|

New Home Construction — The real estate market is, in a word, hot. A big part of that temperature level, and as it relates to the state of the market going forward, is the creation of supply through new home construction. Luckily, those figures came in yesterday.

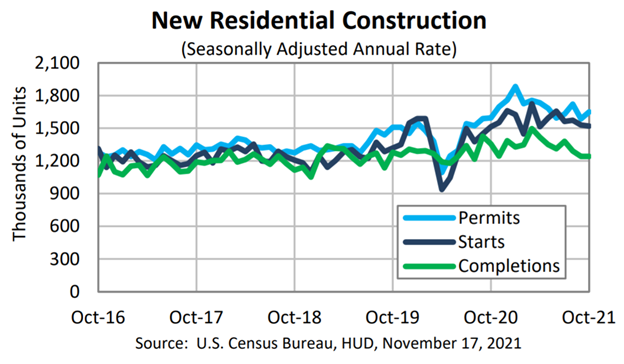

Housing starts for October came in at a little over 1.5mm, while soon-to-be housing starts (aka, building permits) reached 1.65mm. The most important figure, being housing starts, saw a contraction from September, falling 1.6% month-over-month. Remember, price is a function of supply and demand, and as demand for homes has skyrocketed, supply hasn’t been able to keep up, meaning prices go boom. If you’re looking to get into a new home soon, well October didn’t help too much. Demand continues to far outstrip supply, meaning you’re gonna need to save a lot of dough to get the job done. Hopefully you’ve owned a good few What’s Ripe names in your day just as they become Ripe, that’d help.

Run it Back — Remember when everyone was freaking out about the federal government’s debt ceiling about a month or so ago? Are you ready to run it back?

Treasury Secretary Janet Yellen, colloquially referred to as JYell, gave a stark reminder and warning that the next debt ceiling will be reached as soon as December 15th. This is not good, like not even a little bit, for a plethora of reasons, so let’s dive in to a few.

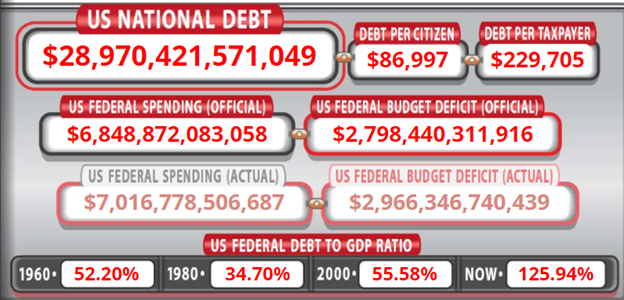

First of all, many critics have said that U.S. federal spending has already reached late Friday night levels of drunkness. As you can see below, the U.S. currently owes just under $29tn to landing counterparties around the globe. That figure is closing in on 126% of the nation’s GDP. Historically, leaders, analysts, and investors alike have warned that exceeding 100% debt / GDP is a bad sign for long term economic growth, just look at Japan.

But what if I told you slowing long-term growth isn’t even the worst part? Halloween has past, but get ready to be spooked.

Government debt is issued on a floating rate basis. That means that interest payments are determined by the prevailing Federal Funds and market rates at the time in which the payment is made. Right now, rates are still at rock bottom. But, as we’ve heard seemingly around the clock lately, the Fed is looking to increase rates as soon as next year, potentially multiple times before FY’23. Doing some quick math shows that for every 1% increase in interest rates, the federal government’s interest obligations increase by $300bn, a shit-ton even by U.S. government standards. This only adds to the country’s already arguably egregious spending, and consider we’re about to drop $1.2tn over the next decade on infrastructure, our spending capabilities are not looking good.

See, I told you it was gonna be spooky, not my fault if you kept reading. What we really need here is a financial advisor, maybe the U.S. could look into some or at least check out Betterment to manage their funds. After all, it is our money.

|

Error voluptatem est id illo consequatur aut. Itaque commodi in quos voluptas velit laudantium. Quisquam eveniet vel incidunt est dolores. Et quibusdam odio voluptatem nihil. Voluptatem reiciendis deserunt pariatur.

Et laboriosam quos possimus odit. Est alias eaque minima facere aliquam.

Vel ex sed est aut. Explicabo quibusdam quo illum ipsum. Ab voluptatibus sunt et nihil libero enim. Officiis harum explicabo ut nostrum est qui eaque.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...