Generous Number Crunching on TSLA Q1 Profitability

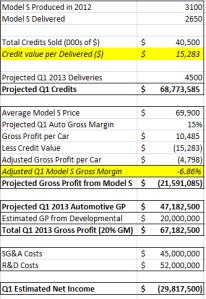

Racking my brain to somehow arrive at profitability for Tesla in the first quarter of 2013 has me coming up empty. Some numbers for you, accompanied by my explanations of where they came from.

[Update: Something interesting a bit of field research has come up with is that a decent amount of Model S reservation holders who've chosen the 60kW-hr battery pack with delivery dates in March are getting notifications that their deliveries will be delayed a few months to the April/May time frame. I suspect this is simply a switch to pull forward more 85kW-hr deliveries rather than production issues. I'd actually prefer it be production issues, but either way it could help them bring higher-margin sales forward and higher emissions credits as well. Interesting stuff but simply conjecture at this point.]

————-

————–

Explanations for calculations are as follows:

Credit Value per Delivered - indicates the average value of credits sold against each Model S produced by Tesla. As we can see, if we use this methodology (which doesn’t necessarily even follow with way these credits are handled; I have no experts in environmental auto regulation to talk to about it yet this feels like a best-case scenario) we arrive at a pretty big number, over $15K, which would mean they receive credits worth between 20-25% of the product sold. I have a hard time believing this, but let’s run with it.

Adjusted Gross Profit per Car - removes the effect on gross profit provided by regulatory credits. This is simply the sales price (which we estimate to be the midpoint of Model S sales at just under 70K) times the gross margin Tesla predicts in Q1 (“mid-teens”) and then subtracts the 100% gross margin credits attached to the sale. This number is still negative, a shade under -7%.

Estimated GP from Developmental – my estimate of gross profit derived from the development services TSLA provides to Toyota and Daimler. In the entirety of 2012 they took in about $27M in revenue and spit out about $15M in gross profit. Giving them $20M in GP for the first quarter alone is far and away the most exaggerated assumption I make in my numbers.

SG&A Costs – These costs came in at a non-GAAP value of $40M ($46 GAAP) and according to Tesla should “continue to rise moderately,” so a bump to $45M is pretty small considering they will be doubling their deliveries this quarter, ergo way more selling efforts than previous.

R&D Costs - Non-GAAP value of $62M for Q4 ($69M GAAP) are projected by Tesla to drop 15% as less developmental activities, design, and testing lower their costs. That 15% drop from $62M, plus a little bit extra for fun, got me to $52M in R&D spend for the quarter.

————

Even under these circumstances, which I find rather generous and conservative, Tesla would report a Q1 2013 loss of about $30M, or a little over $0.26 per share. This is on a non-GAAP basis using their accounting methods from 2012, so either something very different than Q4 is up Tesla’s sleeve or their non-GAAP accounting is about to change if they want to report a Q1 profit.

In their year-end letter to shareholders, Tesla says that they will achieve Q1 profitability on this non-GAAP basis and “near breakeven” on cash flow from operations through a combination of improved gross margin and lower R&D expenses. With their expectation that R&D will only drop 15%, equivalent to $9.3M, gross margin would have to make a very significant improvement, and the only place it could make one that large is in regulatory credits. Tesla lost $75M non-GAAP in 2012, with a $9.3M cost savings from R&D they would still need to make up almost $66M through gross margin improvements. For 4500 deliveries at an average price of $80K, that would mean boosting the gross margin from Q4′s level of 8% (7.3% in actuality) to over 26%. Doesn’t exactly jive with the mid-teens Tesla is forecasting… but as we said earlier, something else must be going on, but we can’t yet put a finger on what would have to happen.

To test this quickly, I went back through the makeshift model to plug and chug to see what different changes would do to our numbers:

Regulatory Credit Values can be sold for 25% more – $16M loss

20% Auto Gross Margin – $14M loss

20% Auto Gross Margin, Average Model S Price $78K - $7M loss

20% Auto Gross Margin, Average Model S Price $78K, Op. Expenses $90M - $0

wat

Over all good analysis.

Some Comments / Questions:

Why are you doing the credit breakout as you are. Maybe I'm off but I would view it as they are getting a 15% margin on the Sticker Price + Credit. Your method, if my calculations that back into yours are correct, is yielding a 12.3% margin, or about $10mm.

Also, I'd think you are underestimating the sales price by a decent amount. If you check out the website site you will see tons of extra features. The sticker price is for the super baseline model. When you start adding in nicer paint, rims, sound systems, sun roof, computer navigation system, in home super charging hookups etc. You can easily be adding 5-10k+ per vehicle. One would expect these extras to have higher margins. This could be an extra $5-10 in contribution margin, depending on your assumptions.

On the flip as you said, the development is way over estimated. Tesla got a flat fee from Toyota for developing the system for its Rav4 EV. Now it gets a fee per battery pack produced for the Rav4 EV but those aren't selling well. Tesla hasn't really received any fees from Daimler and their collaboration is on hold from what I've read.

Also, a clarification question. In some manufacturing isn't the associated overhead of the product picked up in the margin? If this is the case and maybe there is a possibility that you are double counting overhead.

I'm not an expert in Tesla, but the general answer to your question is yes. Labor, materials and overhead for production will be in COGS (or as you say picked up in the margin).

The way he has it laid out would indicate $45M of Non-manufacturing SG&A. Sales, Corp Staff, Marketing, etc... would all go in there. Again, not being a Tesla expert I have no idea if $45M is an appropriate amount for general SG&A, but it wouldn't surprise me if it is accurate the way he laid it out.

Curious as to your thoughts on Fisker Automotive's chairman resigning and its effects on TSLA.

Would a $29MM net loss not be a positive considering they were running at ~$90MM - $110MM losses in 3Q and 4Q during last year.

Update: just read this: "As a result, we expect to be slightly profitable (excluding only noncash option and warrant-related expenses) in Q1 2013."

So what I'm seeing is higher volumes (ex.credits) increase the loss, instead of lead to profitability.

This is assuming that everything is being modeled correctly. I'm not sure it is.

It is. Tesla had $40M in SG&A in Q4 and expect this to "increase moderately" in Q1. So that number is not very much higher than what they did on approximately half as many deliveries as expected this quarter.

Also, the credits. I broke out the two revenue streams just to give everyone the actual gross margin associated with the actual sale of the car itself less the gross profit from selling the corresponding credits. If you do the math, the numbers are correct. To check, simply multiply the gross margin by the average price by the number of cars delivered. It will be the same number as what is reported in Automotive Gross Profit. The main point in breaking the credits out from the Model S sale itself is to give an idea of just how much contribution to Gross Margin we get from Tesla's credits.

Lastly, this was not added to my blog post when WSO put it up, but this remedies the fact that the average price per car is underestimated, which I believe it is. I think the average price is likely to be in the $83-86K range, but assuming an absolute ceiling, here is what I had added to my analysis yesterday:

** [Update: Given the assumption that Tesla is pulling forward as much of their high-margin business as humanly possible, with an average price at an absolute maximum of $99,400 we still need to see them deliver approximately a 17.25% gross margin in order to break even on a non-GAAP basis. It is possible that Tesla can re-bin certain warranty/service expenses and turn them into add-backs that could make this entire number-crunching routine a moot point as well. According to many Tesla owners that have put in recent (i.e. within the past month) reservations for the Performance version of the Model S with the 85kW-hr battery pack (the highest price and margin variety) are getting asked to configure their cars and confirm their payments as early as within an hour of putting down their deposit. In the enormous production rush to finish out the quarter strong, it looks like cars are having some quality issues which may be pushing servicing expenses up for Q1. I fully expect a non-GAAP loss in the high-teen or low $20M range, but can see an unexpected pull-forward making this loss as small as $9M. It's still nearly impossible to find a reasonable scenario in which they can deliver a Q1 non-GAAP profit without adding new changes to their accounting practices that we haven't seen in the past.]

As mentioned, Tesla is pulling forward a lot of their highest-margin sales at the expense of the reservation holders of cheaper cars like the 60kW-hr and no-upgrade 85s. That being said I think the average price will be stepped up a bit (but I have a feeling this will lead to a corresponding DROP in operating margin after servicing expenses are factored in, but that is conjecture that I don't want to stand behind until we see more). Hopefully that clears a few things up for y'all.

To build on this discussion, you could consider pulling in some thoughts from VIC's post on TSLA.

I think that the EV market is a structural loser and Musk isn't going to change it. I also think that the (slow) ramp of the Volt and Leaf are supportive of the thesis that TSLA's goal are aggressive.

Great analysis WhiteHat. On an interesting company nonetheless.

I know a decent amount about Tesla (almost ordered one), but not enough about the business to really add any value to this conversation. Regardless, this is awesome content for WSO.

Patrick - I definitely encourage more intelligent posts along these lines.

+SB

Sequi aliquam facere eum ut corrupti voluptatem quasi qui. Voluptatem natus assumenda qui dolore quisquam iure eius optio. Et et nihil omnis incidunt aut est ipsa rerum.

Similique sunt et ducimus atque amet. Ex repellendus mollitia quae perferendis voluptatibus velit rerum voluptatum. Esse laboriosam mollitia fugit excepturi laudantium vel. Iure aut unde assumenda totam qui quam. Labore similique consectetur nam et quia et.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...