World-Class Financial Analyst

Financial analysts are important people who help businesses and people with their companies.

What is a World-Class Financial Analyst?

A world-class financial analyst possesses a certain set of abilities that allow them to significantly improve an organization. These abilities include the capacity for both quantitative and qualitative data analysis.

A world-class financial analyst has top-tier comprehension ability of both detailed and broad thinking, the ability to strike a balance between complexity and simplicity, and both technological and social sophistication.

Financial analysts are important people who help businesses and people with their companies.

They help their clients who seek to manage and invest their money by providing valuable advice and expert guidance on ‘how to make informed decisions to squeeze every penny.’This is important because it can help people make good decisions about their money and even help the whole market.

Analysts work in diverse places, like banks that invest money, companies that help people manage their money, or consulting firms that advise other companies. They may also serve in government agencies or non-profit organizations, providing expertise to help inform financial decisions.

The job of a Financial Analyst can depend on where they work. But their main job is to help people and organizations make good decisions about money. As a result, the type of work and work environment for financial analysts varies, depending on their preferences and interests.

Key Takeaways

- A world-class financial analyst possesses a diverse set of abilities, including strong analytical skills, attention to detail, effective communication skills, creative problem-solving abilities, and good time management.

- They have a deep understanding of financial markets, economic principles, and industry trends, enabling them to make informed decisions and provide valuable recommendations to clients.

- Continuous learning and professional development, including obtaining professional certifications like CFA, CFP, or CPA, are crucial for career advancement and staying relevant in the ever-evolving financial industry.

- Ethical behavior, including maintaining confidentiality, independence, integrity, professionalism, and compliance with industry standards, is essential for financial analysts to build trust with clients and colleagues and contribute to the integrity of the financial industry.

Understanding a world-class financial analyst

Financial analysts who are best at their jobs are called world-class financial analysts. They are awfully smart and know a lot about money. They utilize all available resources at their disposal, help their clients make informed decisions, and effectively manage and invest their finances.

A World-Class Financial Analyst would leverage various resources, tools, and techniques for gathering and analyzing financial data and information. Then, they can apply this knowledge to inform their recommendations and decisions, such as:

- Financial modeling: a tool for building a pretend version of what might happen with the money.

- Statistical analysis: a tool for looking for patterns and trends in numbers.

- Market research: a tool for asking people and looking at what’s happening worldwide to understand how money might be affected.

They are skilled professionals with a good grasp of financial markets, economies, and industries they work in. Their expertise allows them to analyze and evaluate data and information to identify potential risks & opportunities that affect a company or investment.

Key Attributes Of A World-Class Financial Analyst

A world-class financial analyst is someone with extensive expertise and abilities in the realm of finance. They use their knowledge to analyze financial information and make sound investment decisions effectively.

Some of the key characteristics defining a world-class financial analyst include:

1. Strong Analytical Skills

Analysts analyze and interpret various financial data and information, such as financial reports, market trends, and economic indicators, among others. They use this information to formulate informed decisions and provide sound recommendations.

2. Attention To Detail

Analysts need to pay strong attention to detail and analyze and interpret financial data carefully. This requires high focus and discipline while working, as even tiny errors can have significant consequences.

3. Good Communication Skills

Analysts need to be good at communicating their findings and recommendations to others. They must write reports and give presentations to make sense to people who might not know much about finance.

Note

Good communication skills, including presenting complex information that clients and colleagues easily understand.

4. Creative Problem-Solving Skills

Analysts are good problem-solvers; they can identify and analyze problems and develop creative solutions. They think critically and strategically and adapt to changing circumstances that might happen.

5. Effective Time Management Skills

Analysts often have tight deadlines and a lot of workloads, so they must manage their time wisely and prioritize their tasks.

6. Strong Work Ethics

Analysts must be highly motivated and have a strong work ethic. This includes working independently, taking the lead, and working well under pressure.

7. Professionalism

Analysts must act professionally and consistently follow industry standards and ethical guidelines.

Note

This includes maintaining confidentiality and behaving in a trustworthy and honest manner.

8. Knowledge Of Financial Markets and Industry

Analysts must thoroughly understand the workings of the financial sector and the specific industry in which their clients operate. This helps them assess companies' financial health and determine which investments might be good choices.

9. Adaptability

Financial markets and economic conditions constantly change. Therefore, analysts must be able to alter their analysis and recommendations accordingly, be flexible and adaptable to keep up with these changes, and make informed decisions.

10. Team Player

Analysts usually collaborate in teams, are good team players, and work well with others. This includes listening and considering the perspectives of others and contributing to a positive team dynamic.

Furthermore, they possess strong work ethics, a deep understanding of financial markets and industry, exude professionalism and the ability to adapt, and are team players.

Importance Of Strong Analytical Skills for World-Class Financial Analysts

Analytical skills are a crucial aspect of a financial analyst’s toolkit, allowing them to conduct financial forecasting, evaluate a company’s financial statements to determine its financial health and weigh potential investment opportunities.

A. Fundamental Analysis

To determine a company's potential, analysts analyze various aspects of the company, including financial statements, management teams, competitive positions, and market trends.

They look for the company’s intrinsic value and potential for future growth. The analysis involves examining a company's income statement, balance sheet, and cash flow statement and analyzing its:

- market share

- customer base

- competitors

B. Technical Analysis

Technical analysis is another approach to evaluating a security's performance, such as a stock or bond, and identifying patterns and trends indicating its future direction.

Technical analysts use charts, trend lines, and indicators to identify these patterns and trends.

C. Portfolio Analysis

Portfolio analysis involves assessing the overall performance of an investment portfolio to make informed decisions about its composition, risk level, and potential return.

The process typically includes analyzing individual investments within the portfolio, considering factors such as historical and projected returns, volatility, and correlations with other assets.

Conducting a thorough portfolio analysis can help investors make informed decisions regarding asset allocation, trade timing, and risk-reward balance.

D. Economic Analysis

Economic Analysis involves looking at broad information, like how a country’s economy is doing. It involves:

- How much money is the country making (called GDP)?

- How many people are jobless (unemployment rates)?

- How much do things cost (inflation) to understand the overall health and direction of the economy?

Economic analysts may analyze specific sectors or industries to understand their performance and potential for growth. This helps analysts understand which areas of the economy might be flourishing or shrinking.

Note

To perform all these analyses, financial analysts use various tools and techniques, including financial modeling, statistical analysis, and software programs such as Excel and specialized financial analysis software.

Strong analytical skills are essential because financial analysis forms the foundation of many key decisions by investors, businesses, and governments. Analysts may also collect information from diverse sources besides financial statements, such as:

- Market data

- News articles

- Industry reports

Financial analysts are critical in guiding clients toward sound decision-making about allocating their resources, whether for investment, financing, or operational purposes.

This requires them to gather and meticulously analyze financial data and information from various resources. They must possess excellent quantitative and qualitative skills to interpret and analyze complex financial data accurately.

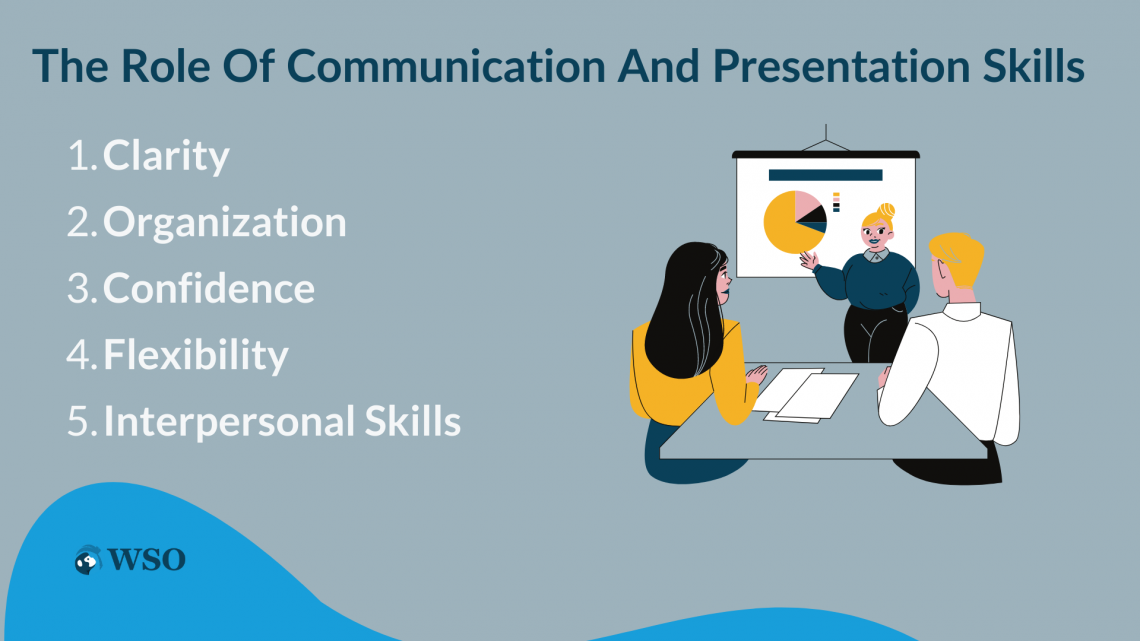

The Role Of Communication And Presentation Skills

As a financial analyst, simply analyzing and providing recommendations is just one aspect of the job. Therefore, effective communication and presentation skills are essential for success in this field, including:

- The ability to organize and structure arguments, demonstrate analysis and make recommendations logically and understandably so the audience can comprehend.

- Use visual aids to illustrate points, such as charts and graphs, to present comprehensible data that captures the audience's interest.

- Anticipate and address objections or concerns that your client or colleagues might have respectfully and persuasively.

There are several key components to effective communication and presentation skills for analysts:

1. Clarity

Financial analysts must present their analysis and recommendations clearly and concisely, without using jargon or technical language that may confuse their audience. Rather, aim to communicate complex concepts in simple, easily understandable terms to a wider audience.

Note

Visual aids such as charts and graphs help people better understand the information being presented.

2. Organization

Analysts formulate their presentations logically and coherently, with a clear introduction, body, and conclusion. They should structure their arguments effectively and present supporting evidence to support their recommendations.

This helps the audience to comprehend the message and its purpose.

3. Confidence

Analysts should be confident in their ideas and explain them persuasively and convincingly. This includes anticipating and addressing potential objections or concerns from the audience.

4. Flexibility

Analysts should adapt their communication and presentation style to fit the needs and preferences of the interested audience. This involves using different techniques, such as storytelling or real-world examples, to make it more relatable and engaging.

5. Interpersonal Skills

Analysts should have strong interpersonal skills, including listening actively and responding to their audience's questions and feedback, not just analyzing and giving presentations. They should build rapport and establish trust with their clients and colleagues.

World-Class Financial Analyst’s Knowledge And Experience

Financial analysts must possess a comprehensive understanding of financial markets, economic principles, and industry trends to carry out their responsibilities effectively.

This helps them understand the following:

- The context in which they operate

- Identify potential risks and opportunities

- Communicate effectively with their clients

- Opportunities for growth and investment

This industry knowledge and experience helps financial analysts to:

1. Understand The Context In Which They Operate

Analysts must understand the broader economic and market forces impacting a company's performance or security rather than just the numbers. This demands a strong understanding, which aids decision-making in the financial markets, economic principles, and industry trends.

2. Make Informed Decisions And Recommendations

They possess a strong understanding of the financial markets and their industries, which are better equipped to make informed decisions and provide recommendations.

They include identifying crucial risks and opportunities and understanding how different market conditions and industry trends may impact a company or security.

3. Communicate Effectively With Clients

Professionals must understand their client’s businesses and industries to communicate information to them effectively. They ensure that the client understands any financial decisions that may impact their business by tailoring their communication style to meet each client's unique needs.

Note

The ultimate objective is to foster confidence in the client’s decision-making and ensure clear and effective communication.

4. Stay Current With Industry Development

Analysts must keep up with industry developments in today's fast-paced and dynamic financial markets and industries.

Professionals who continuously improve their skills, stay informed about the latest research and trends, and adapt to new developments are equipped to succeed in their careers.

Financial Analyst’s Professional Development And Career Advancement Opportunities

Ongoing learning, professional certifications & development are essential for analysts to enhance their skills and career prospects. In addition, these opportunities can help them stay informed of the latest developments in their field and reveal their determination.

Various professional certifications are open to financial analysts. Some include:

a. Chartered Financial Analyst (CFA) certification

The CFA Institute offers the CFA program, a professional certification highly respected in the financial industry. To gain this certification, candidates must pass three tough exams that cover topics such as ethics, financial analysis, and portfolio management.

The program is known for its rigorous curriculum and high pass rates, often recognized as a gold standard in the financial industry. It implies that the holder has vital knowledge and skills to analyze complicated financial data and make good investment decisions.

b. Certified Financial Planner (CFP) certification

The Certified Financial Planner Board of Standards offers the CFP certification, a professional credential to recognize the expertise of financial planners in areas such as investment planning, risk management, and financial planning.

Note

The CFP is seen as a mark of distinction for financial planners and is widely recognized by employers and clients, indicating that the holder has the necessary knowledge and skills to provide detailed financial planning services.

c. Certified Public Accountant (CPA) certification

The CPA certification is a professional credential for accountants offered by The American Institute of Certified Public Accountants, designed to acknowledge the proficiency of accountants in areas such as financial accounting, auditing, and tax planning topics.

To attain this certification, candidates must pass an extensive exam assessing their knowledge of various areas. The CPA is considered prestigious and widely recognized by employers and clients.

It signifies that the holder has high-quality accounting services and is committed to upholding ethical and professional standards.

Note

Financial analysts should emphasize ongoing learning and professional development besides attaining professional certifications. This comprises taking continuing education courses, participating in industry conferences and seminars, and keeping up-to-date with the latest research and trends in the financial industry.

Obtaining professional certifications, pursuing ongoing learning, and engaging in professional development is important for financial analysts to enhance their skills and career prospects.

The Role Of Ethical Behavior In The Financial Industry

Ethical behavior holds paramount significance for financial analysts. Due to their pivotal role in the financial industry, they bear responsibility for making recommendations that have a consequential impact on their clients and the market.

Hence, financial analysts must behave ethically and uphold high standards of conduct. This helps ensure that their recommendations and decisions are based on honest and trustworthy advice and that clients are treated fairly and with integrity.

The financial industry upholds several vital aspects of ethical behavior:

1. Confidentiality

As a financial analyst, it is imperative to uphold the confidentiality of their client’s financial data and refrain from disclosing it without their client’s explicit consent. They must be mindful of their client’s privacy and honor their rights to keep their financial affairs private.

2. Independence

Analysts must be independent and unbiased in their recommendations and not allow personal or financial interests to influence their judgment. They should disclose any conflicts of interest in their work solely on what’s best for their clients.

3. Integrity

Analysts should behave with integrity and adhere to the highest honesty and ethical conduct standards.

Note

Being honest and candid in their dealings with clients and colleagues and not engaging in deceptive or fraudulent practices. This will help build trust and reliability with those they work with, eventually leading to better outcomes for all involved.

4. Professionalism

Analysts should conduct themselves professionally and adhere to industry standards and ethical guidelines. This includes behaving in a way that:

- Reflects the values and reputation of their organization

- Being respectful and courteous towards clients and colleagues

- Help create a positive and supportive work environment

5. Compliance

Analysts must have a thorough grasp of all laws, regulations, and ethical principles that pertain to their field of work. Therefore, it is vital to understand and adhere to these guidelines meticulously.

Ethical behavior is essential for financial analysts to maintain their clients' and colleagues' trust and confidence and contribute to the financial industry's morality and soundness.

Case Studies Of World-Class Financial Analysts

By delving into successful financial analysts, we can acquire valuable insights into skills and knowledge that have contributed to their success, career paths, and key accomplishments.

If you're an aspiring financial wizard, these case studies of two big-shot analysts are gold-full of valuable lessons and insights you won't want to miss.

1. Warren Buffett

Warren Buffett, aka “The Oracle of Omaha,” is a world-renowned investor and financial analyst. Like a financial superhero, he can sniff out undervalued companies with strong growth potential.

He learned his value investing principles from his mentor, Benjamin Graham, who is like a Jedi master. He later founded his investment firm, Berkshire Hathaway, like his Batcave, where he strategized and made millions.

But what makes Buffet stand out is not just his strong analytical skills. Still, his ability to communicate his ideas clearly and effectively and his dedication to lifelong learning and professional development are worth emulating.

2. Mary Meeker

Mary Meeker, a rock-star venture capitalist and financial analyst, is known for her uncanny ability to spot upcoming tech companies with sustainable growth potential.

Starting at Morgan Stanley, she became a tech research and analysis guru and eventually co-founded her venture capital firm, Kleiner Perkins. There, she’s made numerous successful investments in the tech industry, such as:

- Amazon

- Airbnb

What sets Meeker apart from other financial analysts is her ability to identify and analyze emerging trends like a pro and effectively communicate her findings and recommendations. It's like she got a crystal ball for tech investing!

Note

So, for aspiring financial geniuses, take note: build expertise, seek-out promising trends and companies, communicate effectively, and never stop learning. You might become the next big thing in finance or investing.

Advice For Aspiring World-Class Financial Analysts

Financial analysis is rewarding yet challenging. It offers professional and personal growth but requires hard work and dedication.

If you aspire to become a world-class financial analyst, here's a quick guide to assist you in achieving your goals and standing out as a top-performing professional in your field:

1. Develop A Solid Base In Finance And Economics

Financial analysts must have a strong understanding of financial concepts and an understanding of economic principles and trends.

To establish a robust basis in finance and economics:

- Enroll in courses

- Read relevant textbooks

- Conduct comprehensive research online to help develop a better understanding of financial concepts, economic principles, and trends in the industry.

2. Gain Practical Experience

Obtain practical experience through internships or entry-level positions. These opportunities can provide valuable exposure to the financial industry, develop skills and establish a network of business associates.

3. Develop Strong Analytical And Communication Skills.

Sharpen analytical and communication skills through coursework, internships, participating in debate clubs, and other learning opportunities.

4. Consider Obtaining Professional Certifications.

Obtaining professional certifications, such as the CFA or CFP, can help aspiring financial analysts, as they demonstrate a dedication to the profession and can help enhance their skills and improve their career prospects.

5. Stay Current With Industry Developments

Keep learning and developing professionally by staying updated with new research, trends, and best practices in the financial industry and participating in continuing education opportunities.

Armed with these strategies, persistence, and a positive outlook, you can pave your way to a thriving career as a Financial Analyst. Remember to stay curious and commit to learning and growing.

Consequently, you will become a valued asset to any organization and significantly impact the financial world.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?