Theory of Liquidity Preference

A financial theory which posits that the demand for money is influenced by the desire to hold liquid assets and their associated interest rates, affecting economic activity.

What is the Theory of Liquidity Preference?

Liquidity Preference Theory (LPT) is a financial theory that proposes that investors prioritize assets with high liquidity, leading them to pay a premium for such assets while offering less than market value for those with low liquidity.

This difference in price between market value and the actual price represents the risk (or lack of it) associated with the liquidity of an asset.

This is evidenced in the yield pricing of bonds. A bond with a longer maturity typically pays more interest than one with short maturity, enticing investors to buy the less liquid, more risky asset (assuming longer-maturity bonds are harder to trade than those with a shorter maturity).

In macroeconomic theory, liquidity preference is the demand for money, often known as liquidity. Therefore, this approach gives the liquidity component of investment a lot of weight.

John Maynard Keynes first proposed the notion in his book "The General Theory of Employment, Interest, and Money" (1936) to explain how the supply and demand for money determine the interest rate.

The theory states that investors should expect a higher interest rate or premium on assets with long-term maturities that pose a greater risk because, in all other circumstances, investors prefer cash or other highly liquid holdings.

According to macroeconomic theory, liquidity preference is the demand for money considered as liquidity. It depicts the relationship between interest rates and the amount of money people want to keep.

Cash is widely considered to be the most liquid asset. In the liquidity preference theory, it is said that short-term interest rates are lower than medium- and long-term interest rates. This is because investors are not compromising liquidity with longer time frames.

-

LPT tells about how investors favor highly liquid assets, willing to pay a premium for liquidity and demanding higher interest rates for less liquid, riskier assets.

-

Liquidity Preference Theory (LPT) explains how supply and demand for money determine interest rates.

-

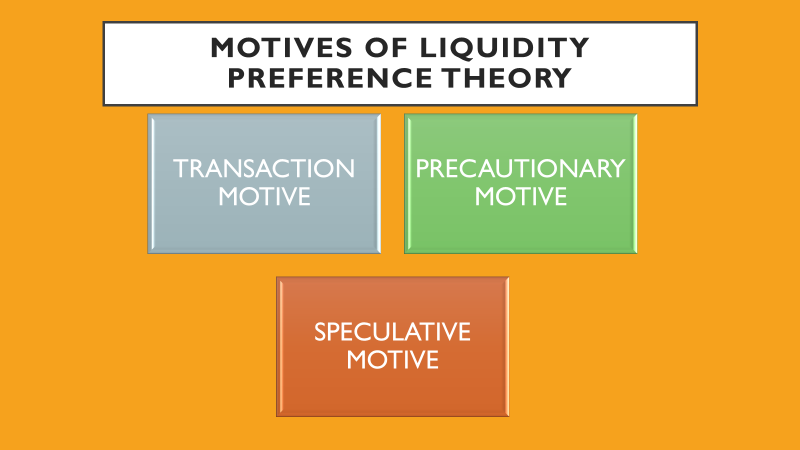

LPT identifies three motives for holding money: transaction, precautionary, and speculative, each influencing the demand for liquidity differently.

-

While LPT offers insights into interest rate determination, it faces criticism for oversimplifying economic dynamics, neglecting real-world complexities, and assuming constant factors like employment rates and money supply levels.

Motives Of Theory of Liquidity Preference

In his book "The General Theory of Employment, Interest, and Money," Keynes introduced Liquidity Preference Theory.

Keynes describes the theory in terms of three motives that determine liquidity demand:

1. Transactions motive

The transaction's motive concerns the want for money or the need for cash in current individual and commercial transactions. Individuals keep cash to bridge the gap between when they receive money and when they spend it. This is referred to as profit motivation.

Businessmen must also keep cash on hand to satisfy their immediate demands, such as payments for raw goods, transportation, and labor. This is referred to as the commercial motive.

2. Precautionary Motive

The urge to keep cash for unanticipated events is the precautionary reason for holding money. Individuals save money to cover the costs of illness, accidents, unemployment, and other unanticipated events.

Similarly, business people maintain cash on hand to weather bad times or profit from unforeseen opportunities.

3. Speculative Motivation

The speculative motive is to keep one's assets liquid to profit from future changes in interest rates or bond prices. The price of a bond and the rate of interest are inversely connected.

When bond prices are predicted to climb, i.e., when the rate of interest is expected to decline, investors buy bonds to sell later when the price rises.

The speculative motive in Liquidity Preference Theory explains how investors anticipate interest rate and bond price changes to maximize returns, balancing liquidity with potential gains or losses.

People will sell bonds to prevent losses if bond values are predicted to fall, i.e., if the interest rate is expected to rise. Investors are willing to give up liquidity in return for interest when higher interest rates are provided.

If interest rates rise and bond prices fall, for example, an investor may choose to sell low-paying bonds and buy higher-paying bonds or keep the cash and wait for a higher rate of return.

How Does Liquidity Preference Theory Work?

According to the Liquidity Preference Theory, the interest rate is the cost of money. So said, when money is demanded, it is not because someone wants to borrow money; rather, money is required because someone wants to remain liquid.

According to the notion, cash is the most widely recognized liquid asset, and more liquid investments can be easily cashed in for their full worth.

According to Keynes, transaction and precautionary motives are somewhat inelastic in terms of interest but highly elastic in terms of income. The quantity of money retained under these two motives (M1) is a function (L1) of income (Y) and is represented as M1 = L1 (Y)

The higher the rate of interest, the lower the speculative demand for money, according to Keynes, and the lower the rate of interest, the greater the speculative demand for money. Keynes stated the theoretical desire for money algebraically as:

L2 + M2 (r)

Where,

L2 = speculative money demand

r = interest rate

It forms a smooth curve that slopes downward from left to right. Now, if M stands for total liquid money, M1 for transactions plus precautionary motives, and M2 for speculative motives, then M is equal to the sum of M1 and M2.

The total liquidity preference function is represented as M = L since M1 = L1 (Y) and M2 = L2 (r) (Y, r).

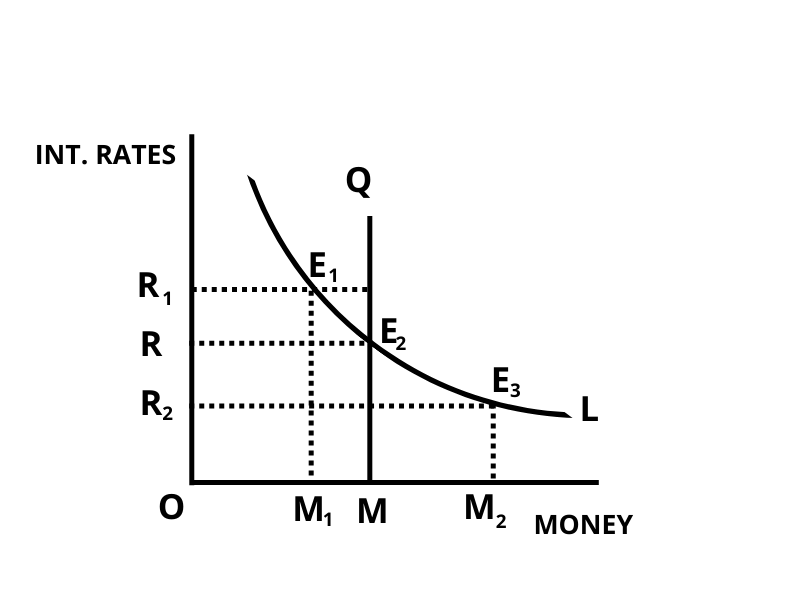

How is the interest rate determined?

The interest rate is set at the point where the demand for money equals the supply of money, just like any other product's price.

The vertical line, QM, represents the money supply, and the horizontal line, L, represents the total demand for money. Both curves meet at E2, where the equilibrium interest rate, OR, is determined.

If there is a divergence from this equilibrium state, the interest rate will be adjusted, and equilibrium E2 will be re-established.

The supply of money, OM, is larger than the demand for money, OM1, at point E1. As a result, the interest rate will begin to fall from OR1 until it reaches the equilibrium interest rate.

Similarly, the demand for money, OM2, is greater than the supply of money, OM, at the OR2 interest rate level. As a result, the interest rate, OR2, will rise, eventually reaching the equilibrium rate, OR.

It's worth noting that if the monetary authorities raise the money supply while keeping the liquidity preference curve, L, unchanged, the interest rate will decline. But conversely, given the money supply, the interest rate will grow if the demand for money rises and the liquidity preference curve shifts upward.

Liquidity Preference Theory VS Transaction Demand for Money Theory

| Key Comparison Terms | LPT Theory | TDM Theory |

|---|---|---|

| Conceptual Focus | This theory emphasizes on the demand for money as a store of value and medium of exchange, focusing on the relationship between interest rates and the demand for money. | This theory focuses on the demand for money to facilitate day-to-day transactions and payments, irrespective of interest rates, emphasizing the transactional aspect of money. |

| Interest Rate Sensitivity | It shows that higher interest rates incentivize individuals to hold less money because they can earn more interest by investing it, and vice versa. | This theory suggests that the demand for money for transactions is relatively insensitive to changes in interest rates. |

| Purpose of Holding Money | It argues that people hold money not only for transactions but also as a form of liquidity for unforeseen contingencies and speculative purposes. | This theory focuses solely on the demand for money to facilitate transactions. It does not consider speculative motives or the desire for liquidity beyond transactional needs. |

| Economic Implications | Central banks can influence interest rates to manage the demand for money and stabilize the economy. Lowering interest rates, for example, can stimulate economic activity by encouraging borrowing and spending |

Changes in interest rates have limited effects on the demand for money for transactions, as it's primarily driven by the need for day-to-day exchanges rather than investment decisions. |

| Long-Term vs. Short-Term Perspective | It considers both short-term fluctuations in interest rates and long-term expectations about future interest rate movements. | This theory focuses more on the short-term demand for money to facilitate immediate transactions. |

Liquidity Trap

A liquidity trap is a situation in monetary economics where nominal interest rates are very low or even zero, and savings become either perfectly elastic or insensitive to changes in interest rates.

In other words, when an economy enters a liquidity trap, central banks find it challenging to stimulate economic growth or control inflation through conventional monetary policy measures, such as adjusting interest rates.

Here are key characteristics and implications of a liquidity trap:

1. Zero Lower Bound (ZLB): In a liquidity trap, nominal interest rates reach the zero lower bound, meaning they cannot be lowered further to stimulate borrowing and spending.

2. Preference for Liquidity: During a liquidity trap, individuals and firms become highly risk-averse and prefer to hold onto cash rather than investing it or spending it on goods and services.

3. Ineffectiveness of Monetary Policy: Conventional monetary policy tools, such as open market operations and changes in the central bank's discount rate, become ineffective in stimulating economic activity.

4. Deflationary Pressures: In a liquidity trap, falling prices can exacerbate the situation by encouraging consumers to delay purchases in anticipation of lower prices in the future, further depressing aggregate demand.

5. Need for Fiscal Policy: Given the limitations of monetary policy during a liquidity trap, there is often a greater reliance on fiscal policy measures, such as government spending increases or tax cuts, to stimulate demand and boost economic activity.

Liquidity Preference Theory Work criticism

Let us list the criticisms of this theory below:

- One of the most significant flaws in the liquidity preference hypothesis is that it presupposes a constant employment rate. In actuality, the unemployment rate is not steady and fluctuates frequently. Moreover, the hypothesis is predicated on a specific level of money.

- It asserts that one must choose between either a cash or bond investment. Many people have money on hand for liquidity purposes and bond investments. This hypothesis fully ignores the circumstance in which some funds receive interest benefits while others receive liquidity benefits.

- The fourth point of contention is that different interest rates occur in different markets simultaneously, something that the liquidity preference theory utterly overlooks.

- Experts say that liquidity preference isn't the only factor influencing interest rates. However, this hypothesis also ignores a large number of real-world elements.

- Individual savings are not taken into account.

This list of criticisms is by no means exhaustive.

It has been noted that interest rates are not solely a monetary phenomenon. Real forces such as capital productivity and people's thriftiness or saving significantly affect the rate of interest.

Critics argue that while Liquidity Preference Theory offers insights into interest rate determination, its oversimplified assumptions and neglect of real-world complexities limit its applicability in understanding the intricacies of economic dynamics.

The desire for liquidity isn't the only element that influences interest rates. There are a number of other factors that influence interest rates through changes in the demand for and supply of investible funds.

The liquidity preference theory cannot simultaneously account for several interest rates in the market. Keynes dismisses saving and waiting as a source of investible capital.

conclusion

Despite its many flaws, the Liquidity Preference Theory is useful for determining the impact of money demand and supply on interest rates. This is because it depicts the link between people's motivations and interest rates.

It also claims that monetary policy is ineffective in the economy due to a liquidity trap that existed throughout the recession. At the same time, we must recognize and evaluate the reality that liquidity is not the sole factor influencing the money supply or interest rates.

In reality, liquidity preference involves selecting from a wide range of assets. It is certain that the demand and supply of every type of asset have just as much right to be considered as the demand and supply of money.

Unless we consider each equally important, the different types of financial investments, including money, we have no way of explaining the coexistence of different interest rates.

The liquidity-preference theory cannot explain the occurrence of different rates in different credit market segments because all units of money are perfectly interchangeable. The classical or neoclassical theories do not always clash with Keynes' liquidity-preference hypothesis.

According to D.H. Robertson, "the rate of interest measures the marginal convenience of holding idle balance need not prevent it from also measuring the marginal inconvenience of abstaining from consumption."

It demonstrates the connection between income-related motivations and interest rates. Additionally, it claims that the economic downturn created an ineffective monetary policy liquidity trap.

Free Resources

To continue learning and advancing your career, check out these additional helpful WSO resources:

or Want to Sign up with your social account?