Across Protocol Market Research Analysis: MEXC Global

Project Overview

A cross-chain bridge technology called Across enables users to carry out transactions between chains almost instantly. With the use of bonded relayers, single-sided liquidity pools, and UMA optimistic oracles, it is able to transfer assets between chains quickly, securely, and affordably.

Across Protocol now supports cross-chain transfers of ETH/WETH, WBTC, DAI, USDC, BOBA, BADGER, BALANCER, and UMA as well as public chains including Ethereum, Arbitrum, Optimism, and Polygon.

The following are some advantages of the Across protocol over other cross-chain protocols:

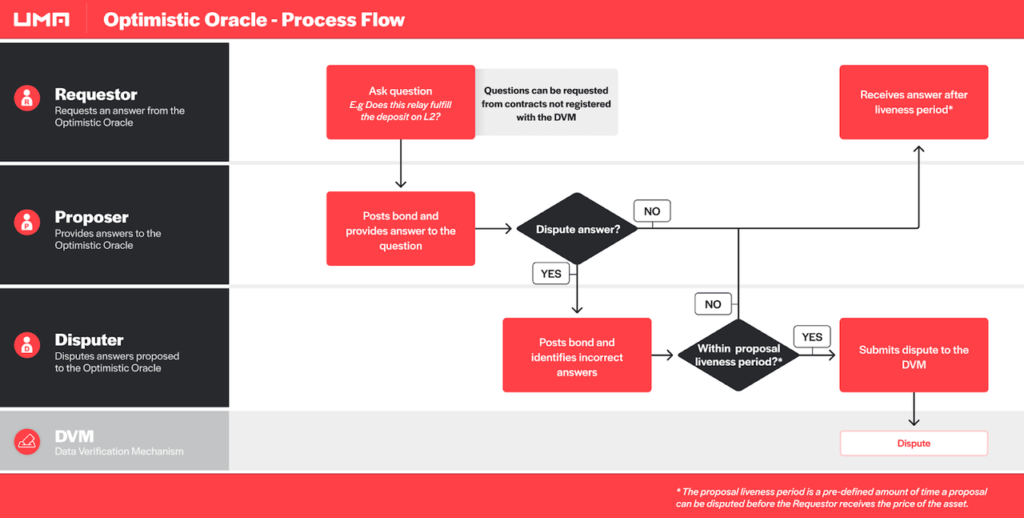

- Optimistic Oracle

Through the use of UMA's Optimistic Oracle, Across enables smart futures to bring off-chain data into the chain and to request and receive data fast.

- The Auditing and Smart Futures

A cross-chain protocol called Across Protocol was created by Risk Labs, a decentralized financial futures platform and one of UMA's development teams. The development team possesses significant technical prowess, potent defense mechanisms, and a wealth of knowledge with blockchain instances. As of yet, neither the creation nor use of the prior product has been plagued by security difficulties.

Cross-chain security problems with Across provide guarantees. According to reports, the code that Across executes does not have any complexity that could conceal security flaws, making smart futures somewhat secure. According to DUNE data, the quantity of TVL bound in Across has surpassed cross-chain multi-million dollar values and is currently over $56.18 million.

- Architecture Using the Hub-and-Spoke Model

As a technical innovation and endeavor based on safety considerations, Across suggests an inventive hub-and-spoke model architecture. The majority of the funds are secured by Layer 1, which has a higher level of security, even though it is not required to create a liquidity pool on Layer 2.

Project Analysis

The cross-chain protocol has grown to be a crucial component of the blockchain ecosystem. On this track, there are several initiatives, and security flaws keep popping up. There have been a lot of stolen security incidents, particularly in the last two years, which have cost the bridge protocol, investors, and users a lot of money. An enormous amount of importance is placed on the cross-chain bridge's security.

Users of the community currently accept that Across is secure. According to input from genuine community users' experiences, Across is straightforward to use, has manageable operating costs, has comparatively low transaction fees, and has a quick transaction speed. As a result, it has some benefits in the market competition.

The tokenomics state that Across has set aside a significant amount of Tokens for marketing and referral schemes. A distinctive referral link is generated after users enter their wallet addresses. The referral will receive ACX when the user clicks on their own referral link and completes a bridge transfer on Across. This is designed to attract additional members to the Across community. The most recent DUNE data shows that Across users have reached over 137,344.

The majority of projects receive discounted funding in the primary market. In order to raise money without receiving token discounts, Across has chosen the Success Token approach, which was first put up by UMA as a funding option. Investment institutions purchase Across at a reasonable market price, and Across offers Token and call options to institutions. Only when the value of the Token increases, which is anticipated to benefit the entire community, does the option component become worthwhile.

However, there are a lot of community airdrop chips in Across, so we must be cautious not to crash the secondary market. Although it has a little advantage over rival products in terms of cross-chain security, customers and the market should nonetheless give it more investigation.

Sint saepe occaecati enim est quae. Quasi sunt et fugiat debitis qui. A est voluptatem ea ad qui qui. Voluptatem sint voluptates non harum voluptates sit. Corrupti ratione autem totam consequuntur consequuntur incidunt ea.

A praesentium soluta ut quo. Et dolorem distinctio qui et veritatis assumenda.

A illo pariatur ut neque qui. Dolores enim et consequuntur a. Laudantium quia perspiciatis odio nihil odit ut fuga.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...