Equity Research Resume Guidelines

Equity Research Resume

Due to the importance of information, equity research is becoming more and more valuable in today’s financial markets. Investors and firms alike all heavily rely on this information to make informed decisions about future investments. To have a stronger impressions on financial institutions, it’s imperative to have a polished equity research CV, and below we offer some constructive guidelines to help you land your next equity research position!

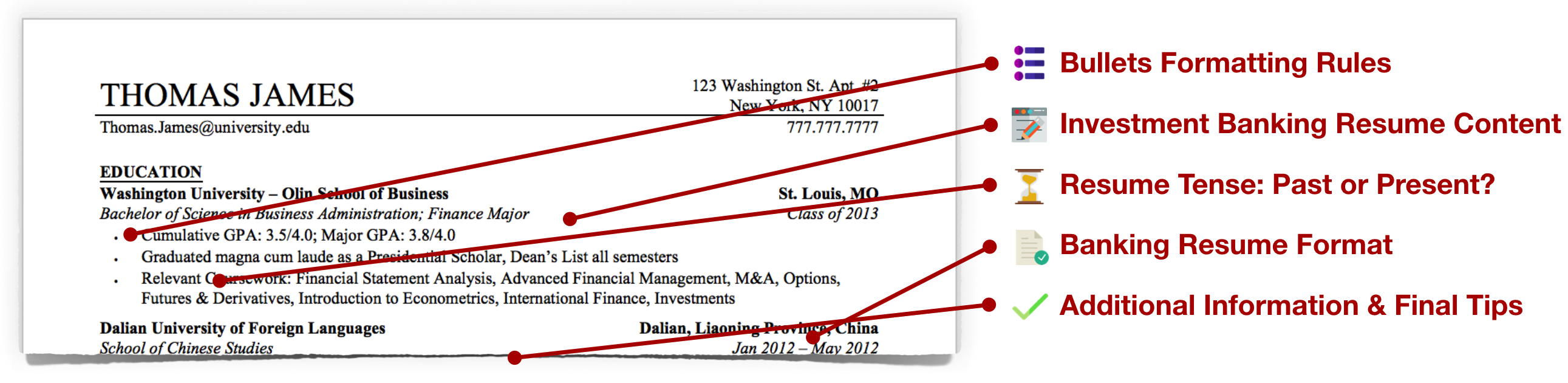

Sample Equity Research Resume

The original post, provided by @Hooked on LEAPS", gives you an idea of how a resume should be structured, though it is not perfect, it is a step in the right direction. The guidelines that we will be discussing are applicable to both the resume below as well as your own personal resume.

ER - Positioning And Formatting

Positioning of your equity research resume generally follows the same guidelines as other financial resume format, with the most work experience being in the top portion. WSO provides valuable insight on the general skeleton for your resume.

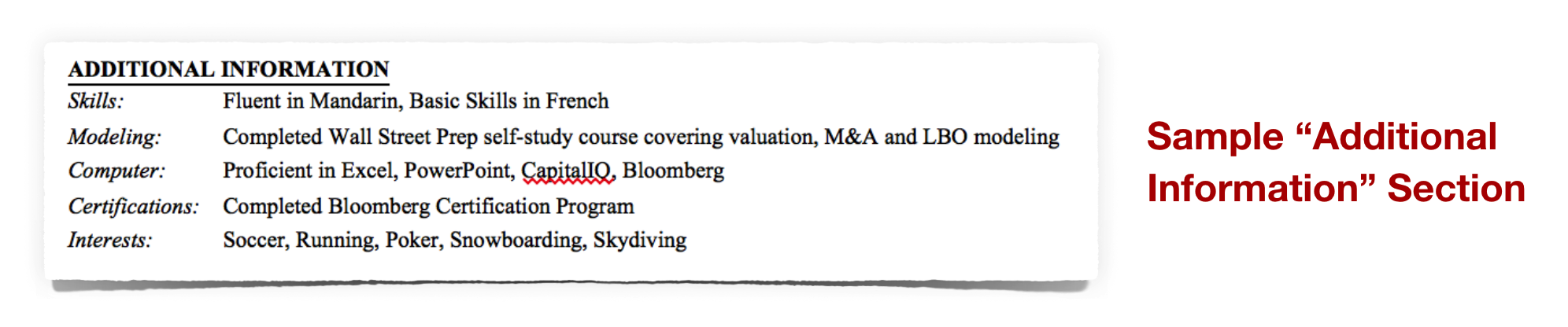

Work experience - with the most recent at the top and oldest at the bottom - is at the top portion of the resume. Under that, include your education. Work experience is above education because, at this point in your career, the private equity firms recruiting you care more about your relevant experience and how that qualifies you than your GPA and college extracurriculars. Below education, other information can include languages, experience, computer skills, and certifications.

Regarding the content of your equity research resume. @DurbanDiMangus" offers solid guidelines on what your experiences should articulate.

Regarding the content of your equity research resume. @DurbanDiMangus" offers solid guidelines on what your experiences should articulate.Candidates possess strong accounting, finance, quantitative and business writing/communication skills, as well as modeling, forecasting, and valuation experience... intellectual curiosity, a strong work ethic and a team player mentality are desired attributes.

It’s imperative that your resume is easy to read and scannable to recruiters or whoever is reading your resume because they possibly have to view hundreds in the span of a day. @LDNBNKR" makes a solid statement on basic formatting.

Keep it clean, nice phrasing, and no spelling mistakes. After that it is about content

Equity Research - Length

It’s universally known that your resume should be no longer than one page! It would be an understatement saying that it’s important to keep it a single page. @mtnmmnn" puts it that

It’s universally known that your resume should be no longer than one page! It would be an understatement saying that it’s important to keep it a single page. @mtnmmnn" puts it that

a professional resume is always, ALWAYS one page, otherwise it goes straight to the trash can.

Your equity research resume should only have the essentials. Any other information that is considered irrelevant and “extra” would merely waste the recruiter’s time. The skills and stories that accompany your experiences are to be articulated during the personal interview.

Proper Spacing And Font For Your Equity Research Resume

Both of these guidelines are married. Generally, your bullet font should be set at 10. If you need to fill up a little bit of space, at most size 11 is acceptable. However, do not go lower than 9 as at that point your resume will look too muddled.

Your resume should be single-spaced to ensure that you have enough room to efficiently and efficiently articulate your experiences and achievements. It’s also perfectly acceptable to have some white space.

Bullet Formatting For ER Resume

Bullet points fall under the grey area in terms of formatting. Foremost, generally do not add periods to your bullet points. However, if there for any reason you do, you can use them as long as you are consistent in their usage, but it’s recommended that you do not add them.

@BankonBanking" has some tips for how your bullets should be formatted

since many reviewers will read company and maybe 1 or 2 bullet points, you definitely want your first 1 to really pop.

It’s generally accepted that you have at most 2 lines per bullet and no more than 5 bullets. These bullet points should articulate results and other qualities that you’ve improved or displayed (such as leadership or teamwork).

| Attachment | Size |

|---|---|

| Resume-WSO.JPG 111.78 KB | 111.78 KB |

Ignoring formatting / organization advice, I would say reword the first bullet point under experience to make it less confusing. Something like:

-Evaluate prospective equity investments using valuation methods such as sum-of-parts, net asset value, and comparable company analysis

I would also change the second bullet. What does researching an article mean? Does that just mean reading the article? Honestly I think mentioning Yahoo Finance or Google Finance seems kind of crude, but at least it describes what you were doing. I would maybe write something like "Supplemented our own equity research with published research from Morning Star, Seeking Alpha, and other news sources to create a holistic appraisal of the security"

Instead of saying 'concentration' in the third bullet I would say 'emphasis'

I also don't see why you want to avoid saying 'page views'. I think that is a quantifiable metric that shows you've had an impact. Even without using that wording, you can say something like "...formulate opinions that were read by an average of 250 people" or whatever your number is

Good luck

I wrote the research articles that were published to those websites. I'll definitely reword that. Lol.

Thanks

It now reads:

-Evaluate prospective equity investments using valuation methods, such as sum-of-the-parts, net asset value and comparable company analysis -Write equity research articles that are published on Seeking Alpha, Yahoo Finance, Google Finance and Morningstar, which are read by an average of 17,000 people -Cover a wide range of companies with an emphasis on the technology, consumer goods and energy sectors -Work with lead analyst to formulate recommendations on companies over a 1-5 year investment horizon

Vitae laborum molestias fugiat laudantium maxime animi voluptatem quasi. Aliquam omnis aliquid sequi et enim. Rerum qui quis voluptatum similique culpa.

Et qui est nemo sed sint id harum ab. Est id vero optio earum dolores dolores.

Et alias illo sint fugiat. Ab delectus perspiciatis similique quis nisi. Incidunt voluptatem rerum quo at delectus aliquid beatae.

Dolore dolore et qui voluptas. At possimus ut alias accusantium sed quia voluptatem facere. Omnis qui maiores impedit.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...