Leaked Shiti Bank Bonus Reviews

Trending Content

| +241 | CVP 2025 Summer Analyst Class Is A JOKE | 105 | 1s | |

| +98 | The "Not So Obvious" things that get you a return offer? | 10 | 12h | |

| +94 | PJT Best EB in the next 5 years? | 46 | 12h | |

| +57 | Ex-JP Morgan analyst awarded $35M decade after NYC building’s glass door suddenly shattered on her | 15 | 20h | |

| +34 | Georgetown Placement for 2024 and 2025 | 20 | 16h | |

| +31 | Pros and Cons of the BB coverage groups | 16 | 4d | |

| +29 | Best IB group on the Street | 14 | 8h | |

| +28 | Barc vs WF for IB (Generalist) | 7 | 10h | |

| +28 | How to deal with egotistical team? | 6 | 10h | |

| +26 | BIG FOUR ARE PARADISE | 4 | 9h |

Career Resources

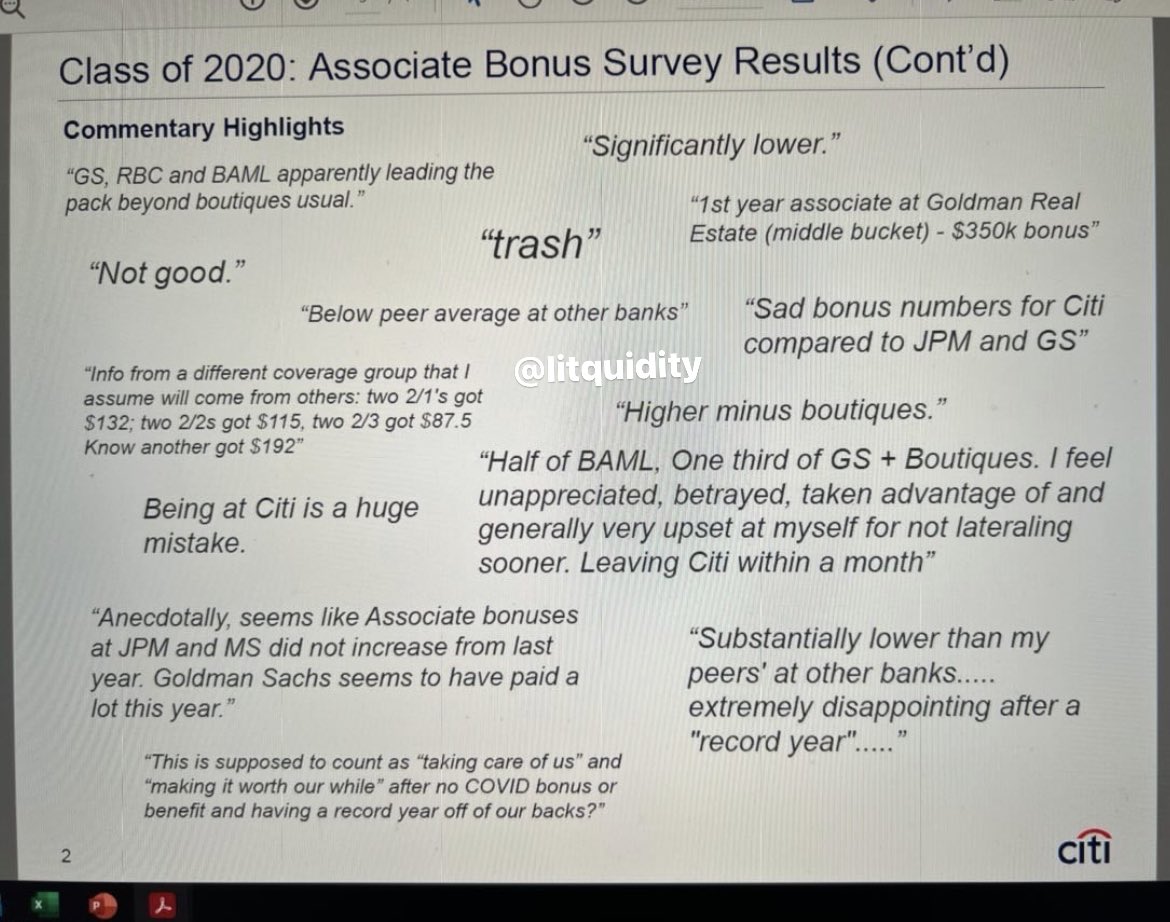

Is this real?

Gonna guess.... hell yeah lol

I heard WF was shit too

It has the right formatting for a Citi presentation, so if it's not real it was at least made by someone at Citi most likely.

Do we have any actual figures?

Lol good number of numbers here (https://www.wallstreetoasis.com/forums/bonus-season-comps?_wrapper_form…;

Numbers off the top of my head (bonus): AS1 - 115k, 90k. Pretty bad.

Jeez…wonder what Analyst numbers were then.

Really want someone from Citi to comment on this. Is this slide being circulated among people who can do something about it? Does IBD leadership care...at all?

I mean, management isn't stupid. No one's deciding between Goldman and Citi so it's kind of irrelevant what GS is being paid.

If Citi's pay was equal to Goldman, the same exact number of junior employees would leave for Goldman vs. if Goldman paid 10x what Citi paid.

Fair point on the GS part, but totally feasible that someone would be choosing between Citi, BoA, and others of similar status. Can't imagine the pay disparity does anything other than hurt their recruiting.

You think Citi is on par with bofa? Ouch

Well league tables say they are....fuck if I know lol

I mean they are on par with BofA. Not sure why this is a controversial statement

Edit: genuinely don't know if whoever this upsets is at Citi and is angry they're being compared to BofA or BofA and not happy with the comparison to Citi haha.

Don't try to rationalize the bonus #'s we're hearing, leadership views, etc. You're going in the wrong direction.

The assumption Citi wouldn't go to GS is false and only for a consideration for students coming out of undergrad, not current bankers. I was at Citi and chose to stay when banks ranked higher than Citi proactively reached out. If you're good and strike while the iron is hot, you can lateral...but may not want to because you recognize that having a big name and good culture is better than having a slightly bigger name and possibly worse culture/people.

But when it comes to bonuses, if you're underpaid then all this might go out the window.

Lol true true

Considering the amount of comp consultants and market intel banks pay for prior to comp, it's pretty shocking seeing Citi coming in so grossly low compared to even its direct peers.

Agree! I’m at Citi and can confirm the bonus numbers were really bad!! On a group call MDs were asking to bring our friends from other banks to Citi. Joked that none of us would ever leave because we are good people

Is there any sense from leadership that they acknowledged they underpaid you guys? Like it truly was so below everyone I'd be hard pressed to believe there isn't an uproar to management regarding it.

So I discussed this with my MD. It just sounded like the ones who’ve been with the MD since many years ago got paid well (he didn't say it but definitely could read between the lines) and are one of his few "inner circle people" then you got paid well. Said the firm has paid 100% and over 100% too

This is good because it will make banks afraid that by shortchanging bonuses they could be publicly mocked like this. It’s not a good look for Citi but will incentivize others to not do the same in the future

4th

Payments are officially slated for the 31st. Some have received them already based on how your bank handles Monday ACHs. Some may choose to wait until March when 401k contributions are paid for the prior year.

Lol, no one's going to quit without a job because bonus was lower than expected

Any departures because of the lower than expected bonuses won't happen for a while

first woman CEO is the real bonus y'all!

All jokes aside, for any major bank, associate bonuses are so far below the CEO's radar that they probably have no idea what they are.

Most of Citi ICG's leadership is from the markets side and Citi has historically been much stronger on the markets and treasury & trade solutions side, so it really shouldn't be a surprise they are de-prioritizing the investment bank

important follow up - this is where yalls bonuses went: https://www.foxbusiness.com/features/citigroup-raises-frasers-pay-by-32…

Looks like "citi doesn't care". For a bank that touts their diversity efforts, WLB, its funny they cant even support the analysts/associates who are in the trenches day in and day out.

I understand being pissed and would be if I was in that situation…but when has Citi ever paid above market vs. peers? I’ve always heard BAML pays better at all buckets / levels

unless EVERYBODY got shafted and the mid bucket was very weak

unclear with the few datapoints from C associates potentially being underperformers (that associate with $90k FY bonus)

Guys it's Citi not Lazard. You know who else had a shitty year (decade)? Wells Fargo, but you don't see them complaining because they know their place in the world.

I mean that may be because their bonuses were ~100%. I used to work there and still have a few friends there and none of them were disappointed. From what I’m seeing of the Citi numbers they deserve to be disappointed. Also seeing VPs at WF in the other thread who were $750k. Citi was clearly underpaid, let them vent. They have a legitimate gripe with management.

Eh, good point. Besides, I'm always here for shaming the shit out of banks to try and force them into paying more and easing up on WLB. Now that I think about it, I'm also underpaid and overworked. #MeToo

Thank you!! Seriously

Bonus was at par with a consultants bonus

I work at Citi and will be leaving in the next month or so. There are so many elements of working here that are a joke. Not sure the problems outside of pay extend to other large banks or not but either way im leaving banking entirely

Ipsa enim aut nesciunt tempore. Hic ea quibusdam voluptas delectus. Repellendus enim quos et atque in enim ipsum. Nesciunt vel dolorum id illum et quisquam ut. Architecto nisi voluptatem harum et. Esse necessitatibus sed quidem odit ipsa nulla non deleniti.

Mollitia exercitationem corrupti hic molestias culpa eligendi. Ab neque quam et quisquam nemo. Est molestiae quis illum eaque laboriosam doloribus.

Rerum iste omnis maxime amet quia laudantium rem. Cupiditate exercitationem mollitia velit qui reiciendis.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Voluptatum explicabo rerum nihil delectus. Iusto et eos officia repudiandae nihil.