|

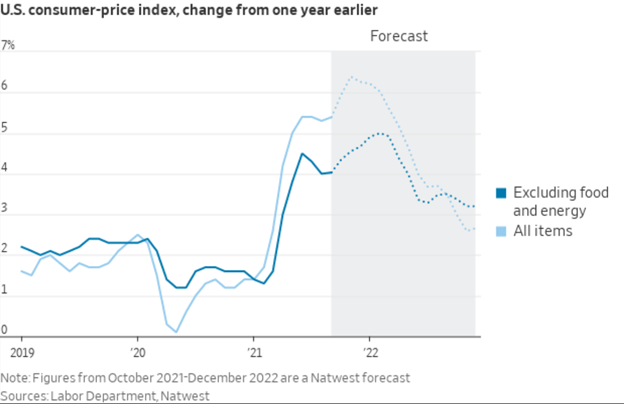

CPI — I’m going to venture a guess that maybe 5-10% of you reading this were born in or before the year 1990. If true, that means the remaining 90-95% of you are currently experiencing the highest annual inflation rate of your life. Congrats!

CPI data released yesterday revealed prices have gained 6.2% compared to last year. That reading is the single highest annual reading since, you guessed it, 1990, and comes in substantially above consensus estimates of 5.9%. If you’re looking for some particular segments to blame, look no further than the usual suspects.

Fuel prices stole the show, gaining 59.1% since last October. Unless you’re super cool and hip and drive a Tesla or something, you’ve definitely noticed this already at the gas station. Overall energy prices, including for appliances used in your home, didn’t catch a break either. Surging over 30% YoY, being comfortable at home is getting a lot more expensive, not great as we head into the cold months up North.

Other substantial contributors included meat, poultry, eggs, and fish collectively pushed prices 11.9% for the year. Vehicles, used and new, and vehicle part prices gained significantly as well with used vehicles leading the charge up 26.4%.

Is anyone surprised at the rate of inflation? Yes, it is quite high. Is anyone surprised at the drivers? No, supply chain issues have been a nonstop news story since COVID started.

|

Riding Rivian — One of the most highly anticipated public market debuts came to fruition yesterday with Rivian Automotive officially completing their IPO, much to the satisfaction of early investors including Ford and Amazon.

Yes, it’s an EV stock, a sector that many investors would argue is looking a little bubbly, but Rivian might be one of the only ones you could confidently point to and say “okay, this might actually have a future.” Now, with that said, the stock is still valued ridiculously high. Originally planned to price shares around $60, the firm went with a $78 offering price that actually ended up going at around $112.50 at open, giving Rivian $12bn in new capital and a market cap of over $106bn. That makes Rivian the second highest valued U.S. automaker in the market, behind only Tesla and far exceeding one of their investors, Ford, at ~$77bn.

There’s a difference between a good company and a good stock. You’re all big apes so I can’t tell you what to do, but you know, just...keep that in mind...

|

Reprehenderit qui qui reprehenderit labore dolores est blanditiis nihil. Placeat aut voluptatem deserunt. Ex non aspernatur corrupti soluta perspiciatis velit occaecati repudiandae.

Fugit doloremque eum fuga dolores rerum. Esse voluptas ipsum laudantium sapiente sint asperiores velit. Sapiente excepturi et neque ut quia sunt et. Voluptatem quis commodi earum blanditiis mollitia natus. Rerum vero et tempora maiores. Nobis est cum in voluptatem numquam.

Facilis architecto officia quia suscipit pariatur consectetur magnam. Praesentium voluptatem quaerat velit voluptas sunt quos. Nesciunt blanditiis modi unde aut neque at eum. Mollitia porro est tempore eaque neque.

Est voluptatem maxime harum corrupti. Dolorum beatae placeat ipsam. Cupiditate placeat voluptatem ducimus. Quia omnis facere ad dolores reiciendis qui. Dicta praesentium excepturi aperiam saepe qui fugiat.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...