The $1 Trillion College Bubble

Sup Monkeys,

So Todd Vermilyea, Senior Associate Director, Division of Banking Supervision and Regulation appeared before the Committee on Banking, Housing, and Urban Affairs, U.S. Senate, Washington, D.C. on June 25, 2013.

Here's an excerpt to put things in perspective :

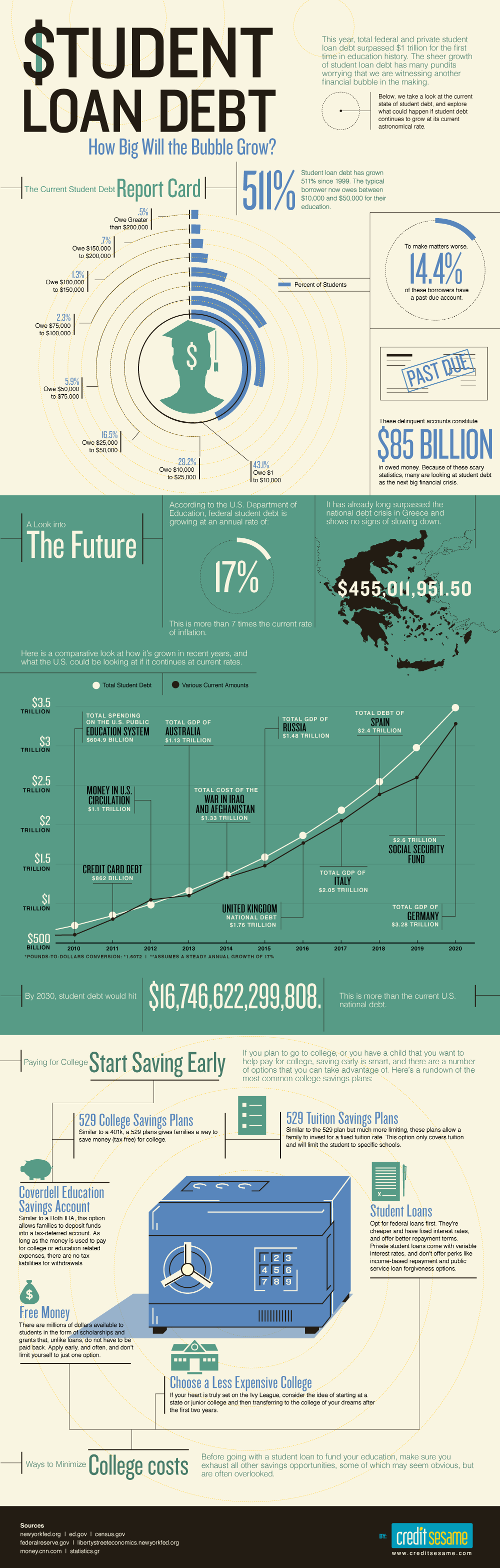

The private student loan debt market stands at a whopping $1 trillion dollars only 2nd to residential loan debt which currently stand at $13 trillion dollars.

The Fed does not regulate the student debt market and it seems the college bubble will continue expanding due to low interest rates. The risk of this bubble imploding will rise significantly within the next 5-10 years.

---

Source:

http://www.federalreserve.gov/newsevents/testimony/vermilyea20130625a.h…

http://www.collegespot.com/wp-content/uploads/2012/11/student-loan-debt…

Yea, our economy is a shitshow right now. But hey, if you time your trades right in a few years you could make a killing off of this.

im gonna write the big short v2 - betting against america's future

At least this issue is focused on education which, on average, increases productivity and helps stimulate the growth of the economy. Of course many students pursue ridiculous majors but the majority obtain skills relevant to the economy (finance, law, engineering, medical, etc.).

The student loan crisis won't be as burdensome as a bubble fueled by middle-class Americans upgrading to McMansions and oceanside condos, or becoming indebted to conspicious conusmer goods... now that's a waste of resources. Same extends to low income earners purchasing RE and goods that they cannot afford.

Why is this just being posted now? It has been talked about for years now.

What future?

I don't get the issue. The vast majority of student loan debt is $25K or under. The majority of defaults are at for profit universities.

College is only as expensive as people want it to be. If people made better decisions this wouldn't be an issue at all.

$1T in debt.

~19.7MM Americans in college (http://www.census.gov/newsroom/releases/archives/facts_for_features_spe…)

So that is roughly $50K per person. Figure that there is skew in the amount of loans people have and that $25K debt number I mention above makes sense.

Also, no shit student loan debt is second to only mortgage debt. How many people have CC limits of $25-50K. And of course student debt increases during a recession as more people seek retraining.

This is nothing but populace hype to roll out a European type system where taxes are increases to pay for college education. Go look at youth unemployment in Europe and their educational attainment and you will realize "free" college for all doesn't make for a better or more robust economy.

http://www.finaid.org/educators/20100929debtdistribution.pdf

Take a look at this and see for yourselves.

Not for profit, private bachelors degree - 80% of students have $35K or less in debt. (50% have $15K or less)

Public bachelors degree - 80% have $25K or less (50% have $10K or less)

So much hype all because a minority of students over extended themselves for a college EXPERIENCE, not a college EDUCATION.

my question is: are there specific CDOs made up of student that are being sold? if so, who is selling them and where can i go to buy (short) them?

Ut quos blanditiis tenetur aperiam ut tenetur. Sequi nobis dolor quidem excepturi consequatur et. Ab aut architecto velit. Tempore neque et excepturi quia. Similique maxime deserunt ab.

Perferendis qui consectetur tempore eum. Perferendis sint nisi corporis et est nobis non. Minus labore magni doloribus numquam repudiandae nostrum. Eos voluptate libero aliquam minima et voluptatum. Facere officiis reiciendis exercitationem id vel nihil.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...