What I Learned: Week 3 At HBS

mod (Andy) note: this was originally posted by the author on 9/17/2012. To get caught up, today we are posting up all 3 parts of the series so far and then will continue to syndicate his posts each week about his experience at HBS.

We had one of those beautiful two class days at HBS today, and so I’m taking some time working out of the iLab on this Monday afternoon to reflect on the last week of learning before I jump into three cases tonight on the Subprime Mortgage Crisis, General Electric’s Healthymagination Program, and an Operations Class Process Simulation.

I find that we are learning so much and covering so much material that if I don’t take time each week to reflect on what I’m learning so much of it will pass me by. So here’s a summation of what I learned last week, designed someday to help me reflect and recall and perhaps share a bit of what’s happening here with those who someday may wish to come (and perhaps help classmates more easily explain to their parents what’s going on).

This post is a follow-up to Week One at HBS and Week Two at HBS. Just like I wrote in those posts, I am absolutely loving the experience here and every day feel like I’m a little kid in a candy store taking in a fire hose of wonderful new knowledge. If you’re interested in seeing more photos from the time here so far, check out my photo blog. I’m also tweeting from time to time via @ryanallis on Twitter.

I have a sense that future reflections may be more spaced out as the club schedule is rapidly starting to ramp up and I’ve joined the Entrepreneurship Club, Start-up Tribe, TechMedia Club, Africa Business Club, Social Enterprise Club, and Energy and Environment Club. My section (F) is also holding its retreat in Vermont the weekend after this.

– THE CLASSES –

Field Immersion Experiences for Leadership Development (FIELD 1)

FIELD 1 focuses on “individual skill building to develop leadership intelligence” and “leadership exercises, peer feedback, and personal reflection.” Here’s what we did last week in FIELD.

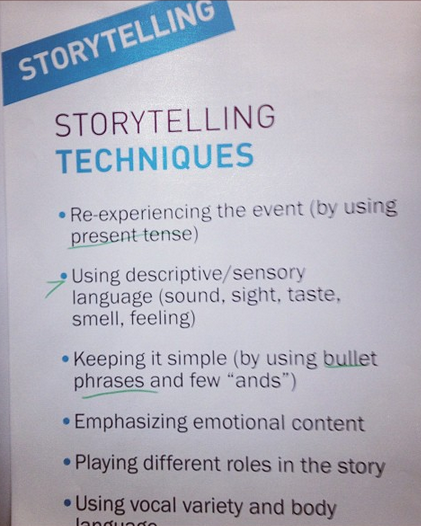

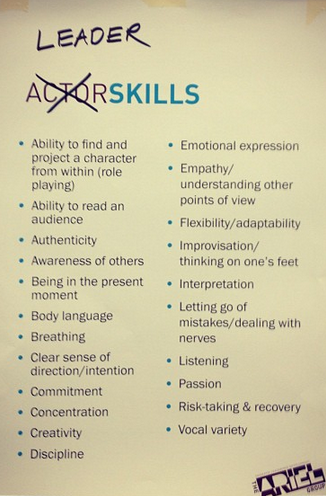

- Storytelling and Improv Workshop - The storytelling and improvisation workshop was the most energizing activity we’ve done at HBS to date. It was put on by the Ariel Group and was designed to help us become better communicators and more engaging speakers (and reduce all the ums, uhs, likes, you knows, and unnecessary ands we often use as crutches when speaking). From the student feedback I heard, this workshop received the highest reviews from classmates of anything we’ve done so far. We took the time to visualize a story of a dramatic defining moment in our life and had a chance to practice telling the story multiple times. It was so wonderful to have a business school (traditionally the realm of the left-brained analytical geniuses) focus four hours on creative and emotional intelligence during the first month of classes. The next day, we discussed plans as a section to continue our practice and attend an upcoming show at Cambridge’s ImprovBoston, now being run by my friend Zach Ward from North Carolina. Here are two photos from the workshop.

Storytelling Techniques

How Leaders Are Like Actors

- Leadership Presence – We also received a copy of two related books–Leadership Presence: Dramatic Techniques to Reach Out, Motivate and Inspire by Belle Linda Halpern and Kathy Lubar and Getting Unstuck: How Dead Ends Become New Paths by Timothy Butler. We read chapter one of Leadership Presence, which was very good and reinforced the lessons learned in our improv and storytelling training.

- Feedback Workshop - We went to the Innovation Lab on campus (the iLab) and filmed ourselves giving and receving feedback based on four fictional cases. The lesson emphasized authenticity, specificity, the intention to help, and humility in the process of giving feedback. One can learn so much when they watch themselves on video! Companies should absolutely utilize this technique in their managerial training programs. After experimenting with a few provided feedback formulas, I found that my preferred way of giving feedback to others in a professional setting was to

- Ask for permission to give feedback

- State the specific behavior I observe

- State the effect of that specific behavior

- Ask for the individua’s perspective on the feedback.

- Hay Group Emotional and Social Intelligence Assessment (EISI) – This session focused on the results of a 360 degree review assessment completed by peers, direct reports, and supervisors we selected prior to us coming to HBS. I found I had the greatest opportunity for improvement in: “Understanding others’ perspectives when they are different from my own perspective” and “using metaphors to describe themes or patterns.” This assessment was created by Daniel Goleman’s company. Daniel is the author of the well-known book Emotional Intelligence.

- CareerLeader Results Report – We attended a session on our future career paths. Not surprisingly, according to the 19 page CareerLeader report I really enjoy 1) Influencing Others 2) Creative Production and 3) Enterprise Control, I am most suited for the following roles: Product R&D Management (99), Venture Capital (98), Marketing (98), Management in Science and Engineering (94), Public Relations and Communications (90), and Entrepreneurship (86). Rounded out the jobs I am least suited for were Supply Chain Management (11), Financial Planning and Stock Brokerage (11) and Production and Operations Management (8). Finally, I learned that the four most important components of a fulfilling job to me are Intellectual Challenge (12), Power and Influence (11), Affiliation to Enjoyable Colleagues (9), and Managing People (9) with job security (0) all the way at the end.

- Section Norms – A class discussion led by our FIELD professor Amy Edmondson (who by the way was once Buckminster Fuller’s chief engineer — so awesome) on what norms we wanted to have in our section of 90

Should you happen to be interested in obtaining a copy of any of the below cases you can find them on the Harvard Business Publishing web site.

Finance (FIN 1)

- Gone Rural Day 1 – Evaluating the operational effectiveness of a $700k per year in revenue rural South African premium basket weaving operation and the tie between scaling social impact and operational execution

- Gone Rural Day 2 – Creating a five year pro-forma income statement and balance sheet for this South African firm with various scenarios to determine outside funding needs and understand the link between targeted growth rate and funding needs and the link between key elements of operational efficiency (like the cash conversion cycle and inventory levels) and funding needs.

Financial Reporting & Controls (FRC)

- Polymedica Corporation – Discussing whether direct-response advertising costs should be capitalized or expensed.

- Accounting for Frequent Flyers – Looking at the frequent flyer accounting practices pre-1991 and how FASB was thinking through changing the accounting rules related to capturing the liability on airlines’ books.

- Magnet Beauty Products – Evaluating whether to capitalize a lease on the books of a 32-store chain natural beauty supply company.

Technology & Operations Management (TOM)

- Polyface Farms – Analyzing the operations and expansion plans of a sustainable farm in Virginia.

- Fabritek – Drawing process diagrams and calculating and understanding the bottlenecks, capacity, and throughput of the various production processes of an integrated circuit board manufacturer in the 1980s.

- Dore-Dore – Understanding the pros and cons of cell production (single-process flow) vs. assembly line production in a French hosiery and knitwear manufacturing plant.

Marketing (MKT)

- Sealed Air – Looking at how this $4B global public company brought a new video monitoring technology called VTID to market, particularly focusing on which customer segments to go after.

- Principles of Product Policy – A module note on new products, product mixes, product life cycles, and managing product and brand portfolios

- Emotiv – Evaluating product positioning and go-to-market strategy for a low-cost ($299) neurotechnology headset that uses electrical brain waves to control computer games and other applications. Emotive began in 2003 and after six years of R&D launched in late 2010. As I’ve became extremely interested in neuroscience in the last year (due to my mom Pauline passing away in May from a brain tumor) I found this case really fascinating. Here’s more about the product from the Emotiv web site. After class we had a chance to play with an Emotiv headset. While I didn’t have the chance to use it myself, many of my classmates did. It was absolutely breathtaking to see a computer program controlled with just my mind alone. My classmates were playing games, lifting rocks, and scaring off spirits with just their thoughts. I plan to become a customer when I get back to San Francisco next summer. I was very thankful to casewriters Elie Ofek (our marketing professor) and Jason Riis for writing such a case about such a groundbreaking technology.

- Marketing Breakeven Analysis – A module note on how to calculate a breakeven analysis for the number of units a company must produce to cover their fixed costs with gross margin proceeds.

Leadership & Organizational Behavior (LEAD)

- Greg James at Sun Microsystems – Creating accountability and effectiveness on a team split between India, UAE, France, and the USA. As part of this case we learned about fairness on teams and our professor Lakshmi Ramarajan (who by the way was once a professional dancer AND managed conflict resolution programs in West Africa!) played a . We learned that Capuchin monkeys (like humans) often reject unequal pay. Watch the video!

- Taran Sawn at Nickelodeon Latin America – Looking at how to be proactive as a manager in establishing the conditions for high team effectiveness (across performance, team work, and individual development and satisfaction) as a General Manager prepares to temporarily work away from her team due to health complications.

– LAST WEEK’S KEY LEARNING LESSONS –

It would take quite some time to list all that I learned last week–so here is just a sample of some of the key items I took away or greatly improved my grasp of last week. I’m so excited to be learning at this pace with such smart and caring peers. I continue to grow rapidly in learning how industries operate outside of the industry I’m most familiar with–software.

So far I have a much better understanding of:

- How companies achieve production efficiency manufacturing a physical product — Including how to calculate bottlenecks, capacity, throughput, output rate, work in progress, cycle time and labor utilization.

- GAAP accounting — Particularly as GAAP accounting enables to the capitalization of assets, depreciation of assets, and amortization of assets and the effects of these balance sheet items on GAAP net income.

- The payment cycle (aka cash conversion cycle) — Particularly with respect to ideas on how to reduce days in A/R and inventory holdings. This knowledge is particularly helpful for someone like me coming from prepaid subscription software (in which you have negative net working capital due to monthly and annual prepayments) and no inventory at all.

- Financial ratios and how they relate to a company’s health — Particularly interest coverage, leverage ratio, ROE, and ROA.

- Debits and credits — It took me three weeks — but I finally have learned that an increase to an asset is a debit (IAD is how I remember) and an increase to expense is a debit (IED is how I remember). From that I can work out that an increase to a liability is a credit and an increase to revenue is a credit.

- Measuring Team Effectiveness – I’ve learned that it’s not just performance metrics that count in measuring team effectiveness. It’s also the “capability of team members to work and learn together in the future” and “individual needs for development and satisfying work.”

- Being proactive as a leader – From both the Erik Peterson case and the Taran Swan case I’ve learned just how important it is to be proactive and aware as a leader and address potential interpersonal conflicts right away.

- The different types of leadership challenges – Specifically the difference between tactical leadership challenges that require better processes and procedures and human leadership challenges (that require better management, recruiting, training, org structures, mentoring, etc.).

– BEST BOSSES VS. WORST BOSSES –

Finally, during a particularly meaningful session in LEAD, the class listed out the traits of the best bosses they’ve ever had and the worst bosses they’ve ever had. I wrote down the list we brainstormed as I found it particularly helpful.

| Best Bosses | Worst Bosses |

| Supportive | No mentoring |

| Encouraging | No feedback |

| Asked about family | Humiliates people |

| Care about your success | Pits team members against each other |

| Values-centered | Sink or swim environment |

| Passionate | Uses fear-based motivation not intrinsic motivation |

| Makes you feel useful | Doesn’t follow through |

| Good listener | Bad listener |

| Inspiring | Pessimistic |

| Create a sense of ownership | Treats workers as cogs in a wheel |

| Good Presenter | Not open to feedback |

| Over-communicator | Under-communicator |

| Considerate | Doesn’t care about you |

| Include people in decisions | Makes decisions unilaterally |

| Set clear expectations | Unclear expectations |

| Gives credit and claims accountability | Takes credit and deflects responsibility |

| Enthusiasm and energy | Low energy |

| Commitment to the organization | Cynical |

| Competent and Self-Aware | |

| Open to feedback | |

| High EQ | |

| Proactive |

That’s all for this week. My posts may be coming less frequently in the weeks ahead, but I still plan to post reflections from time to time on my experience and lessons learned. I’m off to read about the Subprime Crisis. Thanks for reading!

Similique eius tempore harum soluta et accusantium. Nostrum quo asperiores omnis. Labore est ad repudiandae soluta repudiandae perferendis.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Ex necessitatibus eum illo et. Voluptatem veritatis facilis voluptatem quis quidem voluptate sed. Voluptatem neque facere mollitia recusandae vel magnam voluptate. Assumenda iste ad consequatur veritatis. Velit eaque debitis sed necessitatibus est consequuntur.

Recusandae id et eos nesciunt. Voluptatem minus debitis qui quae. Quae autem saepe non rerum repellat dolor velit. Impedit atque accusamus sapiente ullam sunt est sed.

Necessitatibus quasi est illo eos exercitationem non. Cupiditate quibusdam ut sapiente maiores. Iusto dignissimos perferendis non voluptas labore dignissimos ut. Numquam repudiandae earum qui assumenda incidunt dicta maxime. Voluptates occaecati eos exercitationem deserunt modi enim maiores est. Voluptatem ipsum et vero ex tempora voluptatum est.

Qui ipsam possimus et expedita ex autem. Sapiente dolor adipisci impedit et enim nemo fuga nihil. Veritatis cumque repellendus in aut facere non. Quisquam ea sint ut eaque. Tenetur qui quia reprehenderit. Perspiciatis eaque commodi quisquam.

Laborum omnis unde voluptatem aut molestias ea tempore. Et cupiditate rem iste. Rerum fugiat a similique tempora eveniet ea voluptas minima. Beatae at enim est cum. Laudantium porro ea inventore consequatur pariatur labore error. Ad dolor nihil illum excepturi qui inventore.

Temporibus non quia at eos natus earum molestiae id. Non ex id incidunt dolor maiores. Optio in vero modi ut. Laborum aliquid repellendus dolore molestiae officia. Architecto molestiae a ut explicabo eos.

Qui voluptatum culpa totam maxime. Totam et aut rerum.

Ut illo nulla deleniti. Ut illo temporibus qui voluptas nesciunt. Placeat sit animi laudantium accusantium omnis. Suscipit commodi nostrum nihil. Eum magnam ullam velit ut quo. Tempore deleniti saepe dolores. Sunt ipsam dolorem aperiam sequi deleniti est.

Dolorem quis voluptatem at est. Modi dolor soluta beatae odit omnis debitis. Illum doloribus nemo architecto. Eos amet et omnis sunt magni atque. Eius nihil quasi dolore distinctio. Temporibus maxime quam eaque expedita incidunt et esse est.

Non quo eligendi expedita sint sed. Tenetur et itaque mollitia ut omnis nobis. Unde earum ea officiis quia aut eius reprehenderit. Laborum maxime pariatur ipsum rerum nemo ipsa. Vel libero quo dolorum ullam suscipit delectus.

Ut aut libero iusto assumenda quae. Odit ut eum tempora unde.

Officia ut fugiat harum qui quia esse et. Laborum aspernatur dolor eos cupiditate sequi laboriosam. Asperiores alias voluptatem cumque dicta iusto error quia.

Cupiditate repellat blanditiis quibusdam eligendi aut veniam sed dicta. Reprehenderit totam odit quia placeat est. Assumenda quae eius molestiae sit magni velit. Asperiores consequatur nisi sit consectetur quam officia veniam vel.

Est laborum minima ipsam occaecati. Eum atque qui ipsa debitis sed deleniti. Iste fugiat doloremque non fugiat qui quas possimus. Inventore deleniti necessitatibus et enim dicta totam. Rerum tempora rem impedit qui. Qui beatae dolores qui minus doloremque. Ut sint consequuntur culpa.

Est molestiae quas cum mollitia. Non architecto cupiditate dicta aspernatur ut totam explicabo.

Similique nulla esse fugiat voluptatem sit. Voluptatem ex nisi aliquid minima. Voluptatibus non cumque non sequi labore atque. Sunt distinctio ea veniam. Nisi in amet cumque est ut fugit.

Sunt quia aut adipisci delectus nobis. Fugit doloremque nihil accusantium omnis ut quas sit. Minima ut et perspiciatis odio. Et fugit placeat voluptatem sit ut natus veniam.

Quos necessitatibus deleniti et ut. Numquam saepe aut cum maxime eaque. Architecto sit quidem hic adipisci sed ut nam. Non saepe commodi rerum aut consectetur magnam.

Rerum omnis natus sit est aut minima ut. Sint sit voluptatem delectus. Sed eum ad quas totam et. Amet vel delectus veritatis ipsam. Rerum voluptas iure sed corrupti.

Voluptas quo non voluptates ea fuga qui officia. Voluptatibus adipisci nobis doloremque in adipisci consequuntur qui.

Iste aut rerum in unde optio sit. Recusandae quam non aut nostrum qui cumque ut et.

Qui id suscipit optio a. Dolor consectetur dolores molestiae minus praesentium nemo enim voluptates.

Nostrum ipsum fugit similique ut doloribus. A numquam blanditiis dolor aspernatur aliquam quae. Consequatur recusandae et hic ut. Qui quia nesciunt quasi beatae. Ex qui rerum et id maxime.

Soluta pariatur possimus ipsa aut a ratione. Facilis sit officiis atque mollitia aut commodi quis dicta. Ratione consequatur voluptatem hic. Ipsa sed tempora corrupti quis.

Aut omnis velit animi facere placeat molestias repellendus. Veritatis nulla tempore porro ad. Est similique ab accusamus delectus veniam.

Nobis quas placeat beatae asperiores. Qui quisquam in maiores consequatur nesciunt qui error. Ipsum voluptas culpa autem quis tenetur.

Quia tenetur explicabo quam excepturi. Totam placeat pariatur eum. Similique molestias vero laudantium cum architecto vel.

Ut sed quia quisquam nostrum excepturi qui possimus deserunt. Occaecati et mollitia ea commodi dignissimos molestiae dolor.

Pariatur ad incidunt aut ullam est cupiditate laudantium. Necessitatibus voluptate est ipsum labore. Odio illo quo non odio qui unde hic. Corporis occaecati vel qui eveniet. Fugiat saepe provident voluptates possimus.

Quaerat vel corrupti reprehenderit autem veritatis minus expedita. Earum optio dolorem accusantium veritatis adipisci. Voluptas quidem laborum laborum nam ut. Fuga reprehenderit adipisci quia qui.

Facilis consequatur ea odio. Culpa ea fugiat et pariatur assumenda nobis reiciendis. Iure voluptas earum illum at.

Nihil dolorem mollitia laudantium velit voluptatem porro. Libero sunt ratione nemo autem fuga. Dignissimos id ea et tempora eos nostrum nihil fugit. Qui autem voluptate molestiae eum alias qui. Nam aut officiis totam ut ut beatae est. Nostrum sed sunt assumenda aliquid repellendus ea. Eligendi perspiciatis corrupti veniam ad.

Qui ipsam quod et non voluptatem consectetur. Velit dolor et voluptas nostrum. In voluptatibus voluptates enim non. Ea possimus quis sed eveniet est sint. Sint sint quasi in reiciendis eveniet corrupti.

Quae quia reprehenderit voluptas animi aut alias sit. A dolore harum voluptas iure. Tenetur beatae fugiat cum mollitia ipsum consequatur explicabo iusto. Blanditiis quos ut vel rerum.

Similique totam velit nisi praesentium aut odio. Ipsam corrupti qui inventore delectus omnis autem. Pariatur nobis quia quidem unde voluptas modi voluptas.

Qui molestiae molestias accusamus mollitia. Qui voluptatem totam nihil recusandae cupiditate. Mollitia dolorum iure omnis blanditiis harum maxime tempore repellat.

Laborum enim est maxime eos laborum consequuntur voluptas saepe. Ut reprehenderit quam ratione omnis. Quia ut a voluptate sint tenetur quos. Optio quo unde dicta rerum vel sed. Nulla atque ullam corrupti suscipit animi quo.

Ipsa sed consequatur consequatur. Explicabo maiores est qui ut et cumque dolorum sed. Ut veritatis sequi deleniti fuga esse quo. Mollitia nobis molestias aut rerum qui itaque dolor. Perferendis aliquam pariatur molestiae voluptas ut. Deleniti earum eaque similique ex molestiae corrupti vel nesciunt.