Last year about this time I suggested 13 stocks for 2013. The stocks I picked were a subset of my overall portfolio, stocks that I felt at the time were still attractively priced. The stocks typified the types of companies I like to invest in, somewhat dull, but often attractive on an asset basis. Some of them are cheap earners, but first and foremost all had a margin of safety.

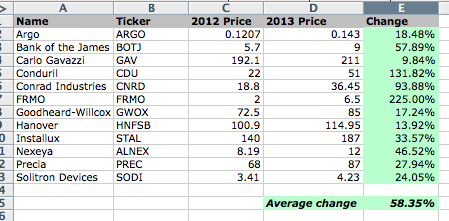

Here are the results:

I want to note that the performance isn't exact, I made the mistake last year of not recording the prices when I did my post. It was hard to find historical prices for the foreign holdings, I used what appeared on my brokerage statement, or what

FT.com had for the end of last year for many of the holdings. I also didn't account for dividends, some stocks such as Argo paid significant dividends meaning the overall performance is understated maybe 1-3% or possibly more.

The picks did exceptionally well for a bunch of companies the market didn't have much faith in. Many were priced below book value, and a few were net-nets. For many of the companies their earnings didn't change dramatically in the past year, what changed was the market realized these companies were mis-priced and acted accordingly.

If you look at my post from last year you'll notice I excluded the category Japanese net-nets from my list above. This is because I didn't specifically name any net-nets, and it's hard to find a way to track that pick.

I did a post on the performance of my Japanese net-nets at one point in the year that should give a good reference for how some of the category performed.

As of the post last year I held all of the stocks I had mentioned, throughout the year I ended up selling some of the positions. I sold my stakes in Argo, Bank of the James, and Nexeya.

I don't advocate holding stocks for arbitrary time periods, rather I prefer to sell when they hit what I consider fair value whether that's in three months or three years. An active investor in the above portfolio would have been able to do better if they sold throughout the year rather than holding onto the stocks. At one point FRMO raced into the $8s, and Installux hit €200, both would have been sells at those points.

A question I'm sure to get in the comments if I don't answer here is "how did your personal portfolio do?" As I mentioned above I owned all 13 stocks coming into 2013, but I also owned about 40 other stocks not mentioned in the post. Overall my personal portfolio was up about 39%, which is something I'm very satisfied with. The difference between the performance of my personal portfolio, and the 13 stocks in this post is that I hold a number of other companies in various stages of value creation that while I'm happy to hold I didn't consider them attractively enough priced to post on them. Almost every stock I own in my portfolio has appeared on the blog at some point.

Here's to hoping 2014's returns are as great as 2013's!

So you're a full-time day trader?

How much do you typically invest in each of these companies?

Considering the S&P returned 30% (return without lifting a finger) and by the look of the stocks you picked I'm going to guess your risk adjusted returns sucked.

Congrats, I could have randomly thrown darts at a selection of stocks with betas of 2 with higher liquidity and more information available and beat you. Shit dude the majority of those stocks didn't even beat the S&P index, your average was boosted by three small, low liquidity "bets"

I was going to use the exact metaphor of throwing darts at a board would have done the trick this past year.

Furthermore is that average change there weighted?

if you guys had chosen to fling darts at a board of stocks with a beta of >2 and actually bought them then you also made a good call on the market. Did you do that? If you didnt then please stop criticizing someone who is actually in their trying to make money and learn and who is doing it in a seemingly thoughtful way.

Thanks for the comments. I am not a full time investor, I just do this on the side.

In terms of returns this isn't my portfolio, just 13 stocks that I had high conviction of last year and wrote about. In terms of risk adjusted returns or whatever I have no idea what they'd be. I don't know anyone who had this portfolio.

I invest in the same style as I post about, my portfolio has 55 holdings or so, all small value stocks, many net-nets, low P/B companies. I also had between 15-30% cash all year, I ended up doing about 40% for the year. Half my portfolio is international, half in the US. My benchmark is 50/50 us small cap value, international small cap value. The "benchmark" did 31.5% for the year, so I'm happy with 40%.

For everyone who thinks these returns are pedestrian congrats on the great 2013. I recognize that a number of people probably had higher returns than myself, but I'm content with how I did. I employed no leverage, and picked all small value stocks, some below NCAV, others below net cash. The strategy is safe, it's diversified with little risk of permanent capital impairment.

Risk adjusted return means the amount of risk you are taking on to reach a return.

The point the others are making is you could have a lower risk portfolio and achieve similar returns.

I'm not sure how that's possible, let's look at risk in two ways.

Permanent loss of capital: Many of these companies are selling for less than their liquidation value and are debt free. They are all profitable as well. Some of them could conduct business as usual for years without a dollar in revenue, I think the permanent loss of capital is low.

Beta: I never look at this, but I presume this is the risk most on this board are talking about. Of the 13 stocks only one had a beta over 1, FRMO at 1.02. The portfolio beta is .36, I pulled the beta values from FT.com. This isn't some high flier high beta portfolio, it's an extremely low beta portfolio.

Given the portfolio beta of .32 what's the risk adjusted return?

Alright, looked up the risk adjusted return formula using beta.

Using 3% as a risk free rate (10 yr Treasury) and the portfolio beta, and the market return (my benchmark return of 31%) the expected return is 13%.

The portfolio did 58% compared to it's expected return of 13% adjusted for risk. I would say that's a fantastic result.

Some of these are so illiquid that the standard Beta calculation will be incorrect (because they don't even trade every day).

Google has the Beta for SODI as 9+.

https://www.google.com/finance?cid=33080

A good exercise would be for you to check the data, and to run the calculations, yourself.

Whats your sharpe ratio?

give the man a chance to breathe.

Oddball Stocks, thanks for the post. Very impressive as I agree with your rationale for choosing these stocks. Out of curiosity, what resources/sites did you use to identify/screen for these companies? Did you use CapIQ?

Thanks for the comment. I used FT.com to screen for international companies, and OTCMarkets.com to find the US stuff. I don't have access to anything paid, so I just used free tools.

For the most part I don't run complicated screens, I find they miss the best opportunities. I run extremely broad screens, such as find all the stocks in France selling at 80% of BV, then I just evaluate each one and see if they're worth further research.

Risk-adjusted return = Sharpe Ratio (or information ratio, if you're into that sort of thing)

It's the single most rudimentary method for comparing portfolio returns. I cannot believe that you wouldn't know that.

Also, your total return for ARGO is 23.40%. Using price return is just silly.

how are you getting 23.4% for his ARGO return or are you risk adjusting it?

You have to adjust prices for corporate actions like splits and dividends.

If a stock was $1 but now is $10, and there was a 1:10 reverse split, you haven't made 900%, right?

I ran it in Morningstar Direct, but its also available on their website:

http://performance.morningstar.com/stock/performance-return.action?t=AR…

Your risk free rate shouldn't be the 10yr. It should be the T-Bill. Any other short-intermediate term bond will be subject to interest rate risk among other forms of risk commonly associated with debt securities. Thus the 10yr can't truly be risk free.

Practically, this isn't correct. Technically, it is. No one in the industry uses the t-bills for the risk free variable anymore.

Zero makes the math much easier. >:)

Personally, I prefer to use a 0% risk free rate.

There is something to be taken actually from all this. Going back and reading his original post I thought he was thoughtful and put some of his ideas in a subset of his portfolio out there to be criticized. Yes, his risk adjusted returns probably weren't that great but maybe everyone forgot that 2013 had an equity market with a raging hard on. I'm not suggesting that you should go put your retirement assets in his picks but I appreciate someone putting a little bit of thought into bets that could do well. Yes I'm using the term bet, because that's what you are doing with this type of stock picking... hell, even buying the index is a bet that you can't do better yourself and most of the time that is probably a good bet.

Yes, throwing darts at a board can produce great returns. Let's face it, finance requires luck and timing as much as it requires the skill to pull it off. Personally, i made a couple concentrated option bets which massively skew my performance to the upside. I'm fully aware that in most years that A. Will not work and B. Those could have easily ended up at 0 (Thank you LINE).

I understand it isn't practically correct. however, it is a more practical RFR than the 10yr.

Fair point though.

Its risk free if you hold to maturity and it's the most common benchmark to use.

If these stocks represent OP's entire portfolio then the sharpe ratio is an appropriate benchmark. If not, then the information ratio is probably best.

Great your portfolio went up (like pretty much all portfolios) and all your stocks except 2 high vol outliers underperformed. Not sure if serious.

How do you go about finding these picks? Especially international ones? How much due diligence is performed before an order?

All of these stocks were trading at a significant discount to book value (with the exception of FRMO) when I became interested in them. Many of them I purchased at 50-65% of BV with the intention of selling them once they reach book.

As for finding them, it was a combination of things. I will do broad screens, such as all stocks with a P/E of 7 selling at 67% of BV and look at every single one. Or with the pink sheets I have been working my way through them from A-Z looking at every stock.

In terms of research my process is this. I want to verify the valuation discount first, so I go to the balance sheet and make sure the assets are good. I adjust for certain things and get a value for what their tangible book value is. Then I look at their earnings over the past few years, I want to make sure I'm not investing in something about to go over a cliff. If not then I read the last few annual reports and invest.

This isn't rocket science investing. This is straightforward Graham & Dodd value investing. I own more than 50 positions in my portfolio and I rarely initiate a new position greater than 3-5%. For many of these stocks their annual report is 15 pages or less, I can research a small company in a few hours.

So much hate... Well man, if you actually put money behind this and made 50%+ well in! I work in equity, and except for my pension, all my cash was in cash and RE, my return were substantially smaller! (well not true as I am levered up to the wazoo in RE...) but still you get the gist.

So you can all masturbate yourself with your sharp ratios, risk returns etc... If I had had the balls of putting more cash in equity like he did, I would be much happier! Now I'll get back to finding someone to fix a fucking boiler.

(Before i get harassed on my response, I agree it might not be the BEST method OP is using and throwing darts at a stock list might have given similar returns, my point is putting your balls in equity for all of 2013 is well done, risk adjusted return or not)

Some of you are fucking idiots.

Great job, Oddball. Keep up the good work.

Facere rem nihil fugit eius veritatis. Ducimus deserunt et labore nihil quam repudiandae eaque. Occaecati magni ut tempore blanditiis velit.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Vel et tempora minus illo quia. Sunt corrupti animi tenetur veritatis. Soluta iste voluptate vero et quia minima dolor.

Atque porro facere quos qui est repudiandae velit. Maxime laudantium vel in aut aut animi temporibus autem.

Et dolor officia ducimus et. Quos maiores inventore nihil perferendis et qui error. Aut vel et distinctio perferendis iste at. Maxime repellat labore dolorem excepturi a ipsam nam suscipit. Iusto id non illum sed impedit voluptatem facere quia. Officia doloremque quo aut veritatis.

Itaque quis eveniet nisi sit sed dolor. Natus aut nesciunt consequuntur. Iste eos non quis quasi. Enim fuga reiciendis quia corrupti a sed iste.