|

PBOC — While Chinese President Xi Jinping certainly puts on a brave (and mildly scary) face on the international stage, it’s becoming clear that his nation’s economy is not exactly on the same vibe.

It’s not all doom and gloom, it’s just not firing on all cylinders like the U.S. and other western nation’s seem to be. Output growth has slowed dramatically this year amid regulatory crackdowns, mostly in the tech and real estate sectors, power shortages at factories, and depressed consumer spending figures.

Like the U.S. Fed, the People’s Bank of China (PBOC) releases statements on their view of the overall economy. One of those came out on Friday, but analysts are less concerned about what was said and more focused on deletions from the statement. Statements such as those describing hesitance to conduct large-scale asset purchases were removed, indicating they could very well be back on the table. This and other simultaneous language changes signal a pivot and the possibility for the PBOC to ease credit conditions and loosen monetary policy in other ways in order to spur growth.

Still, China’s doing okay. We like to say everything’s bigger in Texas, but really everything’s bigger in China, including GDP growth figures. Of the 13 largest U.S. banks with estimates on annualized GDP growth in China, the median remains 8.2% for 2021 as of late October. For context the most prominent U.S. GDP growth estimate for 2021 sits at 5.0%. Do with that as you will, I guess.

I'm Not Leaving — President Biden has officially called on Jerome Powell to continue to Watch the Throne. JPow has been re-nominated for Federal Reserve Chair and will, in all likelihood, be easily confirmed for the position by Congress.

While the money printing king seemed like an almost obvious choice, it certainly wasn’t an easy path. Fed Governor Lael Brainard put up a damn good fight, going so far as to interview inside the White House gates for the revered position. Nothing is guaranteed yet, but the bipartisan support Powell has historically received can provide some optimism for the likelihood of Powell’s confirmation.

Like everyone, JPow has his haters, the most notable and vocal of which being Massachusetts Senator Elizabeth Warren. Warren and other progressive Democrats have voiced concern over the Fed’s historic lack of involvement in societal issues like climate change and wealth (in)equality across the nation as well as Powell’s more dovish view of financial regulation. Joey B, evidently, thinks JPow has done just fine, so let’s take a quick peek at his record.

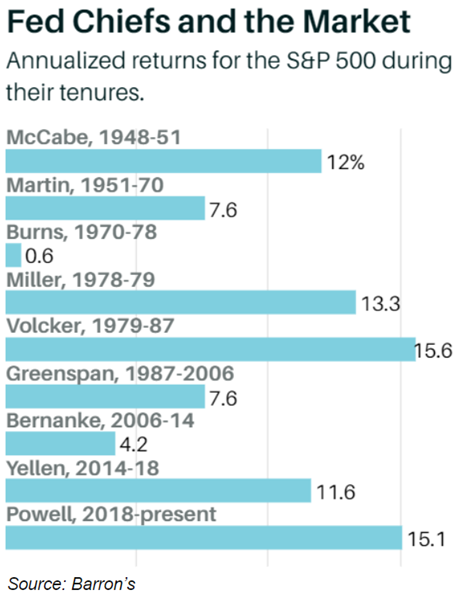

Originally nominated by former President Donald Trump, Powell has held his position since February of 2018. Hard to believe that will be 4 years ago this February, but JPow certainly has had no shortage of legacy making moves since then. Analysts say the normalization of QE, reassertion of the U.S. dollar’s primacy, and expansion of the Fed’s global impact have been the key megatrends for Powell’s service thus far. Whatever your thoughts on those topics are, what matters is, Joey B seems cool with it and we can likely expect continuity of those trends going forward.

I mean, the guy did basically save the U.S. economy from a depression-like environment back in March 2020. Was it too much? Who knows, and I guess we may find out overtime. But the simple fact that Joey B and Donnie T can agree on JPow while vehemently disagreeing on just about anything else speaks volumes.

|

Aut minima autem et et eos. Ipsum aut ut qui nihil velit dignissimos vero. Occaecati autem sapiente qui et ratione. Enim atque et et molestias voluptatem voluptatem. Inventore recusandae nam totam tempore dolorem.

Consectetur deserunt eveniet rerum omnis tempore. Et est reiciendis cum doloribus. Ut dolor earum id. Deserunt fugiat maxime voluptate ea et sunt eum nisi. Quisquam non sunt quisquam quibusdam illo. Cumque doloremque eius doloremque dicta voluptas deserunt. Vel deserunt voluptas ut nobis. Vero quibusdam sequi vel expedita et pariatur quam sint.

Quidem odit debitis aut aut illo natus. Voluptatem nobis totam delectus qui dolorem vitae. Fugiat et libero recusandae corporis sed.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...