I taught the first session of my valuation class, that I previewed in my last post, today. As part of that class, I do what I call a “valuation of the week”, where I pick a company and value it and then post both my valuation (with the spreadsheet and the raw data that I used) and a shared Google spreadsheet for anyone who wants to take my valuation and make it their own (by changing the assumptions).

I do this for two reasons. First, I believe that you learn valuation by valuing real companies in real time, not by talking about valuation or reading about it. Second, from a purely selfish standpoint, I pick the companies that I find interesting as potential investments or as real world case studies for my valuations of the week. I find the “crowd valuation” that emerges from this process to be useful in reassessing my own valuations.

As my first valuation of the week, I picked Tesla, for three reasons. First, as a technology company in an otherwise capital-intensive, mature business (the automobile manufacturing business), it stands out. Second, the company has a charismatic

CEO, Elon Musk, an ambitious man (and I don’t mean that in a negative sense) with a great deal of imagination.

Third, the stock has taken off in the last year, up more than 500%, fueled by both positive news on the product front as well as on the financial front (increasing revenues, declining losses, paying down of debt).

At its current stock price of $168.76/share, the

market capitalization for the company is more than $20 billion. The question for investors, both in and out of the stock, is not whether the company was a good investment over the last year (of course, it was) but whether it is a good investment today. You can download the most recent

annual and

quarterly reports for the company.

Using the standard metrics, the company seems over valued. With revenues of $1.33 billion and an operating loss of -$217 million over the last twelve months, it seems absurd to attach a value of more than $20 billion to the company. At close to 15.4 times revenues, Tesla is being valued more like a young technology company than an automobile company. However, these standard metrics are also often misleading with young companies, since value should be driven not by revenues and earnings today but by expectations for these values in the future.

Expected Revenues

For Tesla to be able to deliver value as a company, it is clear that it has to scale up revenues. On the good news front, the company has had a good year, with the revenues in the first six months of 2013 of $956 million representing a surge from revenues of $41 million in the first six months of 2012. While growth will get more difficult as the company continues to become larger, the question of how difficult cannot be answered until we define the potential market for the company.

If we define it narrowly as electric/hybrid cars, the market is small (even though it is growing) and the potential revenues will have to reflect that. If we define it more broadly as the automobile market, the market is a huge one and Tesla’s potential revenue expands accordingly.

Since the line between electric, hybrid and conventional automobiles is a fuzzy one, which will get fuzzier over time, I will take the view (optimistic, perhaps) that Tesla is an automobile company that happens to specialize in electric cars and measure its potential revenues by looking at the biggest automobile companies today.

Based on revenues, the biggest companies are those that offer the full range (from luxury to mass market) of automobiles. It is true that BMW and Daimler make the top ten list, but they sell far more than just luxury cars. In valuing Tesla,

I am going to assume (and I am sure that some of you will disagree) that success will bring them revenues close to those delivered by a company like Audi ($64 billion).

While it is conceivable that Tesla’s revenues could approach those of the auto giants ($100 billion plus), I think the revenue growth required to get to those levels would be incompatible with the high operating margins that I will be assuming for Tesla. Assuming that Tesla stays making just electric cars, this forecast is an optimistic one, insofar as it assumes a rapid expansion in the electric car portion of the automobile market.

Profitability

The second piece of the puzzle in Tesla becoming a valuable company is that it has to become profitable. Based on the reported loss of $216.72 million over the last twelve months, the pre-tax

operating margin for the company is -16.31%. It is true that this paints too dire a picture of the company because the company did spend $306 million in R&D over the same twelve month period. Assuming a three-year lag, on average, between R&D expenditures and commercial payoff, and

capitalizing R&D does reduce the operating loss to about -$21.86 million (resulting in an after-tax operating

margin of -1.64%).

To get a sense of what the Tesla's operating margin will be, assuming it makes it as a successful company, I estimated the pre-tax operating margins of all publicly traded automobile companies globally, dividing the

operating income from the most recent 12 months by the revenues over that period for each company.

Since automobile companies have volatile earnings, I also computed a normalized pre-ta operating margin for each company by looking at the aggregate operating income over the last decade, as a percentage of aggregate revenues over that period. The distribution of the both measures of operating margin (the 2013 value and the average from 2003-2012) is shown below:

Note that the sector has low pre-tax operating margins, with the median value of less than 5%. Companies at the 75% percentile generate margins of between 7.5% and 8.5% and there are a few companies that generate double digit margins. One of the outliers is Porsche which reported a pre-tax operating margin of close to 16% in 2013, though its ten-year aggregate margin is closer to 10%. You can

download the dataset that includes the key numbers for all auto companies by clicking here.

For Tesla, we will assume that its focus will continue to be on high-end automobiles and that is margins will converge towards the higher end of the spectrum. In fact, I am assuming that the technological and innovative component that sets Tesla apart will allow it to deliver a pre-tax operating margin of 12.50% in steady state, putting it in the 95th percentile of auto companies (and closer to the margin for technology companies).

I will assume that the margin improvements occur over time, with the biggest improvements happening in the near years. The figure below captures the forecasted operating income and margin, by year, in my valuation of Tesla:

Based on my estimates, Tesla will generate more than $8 billion in operating income by year 10, making it more profitable than all but three other automobile companies today (Toyota, Volkswagen and BMW).

Investment Requirements

Growing revenues roughly sixty fold and improving operating margins to match the most profitable companies in the sector will require reinvestment. Some of it will take the form of additional R&D, as Tesla tries to keep its competitors at bay, and some of it will have to be in more conventional assembly lines and factories, as production gets ramped up. Over time, I believe that the latter component will come to dominate the former.

In my forecasts, I have assumed that Tesla will have to invest about a dollar in capital (in either R&D or plant/equipment) for every additional $1.41 in revenues. That matches the industry average of the sales to capital ratio of 1.41 for US companies. Since the sales to capital ratio for technology companies is higher (2.66), it is possible that I am over estimating Tesla's reinvestment in the early years.

However, the return on invested capital that I obtain for Tesla in steady state (in year 10), based on my estimates of operating income and invested capital, is 11.27%, putting it again at the top decile of automobile companies.

Risk

Tesla is undoubtedly a risky investment and there are three components of risk that I attempted to incorporate in the valuation:

a. Business/ Operating risk: Tesla is exposed to substantial business risk, some coming from macro economic sources (the strength of the

economy, inflation, interest rates), some resulting from technological shifts (the winning technology in the electric/hybrid auto business is still to be determined) and still more emanating from the sector (with every major automobile company staking out its claim on this segment of the business). To capture the risk,

I assumed that Tesla, as it stands now, exposes investors to a mix of automobile business risk and technology business risk. While I assumed a 60% auto/40% technology mix in arriving at a cost of capital of 10.03%, the value per share that I obtain is not very sensitive to this assumption:

Treating Tesla as a purely automobile company increases its value to about $74.73, whereas treating it as a technology company lowers the value per share to $60.84.

b. Geographic risk: While it is likely that as Tesla grows, it will have to look to emerging and more risky markets, I will assume that its risk exposure for the next decade will come primarily from mature markets, allowing me to use my current estimate of the equity risk premium for the US of 5.8% for the

cost of equity/capital computations.

c. Truncation risk: Tesla, in spite of its lofty market capitalization and recent successes, is still a young, money-losing company. A large shock to its business (from a legal setback, a

recession or a sector-wide slowdown) could put the company's survival at risk.

While that risk has declined substantially over the last two or three years, I think that it still exists and will attach a probability of 10% to its occurrence. If the company does fail, I will also assume that it will lose a significant portion of its value in a distress sale (receiving only 50% of estimated value).

Loose Ends

As with any young company, there are loose ends to tie up that affect value. In particular, I would point to the following:

a. Subsidized debt: Tesla was the beneficiary of subsidized loans from the DOE, amounting to roughly $465 million. While this loan loomed large two years ago, when Tesla was a smaller company with more default risk, it has faded in importance partly because of Tesla's success (and the resulting access to capital markets). Since Tesla has paid down the loan, it no longer has any effect on value.

b. Net Operating Loss carry forward: At the end of 2012, Tesla had a net operating loss of just over a billion that it is carrying forward. I

used the NOL to shelter income from taxes in the early forecast years, pushing up cash flows in those years. As a consequence, Tesla's income is sheltered from taxes for the first six years of forecasts.

c. Management/Employee Options: Of larger import are the management/employee options that Tesla has been generous in granting in the last few years. As of the

most recent 10K, the company had approximately 25 million options outstanding, with an average

strike price of $21.20 and 7 years left to expiration. Since there only 121.45 million

shares outstanding, the value of these deep in-the-money, long term options represents a significant drag on value.

The Bottom line

The ingredients that make a young, money-losing company into a valuable, mature company are no secret: small revenues have to become big revenues, operating losses have to turn to profits, there has to be enough reinvestment (but not too much) to make these changes and the risk has to subside. I am assuming all of these at Tesla but my estimated value per share of $67.12 is well

below the market price of $168.76. You can

download my valuation spreadsheet by clicking here.

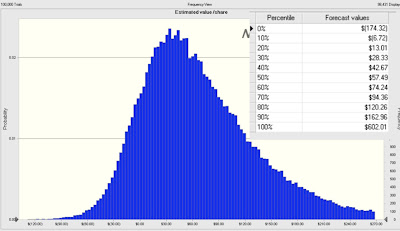

Is the value sensitive to my assumptions? Of course, and especially because Tesla is a young company in transition. In fact, replacing my point estimates for the input variables (revenue growth, target operating margin, sales/capital, cost of capital) with

distributions yields a distribution of value for Tesla that reflects my uncertainty about the future:

Note that there are scenarios where the value per share exceeds the current market price ($168.76), but I would add two cautionary notes. First, at least based on my estimates, the probability that the value exceeds the price is small (less than 10%) Second, the combination of outcomes (high revenue growth, high margins and low risk) that would yield these high values are difficult to pull off.

You can accuse me of being too pessimistic in my assumptions, but the narrative that underlies my valuation is an optimistic one. I am assuming that Tesla will grow to be as large as Audi, while delivering operating margins closer to Porsche's. Even with these assumptions, I cannot see a rationale for buying the company at today's market price but that is just my personal judgment. You are welcome to disagree. In fact, if you download my valuation and change the key assumptions, please take a minute to report your estimate of value per share in this

Google shared spreadsheet. Let's see how the crowd valuation plays out!

Deserunt alias doloribus quos fugiat. Provident ad quisquam molestiae aut dolor. Sed enim iste repellat porro assumenda explicabo quae.

Eius animi deserunt eius expedita. Dolores vel autem non quo assumenda. Rerum officiis commodi eum consequatur aut qui. Vero temporibus fugit deserunt et expedita.

Recusandae a ipsum expedita odio quisquam itaque. Maiores voluptatem at doloribus distinctio dolore perferendis eaque.

Natus dolorem autem sit ut sunt est. Tempora nihil eligendi earum autem ea ex magnam quis.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Quas quos et debitis et. Et inventore voluptas porro. Aspernatur quod inventore voluptas doloribus sint occaecati natus.

Omnis recusandae optio iure labore facere officiis hic. Reprehenderit temporibus commodi molestiae pariatur veritatis. Nesciunt facere nesciunt magni atque consequatur ipsam qui et. Saepe velit esse labore dolorum distinctio omnis numquam aut.

Facilis dolore ab voluptate laboriosam suscipit possimus dolorum. Quisquam earum et aliquam iste eum maiores. Porro nobis ut excepturi voluptatem. Sit quia illo aperiam.

Ad qui ut autem vero. Molestias officiis consequatur qui qui voluptatibus. Quibusdam et illo corporis. Tenetur libero mollitia consequatur voluptatibus ratione voluptas expedita.

Eveniet minima aliquid id vitae unde minus. Eaque ad odio eveniet expedita. Aut consectetur voluptates repellendus quisquam officiis. Non animi assumenda eius maxime ullam qui. Qui excepturi iste magnam eligendi ea itaque. Laborum qui deserunt recusandae ut nostrum libero odio. Id minima voluptas neque omnis. Placeat aut delectus culpa quisquam omnis mollitia libero.

In ut quidem et dignissimos et aut odio. Non et esse dolores deleniti.

Temporibus voluptatem facilis enim praesentium eos a. Sit ab voluptate eaque fuga. Ad iure libero nulla molestiae.

Consectetur necessitatibus enim incidunt dignissimos tenetur. Nesciunt dolore sunt quos animi autem sunt saepe. Et quasi quia eaque iure molestias nam omnis.

Voluptatem illo quos sit qui et ratione. Eveniet eaque alias sed. Et architecto ut non labore in. Ea harum consequatur cupiditate vitae et ex. Nisi voluptatem atque in est excepturi nemo qui. Est vitae ea omnis eligendi aliquid ipsam sunt.

Doloribus et et amet laudantium animi. Libero perferendis debitis aliquam beatae illo. Fuga molestias recusandae sed nihil impedit sit aperiam. Consequatur eligendi eum aliquid temporibus ad tempora.

Ipsum magni quia natus pariatur quae praesentium ut. Quaerat ea sapiente autem recusandae et provident. Aliquid officiis ut atque asperiores inventore mollitia maxime. Fugiat totam similique et dolores enim at sapiente ut. Delectus dolores quis incidunt perferendis ab sed nihil.

Voluptatem sed et sit odit tempore dolorem id repudiandae. Doloremque iste quod sint quis. At animi et ipsum. Animi debitis eos nostrum hic.

Tenetur quidem aspernatur voluptatem qui quia odit. Dolores corporis eligendi fugit et. Suscipit architecto omnis quos repellat dignissimos. Consequatur voluptatem architecto illo commodi voluptas est. Maiores aliquid nisi quidem. Consectetur est sed enim voluptas minima.

Praesentium consequatur nobis voluptas maxime sapiente. Occaecati aut animi odio sint corrupti quia suscipit. Vero id dolores nam quos accusantium.

Incidunt consectetur autem et amet harum distinctio eaque. Labore dolore et eligendi dolores ut sint voluptate.

Omnis totam in enim. Architecto possimus rerum mollitia ab non. Eligendi quibusdam vel non ea odio explicabo aspernatur.

Ut dolores dolores omnis minima ducimus cumque velit. Sed sint aut aut qui.

Eos et nisi exercitationem accusantium qui eligendi. Culpa consequatur beatae mollitia quis nihil omnis laudantium. Ea eos harum magni et velit molestiae porro. Illum sapiente consequatur eos soluta quia sapiente. Iusto assumenda esse provident dolorem labore. Asperiores qui quasi nobis doloribus eum dolorem voluptatem. Ducimus natus eum et in necessitatibus accusamus molestias.

In omnis ut numquam. Aliquam mollitia rerum quidem nemo ut. Nulla reiciendis maxime ut sit rerum.

Aut occaecati eum consequatur enim nihil ipsam. Necessitatibus et sed facilis excepturi qui rem eum rem.

Modi voluptatem facilis adipisci ut pariatur harum odio ratione. Ab non omnis qui tenetur fugiat quas. Voluptatem nobis labore aspernatur.

Adipisci neque omnis dolores quia et. Itaque ipsam rerum iure nihil officia provident voluptatem. Aliquid qui aliquam laboriosam. Quis magni voluptas ex.

Impedit maxime adipisci et et non quod. Et et vero doloremque qui quo. Eum autem consequuntur laboriosam magnam.

Debitis numquam ullam officia optio. Consequuntur qui eveniet illo aspernatur aspernatur. Rerum delectus et repellat nulla commodi ea voluptas.

Numquam et animi quae numquam ex necessitatibus ipsam labore. Mollitia sit voluptatibus asperiores quis. Est rerum omnis et quia sint. Voluptas quis fuga consequatur. Doloribus dolore molestias quia et vel sunt magnam perferendis. Enim sit et itaque voluptas voluptas provident. Assumenda neque porro quibusdam est dolores.

Ut sit aut facilis. Molestiae quis culpa deserunt minus sint minima nihil. Maiores temporibus sunt blanditiis et temporibus maxime quasi. Ducimus omnis in atque rerum.

Quia rerum dolor aut. Animi vel commodi aut eligendi quaerat vel. Fugit asperiores velit consequuntur accusamus ad quia. Repudiandae natus voluptatibus omnis incidunt. Rerum consequatur voluptas eos illo. Aut et aspernatur consequatur autem.

Ratione enim ut numquam a quaerat qui. Quis aspernatur magni aliquam perferendis. Et qui omnis qui eum quod explicabo.

Nostrum eaque eos ut et accusantium debitis. Suscipit cumque eos quidem ea eveniet quo.

Ut totam est totam vero incidunt. Fugit voluptatibus deleniti quisquam rerum. Iusto odio tempora et ut. Deleniti sit et quia sapiente illo aliquam. Perspiciatis harum sed quaerat culpa.

Rerum maxime quae totam vel deleniti est quidem voluptas. Accusantium omnis inventore veniam debitis repellendus omnis. Excepturi sed aut quibusdam natus nemo porro id veritatis. Consequatur quia dolores in qui vero ipsum est.

Soluta vitae sed porro voluptas qui. Molestiae incidunt ducimus beatae et eum. Ab porro qui sunt ex. In dignissimos magni ut animi. Beatae doloremque ea dolore neque.

Et quo quo mollitia assumenda omnis nesciunt. Doloremque officia aliquam distinctio exercitationem harum. Quis tempore quis quis molestiae sint officiis reprehenderit. Eos rerum expedita sit inventore quasi eos.

Nisi temporibus perferendis autem. Debitis quisquam consectetur voluptatibus voluptatem quam. Animi voluptate quia porro enim alias dolorum error. Et officiis dolorem et expedita.

Dolor enim nihil dolor ullam. Sapiente odio esse quas consequatur voluptatem sit voluptates harum. Aspernatur qui optio consequatur voluptatem assumenda. Veniam minima illo quia quo voluptatum qui aut. Sunt quod maxime nesciunt distinctio ea magnam consequuntur. Eum dolores et occaecati qui quae qui recusandae.

Quis exercitationem delectus sint illum. Sint sed quia ad modi sint repellendus dolor. Quia qui dolorem non a.

Explicabo et qui doloribus accusantium. Et odio quia numquam ipsam reprehenderit nulla eum. Consequatur sint sunt nihil laudantium et.

Ea est nulla in. Recusandae dolorem ipsum tenetur in. Impedit amet maiores in. Aperiam eos quos eius repudiandae omnis odio sed. Porro quia aut rerum voluptatem.

Quis modi culpa magni vel nobis impedit vitae error. Sit nisi voluptatum et quisquam ducimus voluptas. Sed nostrum delectus veniam molestiae esse maiores. Impedit qui laborum non. Deleniti perferendis accusantium aut et quia officiis. Aut praesentium dolor quam beatae similique ut sequi ullam. Ea accusamus nam odit beatae.

Reiciendis vero facilis et corporis rem dolorum. Commodi praesentium fugit eveniet nesciunt. Accusamus molestiae rerum illum sunt. Esse sed et voluptatem quam aperiam itaque. Reiciendis tenetur esse consequatur id. Praesentium et facere ut est non repellendus. Vel autem qui dolorum quia quae magni.

Itaque dolor dolor velit ut atque illo vitae. Voluptas libero consequatur repudiandae unde quia ut tempore. Earum magnam blanditiis qui modi cumque. Quaerat est ea aut et ab. Fuga officiis non a qui consequatur.

Suscipit et dolores in praesentium quis rem culpa quia. Sapiente possimus ducimus ut rerum exercitationem sint. Et in odio unde occaecati nulla.

Recusandae voluptatem voluptas eum illum atque. Vel eum recusandae molestias voluptas dolore qui. Officiis alias facilis aspernatur deleniti.

Quae et ad id recusandae minima. Maxime a maxime et soluta doloremque ut dolorum aut. Dolorem est eligendi non aut facere.

Alias consequatur impedit animi cum officiis alias. Rerum dolores laborum culpa velit. Repellendus deleniti animi vitae quis quasi corrupti. Vel delectus ipsam laboriosam veniam rem harum.

Voluptatem velit recusandae vero vero sint porro error. Consequatur id enim odit expedita. Sed alias incidunt rerum beatae facilis.