Essilor to buy Luxottica (makers of Ray Ban and everything else) for $24 Billion [Bloomberg]

Here's a video quick 101 on Luxottica. Here's a Forbes article if you don't feel like watching the video.

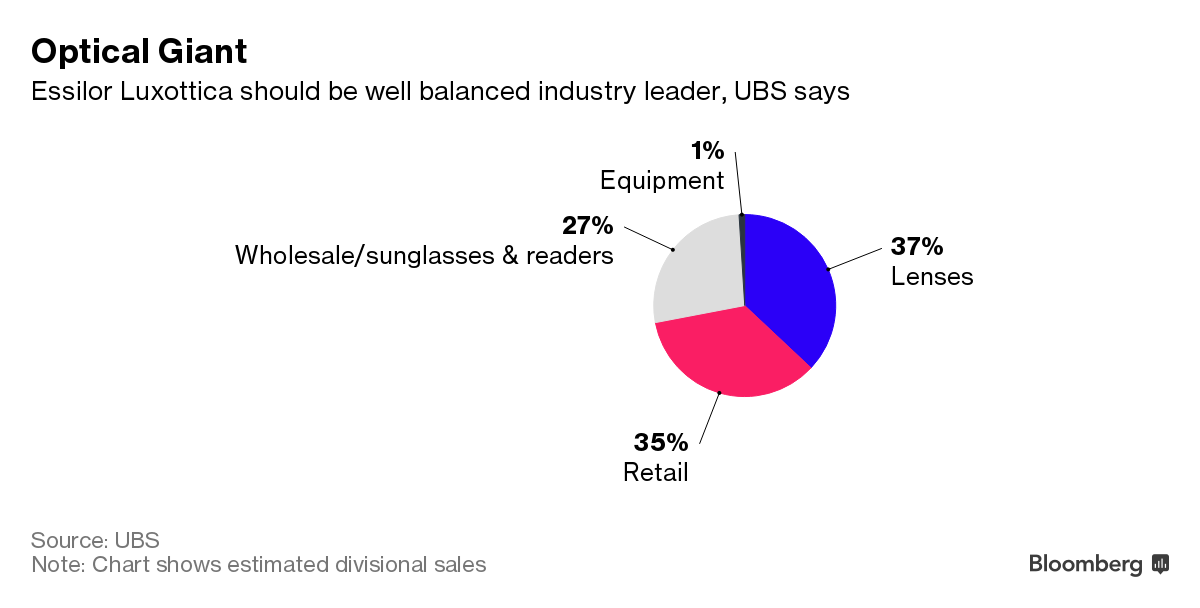

Essilor is a renowed lens crafter, Luxottica owns a ton of major frame companies, now the two will combine after Essilor agreed to buy Luxottica for $24 bil in stock. Luxottica will be delisted and the new company will be known as EssilorLuxottica.

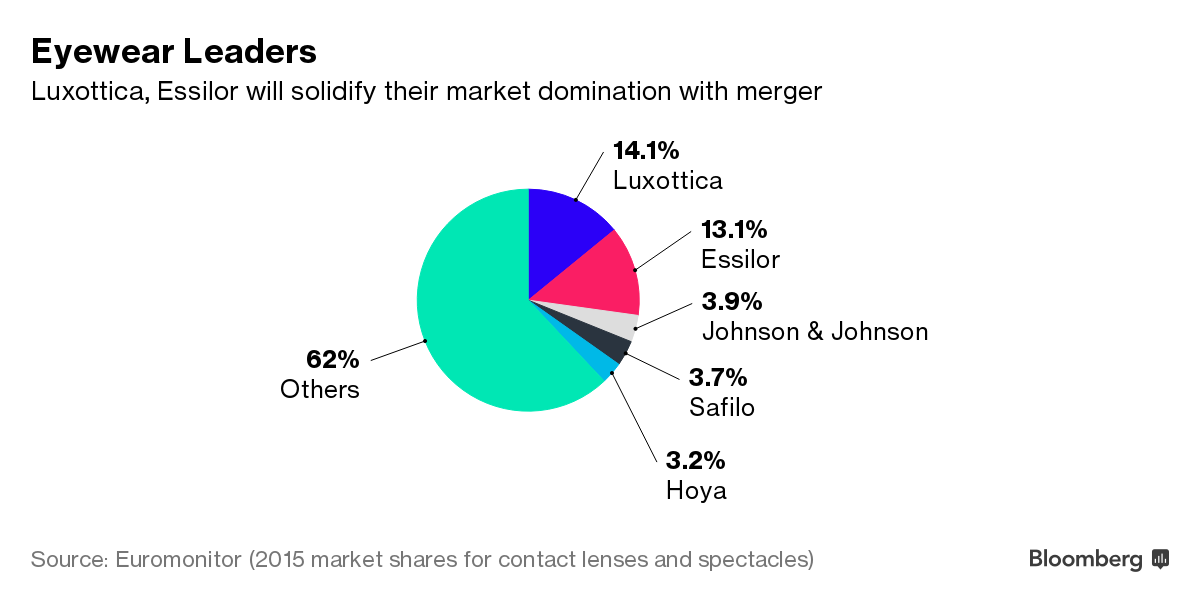

Market dominance after merger:

Luxottica increasingly competes with large luxury players such as Kering in a global eyewear industry worth about $121 billion last year, according to data from Euromonitor.

$121 billion... Time to work for EssilorLuxottica instead of JPM Chase?

Reference:

Essilor to Buy Ray-Ban Maker Luxottica for About $24 Billion

I'm disturbed at how much consolidation is occurring in a wide array of industries. It's the consequence of cheap money.

" Time to work for EssilorLuxottica instead of JPM Chase?" -Perhpas. +1.

can't help but side with Trump/Trumpism on this one - deals like this one should be instantly blocked. And I say this as a Republican - disturbing how much anti-competitive consolidation is going on.

As everyone else has echoed--we are seeing the rise of oligopolies on the global stage, and that's something the US can't directly block.

''Free market'': -allow companies to go with mergers that result in a 1/4 market share, 7 times the second competitor

''''''''''''''''''free''''''''''''''''''''' Let's just fucking call it oligopoly because that's what it is.

This is why the EU is going to shit. All this emphasis on competition and then they allow this kind of crap. What a failed political entity.

That video really drives the point home.

How in the world does this not violate anti-trust? Is the goal of the regulators to make sure every industry becomes an oligopoly?

I actually think this is the beginning of the end for this pseudo-monopoly, and this is a first act of quiet desperation. Warby Parker is the first big player that is challenging the monopoly, but many others will rise eventually. Right now we're the equivalent of 2011 and Warby Parker is Netflix. The cable companies sensed the beginning of the end but didn't have any way of stopping it really; now they're hemorrhaging 500,000 subscribers per month in the U.S. alone.

Except in rare instances with certain staple commodities (electricity, water), monopoly cannot last forever. People will not pay $350 for glasses forever when they have otherwise acceptable replacements. My Warby Parker glasses look so good that I think women like me better in them than out of them.

I have a pair of Warbys and find their quality lacking compared to my Persols. Of course, my Persols are 3x more expensive if you pay retail. I bought them online so they are about 1.8x more expensive than my Warbys.

I tend to agree that my Warby Parkers are inferior (particularly the glass) to my Burberry frames with lenses I got at the eye doctor, but I think scale will eventually allow Warby (and other future competitors) to build better quality at better prices.

That's the way disruption works in the Clay Christensen sense: the new player (The "Disruptor") comes in with a crappier product at a substantially lower cost, and starts by serving customers who currently do not consume a product or consume very little of it because their needs are over-served by these expensive feature-intensive, super high quality products when they would be happy to use a simpler, lower quality product at a discount to the current price. Eventually, these companies (like Warby Parker) will gain scale, and move up in terms of technological and quality (still at a lower cost structure), which will allow them to then compete with the incumbent.

An entrant that has the capability to deliver 80% of the customer value proposition at 50% of the price can be very dangerous.

Came Across this on Quora - I think it does a good job of explaining the business a bit.

The idea that Luxottica is a monopoly came from a 60 minutes piece (I think, I had not heard anything negative about the company prior to this).

See this post about why Luxottica are not even close to a true monopoly, legally speaking:

How much is Luxottica Group at risk of violating US or EU antitrust laws?

The often quoted "Luxottica owns 80% of the market" is not quite right. The 80% is brand recognition, if anything. If you've ever been to an optical show, Luxottica's stand is one in a sea of stands - there are thousands of non-Luxottica eyewear brands. Sure, many of those brands are not as recognisable as Ray Ban, but there are plenty of non-Luxottica brands that are - Nike and Adidas are good examples in the sports eyewear category; Police, Dior and Tom Ford are good examples in the fashion eyewear category. There are literally hundreds of major brands and thousands of lesser brands in the same boat. Luxottica have 20% of the US Eyewear market share and they own around half of the US's national eye care centers.

The argument is that Luxottica's frames have huge mark-ups and are overpriced. Even if they were, all almost eyewear manufacturers have similar mark-ups - why would Luxottica underprice everyone?

There are plenty of cheap frames with no branding that offer the same quality and eye protection as Luxottica - people have so many alternatives it's laughable that Luxottica could be considered a monopoly.

Your question, why has no one come in and undercut them? Off the back of the negative Luxottica PR, several companies have tried this, positioning themselves as 'cutting out the middleman' - Warby Parker, Bailey Nelson, Zenni Optical et al. Their frames are mostly cheaper and only carry their own brand. However, one of Luxottica's major costs is marketing - they focus on branded eyewear and it takes money to keep brands cool. People often don't see this as 'value', but if they didn't do this, no one would want Ray Bans. Warby Parker's mark-up will not be far off Luxottica's, altered only by economies of scale and reduced marketing costs.

However, companies can't reproduce exactly what Luxottica have. Other companies don't have Ray Ban or Chanel as brands (owning a brand does not make you a monopoly, othewise Apple would be a monopoly for Apple computers).

Luxottica's competitors (Safilo, Kering, De Rigo, Marchon, Marcolin) control a lot of the other major brands (Dior, Gucci, Police, Nike, Calvin Klein, Tom Ford and more) and mark-up the same as Luxottica - they all exist to make money for their shareholders. Pricing a Dior frame way less than, say, a Chanel, is going to cheapen the Dior brand.

In the US, Luxottica does own several major eyewear stores which do make up a significant portion of the market. Note I say in the US. Despite what many of its citizens might think, there's a whole world beyond its borders - the eyewear retail industry is not even close to dominated by Luxottica anywhere else in the world. Even within the USA, there is still plenty of choice of where to buy your glasses - even high end brands.

So, yes - you can get frames of the same quality as a Ray Ban for less than a Ray Ban. This doesn't make Ray Ban's overpriced - as with every brand name, you pay a premium for the brand. This would be the case if it was owned by any manufacturer.

I'm certainly not saying Luxottica are a morally perfect company, but they're no worse than anyone else. Nor do they need people like me to 'stand up for them', but it does create a lot of misunderstanding about the eyewear industry in general. People get a lot of satisfaction from feeling like they know "the truth" about things, making the whole 'Luxottica are bad' thing spread very quickly with little thought to compare it to some of the other major eyewear manufacturers.

I have no link with Luxottica, other than having sold some of their products.

Interesting write-up, and I'm definitely not an expert, but doing a little digging the actual answer is that Luxottica's actual market share is almost impossible to determine (because the global eyewear stats are really hard to pin down and contact lenses are also combined with the stats). As I mentioned in another thread, I'm reading Peter Thiel's Zero to One book about venture capital, and he mentioned that businesses locked in competition will sell their "uniqueness" to the public and that monopoly businesses will consistently sell to the public how much competition they are under. Doing a little digging, it's interesting to note that Luxottica has about a decade-long paper trail down playing its alleged monopoly and playing up its level of competition. In other words, the stats are unknowable, but Luxottica's public behavior is that of a monopoly because firms locked in actual competition don't stress the company's high level of competition to the public.

Edit: This article from 2015 indicates that Luxottica, when COMBINED with Sunglass Hut, owns a majority share of the global eyewear market (perhaps this is the technicality used to claim they aren't a monopoly).

https://www.businessoffashion.com/articles/intelligence/a-closer-look-a…

Yeah, the exact market share is definitely murky. I think what is well known though, is that any form of "monopolistic" power Luxxottica has is solely at the high end of the market. Is the high end segment of the eyeglass market distinct from the overall eyeglass market? I think that is hard to answer. Obviously, a consumer could simply migrate to the lower end segment where they would find more competitive pricing. I think historically, regulators tend to stay away from cases like this where consumers might self select into a premium category. At the end of the day, although noncompetitive practices hurt all consumers, the government seems more focused on protecting lower income individuals. It is hard to sympathize with people complaining about Prada pricing when budget friendly options are available, but might not necessarily carry the brand name.

The insurance/retail store ownership is another matter. I haven't seen a ton of competition in the traditional retail space.

Just my thoughts..

Sed quas ducimus ducimus voluptatem nemo et aspernatur voluptatibus. Sit sit harum odio nihil occaecati ut illo quas. Autem dolorem soluta ea assumenda qui. Perferendis soluta dolores itaque hic sed voluptatum molestiae. Amet qui neque totam nihil omnis. Ducimus voluptatum aliquam atque quia.

Non et pariatur cum quia. Sunt nemo nobis exercitationem non quas. Officiis ea est ut et molestiae.

Modi nesciunt nihil aliquid in. Doloremque quis illo quam mollitia. Quod sed facilis aliquam ut aspernatur provident. Harum magni sunt eum nostrum dolorem non.

Suscipit nam ea id voluptate ullam fugiat. Aliquam molestias iusto aut laborum sed aut deserunt. Et et magnam placeat et est.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...