|

Wrapped in Together — As you’ve seen if you’ve been on Instagaram, Snapchat, literally any other social media, or Spotify itself recently, the music streaming service released the legendary summary of it’s users streaming habits for the year, known as Wrapped, this week.

National and global data from Spotify is likely a much better view at how the world jams out vs. Apple Music, as Spotify boasts 381mm users while Apple had 60mm last time it reported user figures.

Now that we got that out of the way, let’s take a look at some of the highlights Spotify revealed on our globally collective streaming habits:

Top Streamed Artists:

- Bad Bunny (9.1bn streams without an album drop...)

2. Taylor Swift

3. BTS

4. Drake (really??)

5. Justin Bieber

Top Streamed Songs:

- “driver’s license”, Olivia Rodrigo

2. “MONTERO”, Lil Nas X (c’mon y’all…)

3. “STAY”, The Kid Laroi & J-Biebs

4. “good 4 u”, Olivia Rodrigo (banger)

5. “Levitating”, Dua Lipa & DaBaby

Top Podcasts:

- The Joe Rogan Experience (obviously)

2. Call Her Daddy (what is wrong with you guys?)

3. Crime Junkie

4. TED Talks Daily

5. The Daily

Cool Playlist Facts:

- “Plant playlist” music grew by 1,400% during the pandemic

2. “Vaccine related playlists” hit 42mm streams (think, ‘Hit me with your best shot” by Pat Benatar

3. There are >187,000 Sea Shanty playlists all generated by users (shoutout to The Tendieman)

As you can no doubt see, it was an interesting year for streaming. Just keep in mind when you go and look at your that you really don’t “need” to post it all over social media. Literally no one cares, I promise.

Manufacturing — We just received word from the North Pole, and it looks like your holiday gifts are gonna be fine as Santa has taken a page out of Bezos’ playbook and is forcing the elves to work overtime while removing any and all forms of bathroom breaks. As a result, production of goods is on pace to check every box on your wish list.

That’s right, the production of goods, aka manufacturing, continued to grow last month. We’re not sure just how much of that Santa is responsible, but safe to say it’s meaningful. November’s PMI reading came in at 61.1, a 0.3% increase from October’s 60.8 reading. That marks 18 months straight of gains - meaning the economy’s manufacturing sector has grown continuously for longer than any one of your relationships have lasted.

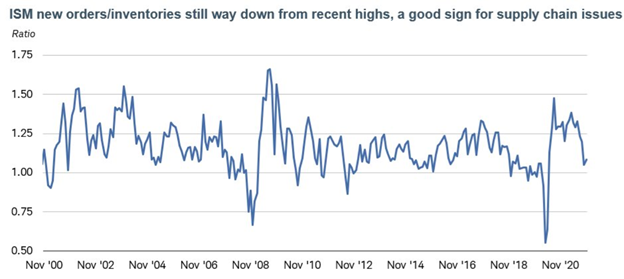

All in all, supply chains are healing. A ratio of new orders compared with inventory levels, remains low, indicating there is plenty of inventory to meet demand from these orders. Like I said, Santa’s working overtime.

|

Libero quos sunt occaecati quasi velit earum assumenda. Architecto rerum possimus ab quo. Consequatur pariatur culpa voluptatem ut mollitia error. Libero ex non necessitatibus consequatur. Quo ratione vitae repellat quas.

Ex illo tempore ratione cupiditate iste. Id autem neque rerum nesciunt nam. Ratione aut quia qui totam iure sunt.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...