treasuries) to the lender with an agreement to purchase it back at a higher price.

The term of a repurchase agreement is usually overnight and the rate at which it is financed is called the overnight lending rate.

Repurchase agreements are also known as “RP” or “sale and repurchase agreements”.

Repos are mainly used by private banks to address a shortage in short-term capital adequacy requirements and by central banks as part of their open market operations.

Lenders in RPs are generally big financial entities such as mutual funds while the borrowers are non-depository banks and hedge funds. The interest rate (IR) charged by the lender is called the repo rate. The security that is sold to the lender is called the collateral and serves the same purpose as collateral on debt securities.

An important concept in the repo market is that of “haircut”. In order to ensure sufficient protection against a fall in the creditworthiness of the borrower or a drop in the price of the collateral, the lenders demand that the value of the collateral is higher than the amount they have lent.

This is what is called a haircut. The rate of haircut is inversely correlated to the creditworthiness of the borrower and the volatility of the underlying collateral. This means “higher the creditworthiness or volatility, lower the haircut demanded, and vice versa”.

Despite being considered a loan (which it really is) with fixed income-like characteristics, legally, a repurchase is a sale first where the title of the underlying security moves to the lender followed by a legal contract binding on the lender to sell back the security at a predetermined rate.

Key Takeaways

-

Repos, or repurchase agreements, are short-term financing tools in which a dealer sells a security with an agreement to buy it back, often overnight.

-

Private banks use repos to meet short-term capital needs, while central banks employ them in open market operations. Lenders are typically large financial entities, and borrowers include non-depository banks and hedge funds.

-

The repo rate is the annualized cost of financing for a repo transaction, equal to the annualized difference the sale and purchase prices of the underlying asset.

-

Repurchase agreements come in two types: term and open. Term repos have a fixed maturity date, while open repos lack a predetermined maturity date and can be terminated by either party.

-

Repo structures vary, with different risks. The 2008 financial crisis raised concerns about their use, especially in hiding financial issues.

Repurchase vs reverse repurchase agreement

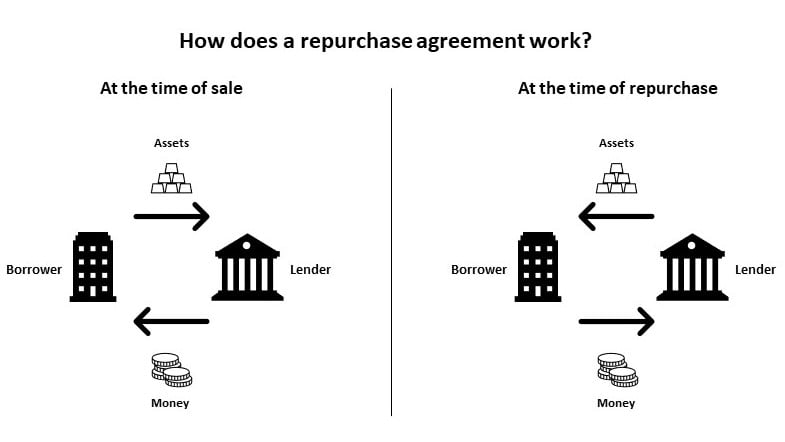

Repurchase and reverse repurchase agreements describe the role of the two parties, i.e., borrower and lender, in a repurchase agreement.

The borrower sells the assets and agrees to repurchase them in the future. Hence, from the perspective of the borrower, the agreement is one of “repurchase”.

The lender first buys the assets and agrees to sell them in the future. As we can see, this is the opposite of repurchase and hence it is called a reverse repurchase agreement.

Consider an example where a treasury dealer sells treasuries to a commercial bank with an agreement to repurchase them at a future date. From the perspective of the dealer, this agreement is a repurchase one while from the perspective of the bank, it is a reverse repurchase agreement.

Near and far leg in a repo

The use of “legs” in the context of repos is unique, as with many words used exclusively in specialized financial transactions. Legs are used to denote the point in a repo. The point of initial sale is called the “near leg” or “start leg” while the point of repurchase of the sold asset is called the “far leg” or “close leg”.

Hence, the start of a repurchase agreement is called the “near leg” and its closing is called the “far leg”.

Tenor of a repo

Tenor stands for the length of time a financial transaction stays open. In the case of a repo, the tenor is generally measured in days with the most common tenor being one day or overnight.

Tenor is a very important concept in the context of a repo. The longer the tenor of the repurchase agreement, the higher the risk involved. Risks come from sources such as a change in the creditworthiness of the borrower, market movement on collateral, etc. This is similar to the concept of duration in relation to bonds, where the higher the duration, the higher the change in the price of the bond.

What Is Repo rate?

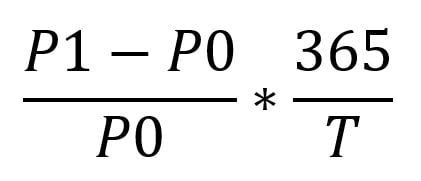

The repo rate is the annualized rate of financing a repurchase agreement. Since there is no interest payment involved in a repurchase agreement, it considers the difference in sale and purchase price to determine the cost of financing the repo.

Calculating the repo rate

The repo rate is calculated by first subtracting the purchase price from the sale price on the two legs of the repurchase agreement. Then the difference is annualized by dividing by the tenor (in days) and multiplying by 365.

The formula for calculating the rate of financing a repo is as follows:

- Let the initial sale price be P0. This is the price at which the borrower sells the asset to the lender and takes place at the near leg.

- Let the repurchase price be P1. This is the price at which the borrower repurchases the asset from the lender at the far leg.

- Finally, let the number of days (tenor) of the repo be T.

Below is an example to illustrate the above formula in action:

A dealer deposits $50 million worth of par value of treasury bonds with a municipality for 5 days. The market value of the collateral posted is $52 million. With a haircut of 2%, the sale price is set to $50.96 million (calculated as 52 * 98%). The agreed repurchase price is fixed at $50.995.

Here the parameters are:

- T = 5 days

- P1 = $50.96 million

- P0 = $50.995 million

Plugging these values in the formula mentioned earlier, the rate is calculated as 5.01% ((50.995 - 50.96) / 50.96) * (365 / 5).

Types of repurchase Agreements

Repos are classified based on how the agreement is structured, how the ownership of collateral is transferred as well as the flow of cash between the parties. Illustrated below are a few such classes of repurchase agreements.

Tri-party repurchase agreement

This is by far the most common type of repos. In this agreement, the custodian bank or clearing agent conducts the transaction between the borrower and lender. They ensure that cash is delivered to the borrower at the start of the transaction and that the borrower returns the agreed amount to the seller for repurchase while holding the collateral securities. They also ensure that the right margin is applied after valuing the securities.

In the United States, the primary clearing banks for tri-party repurchase are JP Morgan Chase and Bank of New York Mellon.

Due bill or held in custody or bilateral repurchase agreements

This type requires the borrower to only put up a guarantee of the collateral. This is generally done by placing the collateral in an internal (“held in custody”) account by the borrower on behalf of the lender for the duration of the agreement.

Due to the huge risks to the cash lender, as well as the creation of centralized counterparties due to the growth of the repurchase market, this practice is less common and in general declining.

Sale-buyback

A sale-buyback transaction is one that has very similar characteristics to a repurchase while not technically being categorized as one.

It involves selling the assets in the spot market and then taking up a long forward position for the same assets in the open market. The payoff and cash flow are similar however there are a few differences when compared to a repo, some of which are illustrated below.

A repurchase is technically a single transaction while a sale-buyback consists of two separate transactions. Since the sale-buyback transaction happens in the open market, the counterparties on both legs of the transaction are different unlike in the case of a repurchase where there is only one counterparty.

A repo requires a special agreement to be in place between a seller and a buyer (typically the SIFMA/ICMA commissioned Global Master Repo Agreement (GMRA)), while no such documentation is required as part of a sale–buyback transaction.

In a sale–buyback transaction, any coupon payment is generally reflected in the price of the security, which may cause slippage in less efficient markets. However, in a repurchase agreement, the lender pays back the coupon received to the borrower immediately.

Disadvantages of repurchase agreements

A repurchase agreement has many similar characteristics to a secured debt transaction. This arises from the use of collateral to finance the repurchase and fixed cash flow determined at the start of the transaction.

Due to the lack of adequate and thorough regulation, especially prior to the 2008 financial crisis, repos were used extensively in complex arrangements without the scrutiny of the financial well-being of the parties involved.

Also, since the term of repurchase agreements is generally overnight and there is not enough time to conduct due diligence, most repos are conducted based on the reputation of the counterparty as well as the value of the collateral and at a very fast pace.

This “fast and loose” practice means there exists a default risk in every repurchase agreement. Further, due to the amounts involved, a big default can trigger a chain of events leading to adverse market impacts.

The other risk comes from the fact that the assets used as collateral may lose value over time, leading to a loss for the lender. This risk increases with the increases in the tenor of the agreement. Hence, the shortest repurchase agreements tend to carry the most favorable returns.

Term vs open repurchase agreements

Repos are classified into two based on whether they have a predetermined tenor or not. The two types of repurchase agreements classified based on this difference are term and open repurchase agreements.

Term repurchase agreements

Repos that have an agreed-upon tenor are called term repurchase agreements.

The price and tenor of the agreement are determined at the start. They are used for short-term financing where the fixed tenor can range from overnight to many months. Most repos are term repurchase agreements with the most common tenor being overnight.

An example of term repurchase is when the borrower needs funds overnight to meet certain capital requirements that are prescribed by the regulatory authorities. The tenor is agreed at the start leg between the borrower and lender and hence the repurchase ends exactly in a day.

It may or may not be rolled forward with similar or different terms, based on the understanding and agreement between the parties.

If the parties agree to roll forward, this becomes a new agreement in itself with the money changing hands (at least on paper) every time the repurchase is closed and rolled forward.

Open repurchase agreements

Repurchase agreements that have no predetermined date of maturity at the start are called open or on-demand repurchase transactions. They are similar to term repurchase transactions except for the fact that they have no fixed maturity or predetermined repurchase price.

An open repurchase can be terminated by either party giving notice to the other party on an agreed-upon deadline. If no notice is given to terminate the agreement, it rolls over to the next day. Since there is no fixed term, the interest rate is recalculated periodically by the mutual agreement of the parties.

The major benefit of using an open agreement over a term agreement comes from the convenience of not having to negotiate and settle daily rollovers.

Due to the high level of uncertainty and risks arising due to the uncertain tenor, the rate of financing an open agreement is almost always higher than that of financing a term agreement.

It is generally used to invest cash or finance assets where the parties do not know how long they will need funding for or what the lock-in period will be. However, nearly all open agreements conclude within one or two years.

An example of an open transaction is when an investor or financial institution needs to raise short-term capital to cover liquidity needs, with uncertainty on when they will be able to repurchase the collateral.

It could range from overnight to a month or two before the liquidity need is fulfilled and hence it is tedious to keep rolling over the agreement every day.

In such a case, the savings related to the cost of rolling forward an agreement (which tends to get costly and messy over time), are offset by the incremental rate of financing on an open repo.

Repurchase Agreements in the 2008 crisis

The 2008 financial crisis drew attention to a type of repurchase agreement called Repo 105 which was believed to have been used extensively by Lehman Brothers to hide its declining financial health leading up to the crisis.

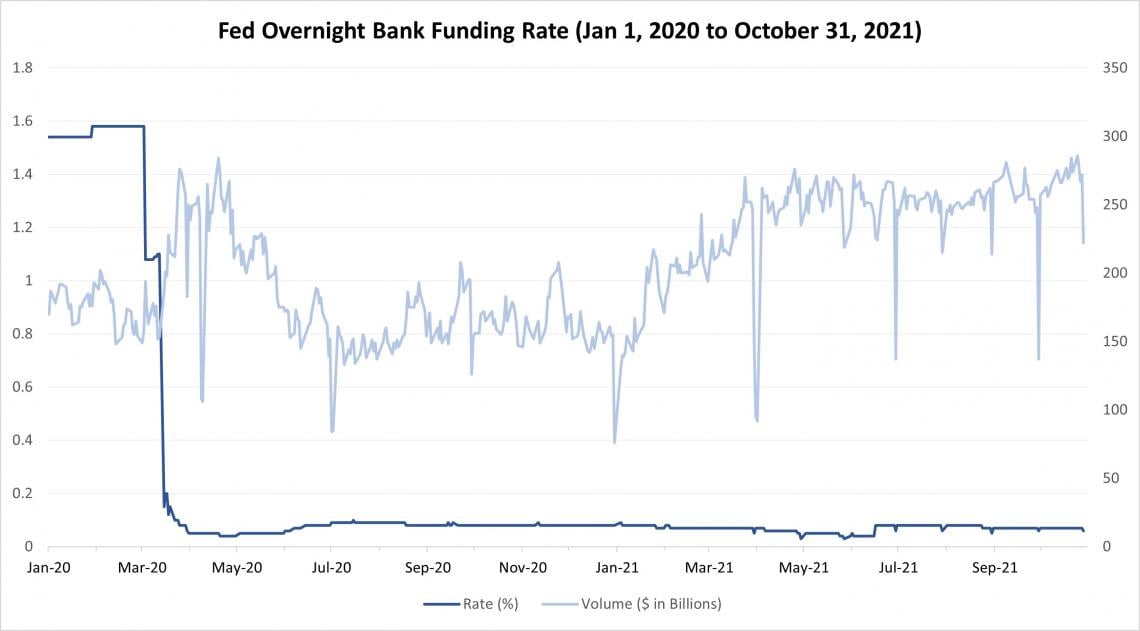

In the years after the crisis, the repo market contracted significantly, although it has recovered and is growing in recent years.

Following the crisis, the Fed undertook an investigation into the use of repurchase agreements and their contribution to the crisis. As part of the investigation, the following areas of concern were identified by the Fed:

- The reliance of the tri-party repo market on intraday credit provided by the clearing banks

- A lack of plan or framework to help liquidate the collateral in case the borrower defaults

- A lack of risk management frameworks and practices to address tail events such as a liquidity crunch or borrower default

New rules were then implemented to address the findings of the investigation such as the Dodd-Frank Regulatory Reform Bill.

Despite that, there is a constant worry that a default by a major repo dealer can adversely affect money markets, leading to contagion in the broader market with negative consequences.

Repo 105 and Lehman Brothers

Repo 105 is the name of an accounting maneuver that Lehman Brothers used to reduce the leverage reported on their balance sheet.

As part of this maneuver, Lehman Brothers reported repurchase agreements as sales. The cash realized from this “sale” was used to pay down debt and significantly reduce the figure of debt until the balance sheet was published.

Once the financial reports are published, the company buys back the underlying assets financed by other borrowings. The name comes from the fact that an asset worth 105 produced 100 in cash (a cost of 4.76% to finance the whole transaction).

After the bankruptcy court examiner’s investigation revealed that the maneuver was used three times, the following actions were taken.

- Fraud charges were pressed against the auditors Ernst and Young (EY) by the attorney general of New York at the time, Andrew Cuomo, seeking $150 million. This suit was settled for $10 million with EY admitting no wrongdoing.

- The senior accounting bodies, IASB and FASB, met to review the accounting treatment of repurchase agreements.

- The SEC sent letters to chief financial officers of two dozen financial and insurance companies

Repo for open market operations

The central banks of most countries use repurchase agreements to conduct open market operations.

Open market operations are used by central banks to provide or remove liquidity from the markets by lending or borrowing from a select bank or group of banks.

The liquidity in the market increases when the central bank lends cash (thereby increasing monetary supply) and decreases when the central bank borrows cash (thereby reducing the money supply). Open market operations are one of the primary tools used by central banks to implement their monetary policy.

Repos are among the most common tools that are used by central banks to execute open market operations.

For example, in the United States, the Fed sets a target overnight interest rate for the repo market which is called the federal funds rate.

When the federal funds rate is higher than the target, the Fed increases monetary supply by lending to commercial banks through repurchase agreements and increasing the temporary monetary supply.

However, when the federal funds rate is lower than the target, the Fed decreases monetary supply by entering into reverse repurchase agreements with commercial banks, thereby decreasing the monetary supply temporarily.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?