Can someone double check this accretion dilution question

Company A is acquiring Company B. Company A is using 100% debt (int rate of 10%). Company B has a cap structure of 25% debt (int rate of 6%) and 75% equity and has a PE multiple of 10.0x. Assume a 40% tax rate for both companies. Is the deal Accretive for company A?

My answer:

The yield of company B is 25% x 6%(1-40%) + 75% * (1/10) = 0.084 = 8.4%

The cost of capital for the acquisition is 10%*(1-40%) = 6%

The deal should be Accretive since the yield of company B is greater than the cost of capital. (also, is describing the 8.4% as the "yield of company B" correct)?

Would that answer be correct or am I missing something?

bump

100% correct

OP had it right. Company A's cost is 6%.

lol

Isn't the yield of seller simply 1/10? Am I missing something here?

your right, assuming that the buyer refinances the debt for the NewCo

Even if they didnt refinance the debt, wouldn’t the seller’s yield be 10%? I don’t understand why the interest on debt would be included for the seller’s yield for the buyer - that would be the yield for the seller’s creditors, which is completely irrelevant

OP is correct, 6%.

How do we explain the company B yield part in an interview. Also, why are we adding debt yield (a cost) to the return. Is it because we are “refinancing” to assume that there is no debt, hence adding back interest? But in that case why are we multiplying the equity piece by 75%. And what exactly does yield mean in this case.

Sellers yield is 10% no? I always thought the inverse of P/E gives you sellers yield. The cost of acquisition if using multiple sources then you would do an weighted average blend. 1/10=10%. Basically you're getting the E/P so the buyer gets 10 cents of earnings for every dollar they pay to acquire. I agree with company A cost of acquisition though and the final answer that it is accretive. Not sure about company B seller yield

I was also confused above, but I thought about it and here’s what I think, anyone feel free to correct me. I believe sellers yield is only inverse of PE if the company’s capital structure consists of just equity, which is not the case here. 75% of the total acquisition price is going towards equity. In other words, you only get a 10% yield for 75% of the investment. You also get a “yield” from paying down the debt because this decreases interest expense. This yield is the post tax cost of debt and corresponds to the other 25% of the investment. As a result sellers yield ends up being a weighted average of the two yields from paying down debt and equity.

Again, I’m not sure about this so feel free to correct me.

Wouldn't the interest expense already be factored into the net income though? P/E is equivalent to Equity Value/Net Income. The tax shields and interest expense should already be reflected in net income given the capital structure. I get the idea you're going for though. In Rosenbaum and Pearl, they say the exchange ratio is equal to Target share price/Acquirer share price, but that formula only works if it's an all stock deal. The formula that works more consistently is Acquirer Shares Issued/Target Shares Purchased. Not sure if that's what you were going for. Honestly a toss up on this question could definitely see it going either way. At least either way you still end up that the answer is accretive lol. Also, isn't company A purchasing Company B using 100% debt? So how do you say 75% is going to equity? Yes company B has 75% equity in cap structure but that doesn't necessarily mean that 75% of the purchase price is going to the equity. Usually the equity purchase price is just the target share price plus a premium, and then the debt is refinanced. The debt could be paid down, but that wasn't stated in the question. I've always thought the sellers yield as the return on target's earnings stream. The inverse of P/E or E/P tells the acquirer how many cents in earnings they will get for each dollar they pay to acquire the target.

My original comment got deleted, but the quick and dirty version is it depends on how the target debt is treated in the context of the transaction:

1) Target's yield can be thought of as 10%, assuming the debt is re-financed by the acquirer (i.e. AcquireCo takes out the debt with new acquisition debt @ 10% pre-tax, effectively paying TEV rather than equity value)

2) Target's yield would be calculated on a blended basis, if the target debt is rolled over (consideration paid by AcquireCo only reflects equity value of TargetCo, and the existing debt on TargetCo's balance sheet is assumed)

While both scenarios would be accretive to AcquireCo with the assumptions provided, TargetCo's existing capital structure would have implications on the underlying metric that we're performing accretion / dilution on (i.e. EPS) for scenario 2). Let's assume a scenario where TargetCo's existing cost of debt was 25% for illustrative purposes, and D/E was 50%/50% - assuming that tranche of debt couldn't be re-financed @ the 10% acquisition financing, would the transaction still be accretive? While this would never play out in reality (cost of equity would likely >25%, and P/E wouldn't be 10x), it does demonstrate mechanically how TargetCo capital structure can impact EPS accretion / dilution.

The reason is because EPS is net of interest payments, and the more levered the target is, the higher the interest expense (and thus lower net income on both a standalone and PF basis). Generally most M&A scenarios play out as scenario 1), however scenario 2) could occur if there are covenants in place for the TargetCo debt that prevents early redemption.

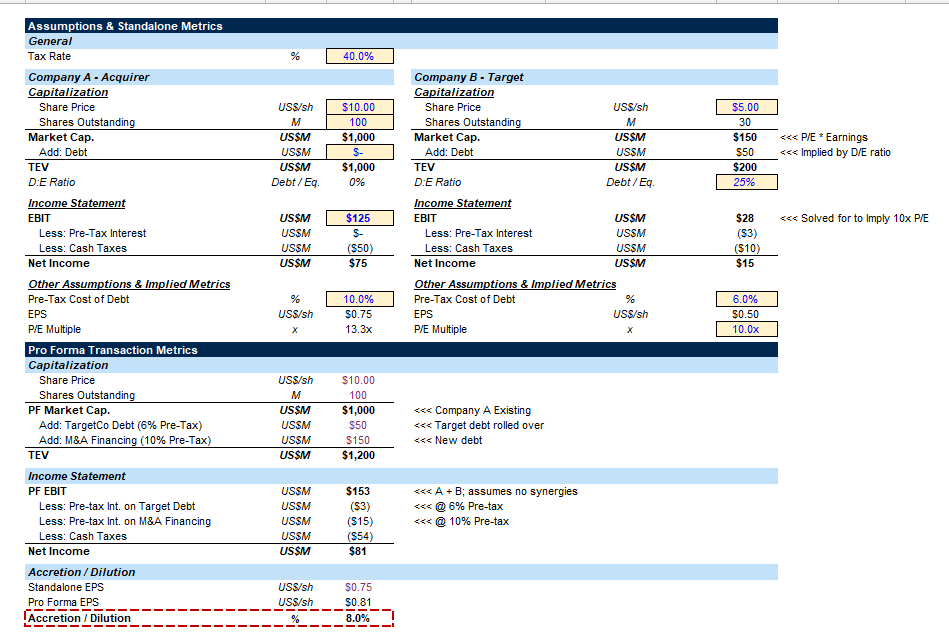

I typically find it helpful to sketch out scenarios in Excel with dummy #s - I've attached a screenshot of scenario 2) based on the assumptions set forth in the OP .

.

This was really helpful. Thank you!

Thank you! For scenario 1, could you elaborate on why it would be 10%? Having a bit of a hard time understanding why capital structure doesn’t affect sellers yield when debt is refinanced. Scenario 2 makes a ton of sense tho

Simply because the TargetCo debt would no longer exist - the AcquireCo is putting a new capital structure in place and just paying for the equity. Now I'm not suggesting the TEV between scenario 1) and 2) are different; $200M in debt will need to be put in place regardless of whether the TargetCo debt is re-financed or assumed. However, when we look at accretion / dilution, all we care about is the PF interest expense and its impact on net income / EPS. Based on the assumptions in the OP, scenario 1) will actually show lower accretion because the cost of debt on the M&A financing exceeds the target's current cost of debt (which will need to be factored into the PF math and lower EPS). However, when asked in an interview setting and only being provided the assumptions in the OP, all we care about is what the acquiror's cost of debt is, vis-a-vis the equity yield of TargetCo (assuming TargetCo's debt gets taken out).

I have trouble agreeing with this. Let's say, hypothetically, TargetCo has $50 million in debt, with net income of $15. Now, let's say TargetCo has $50 trillion in debt, with net income of $15. Yes, in the second scenario TargetCo has more interest payments, but net income is still $15 and BuyerCo still paid $150 for it. Effectively, the seller's yield is still $15/$150, or 10%.

That's not a real scenario because EPS is an output (residual income to equity after interest service) rather than an assumption - income statements flow from the top down rather than the other way around. You can't change capital structure and expect net income / EPS to remain constant.

Enim voluptas ea maxime cum rerum. Autem earum quia repellendus provident voluptatibus illo. Voluptatum vel tempore voluptatem. Voluptate expedita impedit eveniet sit quasi explicabo. Nemo eligendi possimus aliquam et omnis autem laborum. Non ad tempore voluptas nihil voluptatem. Ut perferendis quas et corrupti.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...