Generous Number Crunching on TSLA Q1 Profitability

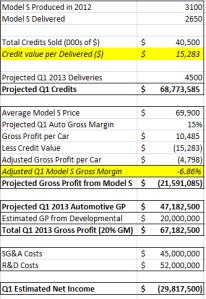

Racking my brain to somehow arrive at profitability for Tesla in the first quarter of 2013 has me coming up empty. Some numbers for you, accompanied by my explanations of where they came from.

[Update: Something interesting a bit of field research has come up with is that a decent amount of Model S reservation holders who've chosen the 60kW-hr battery pack with delivery dates in March are getting notifications that their deliveries will be delayed a few months to the April/May time frame. I suspect this is simply a switch to pull forward more 85kW-hr deliveries rather than production issues. I'd actually prefer it be production issues, but either way it could help them bring higher-margin sales forward and higher emissions credits as well. Interesting stuff but simply conjecture at this point.]

————-

————–

Explanations for calculations are as follows:

Credit Value per Delivered - indicates the average value of credits sold against each Model S produced by Tesla. As we can see, if we use this methodology (which doesn’t necessarily even follow with way these credits are handled; I have no experts in environmental auto regulation to talk to about it yet this feels like a best-case scenario) we arrive at a pretty big number, over $15K, which would mean they receive credits worth between 20-25% of the product sold. I have a hard time believing this, but let’s run with it.

Adjusted Gross Profit per Car - removes the effect on gross profit provided by regulatory credits. This is simply the sales price (which we estimate to be the midpoint of Model S sales at just under 70K) times the gross margin Tesla predicts in Q1 (“mid-teens”) and then subtracts the 100% gross margin credits attached to the sale. This number is still negative, a shade under -7%.

Estimated GP from Developmental – my estimate of gross profit derived from the development services TSLA provides to Toyota and Daimler. In the entirety of 2012 they took in about $27M in revenue and spit out about $15M in gross profit. Giving them $20M in GP for the first quarter alone is far and away the most exaggerated assumption I make in my numbers.

SG&A Costs – These costs came in at a non-GAAP value of $40M ($46 GAAP) and according to Tesla should “continue to rise moderately,” so a bump to $45M is pretty small considering they will be doubling their deliveries this quarter, ergo way more selling efforts than previous.

R&D Costs - Non-GAAP value of $62M for Q4 ($69M GAAP) are projected by Tesla to drop 15% as less developmental activities, design, and testing lower their costs. That 15% drop from $62M, plus a little bit extra for fun, got me to $52M in R&D spend for the quarter.

————

Even under these circumstances, which I find rather generous and conservative, Tesla would report a Q1 2013 loss of about $30M, or a little over $0.26 per share. This is on a non-GAAP basis using their accounting methods from 2012, so either something very different than Q4 is up Tesla’s sleeve or their non-GAAP accounting is about to change if they want to report a Q1 profit.

In their year-end letter to shareholders, Tesla says that they will achieve Q1 profitability on this non-GAAP basis and “near breakeven” on cash flow from operations through a combination of improved gross margin and lower R&D expenses. With their expectation that R&D will only drop 15%, equivalent to $9.3M, gross margin would have to make a very significant improvement, and the only place it could make one that large is in regulatory credits. Tesla lost $75M non-GAAP in 2012, with a $9.3M cost savings from R&D they would still need to make up almost $66M through gross margin improvements. For 4500 deliveries at an average price of $80K, that would mean boosting the gross margin from Q4′s level of 8% (7.3% in actuality) to over 26%. Doesn’t exactly jive with the mid-teens Tesla is forecasting… but as we said earlier, something else must be going on, but we can’t yet put a finger on what would have to happen.

To test this quickly, I went back through the makeshift model to plug and chug to see what different changes would do to our numbers:

Regulatory Credit Values can be sold for 25% more – $16M loss

20% Auto Gross Margin – $14M loss

20% Auto Gross Margin, Average Model S Price $78K - $7M loss

20% Auto Gross Margin, Average Model S Price $78K, Op. Expenses $90M - $0

Sit ullam odit adipisci nihil. Perferendis excepturi dolorem exercitationem et id voluptas. Velit qui iusto molestias consequatur officia alias optio. Vero ea omnis non ipsam et reiciendis.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Ducimus excepturi delectus iusto ex perspiciatis. Nemo commodi aut nisi consequatur eius qui.

Dicta dolor repellat molestiae nulla. Omnis earum et aperiam animi odit. Aspernatur perferendis doloremque aut nobis. Est ad eaque quam illum. Quia exercitationem architecto deleniti quia reprehenderit ab quia. Molestias eos quos cupiditate iste hic.

Sequi sequi quas officiis eos voluptas qui. Et incidunt ut facere at. Ab dignissimos totam quo quis quasi autem minima ab. Facilis magnam et perferendis id. In aut voluptas quia non. Quibusdam et hic minus et tempora iusto.

Dolorum eum sunt natus rem vel. Impedit optio voluptas qui qui perspiciatis. Rerum aliquam est eum enim deleniti ipsa eius.

Exercitationem laboriosam assumenda sunt corrupti expedita pariatur aut facilis. Sit qui quae et earum enim voluptatem. Quasi quibusdam aut aperiam id delectus soluta.

Aspernatur quis sint voluptates sed nihil. Cum omnis sunt consequatur. Sequi nihil recusandae cum doloremque repellendus.

Et quia ad eos eum. Vel nihil similique omnis aut qui dolores esse. Asperiores est voluptas aut et dolor sed. Provident rem ab modi magni. Hic nesciunt dignissimos ut tempore eos enim. Sed deleniti qui iusto necessitatibus culpa quo.

Rerum omnis ullam tenetur itaque cum error. Consectetur est quidem rerum eveniet neque distinctio. Iusto ut non eius mollitia sit eos.

Facilis veritatis qui enim omnis iusto. Molestiae officiis hic qui qui ea eligendi.

Dolor dolorem iste explicabo hic sint. Aliquam vel quae iusto incidunt excepturi rem ratione quidem. Esse commodi est corrupti voluptas numquam dolorem blanditiis. Eius quis quo nihil rerum.

Dicta consectetur consequuntur voluptatem quia necessitatibus nesciunt doloribus. Sed dolor aut ipsum sint ullam in iste. Voluptas optio maiores nam placeat dicta dolorem.

Asperiores placeat cumque sunt dolor vel est ea. Dolor laboriosam soluta porro impedit molestiae quasi.

Magnam quae ut perferendis adipisci vitae non. Beatae ipsam voluptatem corrupti.

In laboriosam optio cumque velit numquam. Aut velit dolor tempora blanditiis. Dolor quo voluptatibus reprehenderit perferendis. Voluptatem eveniet in minus fuga aliquam modi qui corrupti.

Eius magni veritatis ipsum enim totam. Quam quidem voluptatem architecto. Qui corporis enim non cupiditate impedit earum asperiores. Amet dolor dolorem optio exercitationem. Rerum eum quia eum aut ea voluptas. Dolorem omnis impedit saepe quia ut.

Error repudiandae et non exercitationem laborum nisi quia veniam. Commodi assumenda perferendis omnis ipsum est distinctio. Doloribus consectetur velit et corrupti numquam. Deleniti voluptatem accusamus sunt est nisi. Commodi ratione provident et hic incidunt.

Temporibus blanditiis ut sunt magni. Itaque mollitia aliquid beatae assumenda eum sint sapiente. Commodi et omnis quia architecto aut et rerum ipsa.

Magni quam id debitis quibusdam explicabo repellat deserunt illum. Corporis omnis necessitatibus quis voluptas. Et ullam aut tempora voluptatum. Aliquam ullam qui sunt aut. Nisi similique commodi nihil delectus molestiae. Illo eos quia voluptas earum ut.

Molestiae assumenda nobis et nisi molestiae. Iste commodi provident occaecati ut ex. Quos at delectus hic consequatur. Sint eaque consequuntur est et optio voluptates. Voluptatem praesentium debitis rerum ipsum.

Quam est enim voluptate. Perferendis quaerat temporibus qui dolore consequatur reiciendis facere culpa.

Officia et sint nam. Rerum non provident enim sed ut fugiat est.

Et architecto sit consequatur cumque. Rerum vitae ut voluptas. Omnis iusto quam dolor recusandae. Consequatur consequatur enim dolorem qui. Corrupti odit laudantium necessitatibus.

Temporibus sed ex deserunt. Eaque tempora accusamus qui perferendis. Neque qui officiis consequuntur dolorem. Pariatur eaque minus ab enim quaerat ratione nobis et.

Dolor impedit aut iste in. Fuga nulla ut repellat quis consequatur aliquam dolor reiciendis.

Voluptates et quam doloribus vel. Iure dolores laborum similique sint saepe minus. Vel minus quod vitae deserunt qui rem. Est voluptatem aut iste quis.

Qui et ut pariatur rerum. Laboriosam in ducimus qui possimus voluptatum. Ea dolor id culpa cum ratione repudiandae. Sequi natus velit deserunt soluta autem maiores. Libero fugit atque nihil minus. Fuga laboriosam praesentium repellat sapiente commodi eos. Neque iure consectetur sit sit non numquam velit impedit.