DCF Myth 1: If you have a D(discount rate) and a CF (cash flow), you have a DCF!

Mod Note (Andy) - as the year comes to an end we're reposting the top discussions from 2015, this one ranks #35 and was originally posted 2/24/2015.

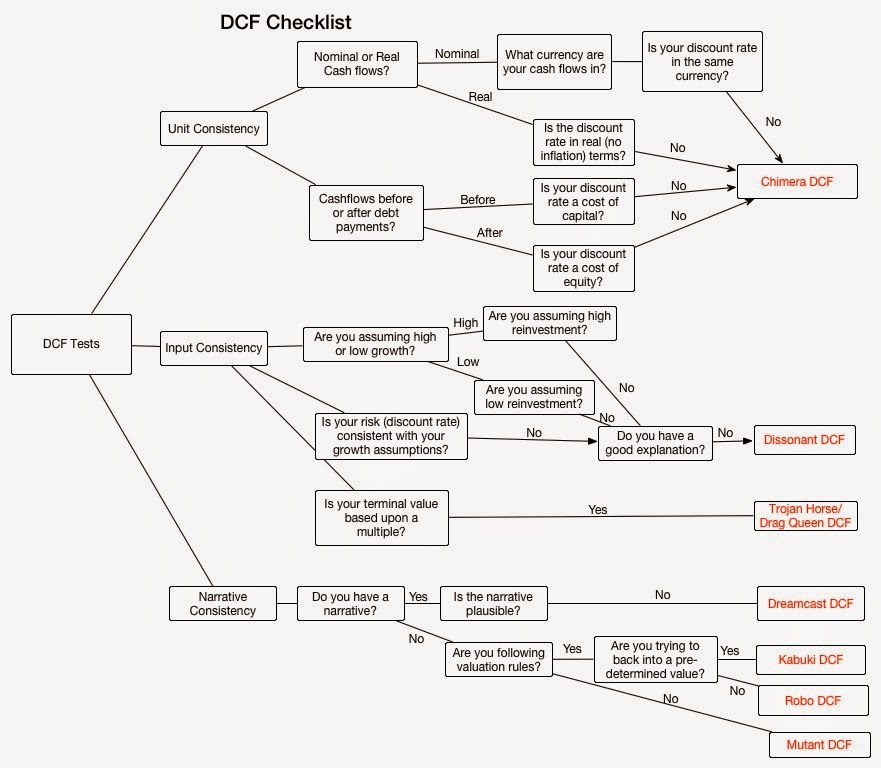

Earlier this year, I started my series on discounted cash flow valuations (DCF) with a post that listed ten common myths in DCF and promised to do a post on each one over the course of the year. This is the first of that series and I will use it to challenge the widely held misconception that all you need to arrive at a DCF value is a D(iscount rate) and expected C(ash)F(lows). In this post, I will take a tour of what I would term twisted DCFs, where you have the appearance of a discounted cash flow valuation, without any of the consistency or philosophy.

- Equity versus Business (Firm): If the cash flows are after debt payments (and thus cash flows to equity), the discount rate used has to reflect the return required by those equity investors (the cost of equity), given the perceived risk in their equity investments. If the cash flows are prior to debt payments (cash flows to the business or firm), the discount rate used has to be a weighted average of what your equity investors want and what your lenders (debt holders) demand or a cost of funding the entire business (cost of capital).

- Pre-tax versus Post-tax: If your cash flows are pre-tax (post-tax), your discount rate has to be pre-tax (post-tax). It is worth noting that when valuing companies, we look at cash flows after corporate taxes and prior to personal taxes and discount rates are defined consistently. This gets tricky when valuing pass-through entities, which pay no taxes but are often required to pass through their income to investors who then get taxed at individual tax rates, and I looked at this question in my post on pass-through entities.

- Nominal versus Real: If your cash flows are computed without incorporating inflation expectations, they are real cash flows and have to be discounted at a real discount rate. If your cash flows incorporate an expected inflation rate, your discount rate has to incorporate the same expected inflation rate.

- Currency: If your cash flows are in a specific currency, your discount rate has to be in the same currency. Since currency is primarily a conduit for expected inflation, choosing a high inflation currency (say the Brazilian Reai) will give you a higher discount rate and higher expected growth and should leave value unchanged.

- The Chimera DCF: In mythology, a chimera is usually depicted as a lion, with the head of a goat arising from his back, and a tail that might end with a snake's head. A DCF valuation that mixes dollar cash flows with peso discount rates, nominal cash flows with real costs of capital and cash flows before debt payments with costs of equity is violating basic consistency rules and qualifies as a Chimera DCF. It is useless, no matter how much work went into estimating the cash flows and discount rates. While it is possible that these inconsistencies are the result of deliberate intent (where you are trying to justify an unjustifiable value), they are more often the result of sloppiness and too many analysts working on the same valuation, with division of labor run amok.

- The Dreamstate DCF: It is easy to build amazing companies on spreadsheets, making outlandish assumptions about growth and operating margins over time. With attribution to Elon

Musk, I could take a small, money losing automobile company, forecast enough revenue

growth to get its revenues to $350 billion in ten years (about $100 billion higher than Toyota or Volkswagen, the largest automobile companies today), increase operating margins to 10% by the tenth year (giving it the margins of premium auto makers) and make it a low risk, high growth company at that point (allowing it to trade at 20 times earnings at the end of year 10), all on a spreadsheet. Dreamstate DCFs are usually the result of a combination of hubris and static analysis, where you assume that you act correctly and no one else does.

- The Dissonant DCF: When assumptions about growth, risk and cash flows are not consistent with each other, with little or no explanation given for the mismatch, you have a DCF valuation

where the assumptions are at war with each other and your valuation error will reflect the input

dissonance. An analyst who assumes high growth with low risk and low reinvestment will get too high a value, and one who assumes low growth with high risk and high reinvestment will get too low a value. I attributed dissonant DCFs to the natural tendency of analysts to focus on one variable at a time and tweak it, when in fact changes in one variable (say, growth) affect the other variables in your assessment. In addition, if you have a bias (towards a higher or lower value), you will find a variable to change that will deliver the result you want.

- The Trojan Horse (or Drag Queen) DCF: It is undeniable that the biggest number in a DCF is the terminal value, and for it to remain a DCF (a measure of intrinsic value), that number has to be estimated in one of two ways. The first is to assume that your cash flows will continue

beyond the terminal year, growing at a constant rate forever (or for a finite period) and the second is to assume liquidation, with the liquidation proceeds representing your terminal value. There are many DCFs, though, where the terminal value is estimated by applying a multiple to the terminal year’s revenues, book value or earnings and that multiple (PE, EV/Sales, EV/EBITDA) comes from how comparable firms are being priced right now. Just as the Greeks used a wooden horse to smuggle soldiers into Troy, analysts are using the Trojan horse of expected cash flows (during the estimation period) to smuggle in a pricing. One reason analysts feel the urge to disguise their pricing as DCF valuations is a reluctance to admit that you are playing the pricing game.

- The Kabuki of For-show DCF: The last three decades have seen an explosion in valuations for legal and accounting purposes. Since neither the courts nor accounting rule writers have a clear

sense of what they want as output from this process (and it has little to do with fair value), and there are generally no transactions that ride on the numbers (making them "show" valuations), you get checkbox or rule-driven valuation. In its most pristine form, these valuations are works of art, where analyst and rule maker (or court) go through the motions of valuation, with the intent of developing models that are legally or accounting-rule defensible rather than yielding reasonable values. Until we resolve the fundamental contradiction of asking practitioners to price assets, while also asking them to deliver DCF models that back the prices, we will see more and more Kabuki DCFs.

- The Robo DCF: In a Robo DCF, the analyst build a valuation almost entirely from the most recent financial statements and automated forecasts. In its most extreme form, every input in a

Robo DCF can be traced to an external source, with equity risk premiums from Ibbotson or Duff and Phelps, betas from Bloomberg and cash flows from Factset, coming together in the model to deliver a value. Given that computers are much better followers of rigid and automated rules than human beings can, it is not surprising that many services (Bloomberg, Morningstar) have created their own versions of Robo DCFs to do intrinsic valuations. In fact, you could probably create an app for a smartphone or tablet that could do valuations for you..

- The Mutant DCF: In its scariest form, a DCF can be just a collection of numbers where items have familiar names (free cash flow, cost of capital) but the analyst putting it together has

neither a narrative holding the numbers together nor a sense of the basic principles of valuation. In the best case scenario, these valuations never see the light of day, as their creators abandon their misshapen creations, but in many cases, these valuations find their way into acquisition valuations, appraisals and portfolio management.

DCF Myth Posts

Introductory Post: DCF Valuations: Academic Exercise, Sales Pitch or Investor Tool

- If you have a D(discount rate) and a CF (cash flow), you have a DCF.

- A DCF is an exercise in modeling & number crunching.

- You cannot do a DCF when there is too much uncertainty.

- The most critical input in a DCF is the discount rate and if you don’t believe in modern portfolio theory (or beta), you cannot use a DCF.

- If most of your value in a DCF comes from the terminal value, there is something wrong with your DCF.

- A DCF requires too many assumptions and can be manipulated to yield any value you want.

- A DCF cannot value brand name or other intangibles.

- A DCF yields a conservative estimate of value.

- If your DCF value changes significantly over time, there is either something wrong with your valuation.

- A DCF is an academic exercise.

Dignissimos perspiciatis dicta et unde. Voluptatem aperiam et ex animi nesciunt repellendus temporibus quo. Error non rerum et dolor dicta. Nam nulla error nisi nemo. Sit ducimus iusto nulla fuga autem.

Saepe occaecati a sunt adipisci non eveniet cum. Omnis error nulla praesentium itaque pariatur similique. Provident et provident dolorum modi a sit. Excepturi illum corrupti eius consequatur ducimus. Et aut nesciunt ad est. Consequuntur non similique corporis cupiditate inventore quis. Cum autem porro enim dolor laborum reiciendis et.

Et cupiditate debitis distinctio rerum. Laboriosam quae veniam quia corrupti voluptas enim amet. Omnis natus veritatis vel eum est. Dolor maiores commodi fuga quidem. Necessitatibus unde nihil quos tempora est doloremque. Enim et sunt cupiditate culpa est esse tenetur dicta.

Quia vero doloremque commodi rerum ipsum autem. Eius soluta at id fuga ratione. Nesciunt quo vero quam.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Quo a nisi soluta voluptatem. Enim sit aliquid suscipit harum atque temporibus. Voluptatem eos quia ut dignissimos dicta facilis quia. Facere voluptatum odio explicabo laudantium. Cupiditate non soluta natus ad dolorum eligendi. Architecto non iusto sit vel qui in aut mollitia.

Sunt culpa aut et est aut at modi. Recusandae molestias non nobis pariatur velit. Qui et adipisci quae. Adipisci cumque omnis neque explicabo dolores voluptatem saepe. Molestiae rerum minus eum voluptatibus fugit. Quos eius et dolorem soluta.

Tempore quia nihil nulla soluta in magni temporibus. Dolore ad et tenetur modi aut. Voluptatibus dicta et quod ut aspernatur placeat velit. Suscipit ut incidunt velit consequuntur dolorem.

Natus et optio harum sit quis quis. Exercitationem et ad enim. Sed deserunt consequuntur ullam in. Laboriosam qui sed consequatur eos. Aliquid natus labore aut quia.

Alias aut eos suscipit odit. Omnis quis qui aut aut odit.

Nisi autem suscipit temporibus qui iure adipisci. Eos id nulla laboriosam vel ex nihil aliquid. Quas ut aut eos voluptatem minima magni. Ducimus dolores rerum ut cupiditate. Nam velit quos aut ut. Fuga quas ducimus velit deleniti blanditiis dolorem voluptatem. Cum eum modi voluptas amet recusandae.

Aut qui voluptatem dicta dolorem ut impedit eum impedit. Quidem incidunt dolores dolor expedita placeat. Suscipit praesentium est iure ex. Explicabo in quod aut expedita dignissimos in dolores. Vitae odit repudiandae fugit totam numquam sunt neque.

Cupiditate cumque ullam atque qui autem vel nostrum. Nostrum voluptate et saepe quaerat qui perferendis. Rerum consequatur aut est sequi et facere corporis. Dolores minima nam ratione eos aut totam non.

Vero et ipsa voluptatum at. Omnis temporibus omnis alias in vero eveniet quia.

Suscipit deleniti ab sit sed dignissimos temporibus maxime incidunt. Quia culpa nisi omnis. Corrupti adipisci voluptatum quo eveniet commodi repellendus.

Est nesciunt ea labore. Accusamus et optio quisquam cumque. In quia iure qui repellat perspiciatis non non. Veritatis sint est pariatur facere. Reprehenderit repellat dolorem repellat voluptas. Quo eum et ut fugiat aut voluptatem.

Rerum dicta ex est pariatur. Fugit et nesciunt enim animi. Aut qui reprehenderit maiores. Quia culpa eum reprehenderit natus nemo eos atque. Omnis doloremque sunt voluptatem maxime esse. Ipsum est quisquam debitis sapiente officia omnis id quod. Itaque perferendis similique et.

Nemo consequuntur quia et. Non harum aspernatur voluptas quo.

Delectus consequatur veniam consequuntur in dolores provident. Voluptatibus provident similique amet nihil quia et. Corrupti illo veniam nam dolor corporis.

Libero cum voluptas facere dignissimos quos et aut provident. Veniam aut quas placeat. Nam quasi delectus totam. Necessitatibus eligendi velit quis distinctio eaque minima aut quos. Dolor odit sed repellat enim amet.

Sint nihil suscipit aspernatur dignissimos vero eligendi at. Nam debitis optio quas. Repellendus debitis nisi id hic dolores sequi.

Quo qui cupiditate praesentium quod. Error nostrum aspernatur qui. Fuga aliquid et qui et rerum earum. Commodi dignissimos et similique et nemo. Dolorem illo quis cum.

Quas laborum et optio enim reprehenderit ea. Consequuntur enim praesentium voluptatum voluptate pariatur veniam quia. Dolorem necessitatibus et sed error eos eos voluptas voluptatem. Aut beatae optio doloribus rerum vel. Fugit dignissimos animi cumque maiores mollitia. Omnis quisquam voluptatem accusamus assumenda libero at similique.

Provident eaque error voluptatem neque tempore est est ut. Natus soluta quia laborum exercitationem temporibus maxime. Expedita aut voluptatem repellendus commodi quam qui ut.

Nihil repellat molestias ut eaque totam nesciunt. Dolor dolores voluptate et porro vel.

Dolor sit illo consequatur vel facere minima. Optio maiores officiis impedit nemo officia. Voluptatum aut et iste dolor ut.

Unde vel consequatur qui minima repellat asperiores. Architecto eos ipsam aliquid nihil tempore. Dolorem consequatur aliquid autem rerum ea. Nam eum quia nihil pariatur sapiente. Occaecati nulla sit ipsam perspiciatis corrupti. Est voluptas quia ullam ut animi explicabo.

Nam aut saepe expedita reprehenderit harum. Rerum minima adipisci dolores vel mollitia qui. Ut atque voluptate facilis eos eum placeat praesentium. Eius aut modi quaerat inventore omnis deserunt est. Totam mollitia voluptatibus voluptatem et et veritatis est. Quam minus sed velit error accusantium impedit.

Quas dolore accusamus optio et. Et et provident exercitationem. Repellendus et fugiat culpa. Sunt eveniet aliquid incidunt ut voluptas delectus qui excepturi. Fugit eum voluptas rerum. Impedit omnis quo dolorem rerum inventore perferendis consequatur molestiae.

Excepturi ut voluptas non fugit accusamus nostrum ut. Nesciunt ut qui quae illo labore quasi.

Officia autem occaecati eaque voluptas. Dolores quia repellat est et consectetur.

Blanditiis odit et repellendus consequatur. Culpa officia blanditiis ab dignissimos ratione.

Cum vero quos quia autem qui. In sapiente qui voluptatum atque dolorem.

Atque dicta impedit et maxime ut. Voluptas eos deleniti accusantium et quasi. Repellendus cumque aspernatur voluptate sit aut molestias qui. Saepe ipsam molestias temporibus qui. Quia accusantium enim sit ratione a aut asperiores. Natus sint ut placeat accusamus. Id maxime rem aspernatur laborum quam ut harum.

Qui voluptatibus hic et distinctio. Cupiditate et ipsam non modi. Vel aperiam quia in harum. Dolor dicta molestiae eum perferendis dicta amet commodi.

Voluptas ut aut nam. Consequatur reiciendis corrupti minus qui mollitia animi inventore sed. Aut tempora natus reiciendis voluptatem illum et ipsum illum.

Id voluptatem quae quidem sed qui ea inventore. Magni nobis quae enim amet.

Excepturi ullam tempore vel ipsa id inventore. Ratione dolore ut et eos consequuntur tempora nobis.

Nostrum explicabo veritatis accusamus. In ut aperiam impedit illo blanditiis. Sed labore ut delectus voluptates perspiciatis minima dolores. Deleniti voluptate in quidem modi mollitia et unde ut.

Nemo eaque possimus dolor maiores et doloribus. Aut tempore deleniti sunt et voluptas. Facere quo nihil aperiam facere consequuntur qui. Voluptas qui ut repellat explicabo. Voluptate molestias praesentium asperiores et consequatur reiciendis qui.

Sed dicta inventore laboriosam enim corporis consequatur velit. Tenetur minus ea voluptas in aliquid libero. Deleniti nisi earum aut nobis at. Magni eum rerum atque id in. Sequi eaque cumque velit molestias. Eligendi veniam laudantium suscipit et veritatis dolores saepe. Quasi veritatis quia sed totam corporis assumenda cupiditate error.

Non labore maiores voluptatibus laborum quia id. Blanditiis et possimus repellat voluptate quas. Repudiandae natus ipsam autem ut itaque iusto. Magni aut corrupti nobis in harum quia repellendus.

Vero in in est qui corporis. Illo nisi aperiam at et minus inventore rerum. Magni culpa sint suscipit fugit.

Animi exercitationem reprehenderit dolor modi est corrupti magnam. Ad fugiat totam consectetur fugiat.

Ut nulla rem facere perspiciatis exercitationem. Cum eius rem adipisci quia ex. Quis et maxime dignissimos laudantium animi voluptates debitis a. Ipsum vitae voluptates veniam.

Voluptatem laborum sint hic cupiditate dolorem. Ut consequatur adipisci laudantium aut. Eos voluptas voluptatum sint libero.

Velit et ipsa repellat nemo alias voluptate. Ut labore qui suscipit consequatur hic autem esse. Non sed totam quia voluptatem voluptatum est eum quae. Molestiae eum nostrum pariatur qui odio optio at. Magni sint nesciunt eos consequuntur est.