SEC Form 6-K

A form used by foreign private issuers (FPIs) to provide disclosures to the Securities and Exchange Commission (SEC)

What Is An SEC Form 6-K?

SEC Form 6-K is a US Securities and Exchange Commission (SEC) form through which SEC-registered foreign private issuers (FPIs) provide ongoing disclosures about corporate news.

When an FPI has listed securities in the US, it becomes subject to mandatory reporting obligations under Section 13 of the US Securities Exchange Act of 1934 (Exchange Act) and has to submit shareholder reports, press releases, and other information that it has already published to SEC.

FPIs have two primary reporting obligations:

-

First, filing an Annual Report on Form 20-F within four months after fiscal year-end, as required by Exchange Act Rule 13a-1

-

Second, furnishing reports on form from time to time, as required by Exchange Act Rule 13a-16

Key Takeaways

- SEC Form 6-K is a disclosure form used by foreign private issuers (FPIs) to update the SEC about corporate news and material information.

- FPIs use it for ongoing reporting, including filing quarterly reports and disclosing material information arising between annual reports.

- It includes material information publicly disclosed, required by stock exchanges, or shared with shareholders, covering topics including earnings, management changes.

- FPIs must file the form electronically through EDGAR and ensure accuracy to avoid SEC enforcement actions for misleading or fraudulent information.

What does SEC Form 6-K cover?

Information

Regulation requires FPIs to disclose to the SEC information:

(1) that is material to the FPI

(2) that the FPI:

-

Files or is required to file under stock exchange rules

-

Makes or is required to make public under home country law

-

Distributes or is required to distribute to its shareholders

Topics

A Form 6-K catalogs items that are material to an FPI. The topics covered include: includes:

-

Earnings information

-

M&A activity and acquisitions and dispositions of assets

-

Changes in management

-

Change in auditors

-

Defaults

-

Bankruptcies or receiverships

-

Events regarding the company’s securities, such as stock splits, payment

-

Any other information the FPI deems to be of material importance to security holders

Most importantly, under Form 6-K, the information disclosed must be material to the issuer and its subsidiaries. This materiality standard helps avoid filing a large amount of insignificant information with the SEC.

Documents

A Form 6-K report includes documents such as:

-

Earnings releases

-

Court filings

-

Materials sent to shareholders, such as annual and quarterly reports and documents prepared in connection with annual and extraordinary meetings of shareholders.

-

Presentations showed at industry conferences.

-

Transcripts of calls with senior management

-

Press releases.

Forward-looking information

The SEC has indicated that Form 6-Ks are entitled to a special safe harbor available only for “filed” documents by its terms. The safe harbor of Rule 175 under the Securities Act of 1933 (Securities Act) and the Exchange Act Rule 3b-6 apply “with equal force.”

This protection is awarded only to statements made in reports filed with the SEC. Anticipative information (such as projected revenues, management’s plan for future operations, and other matters) is not deemed fraudulent (thus is deemed material by the SEC) unless the statements demonstrate the absence of fairness or a reasonable basis.

Are FPIs Required To Furnish SEC Form 6-K Electronically?

Yes, it must be filed through the SEC’s Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system.

The topics in the form are likely material for many FPIs, although FPIs must conclude about any specific Form 6-K report.

A piece of information is considered material if there is a substantial likelihood that an investor would deem the information important in determining whether to buy or sell a security.

However, issuers have been granted permission from the SEC to file documents on paper under the exemptions allowed by the EDGAR rules. A document can be filed on paper if:

-

It is the company’s annual report to its shareholders.

-

It is not distributed (or required to be distributed) to its shareholders, is not a press release, and covers financial results or another material event that was part of an earlier Form 6-K filed electronically via EDGAR.

Liabilities associated with the forms reports

The SEC has brought several enforcement actions against foreign private issuers (FPIs) in connection with alleged misleading information contained in the form. reports.

These actions have been based on claims of fraudulent misrepresentations, improper accounting, deceptive statements, and other illegal conduct.

In some cases, SEC actions have alleged violations of the anti-fraud provisions under Section 10(b) and Rule 10b-5 and violations relating to the form under Section 13(a) and Rule 13a-16.

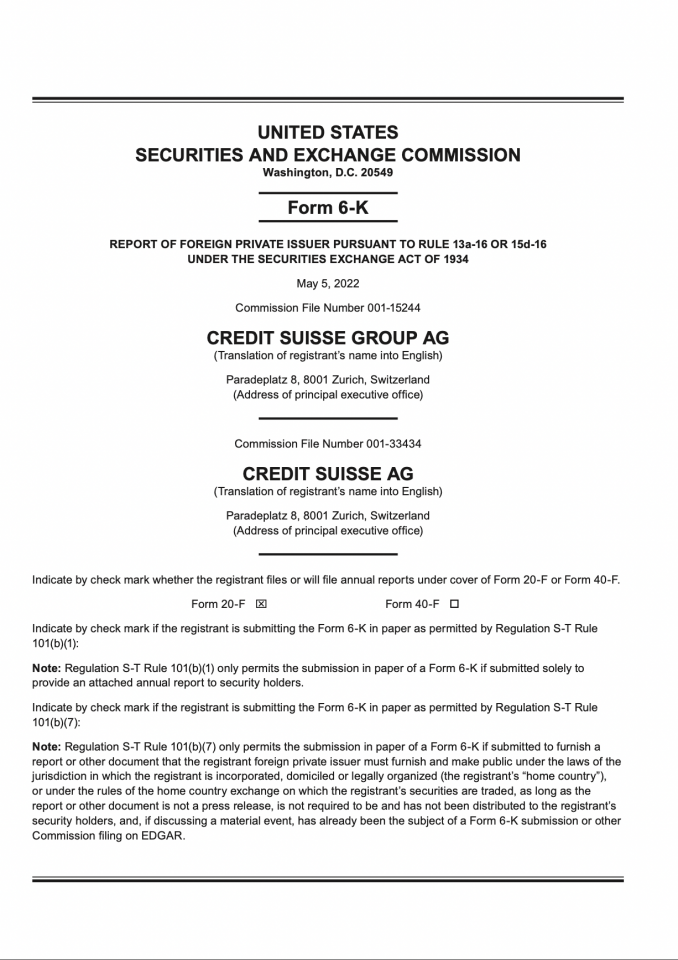

SEC Form 6-K Example

Shown below if the Q1 report on Form 6-K Credit Suisse furnished for the period ended March 31, 2022.

As can be seen above, the form is a four-page SEC document with little more than a cover sheet and technical filing instructions. However, with careful planning, robust controls, tight coordination, and sound counsel, an FPI can reduce complexity and uncertainty.

A foreign private issuer (FPI) that masters the Form 6-K disclosure process will gain an effective tool with which to provide its US investors, the SEC, and the global market with crucial, up-to-date information.

SEC Form 6-K FAQs

Yes, the filling is mandatory.

All 6-K filings are available to the public via the SEC's EDGAR database or on the company’s own website.

No, they are documents that are made publicly available, free of cost.

Yes, all the SEC filings must be in English. If Form 6-K is not in English, the foreign private issuer (FPI) must provide an accurate English summary of the document.

U.S. SEC rules provide that some documents, such as financial statements, press releases, documents sent to shareholders, by-laws, and corporate charters, are too important to be the subject of an English summary. For these documents, a complete English-translated version should be provided.

There is no difference in the actual meaning of providing required information to the SEC. The different terms are labels applied by the SEC. All reports are sent electronically to the SEC via the SEC’s EDGAR system.

or Want to Sign up with your social account?