|

National Holiday — I hope everyone enjoyed our nation’s most important Holiday this past week. No, not Thanksgiving, obviously I mean Black Friday - way more important. The last Friday of November is our one chance to truly embrace the materialistic consumerism that drives our economy, not to mention the fat discounts most stores give, so I hope you did your part.

Anyway, Black Friday 2021 was an interesting experience. For the first time in recorded history, Americans saw a decline in online Black Friday shopping, giving brick & mortar their first W since Bezos came on the scene. Sounds surprising, but this makes a lot of sense. Last year, basically all shopping was done online as a result of you know what. This year, shoppers were understandably just trying to get out of the house for their clothing and houseware needs.

All in all, the drop in online shopping on Black Friday wasn’t anything huge. Adobe Analytics puts 2021 figures at $8.9bn while 2020 was a hair above at $9bn.

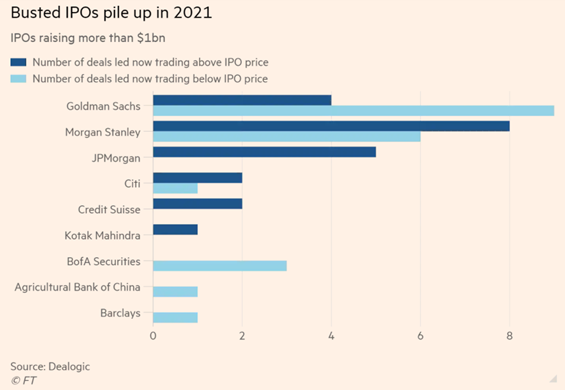

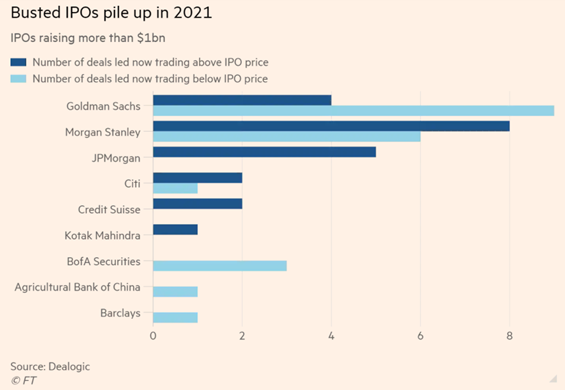

IPOh Sh*t — Froth is defined as a “a mass of small bubbles in liquid caused by agitation, fermentation, etc.” (thanks Google). There is arguably no better way to describe financial markets in recent years, especially high growth stocks, even more especially high growth tech stocks, and most especially to high growth tech stocks that just IPO’d. Well, it looks like that froth is finally fading away, at least in part. Over half of companies that went public this year and raised over $1bn in doing so are currently trading below their IPO price.

Of course, this data has emerged after a brutal selloff on Friday that mostly consisted of a flight out of risky assets. IPO’s are at the top of that list, and this flight to safety can be seen in part by the performance of the Renaissance IPO ETF, $IPO. This fund has sank over 15.4% since peaking back in February, a direct look at the cool down of excitement around these opportunities.

Analysts argue that the valuations assigned to these firms at their debut were largely propped up by massive VC investment from firms like Tiger Global and Softbank. Despite many of the highest profile 2021 IPOs seeing staunch declines since they began trading, the initial pops as seen in stocks like Robinhood and DiDi made sure those VCs saw their payday.

Now, things are different. For reference, Robinhood has fallen over 62% since its public peak, DiDi is down over 50% from peak, and Oatly has sank close to 67%. Hindsight is 20/20, but these companies were basically all hailed as the next Amazon or Google within their industry when they dared to go public. To no surprise, the short-term market pricing mechanism was wrong - super wrong. But hey, now you get to decide: are these companies at generational discounts? Or do young companies, some with literally $0 in revenue, maybe deserve to to shed market cap?

|

Est fugit similique dolorum laborum similique vel aut. Quam assumenda doloremque est rerum suscipit ab. Tempore consequatur tenetur perferendis non autem.

Sint ipsam autem accusamus omnis. Doloremque ullam omnis optio.

Et qui provident ut ut ducimus. Ipsum ab ipsam eos voluptate ipsa. Reiciendis et quia harum voluptatum est omnis.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...