TMT Investment Banking

Technology, Media, and Telecommunications industries

What Is TMT Investment Banking?

TMT stands for Technology, Media, and Telecommunications industries. Investment banks (IB) have TMT industry groups in their investment banking divisions (IBDs). This group advisory services on:

- Mergers & Acquisitions (M&A)

- Leveraged Finance (LevFin)

- Equity Capital Markets (ECM)

- Debt Capital Markets (DCM)

- Restructuring

If you are looking for an investment banking career, chances are you heard or read the term "TMT Investment Banking" at least once. Unfortunately, this term is the most overused on Wall Street.

Remember that TMT IB group offers these services only for companies operating in the TMT industry. This sector is the fastest-growing sector in the global economy. As a result, many investment bankers, PE firms, and venture capitalists target this sector.

Also, this IBD group gives you a front-row seat to see the most innovative and fast-growing companies. The exit opportunities are broad and probably limitless within the finance roles.

In this article, we will discuss:

- Main sub-industries or verticals within the TMT

- The average day in the work of an analyst or associate

- The main trends and drivers

- The difference in financial modeling and valuation of deals

- Investor presentations, fairness opinions, and pitchbooks

- The pros and cons of the group

- Top banks and Exit opportunities

TMT Investment Banking Industry Groups

Companies operating in these industries are highly interconnected.

For example, Netflix began as a technology company. However, it became a media/entertainment company since it focused on original content production.

That is why investment banks combine these industries under one group - TMT. There are three sub-groups in this group.

Media & Entertainment

Companies in this sector produce content. They generate income from advertising, subscriptions, and one-time sales. Most media companies are in the US, although some of the biggest companies are from Europe, China, and Japan.

Telecom

Firms in this segment deliver the content through wireless & wireline services (phone coverage, internet plans, etc.). This sector is considered "defensive" and has the following characteristics:

- Relatively inelastic demand for telecom services.

- Capital intensive business due to fiber-optic networks, satellites, and cell towers.

- Heavy regulation due to the "public goods" status of telecom services.

This industry is probably one of the most diversified because you will find at least one monopolist company in every country.

Media & telecom companies highlight that there are three major metrics in their industries:

- Subscribers

- Penetration rates

- The average revenue per user (ARPU)

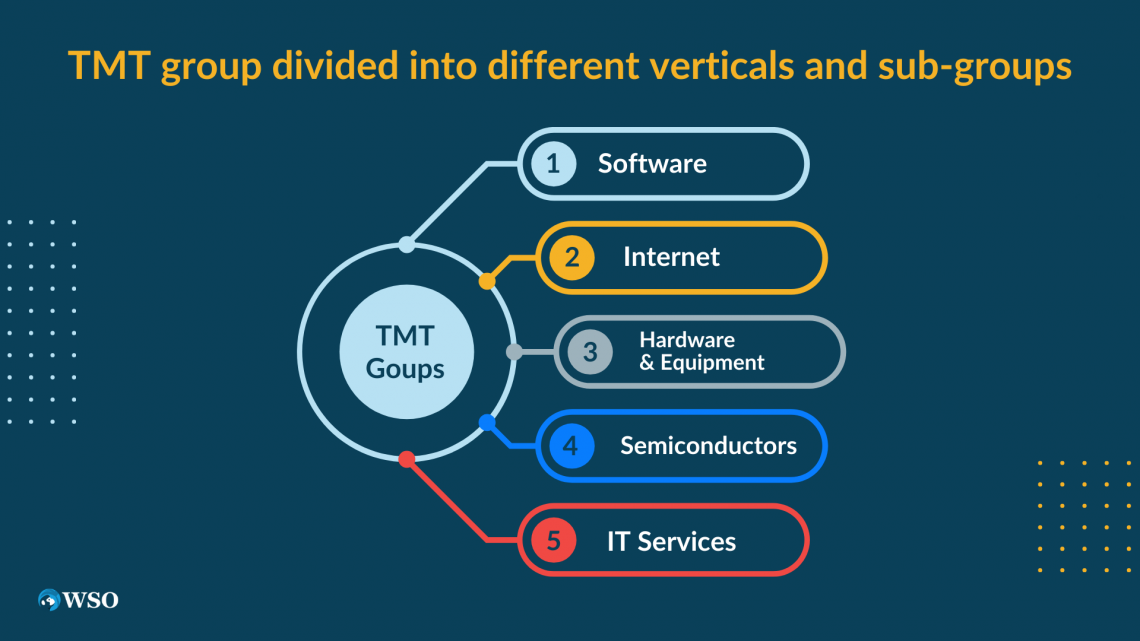

Technology

Businesses in this industry provide customers the means to consume content and do business and personal tasks. These means include software, hardware & equipment, internet, semiconductors, and IT services.

Most companies in this segment fall into two categories:

- Early or growth-stage: These companies are typically tech startups, small and mid-cap companies that want to raise money, grow and become public. You will work with these firms in a small boutique bank and have sell-side M&A deals and equity issuances.

- Mature: These firms are primarily large-cap multinational companies with more than $10 billion in revenue. They target to acquire smaller innovative companies in specific niches. That way, they will stay dominant in their markets.

- You work with these firms in bulge bracket banks and have buy-side M&A deals, leveraged buyouts (LBOs), and debt issuances. In other words, you represent and support an acquirer firm with the acquisition deal of a target company.

Most tech companies are in the US (Microsoft, Apple, Google, Facebook) and China (Alibaba, Tencent). In addition, South Korea, Taiwan, and Japan are well-known for their hardware and semiconductor companies.

Europe has only two big players: SAP in Germany and Spotify in Sweden.

How to Get a Job in TMT IBD or The Recruiting Process

The TMT group doesn't require specific specialized accounting, valuation, or financial modeling knowledge. There is no need to have detailed legal knowledge as well.

You don't need to have a certain:

- Bachelor's or master's degree (such as Engineering or Computer Science)

- Work experience (Television, movie production)

Sure, it would be a plus if you have some relevant background. But, the advantage of having that background is not as high as in energy group investment banking. Keep that in mind.

Investment banks have a standard recruitment process for undergraduates and MBA students. The chances of success depend on

- Your business school

- Grades or GPA

- Work experience & prior internships

- Your networking efforts

- Interview Preparation

Thousands of boutique banks specialize solely in the technology industry. Those banks' clients are many tech startups searching for investors. It's a good entry point to put your foot in the industry, but you may not get deal experience.

There are fewer pure media & telecom boutiques than tech boutiques. So if you want to break into the media or telecom, you should start from either tech or TMT boutique firms.

What Are Your Daily Tasks as an Analyst or Associate in TMT Investment Banking?

Overall, you will do the typical tasks of every investment banker: pitchbooks, deals, and some random tasks.

But, your workflow depends on the following:

- Bank you are working at

- Companies you advise

Suppose you work at a tech-focused boutique bank and with early-stage firms. You may be bored by the private placements. You won't gain relevant modeling and deal experience and will have limited exit opportunities.

But, if you work at the TMT group of bulge bracket banks, you will have a lot of M&A and LBO deals with mature companies. So, initially, it is interesting, but as time passes (at model number 300), you may also get tired.

The hardware, IT services, and semiconductors sectors are mature, and you need to focus on profitability and cash flows.

However, the software and internet sectors comprise a wide range of firms. As a result, you may encounter mature companies and early-stage startups.

"Ok, but what about the Media and Telecom sectors?"

Suppose you work with such Telecom companies as AT&T, Verizon, and T-Mobile. In that case, your work will consist of debt issuances and buy-side M&A deals. So, why are M&A deals in the industry rear? First, the regulation and complexity of the industry put pressure on cross-border deals.

Since most telecom firms have stable cash flows, thus they are ideal candidates to be debt issuers.

The media industry is quite different from the telecom one. On the media side, companies are growth-oriented. You will work with:

- Equity issuances

- Private placements

- Private investment in public equities (PIPEs)

The industry is not considered at the national security level. Thus, it is less regulated and has many M&A deals. However, you may also expose yourself to restructuring and distressed M&A in radio stations and newspaper businesses.

Overall, the TMT group's accounting, financial modeling, and valuation are not extraordinary. The differences might be in the operating metrics you will use in your valuation. The operational metrics vary depending on the sub-groups and verticals you will work with.

Our Elite Modeling Package will give you all the relevant modeling skills for investment banking.

Trends & Drivers in Technology

This sector has the following drivers:

Innovation and Upgrade Cycle

The first introduction of the iPhone by Apple was a sensation for the public. At that time, it was an innovation, and millions of consumers bought this device. But, as time passed, the "heat" in the market cooled.

Today people buy smartphones for replacement rather than "amazing must-have devices."

(Dis)inflation and Pricing Power

The manufacturing process of tech products became efficient, and the cost of raw materials declined over time. As a result, tech products became cheaper. But, the high inflation might put increased pressure on the shoulder of tech companies.

Inflation causes high raw materials prices and other inputs necessary for the tech firm. As a result, firms must constantly improve their operations, products, and services to maintain profitability. These tasks are more challenging in the inflationary economy.

Geopolitics and "National Security"

Technology was once one of the least regulated industries in the world. But, after the Cold War 2.0. between the US and China, governments classified the tech sector as a vital sector for national security. All of that creates tensions in the industry and limits growth opportunities.

Broader Economic Conditions and Personal/Business Spending

Technology is a cyclical industry. In other words, it has a high beta and is highly sensitive to the overall market.

The sector performs well when there are:

- Low unemployment

- High disposable income of customers

- Businesses have lots of cash to spend on the automation of processes, software, servers, and devices.

But, during the recession, it is the first industry facing low demand. For example, you won't buy a laptop or PC for your last money if you don't have enough money. Right?

Tax, Trade, IP, and Fiscal Policy

For software companies, it is vital to have robust protection of intellectual property. Otherwise, they will have issues with piracy. Who does the government favor in terms of taxation? Big or small enterprises, quasi-government sector or private sector? What about the trade policy?

Are the tariffs for imports high? How is free trade made with other countries? The supply chain heavily relies on trade policies, and thus tech firms care so much about trade policies.

Trends, Drivers in Media & Telecom

The trends in the media and telecom industries are different. Media & entertainment companies are considered to be in the consumer discretionary sector.

While telecom firms are in the consumer staples segment. Below are the trends and drivers in the telecom industry.

Government Policy and Regulation

What are the government restrictions on the prices the company can charge? Where is the company allowed to operate? What kind of licenses are needed to run the business?

Upgrade Cycles and Devices

The development of cell phones led to a shift of customers from wireline to wireless communication. Today the development of smartphones, tablets, and other technologies fueled content consumption.

As a result, the demand for data subscription plans surged. As a result, the voice plans became irrelevant to many customers. How often did you use cell data to call via WhatsApp instead of your carrier's minutes plans?

Infrastructure Spending

The data subscription plans mentioned above are costly to telecom companies. The costs are related to infrastructure maintenance and upgrade and coverage expansion (5G).

Price & Market Penetration

In developed markets, firms tend to boost their ARPU using different bundles and mixes of data packages for customers. In emerging markets, businesses focus on rising penetration rates.

Broader Economic, Fiscal, and Monetary Conditions

The media and entertainment sectors rely more on operating expenses (OpEx), such as employee salaries, than capital expenditure (CapEx). The sectors are also cyclical and align with the overall market and economy.

These industries are hit-driven, meaning the churn (cancellation) rate is high. For example, when did you watch the last episode of Game of Thrones, The Lord of the Rings, or Harry Potter?

This uncertainty of demand is the main issue. Thus, if possible, media companies try to bind their customers with subscription-based services.

You probably noticed that even Xbox and PlayStation Now are turning their direction to this business model.

Technology Vertical

This section will divide the TMT group into different verticals and sub-groups. First, let's start with the technology industry. There are five common types of technology companies:

Software

The largest public companies are Microsoft, Adobe, Oracle, Salesforce, VMWare, and SAP.

There are few large and pure-software industry companies in the world. There are two reasons for that. First, the businesses have consolidated with each other, like Oracle. Second, these companies offer services only for customers (enterprises), not individual consumers.

It is hard to attract an enterprise company, but that enterprise will be your customer for life once you do it. Initially, software companies sold licenses for a high fee. Then they charged fees for maintenance and support (about 15-20% of the license fees).

Today, the business model is changed. Firms use a subscription-based model. They charge ongoing monthly or annual subscription fees to use the software delivered remotely. As a result, customers pay fewer upfront fees and can easily install the software remotely.

At the same time, software firms gain more revenue visibility. This shift also affected the accounting and valuation metrics. So, you should be familiar with such metrics as

- CAC (Customer Acquisition Costs)

- LTV (Lifetime Value)

- Churn Rate

- Billings

- Unearned Revenue

Internet

The largest internet companies are Apple, Amazon, Alphabet (Google), Meta (Facebook), Microsoft, Tencent, Alibaba, and ByteDance (TikTok).

Internet companies can do anything from social networking, e-commerce, and search engines, to super-apps like WeChat and Gojek.

The main drivers are Monthly Active Users (MAUs) and ARPU. Some firms like Meta rely on advertising revenue, while others might count on in-app purchases.

The gross merchandise value (GMV) is crucial for marketplace firms like Alibaba. This metric shows the total sales volume of all transactions on the site over a specific period (usually a year or a month).

Amazon and other internet retailers constantly check the Gross Margin and Days Inventory Outstanding since their margins tend to be thin. Our article's valuation metrics for internet companies briefly cover this industry's relevant metrics.

Hardware & Equipment

The leading hardware corporations are Apple, Asus, Dell, HP, Huawei, Samsung, Lenovo, Xiaomi, and Cisco.

The hardware and equipment companies are primarily located in the US, China, Taiwan, Japan, and South Korea. Therefore, the list of mentioned companies is from those countries.

The main feature of the hardware & equipment industry is high capital expenditure (CapEx). So, firms have to invest heavily in factories and manufacture their products.

By nature, this segment is close to the industrial sector. When evaluating the deal, you can use traditional metrics such as gross margin and cash flow. The companies in the hardware and equipment sector are divided into three categories:

- Consumer-focused (Apple, Dell)

- Manufacturing services for others (Foxconn)

- A mix of services and consumer & business products

Other critical factors in this industry are:

- Supply chains

- Manufacturing efficiencies

- Sales channels (direct sales, distributors, retailers)

Most hardware and equipment companies are mature and are trying to add a new source of subscription-based revenue.

For example, Apple generates some of its revenue from subscriptions in the App Store and subscriptions of services from Apple (Apple Music, Apple Arcade, etc.).

Semiconductors

The dominant public semiconductor companies are Intel, Nvidia, Qualcomm, Advanced Micro Devices (AMD), Texas Instruments, and Applied Materials.

Semiconductor companies make inputs for hardware firms. The latter uses CPU, memory (RAM), and graphic card chips to assemble laptops, computers, smartphones, and tablets.

Semiconductor business has Symbios features of hardware and software companies.

Like hardware companies, semiconductor firms have colossal capital expenditures (CapEx). At the same time, just like software firms, semiconductor manufacturers have high research & development costs (R&D).

There are three business models:

- The traditional or vertically integrated model

- Fabless

These companies outsource manufacturing to other firms and reduce their upfront capital costs.

- Fable

These firms outsource some manufacturing processes but do in-house production for the major parts of the process. That way, they maintain the quality of their chips.

Note that the semiconductor business is the most cyclical among other tech verticals.

For example, the new operating system or smartphone increases the demand for microchips. But, if firms supply too many chips, the price might drastically decrease, assuming the demand is lower than expected.

The primary metrics are

- book-to-bill ratio (order received / order shipped)

- capacity utilization (where the firm is in the cycle)

IT Services

The global titans in IT services are Accenture, IBM, Tata Consultancy, Fujitsu, NTT Data, Capgemini, PayPal, and Mastercard.

"Wait, why are PayPal and Mastercard on this list? Don't you think they are more in the financial sector than IT services?"

Yes, I agree with you. But, these two companies depend more on technology and operate in the "Data Processing & Outsourced Services" segment. They are similar but quite different from the financial industry.

The key drivers in the data processing segment are

- Employment levels

- Overall consumption spending (primarily for payment processors like PayPal and Visa)

The "IT Consulting" firms don't sell or produce hardware, software, or content. These companies provide services to maintain clients' current IT systems and infrastructure. The key drivers are

- Business spending

- Outsourcing or offshoring

Telecom Vertical

The largest telecom companies are AT&T, T-Mobile, Verizon, Vodafone, Telefonica, Softbank, Nippon Telegraph, and Telephone (NTT).

Usually, every country has at least one big public telecom company. Thus, this vertical is quite diversified. Also, two important things dramatically changed the industry:

- The deregulation and development of the internet in the 1990s

- Smartphones and data plans

Telecom firms must spend a massive amount of money on infrastructure. So, the capital expenditure is high. But, the tricky part is that the CapEx does not correlate perfectly with the ARPU and market penetration.

The revenue depends on the location of the towers and satellites. More capacity (towers, infrastructure) does not necessarily mean more sales. Telecom companies can increase their revenue without huge CapEx depending on the market state.

According to the largest wireless provider in Canada - Roger Communications, the key metrics in the industry are:

- Adjusted EBITDA service margin

- Blended ARPU

- Postpaid gross adds

- Postpaid net adds

- Postpaid churn

Media Vertical

The most prominent public media companies are Netflix, Fox, Discovery, Omnicom, Comcast, News Corp, and WPP.

The main activity of media companies is content production. However, there are many other players in this segment as well. For example, TV companies like Comcast and advertising companies like WPP operate in this industry.

But, their businesses' drivers are different from pure content media companies. The other types of companies are newspapers, books, and magazines. The media conglomerates typically own them.

For content production companies, the drivers are similar to telecom ones. Overall, there are two ways media companies can charge their clients:

- Charge consumers directly (Netflix)

- Make money from advertising and licensing (Discovery)

This business category is considered a "B2B" segment, although the content is offered to consumers.

The main job is to find the connection between

- Content spending

- Subscriber growth

- Advertising or subscription revenue

Higher content does not always equate to higher profits. You must suit or adapt your content to attract and retain your audience. The primary rationale for M&A deals in this segment is geographic or audience expansion.

The advertising companies like WPP are like professional services firms. Both have high variable costs, low margins, and concentration on corporate clients rather than individuals.

Other metrics might be helpful as well:

- Sales rep productivity

- "Stickiness" of main clients

- Average client size

- Average client spending

Entertainment Vertical

The biggest names in the industry are Disney, Spotify, Nintendo, Electronic Arts (EA), Tencent Music, Warner Music, Activision Blizzard, Kuaishou Technology, NetEase, and Z Holdings.

The main difference between entertainment companies from media companies would be more focus on "fun stuff" (games, music, movies, and theme parks). On the other hand, pure media firms tend to focus on more "serious content" (news).

The entertainment industry is hit-driven. Thus it is challenging to predict an entertainment company's future. However, in 2017, Nintendo released its Switch product, which raised revenue.

Suppose the firm has many franchise systems (Marvel movies, Call of Duty, Mario, Zelda, etc.). In that case, you may connect revenues and expenses with the respective release intervals.

If the company has a subscription-based model (Spotify and Disney+), you may use:

- ARPU

- Subscriber count

- Net adds

- Churn rate

But, if neither of them is applicable, then your valuation looks like valuing a BioTech startup. You are throwing darts with tied eyes.

Examples of Valuations, Pitch Books, Fairness Opinions, and Investor Presentations

- Technology

- Software: IBM & Red Hat - Morgan Stanley and Guggenheim

- Internet: Microsoft & LinkedIn - Qatalyst Partners

- Hardware & Equipment: Cisco & Acacia - Goldman Sachs

- Semiconductors: Nvidia & Mellanox - JPMorgan and Credit Suisse

- IT Services: Fiserv & First Data – JP Morgan, BAML, and Evercore

- Telecom: Rogers Communications / Shaw Communications – CIBC and TD Securities

- Media: Mediaset / Mediaset España (Reverse Merger) – JPM and Citi

- Entertainment: Electronic Arts / Glu Mobile – JPM, GS, MS, and UBS

TMT Investment Banking League Tables: The Top Firms

The leader in TMT investment banking is Goldman Sachs, followed by JPMorgan Chase and Morgan Stanley. These three banks are top 3 in TMT. Other bulge brackets like Citi, Credit Suisse, and Barclays also have strong TMT groups.

We can also add elite boutiques such as Jefferies, Lazard, William Blair, Centerview, Moelis, and Guggenheim. There are also many small boutique banks specializing in one vertical of the TMT group.

For example, Qatalyst is a tech boutique, Fintech Partners specialize in fintech M&A, and LionTree and Raine Group are media & entertainment advisory boutiques. However, telecom-focused boutiques are rare because the average deal size in the telecom vertical is tiny.

Some boutiques like Alpine Capital and Q Advisors appear in the search results. Still, they probably don't have the explicit division of tech, media, and telecom groups.

Also, the telecom vertical is too narrow and thus combined with other verticals in the TMT group.

TMT Investment Banking Exit Opportunities

There are many exit opportunities because you won't pigeonhole yourself in a narrow industry group. All skills are transferable across private equity, venture capital, growth equity (GE), asset management (AM), hedge fund (HF), corporate development (CD), and corporate finance.

Remember that your bank's reputation and the size of your deals will determine your exit opportunities. You won't be able to go straight to PE megafund without a bulge bracket or elite boutique experience.

But you can go to venture capital, growth equity, or small PE funds straight from regional or industry-specific boutiques.

Also, note that venture capital opportunity is primarily available for analysts with tech vertical deal experiences. Advising stable telecom companies on debt issuance is less attractive for VC funds.

It would be viable for media & entertainment-focused analysts to consider restructuring / distressed / credit-related exit opportunities. If you've worked on turnarounds of declining radio or newspaper companies, that will give you an edge for that.

For Further Reading

A few helpful industry resources include

- News

- For media & telecom: FT - Media | Fierce Telecom | Fierce Video | FT – Telecoms | Fierce Wireless | Telecoms.com

- For Tech: TechCrunch | Wired | Red Herring | TechNode | TechInAsia

- Mainstream news: FT | WSJ | NYT

- Industry Research & Reports

- For Media & Telecom: Deloitte TMT | PwC | Signals Research (Wireless) | KPMG Media | KPMG Telecoms

- For Tech: KPMG Tech | Deloitte Tech | Baird's Technology & Services Reports | GCA Global

- Books: Fisher Investments on Telecom | Fisher Investments on Technology

Pros and Cons of TMT Investment Banking

The Pros & Cons are:

Pros:

- You will work with different deals if you work in the bulge bracket and elite boutique.

- You will gain tremendous skills transferable to many industries, and exit opportunities are excellent if you work for the bulge bracket or elite boutique.

- Depending on your vertical specialization, you can leverage your experience to enter PE, HF, AM, VC, CD, or many other roles.

- You will get exposure to restructuring, spinoffs, and turnarounds that you can leverage in transitioning to credit-related exit opportunities.

Cons:

- You might be stuck with sell-side M&A deals with boutique banks

- The sector is too sensitive to the overall economy. During the recession, it might be challenging to work with clients.

- Mega deals in telecom and boutique banks are rare. Thus, you will have less exposure to M&A. All of these might lead to fewer exit opportunities.

In summary, always make decisions based on your end goals! Never blindly follow the crowd and chase the "hot" or "trendy" stuff. Make your decisions on sound reasons and facts rather than emotions. Finally, constantly evaluate your options based on relevance and effectiveness.

TMT Investment Banking FAQs

As of 2022, the salaries and bonuses in bulge bracket banks are the following:

| Banking Title | Salary (Low) | Salary (Mid) | Salary (Top) |

|---|---|---|---|

| Analyst 1 | $100,000 | $110,000 | $120,000 |

| Analyst 2 | $105,000 | $120,000 | $130,000 |

| Associate 1 | $150,000 | $175,000 | $185,000 |

| Associate 2 | $165,000 | $185,000 | $200,000 |

| Associate 3 | $185,000 | $200,000 | $225,000 |

| Banking Title | Bonus (Low) | Bonus (Mid) | Bonus (Top) |

|---|---|---|---|

| Analyst 1 | $75,000 | $100,000 | $115,000 |

| Analyst 2 | $85,000 | $125,000 | $155,000 |

| Associate 1 | $100,000 | $135,000 | $175,000 |

| Associate 2 | $125,000 | $175,000 | $200,000 |

| Associate 3 | $145,000 | $185,000 | $225,000 |

Our TMT Investment Banking and Investment Banking Interview course will prepare you for an interview and equip you with practical knowledge in this Investment Banking Division.

or Want to Sign up with your social account?