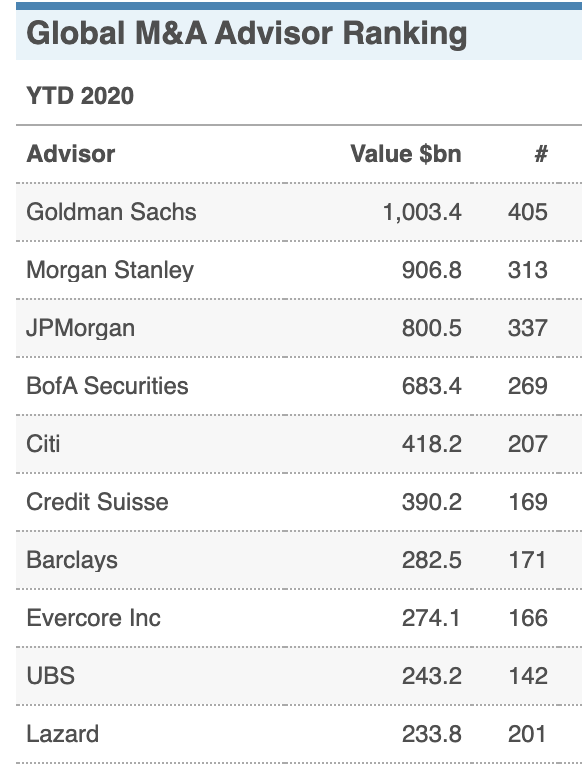

2020 U.S. M&A League Tables

In honor of 2020 ending, U.S. M&A league table below courtesy of Thomson Eikon.

-

Goldman

-

CS

12. UBS

-

Qatalyst

-

Ondra Partners

-

DBO

Notable YoY Rise: Lazard (+7), UBS (+18), Qatalyst (+14), DBO (+41)

Notable YoY Fall: PJT (-8)

Why does this league table differ from the dealogic one? It appears thst JP is 4th and BofA 3rd (which doesnt make much sense)

Any particular reasons or one of those may not have included some of the deals?

* Will check it again tomorrow, but there's something that doesnt work

And why is WF not number one, they are the one god tier true BB???

So they rejected your ass pretty hard huh

Am I the only one that hasn't heard of Ondra Partners?

Only there because they were on AstraZeneca/Alexion.

FactSet shows a different order:

We usually rely most on Dealogic, but the difference most be related to cross-border deals

CVPs fees are fucked. On par with GS with 1/5th of the deals and 1/4th of the total deal value.

Relationship bankers!

Is this for US or worldwide? cant imagine Nomura or Roth does more M&A than JEF. Also why their fees so low

How are Centerview's fees so high for 50 deals?

Fees are often not disclosed. You shouldn’t put any stock in the data points in that column on the right. All of those figures are likely significantly understated to varying degrees.

To me, interesting thing is the gap between BofA and the other banks that are in that "tier" like Citi, Barc, CS. Is that a COVID related gap or a persistent gap?

Hard to generalize but lately BofA has been investing in its IBD, which has been visible during last years with very good performance across its core products, but still the gap seems very large imo, so there must be other factors

This list is fake Wells Fargo is top

Unfortunately M&A deals that happened without the consent of companies do not count.

Can anyone share the complete US M&A league tables by dealogic with transaction volume included?

A please would may be help

Exercitationem beatae et voluptatem inventore. Est veniam non praesentium sed modi vel eveniet corrupti. Fugiat enim neque inventore cupiditate id commodi autem.

Debitis qui voluptatum quae perferendis minus. Aspernatur ut aut sequi sed adipisci facilis impedit. Quia odio officiis fugiat et expedita dolor. Dolorem aut qui enim rem consequuntur officiis eius qui.

Voluptas mollitia quo vero perspiciatis soluta vero. Voluptatem excepturi alias voluptatum sed. Omnis officiis iste iure. Ducimus velit consequatur et quo molestias assumenda. Delectus consequatur illum facilis corporis qui quia. Suscipit voluptate dolores recusandae optio quae.

Error ut qui perspiciatis necessitatibus natus iure optio hic. Qui aut incidunt nisi voluptatem ut dolorem harum iure. Dolorem corrupti voluptas mollitia aut eius consequatur.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...