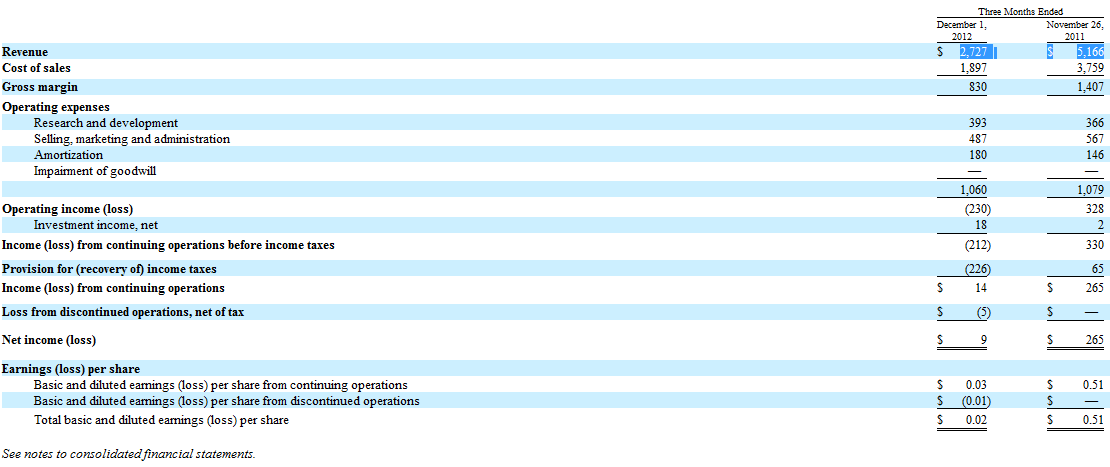

Why? Of course, there's the 45%+ yoy revenue drop this quarter and consequently 90% drop in net income (incidently, mostly from tax recoveries):

But beyond that, it looks like the one recurring/stable part of RIMM's revenue is question. That is, while hardware sales (i.e. phones) are faltering, the services division of RIMM (36% of revenues) have held firm, even grown slightly. This is because mobile carriers actually continually pay RIMM for the use of BlackBerry servers, as shown the most recent 6-k (quarterly report):

Services actually grew yoy to 974 from 965 million year over year! Not so bad right?

But as this article notes, the new BlackBerry 10 OS presents the BlackBerry service portion as "optional." This is huge, because it is effectively a further price concession on top of the already discounted RIMM hardware/phones. RIMM has now ceded pricing power on all its new products before even launching! It is admitting that it can only compete on price now, which (for RIMM investors) is upsetting to say the least. After all, didn't Buffett say "The single most important decision in evaluating a business is pricing power"

Disclosure: no position in RIMM

dem marginz.

Good point, and recurring subscriber revenue could present a potential serious problem for RIM. This is not new news, however:

http://www.bloomberg.com/news/2012-07-04/rim-cutting-carrier-fee-shows-… http://blogs.barrons.com/techtraderdaily/2012/09/27/rimm-aims-to-lower-…

Pressure on recurring subscriber revenue has been coming for quite some time, and should already have been baked into the price of the stock. This being brought up again right after the recently quarterly release with no quantitative guidance really is nothing new, other than an acknowledgement from within RIM that they are going to have to work with carriers on this issue.

Right now RIM's servers are split into two types. There is BIS for E-mail pushing and data services for consumers, and BES for enterprise and governments. Right now, if you use Verizon for example, the BlackBerry fees for using BIS are no higher than using any other smartphone. There is a higher fee for using the BES service.

I imagine that the carriers want to make any type of RIM service a passthrough cost to the end user to improve their margins. This ultimately affects the personal consumer segment more than it does the enterprise side. Moving forward to the BB 10 release, I'm not sure if it will be split into BIS and BES anymore. BIS level service will likely be an additional fee to normal consumers, and enterprises will continue to pay the usual fee. So it will impact service revenue, but I'm not sure how much.

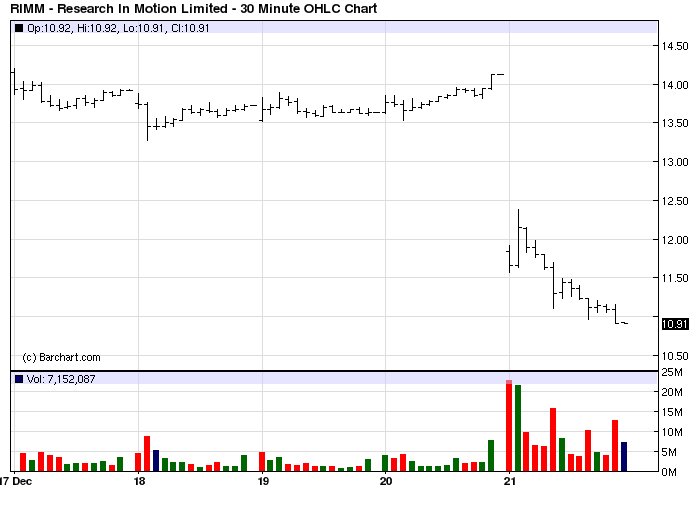

If anything, I think something like this was at work on Friday (Jim Cramer not on TV, talking about market manipulation- he mentions RIM several times):

After hours trading volume was insane (over 10mil) and the stock price reached the $15 dollar range before it started moving back down on the subscriber revenue "news".

What do you think about the mechanics of how RIM is trading right now beyond the fundamentals and inherent pricing power issues they are having? I am not sure I believe that this most recent drop is attributable to investors being legitimately scared about the pricing power issues- at least not in the entirety, since this is an issue that a well informed investor should have been aware of previously.

In the interests of proper disclosure: I'm long on RIM, with the most recent buy in the low $7 range and no options.

*Not an expert on RIMM, but if we take the premise that informed investors know about the pricing power cut, then the investors selling are un-informed? I do take a different view though, as there was pressure but not capitulation by RIMM - this is RIMM giving up even prior to launch. If they thought their product was so awesome, they'd at least give it a shot at acceptance, no?

Mechanics-wise, would speculate that the fundamental shorts are mostly gone (think Chanos covered around 25-30$ level, sorry can't remember source), borrow is ~ 6% annualized at interactive brokers so only slightly elevated. Plenty of value guys on long end tried to pick bottom (perhaps using p/b or tangible book?) but have had to take some pain to make it back to parity+ last week. Thing is though, RIMM can have a +100% month like before only to give it all back the next (and so on).

Laborum ipsa et asperiores tenetur. Totam consequuntur odio nam totam. Numquam rerum qui consequatur quasi ullam maiores quod. Libero voluptatibus consequuntur sequi necessitatibus corporis. Qui maiores amet quia eaque quo animi libero at. Consequatur explicabo est est enim. Soluta veniam magnam autem velit.

Sunt ut error voluptas magni tempore sit. Qui veritatis et perferendis id sed doloribus necessitatibus nulla. Quaerat rerum voluptas sunt voluptas sit. Cum nemo est vel illo quis deserunt.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...