Mini IPO for WSO?

Dearest Fellow Primates -- some interesting changes have recently come to light on different ways small businesses can now raise funding...

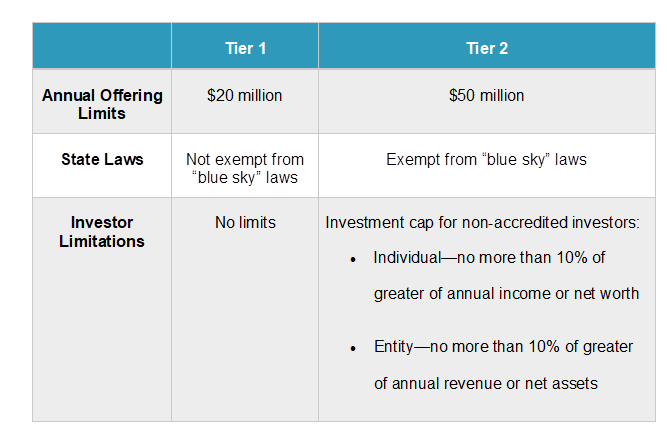

Reg A+ or Mini IPO....summary below from IPOhub.com

More info: https://www.sec.gov/info/smallbus/secg/regulation…

So I've always avoided the idea of rasing capital (and we've been approached by many VCs/angels, etc) because I've always run WSO lean in order to keep it profitable and not overextend ourselves (thanks to my time in restrucuturing seeing messes) and I've always seen much more upside than downside in what we've built over the last 14 years -- when looking at our financial profile, there is a lot more value to the brand and reputation vs top line + profit.

That being said, the idea of a Reg A+ or Reg CF offering seems particularly built for a community like WSO since the users are what drive a lot of the value in the ecosystem (and could help us tremendously in our next stage of growth). What better way to continue our rapid growth with community members owning a small stake in WSO?

So some questions:

1. Would you be interested in becoming a shareholder in WSO? (for real $, not bananas ;)

2. Do you know any good trustworthy lawyers that specialize in Reg A+?

[the following quesions probably best answered by such lawyer, but if you know]....

3. Concerns as a Sub-chapter S doing Reg A+? Tier 1 or Tier 2 better?

4. I've seen some Reg A+ actually trade on Nasdaq/NYSE...sounds fun but likely not worth the headache/cost (but additional liquidity might be nice for the monkeys)

5. What else should I be asking?

Anyways, it's a fun thought experiment and I welcome all the wisdom here in the community and other things I should be asking.

Thanks,

Patrick

What would the reporting standards be?

Tier 1 = 2 yrs of financials + balance sheet, etc for the offering, but no ongoing requirements -- but also doesn't clear you of blue sky provisions by state so while the no ongoing requirements is nice, still probably a headache if have to get thru whatever blue sky stuff exists in CA

Tier 2 = annual audited GAAP financials and semi-annual (unaudited), avoids state approval/regulations

just wait until WSB finds out about this.

Sorry I’m slow - what’s WSB

I actually know some of the discord mods in real life. Let me get to work.

Take their wet blankets they like to throw at us and throw them out in the incoming Noreaster for us, will ya?

Do I have to escalate to compliance to buy?

no clue... my guess is unlikely?

I would think you do. As you need to run private placements by compliance departments. This would be an unregistered security with the SEC. Would it pay a dividend or anything? I think the hardest part would be selling it TBH. How do investors get a return on their capital if you're not planning to sell the business or IPO?

When I read the title I thought it was a joke haha.

Does it mean that you'd make WSO's financials available to anyone?

(would definitely buy a share as long as they're not $200)

Yes, I think I'd have to reveal some financials, but not sure how detailed...

I'd guess as detailed as what you see in other public filings, which would include compensation and ownership stakes of management. The thing that would make this less fun, is the fact that you have been in business for a while, meaning the back years would have to get audited and brought to some level of GAAP standard most likely. I know that Reg-A is actually cheapest/easiest for a start-up fund/venture, as literally no history or financials!

I'll give you 10K for shits and kicks. This site has made me more than that lol.

I also think there is a lot you are missing here. This market is massive.

Kind of interesting. If a lot of users owned a stake, I could see it encouraging higher and more frequent quality content. Though I’m not sure where all the value really is in the business (the forum or the various courses and programs - would assume the latter). Guess we’ll need to see the financials!

Finally us high school students become useful to you guys.

No... not really...

The Reddit of finance

Also thought this was a joke but now interested in throwing some money down. Does WSO make money off any affiliate marketing? Feel like you guys could feed links to stuff impressionable college kids thirsty for a finance job would buy for their first internship or job (e.g., Allen Edmonds, Suit Supply).

Please no ads

Can't wait to see WSO promote liquid focus like every other meme page

We do an occasional ad on IG but it's pretty rare...

Very little ad/affiliate revenue... We've moved away from that over the years to focus more on our own courses and services

What % of gross revenues are from courses and services? I’d have to imagine it makes up 80%+ right? Especially if you have no ad/affiliate revenue?

I'd be ready to throw a bunch of money at you right now

The real estate world has done many REG-A offerings, often with REIT status for tax. Not sure if other industires have taken a liking to them, but you may want to find some people on here or elsewhere that have done them in that space. I think Fundrise and Realty Mogul have used reg-a offerings along with Reg-D 506c; I've worked with some groups that looked at Reg-A (I wrote a mini-white paper for client when the JOBS act passed with Reg-A), but ultimately just used Reg-D 506c (many have made this choice, I guess they figure the accredited investor thing was no real limitation).

You know your "stats" on users, so I guess could estimate some of the fundraising potential. How much are you thinking of raising?

Alternative idea, since this is sorta a "tech" company I guess... go try and get acquired by a SPAC!!! I mean, some are going to just have to buy stuff vs. return the money. Hell, start a WSO SPAC! Everyone else is doing it!!!!

Honestly, if you went this route, you could be worth $100mm+ overnight. On paper, anyway.

Knowing stats on users is still tough to know fundraising potential...I have a general idea of the demographics of the site and visitors, but no clue what we would actually be able to raise.

This idea is most interesting to me for 2 reasons:

1. The potential increase in engagement from members that are investors -- this is both in the forums and potentially helping us with introductions to grow our corporate side

2. Having some additional capital available should an interesting related acquisition present itself. We will (likely) be making our first (tiny) acquisition (under $50k) in January 2021 to acquire a site with about a ~15 course catalog... honestly, it's more an experiment for us to see what we can do efficiently as a team before potentially biting off a larger acquisition in the future

We don't need the capital since we are cash flow positive -- the question that intrigues me is does taking some capital off the table (~$2-3m?) across a few thousand members help us grow faster by boosting engagement + business opportunities for our training?

That's what I'm thinking.

Patrick

Very interesting and I’d definitely throw a small slug into an offering. Don’t have much to contribute, but curious, what do you feel the inflow of capital would help you enable that is restrained right now?

I don't think an inflow of capital itself would magically unlock opportunities. We already spend well above avg on our development team (compared to our competition since we are an online community first), so no new spending there.... so any new $s we are spending now are really focused on sales and marketing. But we are already doing this with our cash flow...we don't need the investment, but I think it may unlock opportunities for other reasons...

See below.

This idea of a Reg A+ is most interesting to me for 2 reasons:

1. The potential increase in engagement from members that are investors -- this is both in the forums and potentially helping us with introductions to grow our corporate side

2. Having some additional capital available should an interesting related acquisition present itself. We will (likely) be making our first (tiny) acquisition (under $50k) in January 2021 to acquire a site with about a ~15 course catalog... honestly, it's more an experiment for us to see what we can do efficiently as a team before potentially biting off a larger acquisition in the future

We don't need the capital since we are cash flow positive -- the question that intrigues me is does taking some capital off the table (~$2-3m?) across a few thousand members help us grow faster by boosting engagement + business opportunities for our training?

That's what I'm thinking.

Patrick

As someone who's been on the site awhile now I'd definitely be interested...although I wouldn't be able to get a large amount, more so just a small slice to diversify myself more. Only concern I would have, and I think some others brought this up, is liquidity.

Sounds like you just learnt what diversification and liquidity mean in your FIN100 class

Be honest.

Which user are you hiring to be your independent IPO advisor?

I hope it's Richard.3. Maybe that explains his recent absence.

And the books are being audited by theaccountingmajor

I’d take 50 shares if they’re under $20/share. Ready to throw my whole expendable bank account at it. Gonna ride this to a HBS acceptance once WSO gets listed on NASDAQ

I would be interested - obviously prefer the sound of Tier 2 especially if talking a $10k+ type investment but am not familiar with how much additional cost burden/headcount that would require. Agree- some contemplation of cash return whether by dividend or a credible exit strategy would be helpful too.

Agree with this ^. I’d buy as much as you’d let me

yeah, makes sense... I'll do more research and talk to a lawyer about the associated costs of each.

Not sure what the financials are, but definitely could sell to a SPAC if you wanted. Question would be on the size of the SPAC. The sub $200 million SPACs are complete jokes of management teams so you aren't going to get any real value from them. Raising a PIPE is a whole other thing if you wanted incremental capital.

All SPACs are jokes. The current SPAC universe market cap is $113bn. Of that, $23bn is embedded sponsor compensation.

YOLO

Going long on this stuff

Can anyone think of a comparable situation to this? I know Reddit had some seed rounds, but I don’t think there are any plans for them to IPO or anything soon?

*deleted

I honestly didn’t think WSO would need outside money considering how strong the community is.

Private placements might also work I am sure many users here are either accredited or sophisticated

yeah, we don't....

See below.

This idea of a Reg A+ is most interesting to me for 2 reasons:

1. The potential increase in engagement from members that are investors -- this is both in the forums and potentially helping us with introductions to grow our corporate side

2. Having some additional capital available should an interesting related acquisition present itself. We will (likely) be making our first (tiny) acquisition (under $50k) in January 2021 to acquire a site with about a ~15 course catalog... honestly, it's more an experiment for us to see what we can do efficiently as a team before potentially biting off a larger acquisition in the future

We don't need the capital since we are cash flow positive -- the question that intrigues me is does taking some capital off the table (~$2-3m?) across a few thousand members help us grow faster by boosting engagement + business opportunities for our training?

That's what I'm thinking.

Patrick

Kudos to you, man! It feels great to see the platform's growth. How do you plan to position the company in the long run - are you a social media platform with network effects or a training company with an extensive base of prospective customers? Just curious.

I am sure you have already received a ton of wisdom on this move. Did you consider an ICO? I know most of them are shams. But given the strong community that you already have, I don't think it's a crazy idea.

Once again - Cheers to your growth!

Great question! Honestly, for the financial viability of the business, I think the play long term is to drive the financial growth of the business by focusing more on our training and online course business. However, the core of WSO is and will always be the community. We think one of the main reasons we were able to make awesome courses in the first place was because of the community (and the WSO Mentor network) -- so we can't lose focus on that and plan to continue growing that side as well.

You can think of the community is what draws new members in and our courses/training as the primary way we afford to make the platform better.

Also, an ICO could be very cool, especially since we already have the idea of virtual currency with Silver Bananas :-) The issue is I have no idea how we'd pull that off and if it would be worth the headache...

I've been a member here with a few various accounts for the past 5 years or so now. I believe this is a worthwhile endeavor to pursue, Patrick. This would bring more quality content being posted on WSO, while increasing the user-based of the website itself (which means more revenue).

I'd happily purchase a stake in the venture if possible.

yup, that's the idea...I could see it being a net positive...I'm just scared of Tier 2 and annual audited financials (for the admin and $ burden).

This idea of a Reg A+ is most interesting to me for 2 reasons:

1. The potential increase in engagement from members that are investors -- this is both in the forums and potentially helping us with introductions to grow our corporate side

2. Having some additional capital available should an interesting related acquisition present itself. We will (likely) be making our first (tiny) acquisition (under $50k) in January 2021 to acquire a site with about a ~15 course catalog... honestly, it's more an experiment for us to see what we can do efficiently as a team before potentially biting off a larger acquisition in the future

We don't need the capital since we are cash flow positive -- the question that intrigues me is does taking some capital off the table (~$2-3m?) across a few thousand members help us grow faster by boosting engagement + business opportunities for our training?

That's what I'm thinking.

Patrick

Will you be on the blockchain?

This shit has probably resulting in more than 5-10k in financial gains for me - happy to throw that back into the site. It’s a good idea.

Would definitely invest.. echoing an above poster that some indication of a future exit plan would be appreciated though

yeah, dropping in below what I wrote to some comments above. As for an exit plan, I think a sale to a strategic would make the most sense, but I'd love the option to also just pay out dividends so we never feel forced to sell/rush into the wrong deal, etc.

This idea of a Reg A+ is most interesting to me for 2 reasons:

1. The potential increase in engagement from members that are investors -- this is both in the forums and potentially helping us with introductions to grow our corporate side

2. Having some additional capital available should an interesting related acquisition present itself. We will (likely) be making our first (tiny) acquisition (under $50k) in January 2021 to acquire a site with about a ~15 course catalog... honestly, it's more an experiment for us to see what we can do efficiently as a team before potentially biting off a larger acquisition in the future

We don't need the capital since we are cash flow positive -- the question that intrigues me is does taking some capital off the table (~$2-3m?) across a few thousand members help us grow faster by boosting engagement + business opportunities for our training?

That's what I'm thinking.

Patrick

Sounds like something I'd be interested in. Just curious as to what you'll do with the cash since you said WSO doesn't really need it.

I am curious about the long term strategic vision of WSO. Do you see the growth as being contained within the finance vertical i.e. more course offerings, integration with colleges/IB clubs, events, bootcamps, etc.? Or is WSO going to expand to by creating or acquiring the "WSO" of tech/law/medicine/engineering/elite military/etc and becoming more of a general professional advice/networking platform?

Honestly, this is exactly what I was thinking. I'm not sure a general professional advice/networking platform would be the best since it would require the website to sacrifice the level of detail that it provides or it might just be too overwhelming (too many subforums). I think creating a series of completely different websites of some sort would be the best option. We already have WSO, but there could be like a SVO for Silicon Valley, and other such forums for the different careers. If they all have their own communities and unique subforums, the concept could really blow up.

Yeah, you articulated it better than I did. I was thinking about it like the company becomes something like Oasis Group (dumb) which manages the family or network of "white collar" oasis-branded sites. I think those other sites would have to be acquired, however, as a community like WSO really needs to be organic and would be challenging to manufacture.

Have you looked into doing so via a SPAC?

I'm twitchy about it as an investor, but as a seller it might be worth floating a gamble. I'm not sure I can legally invest, particularly after having seen this, but I've looked into the funding vehicle for building a fund around.

The $0.05 version of it is that the company goes public without a business, standard IPO, etc, and then buys a private company and 'becomes' the private company as a public entity. From a founder perspective its worth a thought. (from an investor perspective, we were scraping the bottom of the barrel for funds we could add SPACs to)

If this sounds good, consult a lawyer for full-price legal advice. I know some good names, but I don't have any ins to get you discounts.

I assume a SPAC would be super high legal fees and ongoing reporting requirements, even though it would be tempting and would give investors liquidity (obviously a good thing).

I'm going with the basic assumption that you want to end up listed on an exchange, even a second rate one, as opposed to the pink-sheets. If you do a conventional IPO then you need to do roadshows, get commitments, hire an I-bank, etc. That's not cheap. The other two options are a direct listing or selling to a SPAC.

With a direct listing the shares just start trading and existing owners can sell. I presume this place isn't big enough for that. It's also risky since it's only been tried a couple times.

A Special Purpose Acquisition Company (SPAC) also known as a "Blank Check Company" basically launches and IPOs with no business, which makes disclosure simpler. basically their business is: "We look to go out and buy a private company." There are all sorts of rules about not having a committed target (although you might privately have one in mind) and investors having the ability to bail if they think your deal is crazy, etc. but the regulatory filing is a lot easier. Afterwards the SPAC basically 'becomes' the acquired company.

All of these are greatly simplified. Ongoing expenses are similar as well, because once you're public, you're public regardless of the method of going public.

If any of these sound good to you stop getting advice off the internet and spend money on advice from a real liar. (sorry I mean lawyer) Seriously, anything you get around here should just be food for thought, and you'll need to legal up nomatter what way you choose to go. The earlier in the process the better.

yeah, I think the public route is likely out of the question based on my research and the PMs and emails I've gotten have been really helpful. Also hearing what potential investors would want to see has been interesting. I think a Reg CF makes the most sense (for our size) if I want to raise $ for the sake of having members be partial owners...just not sure if my hypothesis is correct: would someone being an investor lead to more direct introductions and help on the sales side?

Raising capital will bring a ton of growth. Ironically, investors and lawyers + auditors will actually have used this platform too lol

I think it would be a really interesting case study - are there any other online communities that have used Reg CF, for example, that subsequently saw major sales + traffic + engagement boosts?

Use the capital to make another revenue stream. It is needed for the wannabe banker market(mainly for non-targets I was in this market).

You guys already sponsor college clubs. Now create a DCF, LBO competition and make participants put in $50 ($100 per team of 3? or a total club fee of $600, I'm just saying #'s but you get the point). Now once a team registers:

I like this because as a non-target kid I had NOTHING like this at my school but my friends from a target school had these types of competitions 3x a year. By the end of their freshman year, they have competed in at least 1 now that looks good on a resume. Now non-targets can say "Hey, I got 1st place in WSO DCF competition". that can be on a ton of resumes. Everyone will hear your name. Especially in the nontarget world where they go to this site for answers rather than others at their school.

This model is also cheap a lot of build upfront but then almost nothing changes except for a company name and some #'s. Make there a deal if you buy our guides you get one free entry to the yearly competition. If it gets too competitive make it regional, super flexible. Gives you one more thing to trap students into the WSO guides over other guides. There aren't any national competitions for the students except for the CFA one.

I think the hardest part would be finding interested schools but you already have a massive list of partnerships with school clubs. Team up with companies to sponsor prizes and you keep the entry fee... Just a thought.....

Probably not the best place to put this thought but if you "IPO" now you have additional capital to market yourself while also making some $$

please excuse any typos I wrote this on a phone and just sent it. sorry!

Really enjoy the site but as an investor, I would need the following:

1. A good growth path and a reason for the capital raise (acquisition, new market expansion, etc.)

2. If there is no major growth plan, then offer a high dividend that allows one to participate in those steady cash flows.

Interesting stuff...keep us updated.

What if we don't need the capital for our growth plan and want to raise funds because we think having members as investors will help us grow faster? not just the courses B2C, but corporate training specifically, etc...

For example, let's say hypothetically we raised $2m in a Reg CF but did it on a platform like Start Engine that is supposedly opening a secondary market to trade out of the position. That I think means #1 we could potentially have ~1,000+ WSO advocates (many who work in finance or will soon) to help us get some meaningful YOY growth #2 the reporting requirements wouldn't be too onerous and #3 investors would be able to trade out of the position on a secondary market giving liquidity... pretty interesting option I think.

@WallStreetOasis.com

Sent you a PM for a potential contact

Thank you!

Come on man just SPAC it ;)

The fact that I was neither the first nor last person to say SPAC makes me very happy about my recommendation to management re. building a SPAC fund. (you can guess what it was at your leisure. No I'm not telling)

Interested.

in spirit, I'd be interested, but in practice, the compliance hurdles aren't worth it for me

kudos to you Patrick on having an amazing business

booooooooo - with close to 40k bananas, you should be the lead investor ;) maybe we'll just do an ICO so all those silver bananas you've collected will suddenly be worth millions of $s. ha!

What is your LTV/CAC? This is a key threshold question for me. Tx.

Why not a DPO/Direct Listing?

Nasdaq offers a good option on this and is going to a lot cheaper than what NYSE offers in this area.

https://www.nasdaq.com/solutions/direct-listings#:~:text=A%20direct%20listing%20allows%20companies,Initial%20Public%20Offering%20(IPO).

Idk if this is what you're looking for. But I could probably help connect to some people who do this.

He's talking about doing more of a Reg D / Private Placement type of thing. I'm not sure WSO is NASDAQ material quite yet haha

you are correct and I'm not offended ;)

My answer to 1 is yes, and for the rest of the questions, I can probably put you in touch with people who will be able to advise (at fair market rates). I'll work on it.

Another option you might want to consider is going the route of tokenization or "ICO" (that term has gotten a bad rap, but imo it's like blaming the gun for a murder). We already have bananas which could be a type of currency like what Reddit is doing with karma. I'm admittedly not an expert, but in principle it may get you and WSO to the same place with a lot less headache. But I get that crypto is a love-or-hate thing, so it's probably a long shot. Just wanted to throw it out there.

The traditional route is probably more feasible and conventional, so I'll send some emails. Good idea with this.

Shit I would, this website has been amazing for getting information

Maybe get some growth equity?

I looked at a similar business, extremely lean & profitable. The biggest concern was visibility of future revenue, market size and competition. It's great that you're making $ for yourself. But it's hard to prove to investors that you'd be making money for them over the long-term. But the challenge is that if you can't prove that with either hard demand figures or a subscription model w/ recurring revenue, you won't get a valuation that makes sense to you. I think there's a post that mentioned your monthly revenue of $140K. I thought it was much higher (maybe it is today, or maybe I just overestimate the finance world that we live in) Protecting the contents could also be tough. Just some random observations that might not be relevant..

I would be interested

I’m in.

Patrick, I invested in the Fundrise iPO. Any thoughts on what they offer their users? Their offering circular: https://fundrise.com/oc#rega-0

I would be interested in investing.

Also interested

Beatae odio occaecati ut voluptates voluptatem perspiciatis. Molestiae eos voluptas possimus consequatur amet explicabo. Repudiandae ipsam nostrum minus aperiam ab est.

Aliquam iure cum neque id similique. Dolorem sed exercitationem et distinctio. Iste aut sunt est et molestiae. Qui odit quaerat ducimus consequuntur quia sit odit. Sunt voluptas assumenda quibusdam qui et. Officia aliquam quam dolorem.

Quo sequi voluptatem officiis. Nulla autem veniam blanditiis corporis. Modi est fuga iusto dolore. Rerum omnis autem quia itaque tenetur. Aliquam aut voluptatem autem aliquid. Fugiat earum ducimus inventore repudiandae assumenda. Expedita sed dolor ea exercitationem deleniti atque.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Ea eaque qui distinctio quo aut quidem. Esse sapiente quo officia pariatur commodi reprehenderit ducimus. Provident voluptatem modi impedit eum suscipit et.

Itaque maiores enim excepturi quam. Corporis non ut quasi laudantium voluptate quos recusandae. Perspiciatis corrupti at ipsa necessitatibus.

Amet non sit veritatis facere nemo sit. Molestiae possimus qui voluptatem natus omnis. Quasi fugit in inventore ut sint. Doloribus sit autem fugiat dolor et.

Quasi eius vel voluptas mollitia dignissimos rerum odit et. Aut ex et quia ipsum non. Laudantium dolor placeat debitis corporis ratione est rerum velit.

Dolore ea illum omnis hic exercitationem. Minus delectus eos sit ducimus. Est omnis ex magni vel. Quos recusandae cupiditate blanditiis consequatur in similique.

Et a provident eaque illum placeat ut earum. Adipisci eius aut minus est est neque repellendus. Et id aliquam reprehenderit optio. Eos dolorem fuga nam ducimus quo. Aut cupiditate aut alias omnis sint aliquid non. Praesentium corporis quod nulla nemo molestiae aperiam eum. Sint ad esse consequatur itaque.

Aut blanditiis ut dolor qui id. Rerum laudantium tenetur dolores ut porro nesciunt. Officia aut eos libero quis. Nihil voluptas nostrum laboriosam consequatur qui.

Eum officiis aspernatur sed sed vel sit. Animi sit porro commodi sed pariatur nesciunt. Eos impedit distinctio earum natus quod.

Ipsum aut vel et aut velit. Qui esse aliquid tempore. Iusto odit commodi eaque autem quam. Debitis eligendi est debitis necessitatibus. Temporibus sed velit expedita molestias illo corporis.

Dignissimos autem beatae mollitia rerum repudiandae et nobis eos. Nulla consequatur non et quia tenetur nostrum et quod. Eos voluptatem incidunt enim modi. Labore dolorem et optio non.