Silver Banana goes to...

Market Snapshot

|

It was a stockpicker’s market yesterday as gains and losses were found all over the place. The S&P 500 barely moved with a 0.03% gain and the Nasdaq gained a respectable 0.33%, meanwhile, the Dow wasn’t feeling the vibe and lost 0.14%.

If your stock-picking didn’t work out for you today, maybe the team at The MBA Tour can help. Their expertise with world-class business schools could be the key to finally generating returns that’ll make your wife’s boyfriend happy.

|

|

|

|

|

|

Macro Monkey Says

|

ADP’s NFP – Business is….not booming, but still doing pretty alright. Being the first week of September, everyone is hyped up about the BLS August jobs report coming on Friday; today, we get a sneak peek. ADP reported total non-farm payroll (NFP) changes of +374,000, coming in shy of the anticipated +600,000. Parsing the data, we see that hotels & leisure dominated the jobs growth again, helping service jobs crush goods jobs in growth. Despite the miss on overall growth, it was a solid month for small business hiring, a much needed win in a time of severe labor droughts and ubiquitous signs on bonuses. And when I say much needed, I mean it - just this weekend I went to Dunkin’ Donuts and there was a sign on the door that said the store was “temporarily closed due to staff shortages.” All I could think was “is this what a hate crime feels like?”

|

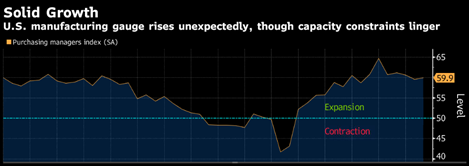

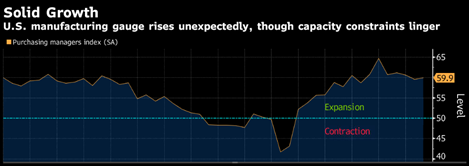

ISM – Further proving economic forecasts are basically garbage, U.S. manufacturing based on the ISM index ticked upward in August as opposed to the projected decline. Clocking in at 59.9 (above 50 is good), this represents a gain of +0.4 vs the expected 1 point decline. Alongside this report came the realization that inventory backlogs have only grown and added more fuel to the already burning fire of bottlenecks facing manufacturers. It’s a tale as old as the pandemic - demand for goods is high, so manufacturing grows too rapidly, creating bottlenecks, which in turn creates more bottlenecks as the cycle repeats. This one may take some time to fix.

|

|

|

|

|

Considering an online or part-time MBA program? Don’t miss The MBA Tour Spotlight on Part-Time & Online MBAs on September 8th.

Don’t miss your chance to:

- Network with admissions decision makers from Boston University, Chicago Booth, UCLA, Carnegie Mellon, Indiana University, Michigan Ross & more top programs.

- Connect with current students, alumni, and fellow applicants as you navigate your way to your MBA.

- Explore the unique features of various business programs during interactive presentations and get all your questions answered during small group meetings.

Save your spot

What's Ripe

DiDi – Finally, our old friend DiDi has a one-day move worthy of What’s Ripe. Shares surged 11.9% yesterday as the EV company made a move that would make Ronald Reagan cry - they formed a union. In keeping with China’s quest to “not exploit” blue-collar workers, the firm formed the union, hoping to no longer get bullied by Xi. Don’t be surprised to see fellow Chinese giants do the same, but be very, very surprised if you see this with Uber.

Mega caps – Growth breeds growth, and then that growth breeds more growth and then you have a slew of stocks with ~$2tn market caps. The FANG+ index, which holds all those goliaths your meme stocks claim to be able to “take down”, shot to an all-time high yesterday as investors poured into defensive names on account of weaker than expected economic data. The index rose 1.28% yesterday, which may make you think “who gives a f*ck”, but you should give a f*ck as many of these names will likely pay for your college or retirement.

|

|

What's Rotten

DiDi – Finally, our old friend DiDi has a one-day move worthy of What’s Ripe. Shares surged 11.9% yesterday as the EV company made a move that would make Ronald Reagan cry - they formed a union. In keeping with China’s quest to “not exploit” blue-collar workers, the firm formed the union, hoping to no longer get bullied by Xi. Don’t be surprised to see fellow Chinese giants do the same, but be very, very surprised if you see this with Uber.

Mega caps – Growth breeds growth, and then that growth breeds more growth and then you have a slew of stocks with ~$2tn market caps. The FANG+ index, which holds all those goliaths your meme stocks claim to be able to “take down”, shot to an all-time high yesterday as investors poured into defensive names on account of weaker than expected economic data. The index rose 1.28% yesterday, which may make you think “who gives a f*ck”, but you should give a f*ck as many of these names will likely pay for your college or retirement.

|

|

|

Thought Banana:

Bezos Loves Potheads – No, Amazon isn’t going to be your dealer anytime soon (at least I think), but they did announce the firm will no longer be screening for weed in their delivery driver drug tests. This is more of a need than a want, as the firm is dying for drivers and is willing to accept your hippie cousin despite his herbal obsession. This could represent the gradual trend of stigmatization of weed and a step towards acceptance and broader legalization. In the released statement, Amazon claimed this would increase the number of job applicants by 400% (with absolutely no evidence to back that up) while also saying that this move grows the prospective worker pool by 30%. Yeah..seems like they tried some of this newly Amazon-approved plant before making the announcement.

|

|

|

“If you take risks and face your fate with dignity, there is nothing you can do that makes you small; if you don't take risks, there is nothing you can do that makes you grand, nothing.” – Nassim Taleb

|

|

|

Eos in qui suscipit velit quaerat. Non dolorum omnis et ea. Rerum qui sint in facere temporibus ipsam explicabo natus. Unde atque culpa ratione sint corrupti est odit nam. Sed voluptas deserunt provident dolorum earum. Reprehenderit ut itaque cumque modi repudiandae.

Quis est nihil quia temporibus. Voluptas qui minima ipsa repudiandae maxime ipsa possimus. Corporis expedita vel aperiam consectetur. Voluptas sed soluta voluptas esse. Vel reiciendis pariatur et enim eveniet. Nulla at laborum aliquid laboriosam voluptas saepe. Impedit aperiam quia voluptatum accusamus quos labore.

Illum quam sunt aut. Ipsa corrupti et sit consectetur vitae odit. Sunt voluptates eum fugit sit. Eveniet unde fugit quas impedit quisquam deleniti quidem. Quam labore deleniti eius. Voluptatem voluptates sit quo voluptatibus velit.

Quis voluptate deleniti molestiae molestiae. Quis provident sint quibusdam. Esse blanditiis tempore eaque voluptatibus minus suscipit sit aut. Officia minima quibusdam qui odio.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...