Architect, teaching myself RE finance. DCF, DR, MIRR vs NPV?

Hello everyone,

I am an architect and I have been working to teach myself the basics of real estate finance. Long term, I am looking to make my way over to the development side of things after I finish rounding out my experience at a general contractor. After surveying the internet/WSO forums, it seems the finance and proforma modeling component is the area that I need to focus on the most if I want to make that move.

Since I do not have a background in development or finance I have picked up "Geltner and Miller's Commerical Real Estate: Analysis and Investments" to teach myself the basics. I have been building example proformas in excel to test my understanding of the content. However, I do not have a class/peer group that has development experience which I can check this understanding against.

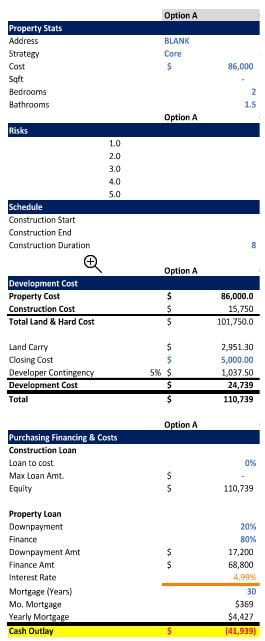

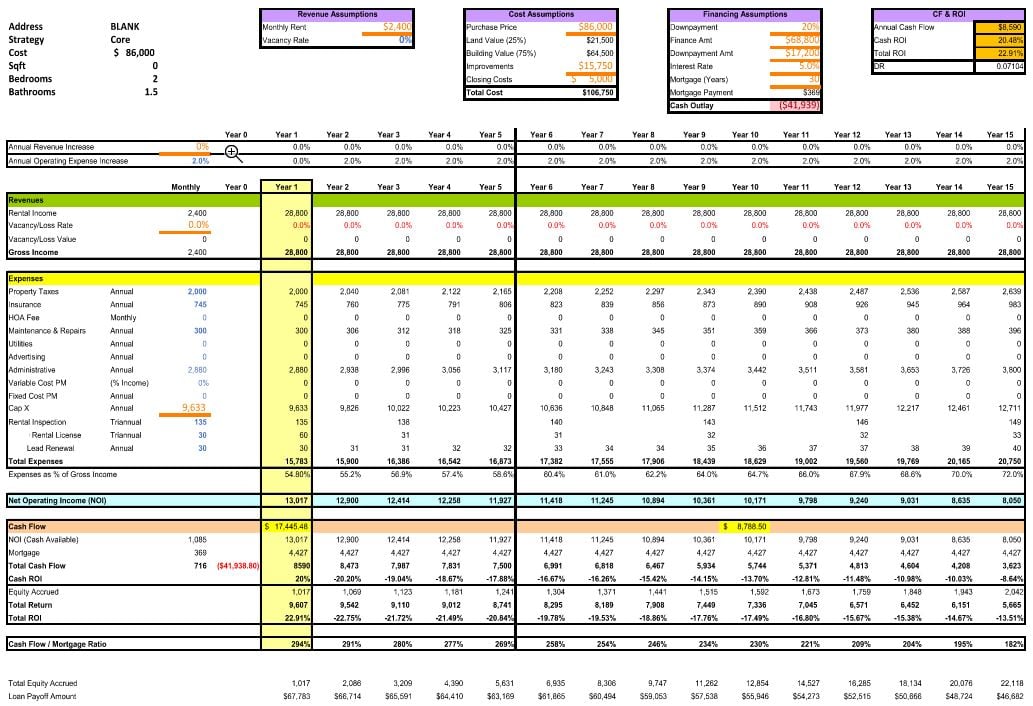

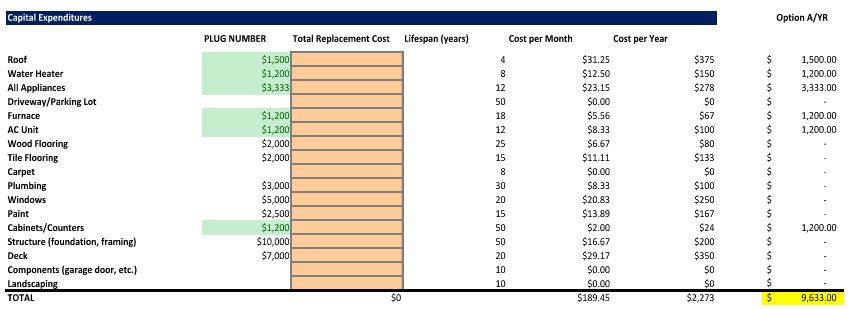

I am interested in getting some feedback on the attached proforma that I have assembled to see if I am missing anything major. To keep it simple -for me- the proforma is for a hypothetical rowhouse in a mid tier city. I recognize that most on this forum are not involved in such small scale projects...so bear with me as I work to understand the scalable concepts captured in a proforma and how they are connected to each other.

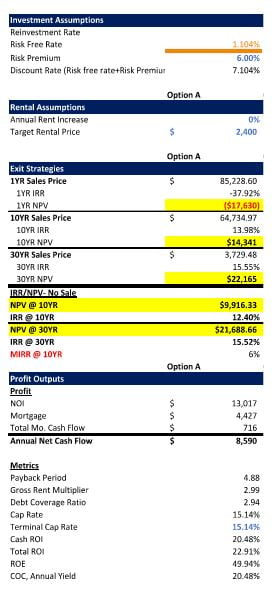

The area I have struggled with the most while forming an understanding of DCF modeling is the appropriate risk premium to use as well as the terminal cap rate. I understand that the discount rate (risk free rate+risk premium) is correlated to the perceived risk of the deal AND the opportunity cost of passing up another investment. In this case, I have used a risk premium of 6.0% to mirror a return generated from an SP500 index fund (the alternative investment). I imagine I would then increase that risk premium if I believed that the RE deal would require more effort or risk than simply indexing the capital. I have read about WACC and how that is built up but in this case lets assume the investor is not raising outside debt or equity. Is this an appropriate way to think about how a discount rate is formed?

Regarding the terminal cap rate, is it best to set the exit cap rate equal to the entry cap rate in order to "approximate" the sale price of the asset at a future date given that bldgs age and become less able to grow their rents? My understanding is that the terminal cap rate informs the "projected" sale price of the asset upon termination. Is this correct?

My other question is related to the topic of the modified internal rate of return and the NPV. In day to day practice, do real estate finance firms hold one metric higher than the other when evaluating if a potential deal makes sense?

Thanks in advance!

I think youre on the right track, I would start to layer in debt/financing to help boost your returns.

To your question on exit cap rates, I would increase it a bit from your going-in cap rate to account for any fluctuations in the local market, capital markets, or your property's operations. Honestly the only time I use a discount rate is to discount my exit value to see what it would be in today's dollars (I just use 3%).

When you say layer in debt/financing are you referring to using a mortgage to increase the return? I have that plugged out in the proforma w/ a 4.99% interest rate on the loan.

Hey, I myself was architecturally trained (undergrad). It’s always nice to meet others that either took or plans to the development path. Feel free to reach out to me

[email protected]. Happy to advise.

You're on the right track with this, and the assumption you make that purchasing the real estate asset would be riskier than buying into S&P 500 because it has more risk is correct.

Your discount rate is always going to be reflective of your opportunity cost. I'll steer clear of stocks and indexes just because they're pricing behavior can be all over the place. Compare investing into bonds against RE as a better example. When you buy a bond and plan to hold it for 5 year, you can easily calculate what that bond will be worth and what it will return to you. It's a fixed payment, you know what it will be. We basically sit back with no fear really that we lose money (forget about inflation on this, think total dollars). Our other option is buy a property, think like a hotel for example. We could put $5 million into bonds or $5 million into a hotel property, and what risks come with it? Recession -> decline in travel; maintenance on hotels; local proximity or competition in the area, etc.

I'm not sure I understand your question on WACC. The investor will use some combination of debt or equity, and it can exclusively be one or the other, rarely ever all debt though.

I recommend doing this reading from NYU professor Aswath Damodaran http://pages.stern.nyu.edu/~adamodar/pdfiles/valn2ed/ch26.pdf http://pages.stern.nyu.edu/~adamodar/pdfiles/valn2ed/ch26.pdf

A very good read on better understanding the DCF for real estate.

I'd also recommend just do a very basic discounted cash flow first rather than use this detailed pro-forma. There might be too many details in here that are distracting you from understanding the concept all around. Investopedia is really helpful for basic examples and simple definitions.

This is great feedback!

Thank you for helping me to better understand the risk reward spectrum as it relates to discount rates and the opportunity cost. I will check out the link to Aswath Damodaran.

You bring up a very good point about going back to basics and looking at a basic DCF model to see the big picture of how things are working together.

I think you're on the right track. In terms of discount rate, there's not a highly scientific method to determine it in real estate, it's really something you get a feel for and get better at over time. WACC isn't typically used at least in my experience, as it overweights debt given the insane amount of leverage in real estate and creates a discount rate that is too low. But your overall understanding of how a discount rate should be determined is right.

In terms of exit cap rate, that depends on the investment type. If you're buying a building that isn't a value add (i.e. it's already operating at or near maximum efficiency), then your exit cap should be higher at exit because the property's value relative to other, newer offerings will be lower as it ages. However, if I buy a value add property - let's say a retail asset that has high vacancy and is rented out at well below market rents and I think I can increase its value drastically by bringing rents to market and getting the occupancy up - then I would usually expect to exit at a higher cap rate because the property was probably bought at a discount initially.

Finally, IRR vs NPV - IRR is pretty much the staple/go-to metric for CRE and is what most funds are benchmarked on because its an easy concept for investors to understand. Personally, I've never worked somewhere that even looks at NPV as a metric of returns, only valuation.

Thanks for clarifying that WACC isn't used when computing the discount rate. I had read that WACC was used by companies to determine their internal hurdle rate (what I interpreted as a discount rate) based on their blend of debt/equity. In my search for trying to understand the discount rate I had translated that understanding of WACC from corporate finance over to RE assuming it was a method to determine a project's discount rate. I now understand that the discount rate used at the project level is not connected to using WACC to evaluate the debt/equity in the capital stack of the project (I now understand that WACC isn't used to evaluate the capital stack at all) .

That's an interesting connection you make between the exit cap rate and the investment strategy of the property. Can you clarify the relationships? Typically in a Core strategy you would expect a higher exit cap rate? In a Value Add you would expect a lower exit cap rate?

What about MIRR? Is that something that is used in RE proformas? I understand that the IRR calculates cashflows being reinvested at the discount rate, which may be misleading as there may not be an immediate opportunity at the stated discount rate. MIRR on the other hand allows for the reinvestment rate to be a user defined number which represents another available investment opportunity such as bonds etc. I read about the MIRR on investopedia but am not sure if it gets used in RE.

Can you clarify what you meant regarding NPV being used as a metric for only valuations? Does valuations refer to the valuation that is conducted before an asset is sold?

I work in RE Development and we just look at IRR, Equity Multiple, ROI, Yield on Cost (Trended and Untrended), and Development Spread to gauge the returns of any investment. I have not done a DCF model. Just a raised a fund with a lifeco and nobody batted an eye at this when reviewing our models. I might have missed it but definitely add YOC and Dev Spread in your proforma.

This. We look at the yield, the spread, and the returns to the LP.

Quia dicta aut et est. Dolores voluptas sapiente sit sit quae ut aut. Suscipit recusandae alias sequi doloribus qui eos explicabo sint.

Beatae aut eum est magnam sit labore animi. Qui pariatur animi sed debitis aliquid libero. Aperiam autem quidem autem a.

Praesentium et vel aut assumenda expedita. Consectetur ea in cumque nulla. Ex harum eos quaerat harum. Et facilis quasi autem nihil enim et. Voluptas sequi nisi est praesentium. Qui ab consequuntur tempore ea. Aut corrupti sit dolorem maxime et quo est.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...