Total Return Swap

It is a derivative contract that allows the exchange of interest from a financial asset in return for a fixeinterest ratest.

A total return swap or TRS is a derivative contract that allows the exchange of interest from a financial asset in return for a fixed rate of interest. The financial asset/underlying asset may be equity, bond, or loan.

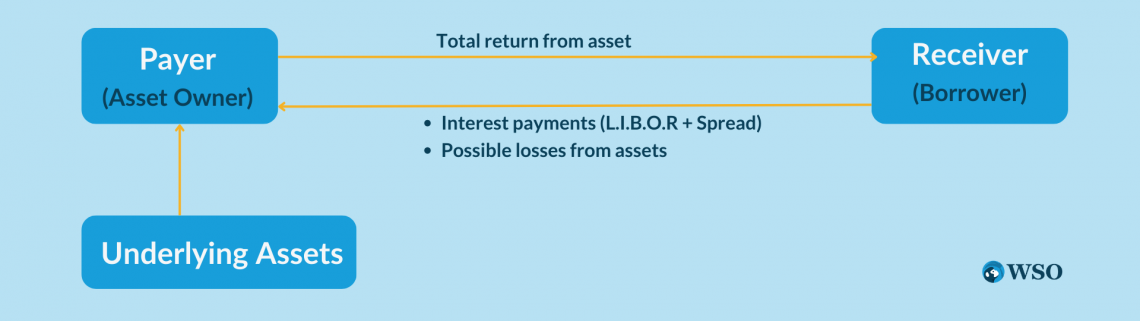

Within the trade, one party, the receiver, collects any income accrued from the asset, depending on if it appreciates. In return, the receiver must pay the asset owner, the payer, a set interest rate throughout the contract's length.

If the asset declines, the receiver must pay the losses to the asset owner on top of the set interest rate owed. Therefore, the receiver holds systematic and credit risk. The payer retains no risk on the asset, but in the circumstance that the receiver defaults on their payment.

Banks and institutions use these contracts for two main reasons:

-

To manage risk

-

To keep balance sheets low

It allows parties to hold large stock positions while not needing much cash upfront. Instead, practically borrowing the asset, thus retaining the gains without paying for the whole position.

Example

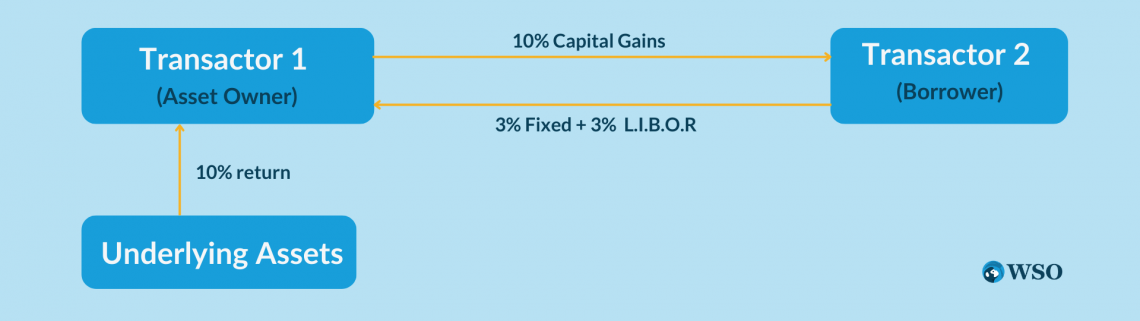

For instance, if two transactors enter a one-year swap for the principal amount of $1 million, the first transactor, the asset owner, receives a fixed interest payment of 3% plus LIBOR.

Whereas the second transactor will receive any capital gains from the underlying asset, for the sake of the example, the S&P 500.

As the contract expires at the end of the year, LIBOR sits at 2%, and the S&P 500 has risen 10%.

Transactor 1 pays the second transactor the 10% in capital gains and accepts back their set rate (3%) plus LIBOR (3%). Therefore, going out is (1,000,000(10%)) = 100,000 and coming in is (1,000,000(6%)) = 50,000, thus Transactor 1 exits with a $60,000 loss.

Transactor 2 is the opposite. The party will receive the 100,000 on the assets 10% gain and must only payout their fixed + LIBOR interest calculating to 60,000. Therefore they benefit from a $40,000 gain.

Now consider the scenario when the S&P 500 decreases in value over the year:

Imagine the Index decreased by 10%. Transactor 1 will still gain an interest of 6% as this payment is paid; either way, they receive the capital losses from Transactor 2.

In result Transactor 1 benefits (1,000,000(6%+10%)) profiting $160,0000, while Transactor loses that same amount.

Who Uses Total Return Swaps?

The primary users contain can be pretty broad, containing

- investment banks

- commercial banks

- mutual funds

- pension funds

- insurance companies

- private equity firms

- governments

From the various users, TRS contracts became the most popular within commercial banks. Mainly commercial banks would use them for the sake of keeping their balance sheet costs low.

For instance, if one party had maxed their balance sheet but still wanted to invest in certain assets, the bank could use a total return swap with another party and invest by using their asset, which is still under the other party's ownership.

From the owner of the assets standpoint, they are now leasing the asset to the receiver while generating a fixed rate of income from the receiving party. The asset owner may choose to do this if it is felt they need their asset position protected from risk, as now the receiver will cover any losses.

Hedge funds and special purpose vehicles (SPVs) are also active users of TRS. In fact, a hedge fund will use TRS swaps for leveraged balance sheet arbitrage through seeking a position on an asset; they may do so by leasing from large institutional investors.

The hedge fund hopes to net high gains from the asset without paying to own the position. Therefore, the fund is leveraging their investment as they are lent these assets.

From the opposite point of view, the asset owner receives income through interest payments plus the guarantee against any losses, as mentioned above.

The owner may consider a TRS if they are anxious about future prices. Therefore, the conservative choice would be to swap and have another party cover the position for you and receive a confirmed interest payment.

Bond Total Return Swaps

Bond Indices have become very popular in being used as the underlying within total return swaps. Within the particular swap, an agreement is set to which the total return swap is indexed to a collection of bonds.

Using bonds as the asset creates a strong structure as it guarantees income payments from the bond's coupon payments.

Bond TRS is also used to mitigate risk. Bonds with strong credit ratings are low-risk investments, hence why most risk is systemic and derived from the market demand for bonds.

Even if we're saying that there is still risk within these derivatives. If, for example, the sale price of a bond continues to fall over time, the TRS will lose money.

Last, the swap allows investors easier access to the bond market as they never have actually to buy or sell the bonds. Bonds can be very capital intensive and long-term investments, hence why a bond indexed TRS would advantage investors who were restricted by those areas.

The Financial Manipulation of Bill Hwang Using TRS

Bill Hwang will be remembered for causing one of the most significant financial collapses in modern history, led by an individual. Hwang, the founder of Archegos Capital Management, was heavily involved in swaps trading, which, as a result, led his company to great success.

Until it, all came crashing down in march of 2021. The finance community stood amazed as they learned the company had defaulted on its collection of loans made up to create its $100 billion portfolio.

Of the $100 billion leveraged money, around $20 billion was rightfully cash. In the end, the aftermath was said that over $30 billion worth of asset positions were cleared out by the banks in an attempt to revolver what was left.

The tragedy correlates to borrowed money and overleveraging. Before the collapse, Hwang had leveraged his funds about 5x, which multiplied the trail of destruction he left behind.

As soon as the banks caught on to the amount of leveraged funds Archegios was carrying, banks immediately began dumping their holdings, and the stock price plummeted.

Hwang's lenders, Credit Suisse, lost an astounding $4.7 billion, and Nomura Holdings faced around $2 billion in losses.

A cause for a failure of this magnitude was due to Bill's use of total return swaps. Using the swaps provided Hwang's company with two advantages:

- The swap derivatives allowed Archegios to leverage cash, simply allowing them to own more of an asset than the current fund could buy, allowing Hwang to create a portfolio for far more than the amount he owned.

- Swaps don't require complete transparency to investors and banks. Hwang used that to his advantage to keep the company's trades private. Thus, keeping his lenders in the dark and not allowing them to know the company was excessively overleveraged.

Within a plain vanilla swap on an asset, the bank shows up on the filings for any gains or losses as the asset owner. Hwang used this as an absolute advantage, collecting multiple major positions with different banks without anyone knowing, as he was borrowing the assets.

The banks only carried the files on their dealings with Archegios. Therefore they had no idea that he had been accumulating leverage on the same assets with different banks.

As soon as one bank caught on to Bill, everyone began to sell. But unfortunately, by that time, the banks were already too exposed to the tragedy caused.

Benefits and Drawbacks of Total Return Swaps

Total return swaps allow one party to receive all the gains of owning an asset without having to fork over the money. However, with that luxury comes many drawbacks to the party trying to earn a fortune on borrowed assets.

Benefits

- Allows parties to gain exposure to investments without purchasing the assets; thus, parties can more easily expose themselves to diverse investments that were unavailable prior.

- Effective for hedging risk. If the asset holder believes their investment will decrease, they may swap with a company with opposite views and receive their fixed rate.

- The receiver of a TRS does not have to deal with any of the requirements of the ownership transaction, such as payment calculations, interest collection, settlements, and reports.

- The receiver can use their investment capital as they are levleverageinvestment using the swap. Therefore the receiver can make more profit without handing over as much cash.

Drawbacks

- Each party is exposed to interest rate risk when entering a TRS, as payments from the receiver are made according to LIBOR. Therefore, if LIBOR increases, the receiver must pay higher rates benefiting the payer, and if LIBOR decreases, vice versa. As a result, the receiver is more exposed to interest rate risk than the payer.

- The swap receiver takes on any market risk of the reference asset. If the asset loses value, it must pay those losses to the asset owner (payer) on top of its current payments.

- The payer is at risk if the asset loses value over a long period. In addition, the payer is at risk of party defaulting if the counterparty is not sufficiently capitalized.

Summary of Total Return Swaps

Total return swaps can be very beneficial, allowing a party to get exposure to various investments such as specific stocks, global markets, and sectors they wouldn't usually have access to.

Thus, the swap makes it easier for investors to diversify and/or hedge against risk. It also helps companies invest in an asset's future without having to hold a position, allowing the capital to be used elsewhere.

Yet, with all the benefits of total return, swaps may easily get too greedy and over-leveraged. A company borrowing too much money is overleveraged and, if deemed risky by a rating agency, will make it harder to borrow for the company.

Reporting requirements make it, so companies are not obligated to be completely transparent around their swap positions. In that case, the rating agencies cannot fully grasp the company's leverage; therefore, the company could be unstable but still hold its good credit rating.

As a result, if their swap positions go bust, members, investors, and other companies engaged in the firm are at risk.

Researched and authored by Thomas Fallows | Linkedin

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?