Audit Legal Implications

To check the legal compliance of various elements.

What Are Audit Legal Implications?

For businesses to improve their performance, they must undergo an audit. However, the procedure may terrify some companies, causing them to postpone its implementation, perhaps introducing hazards that may have been avoided if done differently.

The significance of conducting a legal audit for businesses stems from its purpose: to check the legal compliance of various elements, such as clauses, rules, contracts, and other duties that must be met as a legal organization.

The primary goal of an audit is to ensure that a company's operations are efficient and that its commitments are met. Among the advantages that can be acquired, we can find:

- A strategy that includes both preventative and remedial actions.

- Continuous enhancements to various business processes.

- Identifying business risks to avert future frauds or blunders.

- Internal communication has been improved.

The legal audit is the responsibility of a group of accountants. They can uncover difficulties inside the company that can be foreseen and remedied to guarantee a good performance by employing various methods.

The audit might be considered a rigorous and systematic examination to find flaws or improvement opportunities.

Every six months or once a year, an audit must be performed. Nonetheless, if there are administrative issues, the help of a specialized business might be sought.

What is an Audit?

Auditing is a thorough analysis and assessment of a company's financial statements. Financial statement audits, an analytical inspection, and an evaluation of a company's financial statements are usually undertaken by an external third party.

Internal auditors and government entities such as the Internal Revenue Service (IRS) can conduct audits.

Audits are conducted to check that financial statements are produced in conformity with applicable accounting rules. The three primary financial statements are as follows:

Management prepares financial statements internally using applicable accounting standards such as International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP). They are designed to offer relevant information to the users listed below:

- Shareholders

- Creditors

- Governmental organizations

- Suppliers

- Partners

- Customers

What Are Legal Audits?

A legal audit assesses a company's legal situation and concentrates on a specific component of an organization. A legal audit assures that the organization has no hidden hazards. It also exposes issues that put an organization in danger of penalties and lawsuits.

While a legal audit conducts an in-depth review of one aspect of a business, it is not so intrusive as to interfere with day-to-day operations.

A legal audit may cover the following topics:

- Selection and structure of a corporate company

- Board of Directors Acts and supporting papers

- Marketing and distribution methods

- Estate planning

- Intellectual property protection

- Any ongoing or impending lawsuit

- Employment contracts

- Insurance coverage

- Compliance with securities laws

- Human resource processes, such as hiring and firing

- Sales and collection tactics

- Antitrust and associated government rules

- Product liability

- Environmental legislation

audit legal implication: Importance

An auditor's legal significance is to ensure the dependability of financial accounts for all external users.

Auditors risk legal and criminal liability for carrying out their responsibilities and guaranteeing the transparency, usefulness, and trustworthiness of financial information given by reporting firms.

Audits are required to assess whether the transactions presented by a business accurately depict its economic status and operations.

Internally generated financial records are prone to exploitation or fraudulent conduct by insiders. Internal parties may have underlying motives to alter this information, and auditing is necessary to guarantee that the records are not misstatements due to error or fraud.

As a developing company, it is critical to recognize possible concerns or liabilities before they become a reality. The most prominent advantage of a legal audit is that it identifies compliance concerns before they cost the organization money in penalties or lawsuits.

Different firms are subject to varying types of liabilities. The legal audit identifies these possible difficulties as they pertain to the unique circumstances of a corporation.

A legal audit can bring the following benefits even to a small business:

- Providing investors and lenders with reasons to believe in a firm

- Increasing your profit margins or achieving profitability by identifying operational inefficiencies and major fraud concerns

- Simplifying the tax system

- Avoiding legal culpability

What Is An Accounting Fraud?

Accounting fraud occurs when a business, such as a corporation, intentionally falsifies its financial statements and records. Accounting fraud is hard to define since most financial representations are based on guesses.

For example, suppose a corporation decides to produce an estimate that is later amended. In that case, this is not deemed fraudulent activity as long as the forecast was done in good faith utilizing all relevant facts.

Accounting fraud is when a corporation intentionally understates its revenues to look more lucrative or overstates its assets to appear more financially sound.

Accounting fraud can be committed by overstating revenue, omitting to report costs, or misstating assets and liabilities.

One of the most well-known examples of accounting fraud is the Enron incident.

Punishment And Legal Actions For Accounting Fraud

Accounting fraud is a crime that can be prosecuted in both criminal and civil courts.

The Securities and Exchange Commission (SEC) is an independent body in the United States that is charged with safeguarding investors and ensuring fair, orderly, and efficient markets. This is primarily to ensure public faith in the financial system.

Accounting fraud weakens the confidence that a market system requires. For example, if a consumer of accounting records, such as an investor, cannot trust the firm's reported financial accounts, the investor is unlikely to invest cash with that company.

Auditors are held to the same standard. Investors need to believe that they can rely on auditors' opinions and that they will receive appropriate advice. Otherwise, the financial system will be jeopardized.

As a result, three factors must be present to create an efficient and transparent market economy:

- Regulations (accounting standards)

- Examiners (auditors)

- The authorities (laws and government agencies)

Laws and Regulations of Auditing

The auditor's examination of whether the firm has adhered to the laws and regulations is a crucial aspect of an external audit.

Applicants preparing for Audit and Assurance (AA) and Advanced Audit and Assurance (AAA) must understand how laws and regulations affect an audit, not only in terms of the work required of the auditor but also in terms of the responsibilities of both management and the auditor when it comes to laws and regulations.

The standard specifies a 'non-compliance' conduct as follows:

'Intentional or negligent acts of omission or commission perpetrated by the entity, or by those tasked with governance, management, or other persons working for or under the supervision of the company, that is contradictory to the prevailing laws or regulations. Personal wrongdoing unconnected to the entity's commercial activity is not non-compliant.'

Direct And Indirect Laws & Regulations

To continue doing business, an operational entity may be required to comply with several rules and regulations.

Many companies, for example, may be required to follow severe health and safety regulations; a food maker may be required to follow strict food hygiene legislation; and an accounting company must follow a code of ethics from its professional body.

Such rules and regulations will immediately and indirectly impact financial statements.

The auditor will be concerned with obtaining adequate and suitable audit evidence that the company has complied with such laws and regulations for those rules and regulations that have a direct influence on the financial statements.

When auditing payroll, for example, the auditor will be worried about assembling sufficient and appropriate audit evidence to guarantee that the entity has correctly applied tax legislation.

If it has not, there is a risk that the entity will be fined for noncompliance. The financial penalties could be material in solitude or when aggregated with other misstatements.

Furthermore, quantities in financial statements may be incorrectly stated due to non-compliance with rules and regulations.

The auditor will conduct processes to discover noncompliance with such regulations and statutes for rules and laws that indirectly impact financial statements. Examples include:

- Compliance with operating license terms.

- Compliance with regulatory solvency criteria

- Compliance with environmental standards

Reporting Suspected Or Identified Non-compliance With Rules And Regulations

When auditors detect noncompliance with laws and regulations, they must register those in control of governance.

However, the auditor must exercise caution because if the auditor feels that people in charge of governance are engaged, they must notify the next most significant degree of authority, including the auditing committee.

If a higher authority level is unavailable, the auditor will consider obtaining legal counsel.

The auditor must also assess if the non-compliance significantly influences the financial records and, as a result, the impact on their report.

If the auditor discovers or suspects noncompliance, they must examine if the law, regulation, and ethical obligations compel the auditor to report to an authorized authority outside the company or whether duties exist whereby this may be appropriate.

Audit And Money Laundering

Many crimes aim to make money for the person or group who commits the act.

Money laundering is the processing of unlawful proceeds to conceal their illegal origin. This procedure is crucial because it allows the criminal to enjoy the gains without jeopardizing their source.

Auditors must exercise extreme caution regarding money laundering problems, especially in cash-based organizations with vast potential for money laundering. Money laundering typically occurs in three stages:

-

Placement: the injection of unlawful finances into a financial system.

-

Layering: the process through which money is transmitted via significant transactions. This is intended to make it extremely difficult to track the money back to the origin.

-

Integration: the process by which 'bad' money becomes 'pure' when it enters a legitimate economy.

The following are examples of money laundering offenses:

-

Obtaining, utilizing, or owning illicit property.

-

I am participating in an arrangement known or suspected of assisting in acquiring criminal property.

Money laundering is a felony act in many countries. Suppose an auditor or accountant discovers a situation that may give rise to money laundering. In that case, they must report such suspicions to a 'money laundering reporting officer' (MLRO), whose obligation is to notify an enforcement agency of such apprehensions.

It is illegal to fail to notify suspicions of money laundering to the NCA or the MLRO as soon as possible, and it is also unlawful for the MLRO to forget to forward a report to the NCA.

Legal Liability of Auditors

Issues concerning auditors' legal culpability are growing by the day. Auditors are critical individuals since they are ultimately accountable for improving the dependability of financial accounts for all types of external consumers.

They, like other professionals, may risk legal and criminal responsibility when carrying out their obligations.

Without independent and skilled auditors, many fraud instances worldwide would have gone unreported, not to mention all the additional cases that have yet to be identified.

Auditors may incur legal and criminal liability while carrying out their tasks. They are subject to a professional code of ethics that requires them to use caution when doing their jobs.

Due care entails four components:

- Having the necessary abilities to assess accounting records

- The need to use skills with sufficient care and diligence

- Taking on things with honesty and integrity

- Liability for carelessness, bad faith, and deception

Auditors are accountable to the consumers of financial statements and the potential users who may rely on the financial statements on which they provide an opinion.

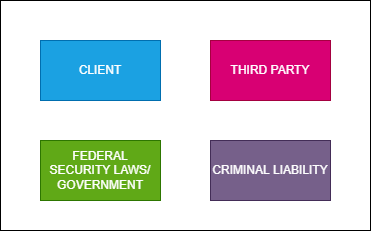

These are sources of legal liability for an auditor:

The possible reasons for suing an auditor include-

- Breach of Contract (for Client)

- Negligence (of Third Parties users)

- Fraud/Gross Negligence (by Federal Securities Laws or Government)

Lawsuits against Auditors

Investors rely on corporate auditors to maintain an objective eye on the accounting processes of the firms in which they invest.

Historically, investors have not been afraid to file lawsuits when they considered auditors were not doing enough to prevent their clients from cooking the books or participating in other financial irregularities.

However, a recent study found that lawsuits against auditors for accounting irregularities have decreased over the last 20 years. This isn't because accountants have gotten better at their jobs or businesses have been more honest.

Unjustified Lawsuits

Despite the possibility of litigation against auditors, many third-party claims are unwarranted.

For instance, if a third party tries to sue the auditor because the client (i.e., the firm being audited) is no longer viable, the suit is unjustified since the auditor is not responsible for ensuring that the organization is possible and can continue functioning in the long run.

The auditor ensures that the financial statements are prepared moderately by the applicable assessment criteria. Furthermore, unjustified litigation may entail audit risk phenomena.

Audit risk is the possibility that an auditor performs everything correctly/to the best of their abilities but expresses an incorrect audit opinion on the financial report.

Essentially, the scenario concerns mistakes in financial accounts that might persist well after the auditor has fulfilled the regulatory body's auditing requirements.

Successful Lawsuits Against Auditors

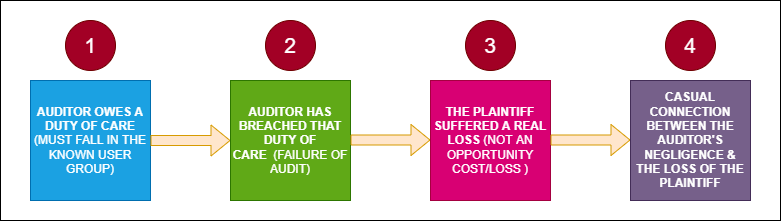

It is not enough for a third party or a client to successfully present evidence and pursue a court action to sue an auditor for carelessness. The plaintiff must establish the four following criteria:

Audit Legal Implications FAQs

The 20 percent accuracy-related penalty is the most typical penalty imposed on taxpayers during an audit, although the IRS can also levy civil fraud penalties and propose criminal prosecution.

The auditor is exclusively responsible for ensuring that the financial statements are presented relatively by the applicable assessment criteria. Furthermore, unjustified litigation may entail audit risk phenomena.

Yes, auditing is legal. An audit, as it is most usually used in legal contexts, is a professional accountant's study of financial records, papers, and other evidence.

Audit failures are frequently associated with deposit losses, job losses, and individual livelihood losses.

The auditor's professional obligation to keep client information secret may prevent reporting identified or suspected noncompliance with laws and regulations to a person outside the company.

The IRS does not allocate your mail audit to a single individual. Therefore, if you do not react, respond late, or respond incompletely, the IRS will most likely invalidate the items on your return, scrutinizing and giving you a tax bill - plus penalties and interest.

Researched and authored by Shannon Fernandes | LinkedIn

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?