EBITDAR

A measure of the operating profitability of a company that includes rent and restructuring costs as well.

What Is EBITDAR?

EBITDAR is a non-GAAP metric used to assess a company's financial performance. It includes earnings before interest, taxes, depreciation, amortization, and restructuring or rent charges.

EBITDAR can be calculated using data from the income statement even if it does not appear on a company's income statement.

Similar to EBIT or EBITDA, EBITDAR adjusts net income to be internally analyzed by removing particular costs.

EBITDAR is a statistic primarily used to assess the financial performance and health of businesses that have undergone restructuring within the previous year. It is also helpful for companies with distinctive rent expenses, such as restaurants or casinos.

Along with profits before interest and taxes (EBIT) and earnings before interest, tax, depreciation, and amortization (EBITDA), it is a term that exists.

Key Takeaways

- EBITDAR, short for Earnings Before Interest, Taxes, Depreciation, Amortization, and Restructuring or Rent charges, is a non-GAAP financial metric used to evaluate a company's financial performance.

- EBITDAR is generally used to assess the financial health and performance of businesses, particularly those that have undergone restructuring in the preceding year.

- EBITDAR is especially relevant for industries with substantial rental costs, like retail, airlines, hospitality, and restaurants.

- Advantages of EBITDAR include removing non-recurring expenses, enhanced comparability, and controllable cost focus.

- Disadvantages include treatment of frequent restructuring, cost management error oversight, regional disparities, and operating cash flow estimation issues.

Formula and Calculation of EBITDAR

EBITDAR is similar to EBITDA. It is the same operating profitability measure, including some additional items. These items can be rental or restructuring expenses.

Since EBITDAR is a variant form of EBITDA, let's focus on the calculation of EBITDA first. To get to EBITDA, we should subtract SG&A ( selling, general, and administrative expenses) and COGS (cost of goods sold) from Sales. SG&A and COGS form together operating expenses that a company incurs to run its core business.

This works if a company separately reports D&A:

Sales - OPEX = EBITDA, where OPEX is COGS + SG&A

If a company includes D&A in COGS, the formula above will directly yield EBIT. You will need to add back D&A to obtain EBITDA. Very rarely will D&A be part of SG&A.

Another manner of calculating EBITDA is to start from Net Income:

Net Income + Interest Expense + Taxes + D&A

What Are Selling Expenses, General & Administrative Expenses, And The Cost of Goods Sold?

SG&A expenses are considered indirect. It means remunerating parties that are indirectly involved in the main operating activity.

For example, it could take the form of salaries for support functions (finance and HR teams). Selling expenses can be both direct and indirect.

Let's define each category of SG&A:

- Selling expenses represent advertising, marketing, and travel charges. It also includes the salaries of a direct salesforce, payroll taxes, and benefits.

- General expenses represent utilities, office equipment, renting costs for offices or headquarters, and insurance.

- Administrative expenses represent consulting fees and internal indirect staff costs.

COGS (Cost of Goods Sold) regroups all direct costs incurred to produce a company's products. Expenses for raw materials, subcontractors, and labor are examples of COGS.

Operating costs can also be put into categories:

- Fixed costs: They are independent of the level of production. You incur these costs independently of producing one unit or one million. They include insurance payments, wages for support functions, leases, and rent.

- Variable costs: As their name indicates, these costs depend on how much you produce. They include raw materials costs, marketing, advertising, or packaging.

What Is Depreciation & Amortization?

Depreciation is an accounting measure to record the loss of the book value of a company's long-term fixed assets over their estimated useful life. It is a non-cash expense (no cash inflows or outflows).

Amortization is almost the same but is used to reduce the value of a company's definite life intangible assets.

We always depreciate property, plants, and equipment, except land. But on the other hand, we always amortize intangibles like copyrights, licenses, trademarks, patents, customer lists, etc.

EBIT is often reported on the income statement as operating profit, operating income, or profit before interest and taxes. However, EBITDA and EBIT are useful for comparing companies' operating performance without accounting for the capital structure and tax regime.

However, D&A reflects differences among companies in capital spending and depreciation methods (straight line or accelerated). Therefore, EBIT is also a less precise metric of the operating cash-flow proxy because it is affected by the non-cash expense D&A.

Now that you understand EBITDA's meaning, calculating EBITDAR is no longer a magic trick. To get this measure, we have only one step to do. First, we should add to EBITDA rent and/or restructuring costs.

EBITAR Vs. EBITDA

Calculating EBITDAR is simple. What is more important is understanding why and when we would opt for this metric. We remind you that R stands for rental and restructuring costs.

EBITDAR, where R is for rent expense, is used to assess the operating performance of companies in specific industries like Retail, Airlines, Hospitality, Restaurants, and similar.

Let's first explain why we want to include restructuring costs in the EBITDA measure. As we said earlier, when we look at EBITDA, we want to see how a company's core business activity performed.

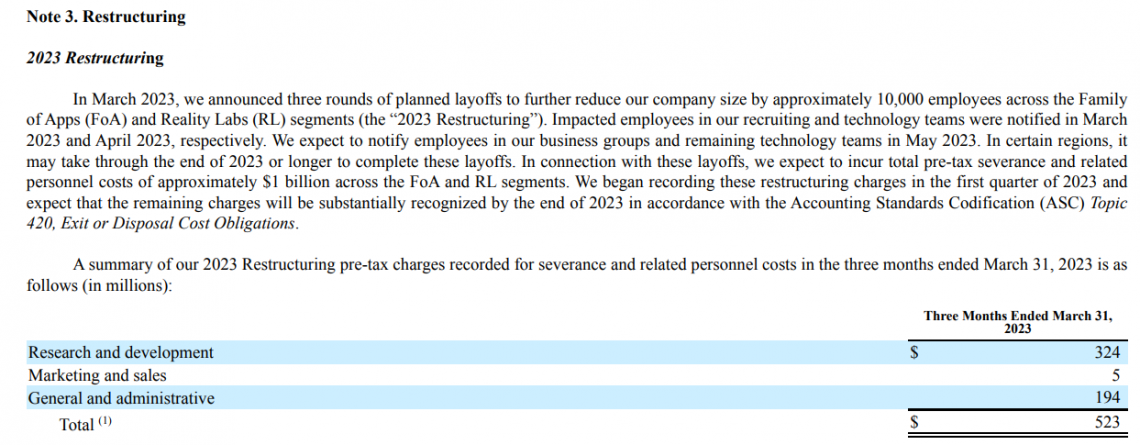

Restructuring costs arise when a company morphs its activity and incurs charges. For example, in the first quarter of 2023, Meta (parent company of Facebook) recorded a pre-tax restructuring charge of $523m:

In this situation, we observe that the nature of restructuring costs is severance from downsizing the staff. Do restructuring costs say something about the operating performance of a company? Not specifically, restructuring costs don't say anything about how well Facebook performed in this quarter.

Please note that Analyzing Meta's income statement needs to provide detailed information about the composition of operating expenses. Usually, reading notes and footnotes is very informative and allows you to detect important figures and events.

Do restructuring costs dwindle our EBITDA? Yes, because they are part of operating expenses. If we forget about these costs, the EBIT margin of Meta would be as follows:

7,227 / 28,645 = 25.3% (EBIT/Revenue)

If we include restructuring costs, the EBIT margin will become 27.1%.

Note

Restructuring costs are often part of normalizing financial statements. Analyzing operating performance requires stripping out all non-recurrent expenses that inflate or deflate financial figures.

Rent expenses may vary from industry to industry, from company to company. For example, an airline company relies exclusively on its fleet to run the business. Therefore, including rent expenses (costs related to maintenance and financing a fleet) allows analysts to neutralize the effect of abnormally high rental costs.

By doing that, a more accurate comparison of companies can be conducted. As you see, we don't only refer to the rent of land or property while computing EBITDAR. Generally, industries with unusually high rental costs use this metric.

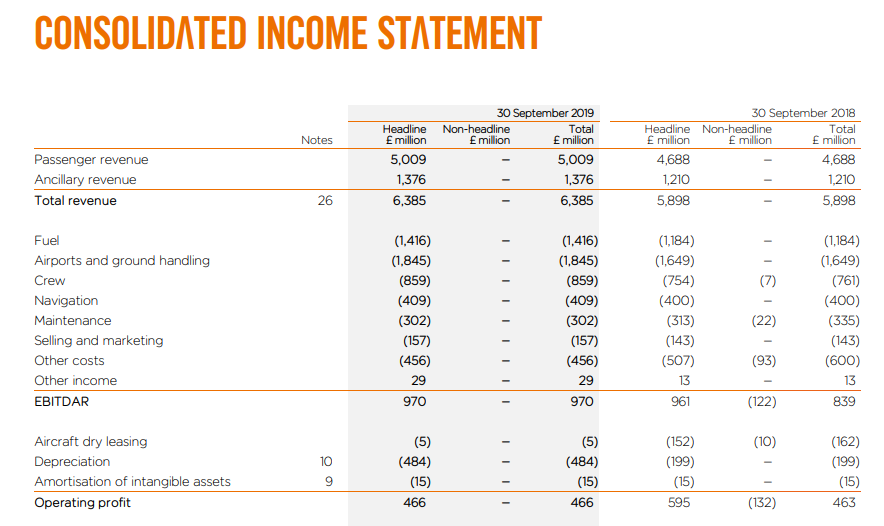

Let's look at the income statement of EasyJet. Airlines companies report rent expenses as part of operating expenses:

Easyjet breaks down its operating performance by EBIT (operating profit) and EBITDAR. It is immediately noticeable that the difference between them is significant. For example, in 2019, computing the EBIT margin gives 9.3%, compared to 19.4% of the EBITDAR margin.

Hence, one may need to accurately assess the operating performance of Easyjet using only the EBIT margin as a reference point.

Note

Low-cost airlines tend to have higher margins than premium airlines due to their modified cost structure.

In the retail, hospitality, and restaurant industries, eliminating rent is necessary to assess performance based on more controllable elements. Adding back rent and lease expenses helps to perform an "apples-to-apples" comparison.

Imagine a restaurant leasing its space. Naturally, this expense would decrease the operating performance of a restaurant. Also, if this restaurant is in the center of Paris, the cost would be meaningfully higher than for one in a godforsaken location.

Yet, the cost structure is different, but their business remains the same. If you were to invest in a restaurant, you would be particularly interested in how many people they serve, their attendance, location, and capacity to attract customers.

A hotel in the center of Paris would pay much more for rent. Still, he would likely also have better attendance and, consequently, better operating performance, all else equal. On the other hand, would you bet money on a restaurant without rent costs but with a poor customer base and visibility?!

Advantages and Limitations of EBITDAR

Using EBITDAR is inevitable for some industries. Even if this metric is more relevant than EBITDA, considering its advantages and disadvantages is necessary to know when it should be applied.

Advantages

The advantages of using this measure are non-negligible and can be useful in many situations, mainly because:

- Removing Restructuring Costs: EBITDAR removes restructuring costs, which are very often one-time. These expenses are generally non-recurring. Therefore, it is wiser to neutralize them to get a more realistic operating performance.

- Making companies comparable: Due to sector-specific characteristics, companies may not be comparable if you use standardized profitability measures. Adjusting for rental costs helps analysts analyze companies without being disturbed by discrepancies linked to owning or leasing assets.

- Stripping away geographical price differences: The geographical reach of companies also matters. For example, some locations represent higher rent costs because of the region's nature.

- Better focus on manageable costs: In finance, R-costs are considered non-controllable. This type of cost is less predictable and can't be approached like controllable costs. Eliminating them helps management to stay focused on elements they can influence.

Disadvantages

Any financial measure could be better, which is why EBITDAR has several limitations as well:

- Different nature of one-time and multi-time restructuring costs: Frequently incurred restructuring costs can be considered inherent. This happens when companies regularly undergo restructuring activities. Since these costs are part of companies' normal operating life, it might be unfair to ignore them.

- Missed control over management errors: In addition, frequent restructuring costs may be a sign of the management policies' inefficiency. Management is expected to use the control they are given to manage a company efficiently.

- If they are unsuccessful, ignoring restructuring costs would not be fully accurate due to their ownership of controllable aspects of operations. For instance, imagine management opening a new branch in a new region.

- Poor market analysis shows that sales are not at the expected level in a year, and a company is losing money. Therefore, restructuring expenses stemming from this failed policy are entirely due to their fault.

- Spending and earnings differ by region: We said that some regions have higher rent costs. However, the standard of living cannot be resumed at rent costs. Regions with higher standards of living can also have higher prices and salaries. Thus, companies in these areas charge more for their products and services.

- This inflates the top line and income. So, a company records higher revenues and lower operating costs.

- Inaccurate estimation of the operating cash flow: We mentioned that EBITDA is used as a proxy for the operating cash flow (CFO). Adding R to EBITDA makes the outcome less appropriate for estimating CFO. Restructuring and rent costs often are cash outflows.

- It means that they decrease the cash balance of a company. Therefore, adding them back is misleading and doesn't reflect how much cash a company earned over a period.

or Want to Sign up with your social account?