Anyone have experience in Shareholder Advisory IB? Goldman posted a new analyst position & I have a few questions.

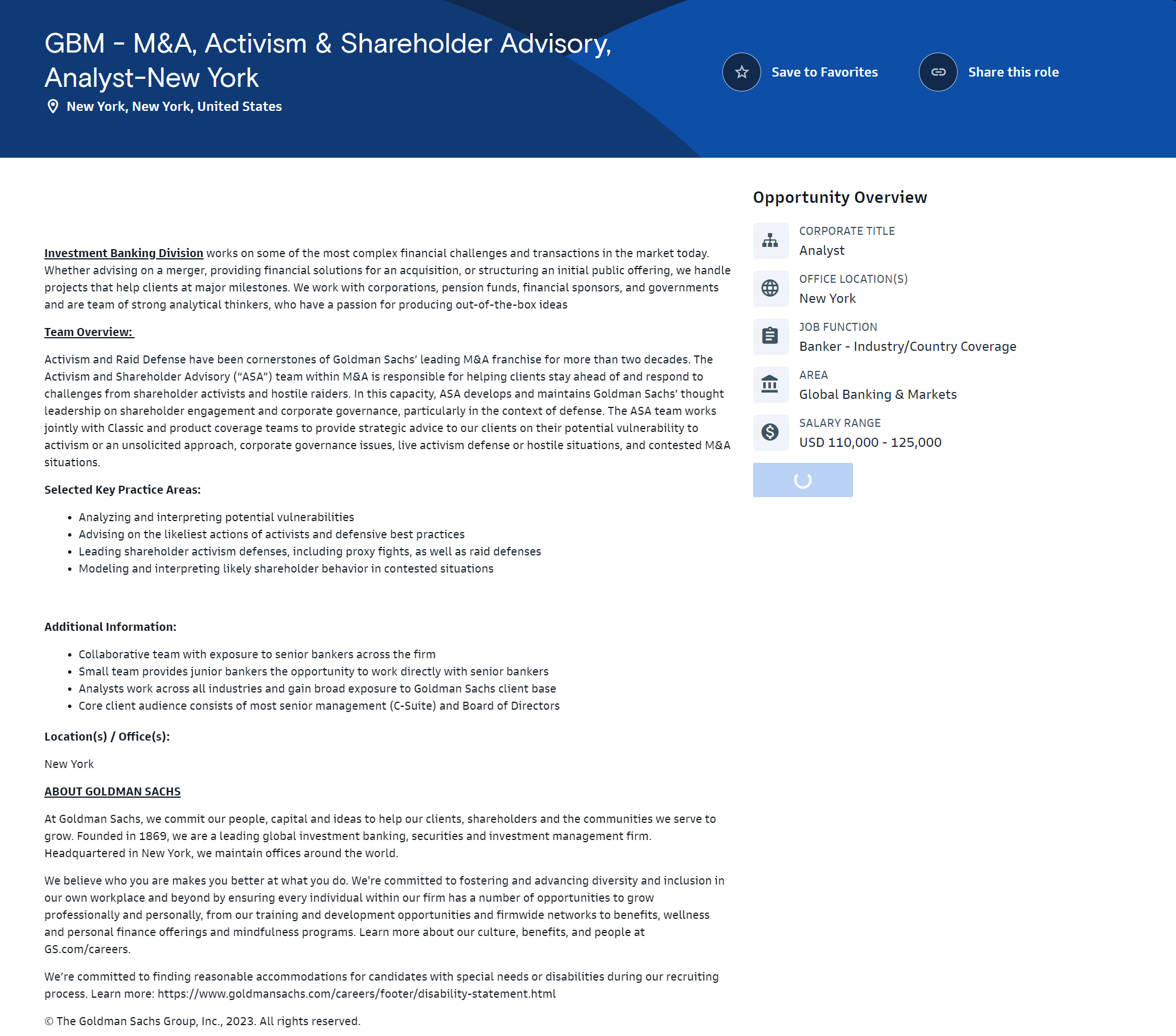

I just saw Goldman posted an analyst opening in their Shareholder Advisory practice. (Screenshot below)

I had a few questions & comments and was hoping someone with experience in a shareholder advisory role could provide some clarity.

Do these roles fall into traditional coverage groups? Are you an advisor specifically to "Energy corps facing activist pressure" or just "Any corp facing activist pressure?". The job posting says "Analysts work across all industries and gain broad exposure to Goldman Sachs client base" but as my career has gone on I've come to learn many firms may say "work across all industries" but what that really means is "the firmwide practice works across all industries but in reality, we segment coverage into geographies so west coast shareholder advisory is 90% TMT workflow, east coast does financial services, etc".

I've personally found wholly transaction-driven sector coverage extremely boring and have some unique experience in "shareholder advisory" for a start-up during a founder dispute and found it deeply engaging. This was a strange case where one of the founders was my friend and I kind of just fell into being his advisor/helping read and draft contracts/anticipating potential strategies by our counterparty, but it was way more fun than my real job! If this is a role where you don't have to be locked into a coverage group and is driven by activist pressure (as opposed to transactions), that sounds perfect. Wondering if I'm off base here.

Are there good exit opps here? Do PE firms value the skillsets you develop in this role or are you just a shittier version of a corp lawyer?

What exactly does "doing defense strategy" entail? My understanding is that the "terms of engagement" so to speak will be very unambiguous and mostly driven by existing contracts and state/federal law. Is the nature of the role to know what types of things could show up in a contract that put the client at risk? Is it just recommending to any given board they enact some random anti-raid defense I've heard of before ("poison pill", "white knight", whatever)

Given the role does not seem transaction-driven, is this type of role fundamentally different than most IB roles? Please correct me if I'm wrong about it not being transaction-driven.

Thanks in advance!

There are not that many activist campaigns in any given industry at one time so it'd be hard to only work on energy for example. SA is a very small team (usually NY/London, no west coast or regional presence) at most banks, and you are usually industry-agnostic and work with coverage teams to understand the industry landscape. Your role is to know the activist playbook and coverage comes in with the company knowledge.

There is a lot of strategy involved and things like poison pills, white knights etc are really quite uncommon. I'd say most common issues are around strategy, board of directors, or a particular segment that activists want spun off etc. It can be transaction driven when there is an M&A deal at issue, but it's not the majority of your work.

To give you some examples of recent activist campaigns, most are fairly interesting. Think Salesforce where activists wanted cost cuts, Exxon/Engine where they proposed (and won) some climate-friendly board directors, Disney where an activist forced them to restructure, or prodding Apple to start doing stock buybacks.

Lastly this group does not exit to PE since you spend little time modeling or in Excel. Many stay because it's an interesting role, but others move to coverage if their goal is PE.

Thanks for the reply! Honestly not super interested in exiting to PE anyways, so that sounds good to me! This sounds like a perfect role for my goals.

Do you think it's feasible to eventually move to a coverage group from this role? And if so, what would a hypothetical timeline look to get there? I am interested in this role, but unfortunately am super interested in PE as well and the modeling/technical component...

Tenetur dolore error sunt ipsa. Et rerum earum saepe rerum laborum fugit maiores.

Sed vel nemo recusandae ut repellendus. Repellat molestiae deleniti expedita eos sapiente fugit. Et qui nobis ab reiciendis ea alias ea.

Dolore nemo voluptas aperiam odit quia et. Expedita ratione dolores et. Culpa eos sunt laudantium unde ullam cupiditate exercitationem natus. Sed consequatur repellat accusamus natus commodi. Eligendi modi illo nam.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...