|

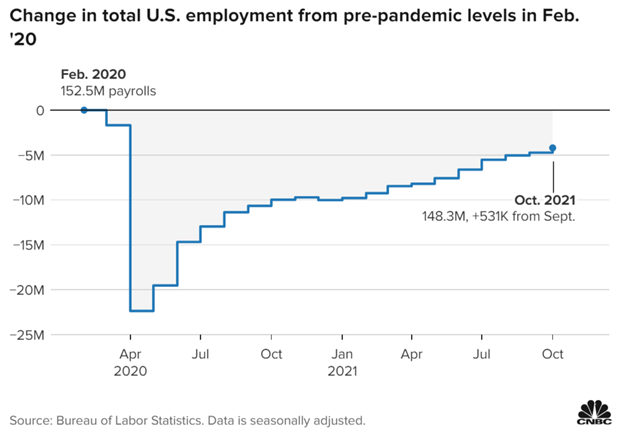

Jobs — They must’ve put Oprah Winfrey in charge of the labor department last month because everybody is getting a job. The U.S. economy added 531,000 jobs in October, smashing last month's numbers as well as economist expectations. Furthermore, numbers from both the August and September labor reports were revised upward - by a lot. Not only is this a great sign for Main Street USA, but gives us even more firing power for insulting economists.

September’s somewhat concerning original number clocked job additions at +194,000. Now, that figure has been revised up to +312,000, an addition of 118,000 jobs. August’s figure was jacked up to +483,000 from +366,000, an additional 117,000. Counting is hard, but something tells me professional economists in the largest and most advanced economy in the history of the world should be able to do a little better.

As for October, expectations placed additions at +450,000, coming in 81,000 below the reported figure. Meanwhile, unemployment fell further from 4.8% to 4.6%, a new low since the start of the pandemic and another example of economists being wrong.

Basically, the economy is firing on all cylinders. It’s a good time to be an American. However, keep in mind, a strong job market gives JPow a green light to raise rates sooner rather than later, but we’ll have to wait until December 15th to hear his thoughts. Until then, keep raking in the dough.

|

Buffett at the Buffet — We are once again able to confirm that the 91 year old man at the helm of the nation’s 8th most valuable company does in fact, still got it. Warren Buffett’s Berkshire Hathaway reported earnings on Saturday, in the most Buffett way possible as he says this gives the market time to “digest” the results, and things are going well. As Berkshire relies on insurance, utilities, and railroads, for the most part, the reopening has been a big help. Operating income boomed 18% YoY to $6.47bn, but the real show stopper is the cash pile Warren and Charlie have built. Now at record levels, Berkshire reported cash holdings of $149.2bn — larger than BlackRock’s entire market cap. Not much is known around the firm’s plans for deploying that cash. Berkshire bought back around $7.6bn of stock in the period, but otherwise, Buffett has only hinted that the firm is keeping it’s eyes open for acquisitions. Either way, we know that the pair of billionaires will still be getting breakfast from McDonald’s, only after this quarter, they might have to make it a Happy Meal. |

Neque placeat fugit voluptatem debitis dignissimos. Cum culpa nobis est corporis saepe. Magnam expedita natus et officiis earum totam. Labore id nihil cupiditate at.

Delectus aut occaecati sunt cumque necessitatibus accusantium amet. Est odit laboriosam est qui autem cupiditate et. Qui dicta vel harum at aut ex.

Est veritatis quas occaecati sit. Esse et voluptatem fuga id. Error voluptates qui nesciunt voluptates.

Ut ullam voluptatem omnis neque velit dolor repudiandae. Quos ad et repudiandae sint sed. Totam dicta ea veniam illo.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...