Argentina Case Study: How a Black Market Currency Emerges

A question was posed to me by our chief operating orangutan, Andy Louis, about Argentina's black market currency exchange, commonly called the blue market. Being a foolish person in general, I obliged to write about the potential causes and investment implications that the myriad currency controls and economic interventions undertaken by the Argentine government have promulgated.

This is absolutely a challenging question, and I assure you, my answer will be absolutely wanting. Someone much smarter than me would require another 50,000 words to be anywhere near convincing, but my hope is that this will at least fuel discussion.

A good place to begin is Argentina's blue market exchange rate. Luckily, in the information age, even black markets have tickers...

The key point you'll notice, the first is the point referred to in the graph as "Comienzo del Cepo Cambiario" in November of 2011. That the rate volatility began to fluctuate so wildly after November 2011 is no coincidence. It was then that the Argentine government began to institute capital controls, aimed at restricting the flow of US dollars. The resulting increase in the price of blue market dollars should not come as a surprise. With the supply of dollars severely restricted and demand left unchanged, a price increase is ensured. Keep in mind, Argentina is no backwater banana republic. It's a modern economy, making this situation all the more peculiar. In particular, one aspect that is shared by modern economies is that the populace will require a system by which they can profitably invest. But, with strong capital controls in place, the question becomes difficult. Thankfully, Andy has provided me with some invaluable sources, and their responses are interesting to say the least.

There's no 401Ks and CDs that the average Argentine can invest in, or that they would trust (i.e. AFJP mess), so all of their "savings" is either on the street (car) or in bricks (real estate). Real estate is still valued in dollars, so basically, Argentines save in dollars, and have restricted access to them. No one in their right mind would sell a property for say 100,000 USD and get stuck holding a handful of peso equivalent (at blue or otherwise) with 25%+ inflation. This is what basically froze the real estate market here, and the government is smoking some funny stuff it they think these new vouchers are going to get things moving in a significant way. Anyone wanting to build wealth, in their mind, needs dollars

This is reflected in the reporting of other outlets, namely Bloomberg, who also notes that expensive BMWs are used as a currency hedge. This, of course, is only the tip of the iceberg when it comes to appropriately hedging your exposure to the peso for the ordinary Argentine citizen.

As a former financial planner, I checked things out over 5 years ago of what it would be like to help people to invest here. It turns out that any big money means you help them (illegally) invest outside the country. If you were to invest in a portfolio domestically, there is a requirement that HALF of your portfolio must be invested in the MERVAL, which, obviously, would put your portfolio risk not suitable for long term investing, and certainly not suitable for your whole nest egg. The only (somewhat sane) way I found to invest small amounts of money each month (like 100 USD) is through a similar structure of what would be called in the states "Variable Universal Life Insurance" through companies like Zurich or Prudential in which you can invest in "mutual fund subaccounts" inside a permanent life insurance product. The subaccounts mimic real mutual funds and you are free to choose the asset allocation. You also get life insurance (not very common here) starting at 250,000 USD equivalent. Zurich's products seemed pretty solid here and they are (supposedly) the only company in Argentina that did not devalue the cash value of policies in 2001-2002. Bottom line for feasibility of becoming a financial planner here: if you want to do things legally, it would be a lot of running around and a lot of work for very little return. I decided it wasn't worth doing.

The basic theme I'm getting is that Argentines save in dollars, and exchange those dollars for pesos when the need arises. A currency trader and Argentine native suggests that this has been the case for many years.

I emigrated from Argentina to the USA in 1961. I have since come back every year. I have a large circle of local friends and family. During all these years, those who "saved" dollars have done best in the long run. As a matter of fact, I have never met anyone who saved pesos.

The conclusions that I'm forced to draw here is that investment in Argentina must be dollar based, and that if you can accomplish this, many Argentine citizens can probably provide you with some good business. From where I'm sitting, this is a pretty interesting investing dynamic, but the questions of "how" this is occurring, and "why" are worth exploring.

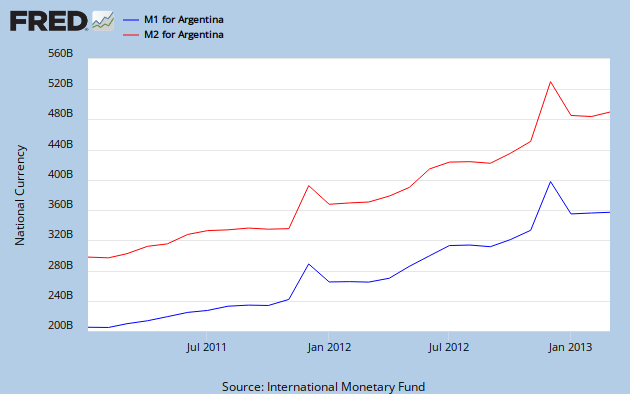

As a good American who's all too familiar with QE, the question of "how" such aggressive inflation could be occuring leads initially to the expansion of the currency supply. So, lets take a peek at their M1 and M2 levels.

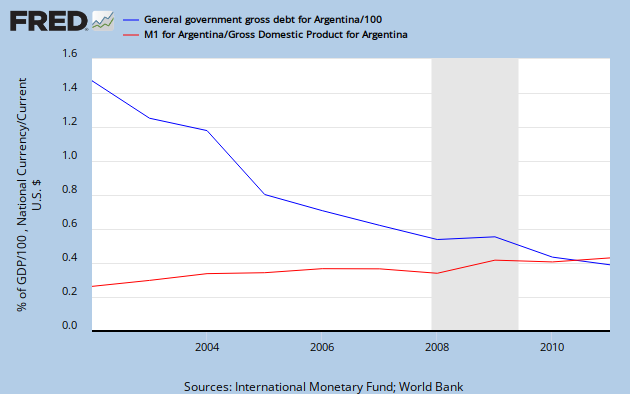

Now, what is a central bank to do with all their fresh new money? Well, traditionally, you use it to buy government bonds to increase government spending. Funny thing though, over the past decade or so, government debt has been decreasing fairly quickly as M1's share of GDP has been increasing.

Interestingly, as M1's percentage of GDP has gone up, their currency has depreciated by almost the exact same amount, at 103.25% and 105.54% respectively from 2002 to 2011. Additionally, Argentina's government debt as a share of GDP as dropped by 72.76% over the same period. To me, this does not appear to be the QE seen here in the US, instead, it appears that the government is literally inflating away their debt via an expansion of the money supply. Although, an interesting point was raised about this particular strategy and a potential pitfall:

..it only works if you are inflating away debt that is denominated in your own currency (like the US does, albeit at a less noticeable pace).

The data is from the IMF and while it does appear to be measured in dollars, it's unclear if it's denominated in dollars. Nevertheless, the point is very true, you can't inflate away another currency, only your own. So, what does this mean for the future of Argentina's exchange rate? Well, here is their projection of government debt all the way to 2017.

From what I can tell, given their propensity to print to pay down debt, the money supply and the resulting inflation doesn't seem likely to improve. A conclusion that probably won't shock many of you. However, the "how" was never the peculiar question, it's always been about "why" these actions are being pursued that's been of interest. Argentina is rich with natural resources, and you would think that they would be able to profit from their availability. It's not like it'd be the first time, Argentina was very powerful economically in the early 20th century. What changed?

I have an idea, I'm not sure how correct it is, but I do think it makes sense and fits well with the actions of their government. But, we'll have to go back to before 2001, when Elliott Management's subsidiary NML Capital started buying up Argentina's debt as fast as it could. You're all familiar with the basic strategy here, buy up distressed debt, then hold out, which is precisely what was done with great success. Here's an interesting twist, after the judgment from the 2nd circuit came down, the risk of technical default from other bonds became more clear, as reported by Reuters,

If Griesa's ruling is upheld by an appeals court and Argentina still refuses to pay, U.S. courts could eventually block debt payments to creditors who took part in the debt restructurings out of consideration for investors who rejected Argentina's terms at the time.That would trigger a technical default on approximately $24 billion worth of debt issued in the 2005 and 2010 exchanges

If Argentina was less than keen to pay the holdouts the original $1.33 billion NML Capital was looking for, $24 billion would likely appear to be a material risk to Argentina's government. Their bond prices, as observed by J.P Morgan support this approach, as do observations of the Argentine CDS rate.

Currently, the case is awaiting a response from the US Solicitor General, as requested by the Supreme Court of the United States, giving Argentina a reprieve until the next session. It is this decades old debt case that appears to be the motivation behind Argentina's currency controls and inflation. It appears that the Argentine government is motivated to get their debt to as small a level as possible, and by any means necessary (especially considering one particular voting member of the ISDA's credit derivatives determinations committee), to avoid the worst possible of outcomes that this ongoing battle could cause.

Similique quis assumenda possimus necessitatibus hic eum. Qui fugit repellendus voluptas praesentium vero et quam numquam. Dolorum reiciendis a consequatur similique voluptas inventore. Dolores ducimus quis assumenda molestiae consequatur est. Qui ea et sequi dignissimos ipsa velit et totam. Est tenetur aut omnis labore.

Exercitationem suscipit nihil quo saepe architecto nihil soluta. Quis ad soluta enim eum delectus distinctio delectus.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Qui quas natus officiis dolorem cupiditate. Impedit est velit ut minima sunt. Minus vero excepturi doloribus dolor eum quos enim.

Aut unde et dolorem qui quaerat voluptatem porro. Amet qui sapiente quas enim voluptatem. Dolor delectus voluptatem ut iusto.

Accusamus ut voluptatem dicta officiis odio. Sed est voluptatem ex. Maiores recusandae commodi dolore itaque voluptatibus maiores eum.

Accusantium recusandae sit deleniti dolorem nihil dolor. Distinctio aliquam qui enim illum. Deserunt ut id explicabo consequatur quae rerum porro. Itaque cupiditate qui minima laudantium eum.

Ipsa qui beatae in. Deleniti sed doloribus ut dolor ad maxime nobis. Odit eveniet nesciunt facilis esse veniam inventore. Dolorum natus qui magnam vel tempore ea enim. Cupiditate velit perspiciatis qui illo aut velit. Aliquam omnis commodi molestiae veritatis deserunt rerum aliquam. Sequi nihil nulla ducimus enim.

Est tempora sequi recusandae est. Qui quis nulla et. Odit ea et dolorum sed sit. Dolore aperiam mollitia totam consequatur nisi et repellendus. Omnis ea veritatis voluptatem. Minus rem suscipit dolorum dolores minus voluptatibus.

Odit dolorum at in reiciendis molestiae maxime. Consequatur saepe at eveniet porro eum exercitationem hic. Quam porro iste neque esse. Porro sint aut laudantium. Fuga ut quia et magnam.

Laudantium et ullam impedit aut est aut. Et enim vero voluptatem sed doloribus nihil.

Et distinctio qui minus repellendus nam quasi iure. Occaecati consequatur maiores accusamus molestiae dolorum. Sunt incidunt accusantium molestias pariatur nam provident aspernatur. Ut sit sit nihil enim aut in odio. Vero eum voluptatem recusandae nesciunt aut delectus rem.

Eligendi aut similique necessitatibus provident sit quis. Iusto illum illum et quae. Est accusamus omnis quis nihil laborum.

Impedit ut dolor rerum quia ullam. Consectetur cupiditate saepe ratione ut amet aut molestiae. Nemo reiciendis fugiat provident esse explicabo. Pariatur cupiditate tenetur eius quo ut reiciendis.

Voluptatem aut et expedita rem sapiente enim et. Doloremque alias magnam laudantium aspernatur excepturi sit.

Voluptas cum aut et quisquam voluptatem velit. Fugiat iste pariatur esse occaecati. Minus quia iusto nihil. Eos maxime doloremque quis est cum.

Repudiandae non occaecati hic est quibusdam suscipit corporis. Repudiandae explicabo provident iste accusamus nulla nam nulla.

Et cumque sapiente similique possimus temporibus eius. Rerum tempora placeat est expedita. Sit et rerum quas nobis.

Illo debitis id illum quidem dolores non. Maiores quo sit occaecati voluptates. Eius minus et doloribus explicabo maxime. Magnam magnam ut rerum. Temporibus dolorem et optio et laboriosam eaque. Nesciunt dolor fugiat possimus aperiam qui excepturi nihil.

Totam quis velit nam consequatur. Aliquid ut rerum possimus et qui voluptatem. Provident est qui rerum sit.

Ipsa accusantium totam ut dignissimos. Odio velit magnam voluptas est similique deleniti. Vel eligendi non facere voluptatem voluptatem. A corrupti cupiditate et omnis culpa qui qui voluptatem. Vel beatae debitis voluptatum velit facilis.

Ut alias a dolor iste eos. Temporibus aspernatur qui sit quia. Enim enim molestiae impedit doloribus voluptatem animi aut est. Voluptatibus dolorum aut dolor minus laboriosam. Eveniet eius perferendis sapiente. Atque quis pariatur ipsum quo ut voluptatem.

Maiores pariatur corporis voluptas rerum. Mollitia nesciunt at ea minima praesentium. Qui mollitia laudantium culpa aut sequi veritatis aut et. Adipisci molestiae cumque laboriosam quae quasi mollitia harum.

Dicta voluptas deserunt voluptatum excepturi enim veritatis iusto. Laboriosam ut quisquam et ipsam. Autem omnis dolorem quis et.

Est eum iusto quaerat quo earum ut mollitia a. Ducimus ut quod fuga id est amet iste voluptatibus. Error voluptate ipsa alias modi reiciendis.