Trending Content

| +169 | The "Not So Obvious" things that get you a return offer? | 20 | 5h | |

| +101 | Is my life over after not getting GS? | 25 | 5h | |

| +65 | Best IB group on the Street | 28 | 2s | |

| +56 | BIG FOUR ARE PARADISE | 15 | 8h | |

| +49 | Thoughts and tips on how to speak like an investment banker. | 25 | 7h | |

| +47 | Tell me one good reason why Jefferies isn’t going to be a top bank in the next 5 years | 23 | 29m | |

| +36 | UBS Outlook | 28 | 1d | |

| +34 | How to deal with egotistical team? | 6 | 3d | |

| +33 | Highest Paid Bankers in Toronto? | 51 | 6h | |

| +25 | Got RBC offer but I have cold feet accepting. | 33 | 1d |

Career Resources

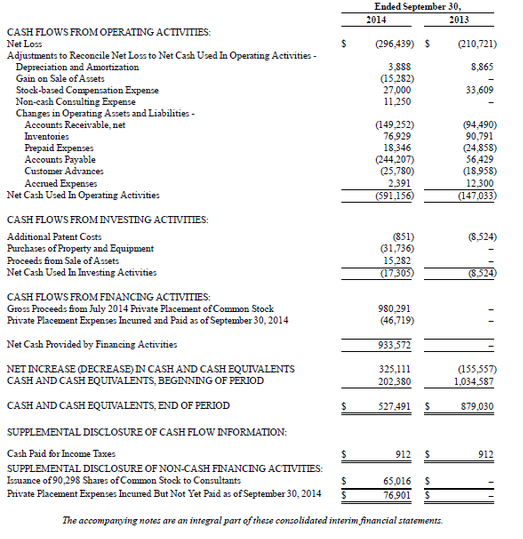

"Purchases of Property and Equipment"

Edit: not sure what exactly "Additional Patent Costs" entails, but in general I would consider that CapEx as well

My understanding is that the PP&E would be capex, as you stated. The patent costs would contribute to an intangible asset, which may (or may not) be amortized. CapEx is depreciated.

Is that really how you distinguish Capex? That it's depreciated?

Do you know what CapEx is and why it's important to know or do you just treat it like 5 letters strung together?

The reason I almost always answer with "My understanding..." is because I don't want to look like a fool if someone proves me wrong, alright? That's logical to me. If you want to be a wise ass, let me distinguish better:

You would DEPRECIATE physical assets. INTANGIBLES are AMORTIZED and are not physical assets. A patent is an INTANGIBLE ASSET (not DEPRECIABLE because it's not a PHYSICAL ASSET). Given that the other investing purchase is for PROPERTY AND EQUIPMENT (a PHYSICAL ASSET), you would DEPRECIATE it. Whether something should be considered capex may depend on the industry, tax laws (you don't need to amortize all assets the same), etc. What are the future benefits of the asset at hand?

You also didn't answer the question, so you did no better to help any cause. Douchebag.

Dude you're an idiot he's pointing out that you apparently define CapEx as "something that is depreciated." Tangible asset purchases are CAPITALIZED then depreciated, just as intangible asset purchases are CAPITALIZED then amortized.

The only argument that you could make - which you didn't - is that intangible assets shouldn't be included if you're looking to hone in on Maintenance CapEx; however, considering that this company has spent on patents for two years and PP&E for only one, I'd say it's safe to include patent costs in maintenance capex.

I really want to let you continue to dig yourself into this hole of idiocy you've broken ground on but you're putting out too much misinformation. Here's Investopedia to end the argument:

Source: http://www.investopedia.com/ask/answers/112814/whats-difference-between…My point was simply that capex is any expense a business needs to make to protect or grow the value of its assets. Whether it is spending on intangibles or PP&E, I really don't care...and neither should you.

Soo what do you call an expenditure that is amortized then?

Autem a sunt corrupti ratione. Reiciendis vero earum et placeat distinctio. Quis quo et totam aut id et quisquam. Qui quia voluptatibus sequi labore eos. Occaecati rem velit corrupti quia. Repellat et quia omnis aliquam voluptatem.

Possimus dolores sed natus dolore aliquam. Dicta odit soluta corrupti voluptas dolor et. Nobis animi sint magni consequatur nesciunt alias.

Qui voluptas et quis aut similique perspiciatis non. Repudiandae quis perferendis quaerat quia. Veniam vel laudantium quo.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...