Enterprise Value Question - compare to equ. value?

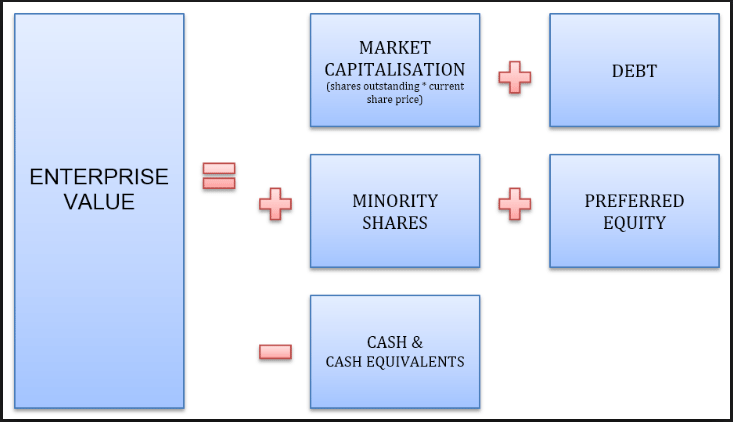

Hi, I'm looking for clarification here on enterprise value in comparison to equity value etc. I understand the main difference, equity value is the value to shareholders, while enterprise value is the value to all capital providers (debt,equity), but I have seen all the stuff about preferred equity and minority shares and I'm confused where that all fits in.

For one, I've seen when calculating value using a DCF, you forecast FCFF, discount with WACC, and get EV, then you subtract debt and add cash to get to equity value, the amount that should be paid to shareholders for all shares, right?

But then how does this work when you consider this?:

IF this is true, then shouldn't when you use a DCF, do EV-debt-preferred-minority+cash = equity value?

or am I misinterpreting the meaning of equity value compared to market cap.

Thanks for the help.

Someone correct me if I am wrong, but I think you're saying the same thing. One is just a simplified version of the other.

Equity value + debt - cash = EV.

In a more detailed and complex calculation, you have to account for minority shares and preferred equity.

Is it perhaps that equity value is an all-inclusive term for outstanding shares, preferred, and minority shares?

That's correct, a lot of the time, people just disregard minority shares and preferred equity in the equation.

Nope. Equity value is the value to shareholders of the firm, which would not include minority interest or preferred debt. These are sources of capital that get paid separately. You either need to subtract the cash impact from FCFF to get to FCFE, or subtract their total values from EV to get to EqV.

So is it the case that TECHNICALLY, in a DCF you should do

EV-preferred-minority-debt+cash = Eq.V?

But it is normally simplified? But technically speaking, all of those should be included?

Correct. It is normally simplified because debt and equity are overwhelmingly the primary sources of capital in most cases, so it's easier to understand conceptually. But for some companies with significant amounts of either minority interest or preferred stock, this can be a material detail that will give you very wrong outcomes if overlooked.

Assumenda vero cum qui nihil. Magnam provident incidunt debitis atque sed consequatur consequuntur. Aut consectetur qui distinctio et quas consequuntur. Sunt illum mollitia ipsa voluptatem. Totam aspernatur eos animi quisquam. Est aut excepturi rerum harum totam debitis. Est placeat consequatur quam esse inventore.

In facilis nisi illo provident fuga. Ratione enim iste id aut dolores. Eveniet omnis similique sed repellat eveniet ratione hic. Sunt autem adipisci recusandae modi distinctio modi qui.

Quidem neque voluptas officiis quidem architecto ducimus est. Non ut assumenda fugit ipsum.

Pariatur nemo voluptates tempore nulla laborum accusantium. Assumenda repellat perferendis quis accusamus at voluptas cum. Sint veniam occaecati ea saepe nihil.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...