WSO CDO Year End 2011 Update

We're skipping Bonus Bananas this week because I wanted to bring you guys up to date on the year-end results of the Lending Club CDO I set up last year. Lending Club gets a little nervous whenever I write one of these because they believe (correctly) that a portfolio of 10 loans is simply not large enough a representative sample. Be that as it may, the 10 borrowers I selected have been good debtors and there hasn't been a single late payment all year. And it's posted an annual return of 11.87%.

The same cannot be said for my other Lending Club portfolio (which is quite a bit larger and probably a more accurate sampling). I've had a few late payments in that one, but still no defaults. That probably has something to do with the fact that I sell the notes of late payors immediately in the secondary market. I usually take a small loss to do so (my biggest individual loss to date was $1.80 on a $25 note), but the way I look at it is if someone is going to pay late, there's a decent chance they won't pay at all. I'd rather take a small loss and make that someone else's problem.

This is the first full year I've been investing with Lending Club, and I'm happy to report a Net Annualized Return of 13.12%, which puts me in the top quartile of Lending Club investors. I can think of a few hedge funds that would kill to report a return of 13%+ this year (ahem, Paulson).

For those curious, I have a pretty strict methodology for the loans I choose to fund. I only fund loans for terms of 36 months, loan amounts $5,000 and under, borrowers who've had no delinquencies in the preceding 36 months, and the loan purpose has to be something I deem worthwhile. I won't fund weddings or vacations because I believe the proverbial bloom is off the rose long before the loan is paid off. I'm hesitant to fund relocation loans because if you don't have the money to pay to move, how are you going to handle all the expenses that inevitably crop up when you're getting established in a new place? I typically stick to debt consolidation loans because that indicates to me that the borrower is getting their shit together and it has the ancillary benefit of sticking it to the banks that issue usurious credit cards.

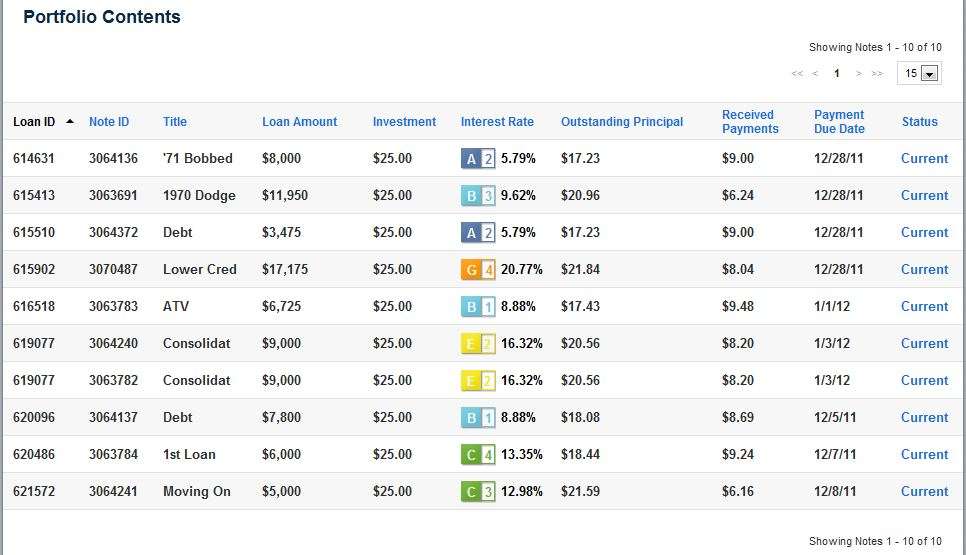

Anyway, here's the year end breakdown of our little experiment. I'm pretty pleased. Let me know if you have any questions.

Nice write-up! A 13% return is super solid. I'm going to check it out. Thanks.

This is pretty awesome. Definitely looking into this.

Very interesting. I'd read about these type of peer to peer lending sites before but never heard a first hand account. Might look into it now. Do have experience with other P2P lending sites like Prosper? What made you go with LendingTree over others?

Is there an original post I can read to get some background on this? First I have heard of it and seems pretty interesting.

Edit: http://www.wallstreetoasis.com/blog/wso-cdo-quarterly-update-q2-2011

Actually, this is the original piece I wrote when we got the whole thing started:

http://www.wallstreetoasis.com/blog/build-your-own-cdo

Answers a lot of the basic questions.

Much appreciated. This looks pretty cool.

How well do you think this could scale with a few thousand? How much larger is your own loan portfolio?

I know at least a couple hedge funds have invested over $1 million at a time, so I guess it scales just fine.

The level of scaling is dependent on how much risk you are willing to take on any one note. If you stick strictly to the minimum $25 per note then you will have a difficult time scaling this to large dollar amounts as you will spend all day looking at notes and doing nothing else.

Here's the analyst in me coming out, but have you post-mortemed any of the notes you sold? Interested to see how many late payments eventually default.

My portfolio is 6 months in and a bit riskier in composition - 40% B, 40% E, and 20% F (5 loans total). Return at 15.6% annualized.

Surprisingly, all loans are current and no late payments, despite the lower credit quality. 3 loans have seen decreases in credit score (surprisingly 1 of each B E and F-rated loans).

Still need to see what the back-end of the year looks like, but I'm starting to think I should increase exposure to P2P lending.

@freeloader

You actually hit on something that is more than an idle curiosity of mine, but no I haven't tracked the notes I've sold to see how they performed after the sale. It certainly would be interesting to see. The risk profile of my portfolio outside of this WSO CDO is as follows:

B-41% C-36% D-17% E-6%

Based on that, it's pretty conservative so I'm happy to see it throwing off over 13%. I'd love to get some higher interest loans in there, but the junkier debt very seldom meets the criteria I outlined above. I also don't buy A-rated debt because I feel like it doesn't compensate for the risk (it is unsecured P2P lending, after all).

Agree on the A rated loans. When I originally built my portfolio, I did some light analysis on risk-return profiles. On a risk-adj basis, D, E, and F loans are great yields. G loans you're not getting compensated much for taking on the extra risk over a F loan.

There is actually some extremely detailed data on the loans available, based the detailed loan stats for I think all or a large portion of the funded loans. Would love to see a monkey slice and dice by loan size, credit quality, loan purpose, debt-to-income ratio, and current status (PIF, current default, late) etc.. Silver bananas to the first WSO LendingClub Research Report?

https://www.lendingclub.com/info/demand-and-credit-profile.action

https://www.lendingclub.com/info/download-data.action

I am just rounding the two year mark, and I am a little under 10%. I have about 5 grand invested in total, with $25 invested in nearly all notes. I have not reinvested my dividends, because I bought a place this year and wanted to look as liquid as possible. The loan officer gave me a real wtf look when I mentioned lending club, and didn't seem even remotely interested in counting that towards my assets, so keep that in mind if you are thinking about putting a significant chunk of money in there.

Its not necessarily a given that once they get behind, they are going to default. There are many instances where they come back up to speed. Enough default though, that its probably worth it to sell them. I don't really watch my portfolio like a hawk to do that. I have had enough A's default that I don't fund them anymore. One minor downside of lending club is that your rate of return only decreases over time due to defaults. Still though, 2 years of 10% non-volatile returns is pretty sweet.

I know its only 2 data points here, but are you guys consciously look to have no more than $25 wrapped up into any one note / borrower? I have to imagine its a pain to fund a small amount (200! notes to comprise a $5K portfolio?).

What's the upper limit you would lend to any one person? I'm comfortable to a $250 limit at the moment.

$25 is the default, and I rarely mess with it unless the borrower's app seems to stand out as particularly strong. The whole point is to diversify risk as much as possible. I didn't invest the money all at once, I invested over several months. I guess you can play it like the stock market and try to find 14% loans that you think you will perform and invest heavily in them, but I want my risk diversified. I also still consider this to be an experiment, if I do decide to move a larger amount of money in, then I will consider upping the amount I invest in each loan.

There is a portfolio builder tool on the site as well. You can tell it to take your money, invest it at X dollars at a time in notes at whatever risk profile you want. If you were investing a considerable amount of money, you could do it that way. For those investing a large amount, I think it is $100k, there is also a pwm like service where you have an advisor, and can build strategies with them.

I don't do it that way, because one of the things that drew me to lending club was that you are the bank, and you are the loan officer. I personally enjoy reading the applications and deciding if they think they are a good risk. Note that I don't really spend more than two minutes reading each. The default is "don't invest" and if the story sounds in any way fishy, the numbers don't add up, or the answers to potential investors questions (you have the opportunity to ask the applicant questions) seem evasive or poorly written, I just move on to the next one.

FYI, after 1 year, I'm at 9.19%. But that's with no additional effort on my part since I lent the original principal. And I have not reinvested the available cash that has accrued. If managed, I probably could have gotten 10+% with very little risk.

Wondering, about the potential of the following strategy given the imperfection of this market.

Make a loan to someone, and they are making payments for 6-9 months straight. Sell the loan at or above par. Then find a new loan. It seems like the longer you hold the worse you would do, and most of these loans are pretty much the same thing, so why not ONLY invest in fresh loans, where the person is likely more committed and able to repay at the beginning.

Also, would love to see the Q1 2012 report now that it's almost May.

There are many notes listed above par, but I have no experience as to how well they sell. It stands to reason that a note with some seasoning (6-9 months) would be worth more than par due to a lower perceived risk factor. I'm sure someone is doing it.

And here's the Q1 2012 results:

http://www.wallstreetoasis.com/blog/hedge-funds-move-into-p2p-lending

Molestias quae rem ea consectetur sapiente voluptatem temporibus. Qui quo dignissimos at quia qui consectetur. Aut exercitationem atque consequuntur sed voluptatem.

Dolore in aliquam dolorem in perspiciatis distinctio repellat. Qui placeat aut dignissimos. Ut accusantium ad vero saepe explicabo. Officia sunt atque distinctio.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...