Why do people rely on analysts' estimates although they're usually wrong?

Three ways that investors might try to forecast current-year earnings:

1) Use analysts’ estimates

2) Assume results will approximate last year’s earnings

3) Calculate an average of the last several years’ worth of earnings.

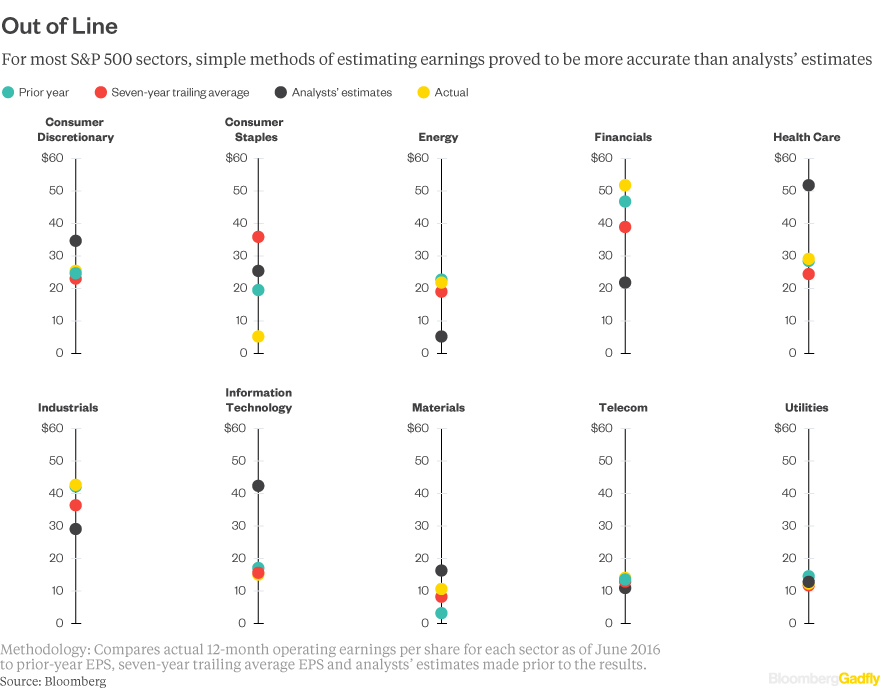

Of the three alternatives, analysts’ estimates were the worst predictors of S&P 500 earnings from 1996 to 2016.

Why then, are so many people still rely on analysts' estimates?

Interesting stuff.

-One thing is that analysts usually exclude the effects of extraordinary expenses, so I am not sure if this study includes that consideration. No analyst is going to project a massive goodwill write off that may come out of the blue. -There is likely some sort of optimism factor in which analysts are underestimating broad economic factors. -Analysts don't really strive for figures too far outside of consensus - if you are the lone analyst and you are right, you're a genius, but if you are lone and wrong, you'll probably lose your job. Being part of the consensus and being wrong likely gives a little more security for reasoning.

One thing that has always bothered me is the news headlines after earnings - e.g., "Netflix misses analysts' estimates by $x.xx." Companies don't miss analyst estimates, analysts miss on their company estimates.

And nowadays, companies usually miss or exceed by at most +/- $0.02, for some reason ;)

Being in sell-side ER as an associate, I look at analyst estimates to be a reflection of a management teams strategy. Often times management gives some type of guidance, and that forms the basis of analyst estimates, the more guidance management gives the more accurate analyst estimates will be. Which is why analysts often times appreciate visibility and why I think some companies trade at higher multiples than peers that don't give guidance/visibility. So, in a sense when a company misses estimates (if the company is giving guidance) then they really are missing their own expectations. The problem occurs when management doesn't give any color/guidance, then the analyst are missing company estimates. However, management often times speaks to analysts after earnings calls and look at their models/reports, and thus they do impact the direction of analysts estimates by the things they say, without saying anything specific. All in all, it comes down to if management wants to give visibility and increase multiple on their stock, never gives visibility because they don't care or have other strategies (buy backs) or only gives visibility when things are good/aren't uncertain.

Agreed! the last part, i always feel the logic behind that title is upside down

I would have to take contention with the premise that investors forecast earnings in the fashion described (I read the article, but regardless, I disagree with the assertion).

While it varies industry to industry, earnings forecasts are generally done on a forward looking basis with growth rates and margins tied to company and industry specific factors (e.g. price of oil vs global demand of oil when looking at oil companies). This need not approximate last year's earnings nor does it need to rely on an average set of earnings. And it most definitely does not need to rely on analyst forecasts. In the case of the former two, an analyst would be implicitly assuming that, "past results are indicative of future results", something that is disavowed in almost every piece of financial sales literature because it is silly to think in such a fashion. In the case of the latter, one need not use sell-side analyst forecasts at all (e.g. Buffett has never once purchased a stock based on a brokerage report).

Now onto the substantive aspect of your question. Sell-side analyst forecasts are generally viewed as a proxy of sorts for what the market at large expects and what management has guided to. In the case of the former, this results because the sell side as a whole speaks to a large portion of the buy side and more or less gets feedback as to how they're thinking. Analysts then generally incorporate their 'read' of the buyside into their model. As not every analyst talks to every person, the range of views can then generally be capture in the 'consensus estimate'. Obviously, this number will not be right as it's a distillation of market expectations as opposed to an objective measure of truth, but regardless, it is one of the only proxies we have for what is 'priced in' for a stock even though it is admittedly a deeply flawed metric.

As to the second point on management guidance, this is more of a symptom of laziness on the part of sell-side analysts and the asymmetric risk/reward profile of being right in isolation or being wrong with a crowd as detailed by RobberBaron123. Specifically in the case of the former, management guidance allows analysts to simply plug in the guidance without having to think about the implications and it allows them to stay within the good graces of management which is important for corporate access purposes. Indeed, Jamie Dimon along with a handful of other significant business leaders are pushing to eliminate management guidance on calls as it lends itself to manipulation of sorts (amongst other problems).

This is just a summary of it, but happy to elaborate on any specific portion of my response. Cheers.

If the point is to see what's priced in the stock atm can't you just reverse engineer the model until you get a set of values for operational margins/growth/etc.. which make sense ? and then what's the point in finding out how much growth the market is pricing in ? except to comment on it, aren't we in the business of forecasting stuff here ?

.

There should be a case study on ATP Oil & Gas. Company spent wildly, could never achieve management estimates, and blamed their failure on the BP oil spill. But in relation to Braininajar's post, you can usually go with management guidance and in some cases, you adjust to that. Does management have a history of being right? Obviously they also can't forecast 100% correct and will miss on the rare event, but those that are consistently wrong (e.g., ATP), you would discount their estimates.

Braininajar is largely correct. Sell-side estimates roughly approximate management guidance. Outliers above and below are generally making a strong call on the stock one way or the other. There is a buy-side "whisper", which is where holders feel the company needs to print in order to support the investment thesis at current valuations. If you miss the whisper, the stock will go down despite headline beats.

“There is a buy-side "whisper", which is where holders feel the company needs to print in order to support the investment thesis at current valuations. ” I am sorry, but what do you mean by "needs to print" here? thx!

What concerns me is when companies pay too much attention to consensus estimates. You take a company like Priceline (PCLN) which has beaten estimates every quarter since Q2 2008, by a pretty consistent 5-10%. Is this really happening by random chance that they just happen to come in a few percent better than Street every f@&ing qtr for 24 quarters? Or is the team there "managing" to a number so as not to disrupt the flow of performance much in any given q? That always concerns me when you get finance teams who start to manage to a number, because the risk that they are doing something aggressive on the accounting side or misrepresenting underlying trends is too high. Not trying to accuse them of anything here but it's just the type of pattern that I always find sort of disturbing.

What do analysts base their estimates off of? (Originally Posted: 07/06/2012)

When someone conducting an ER report forecasts earnings or share price, what do they base those off?

I'd be curious if there are management teams that do or have purposefully and continuously set their expectations lower than what they believe they will hit. E.g., what if PCLN mgmt have gave their estimates every quarter that were 5-10% under what they believed they could actually achieve? The stock would fair well after each beat, it looks like they are doing phenomenal, and mgmt may have some nice comp built into either performance or stock. I imagine they'd be in trouble if the SEC ever caught wind that they were purposefully doing this, but it would be interesting to read about.

yeah, i mean I am sure that they are doing exactly this. Current CEO (who previously ran PCLN and came out of retirement after Darren Huston hooked up with employee) is notorious for sandbagging the guidance. In theory the Street should be catching on to this though and analysts should be boosting their estimates by whatever the historical beat is. If PCLN then feels the need to beat the upwardly adjusted Street numbers then you get an endless spiral where there is a lot of pressure to fudge the quarter.

Essentially you are asking a dumb downed version of valuation analysis. Depending on the company/sector estimates and target share price are derived by either DCF, comp analysis, multiples, SOTP, previous transactions or even consensus. I knew of one analyst who would actually model by first coming up with eps and then building his model from there. Seemed to work for him.

Months of research, an in-depth understanding of the company and a good grasp on macro/industry conditions.

Or... they pick up the phone and call management.

10k or Investor presentations can provide sales forecast guidance, i.e. some companies will disclose that they expect same-store sales to increase by x% next fiscal year. But those suck, do your own due diligence.

Ea amet error eius reprehenderit. Est et aliquam explicabo et. Dolor cupiditate at sit deleniti enim voluptatem. A officia perferendis adipisci aut sed ea atque.

Nobis et minus numquam ullam cumque. Corporis voluptate quibusdam tenetur voluptatem quas. Dolorem eos et tenetur facere a. Inventore aut beatae itaque eaque autem. Totam voluptatibus voluptas aut. Pariatur consequuntur repellat error est.

Est minus ab explicabo ea. Hic omnis quia est nihil ut. Sed quae voluptas nostrum esse.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...