RIP Melvin Capital

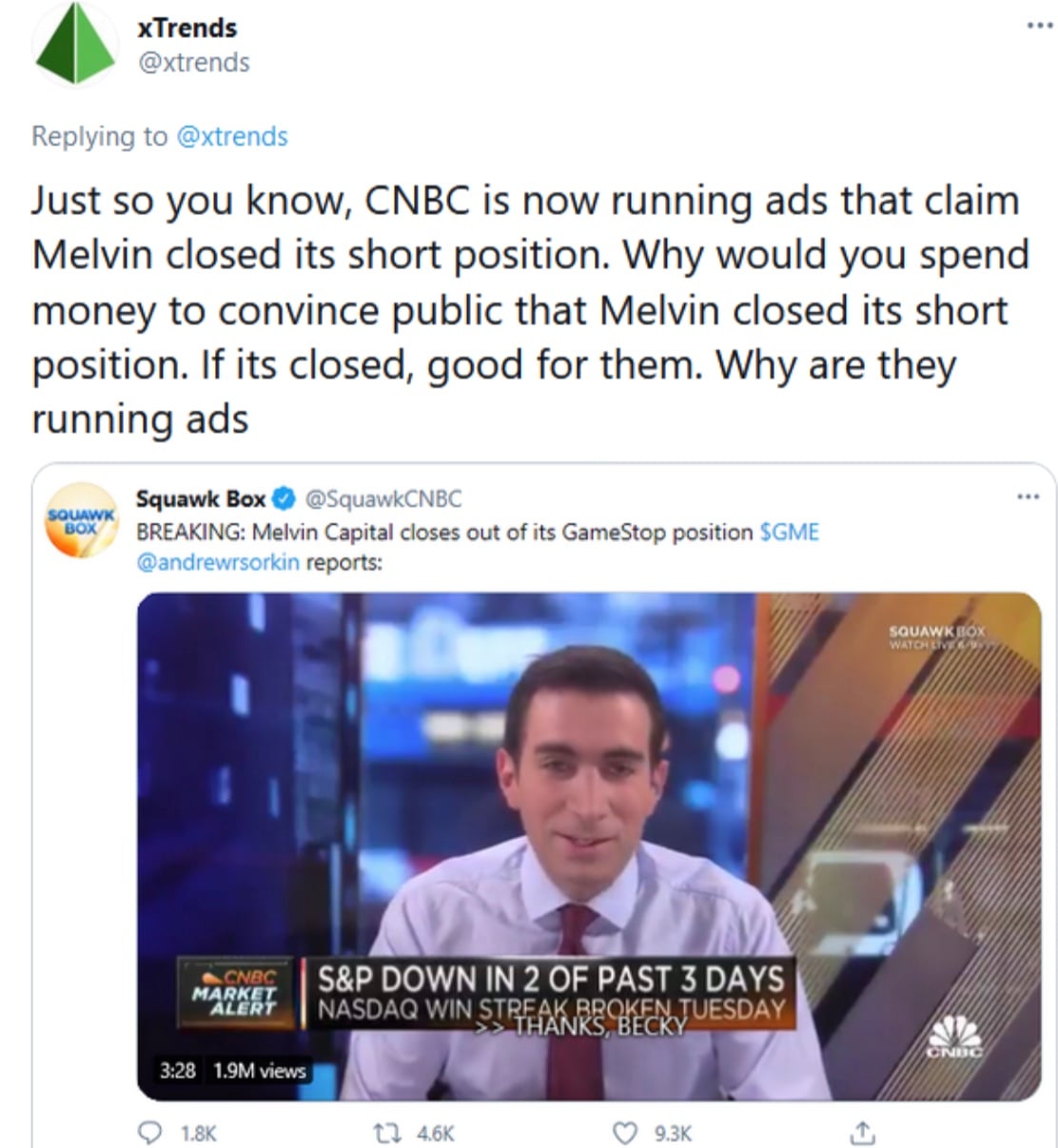

To all those who work at Melvin, I hate to say it but you might want to start dusting off the old resume. Melvin has literally and unequivocally said in the past that they do not comment on positions. So what does this mean? They stand to lose more from the MOASS than they do from being found guilty about lying on their position. They exited? Show me an official report. Hope you have your popcorn ready for next week

I do not see how Melvin didn't see this coming. Stuff like this has happened in the past just not to this level. They pay millions upon millions per year for "research" and couldn't monitor a fucking reddit forum half their analyst class probably knew about.

Survival of the fittest lol

I think it just boils down to pure arrogance. “These people don’t have the power to stop us”

Yeah I think they essentially concluded that ... that many people won't pull the trigger.......... they thought wrong - lol - but to give them credit, something organized like this is one of the first of its kind.

"Adaptive Market Hypothesis" by Dr. Andrew Lo at MIT. Great read.

Markets aren't efficient. They're evolutionary.

My opinion is they never thought that millions of people on the internet would gang up on their short positions. The Reddit post was started last year on GME short positions and didn’t gain popularity on wsb until last week. I think what we are seeing is a historic moment in the markets where the people unite together to basically take down hedge funds plan. I am excited to see what goes down next week, it’s going to be ugly for either side of Institutional or retail depending on what illegal shit goes on, who knows at this point.

Well we know that sadly there WILL be retail bag holders who were waiting for the price to hit 6,942.0, just a question of what will happen to the hedge funds

That is what worries me in terms of the overall market. Their shorted positions are stupid high and so many top banks are also involved in these positions. We could see the entire market go red.

Now he's gonna work on the bankruptcy of his own firm

This kid is meme'ing on them. He doesn't work there.

Noticed that when I asked myself what a nontarget was doing there

hahhahaahahhahaaha

Let ‘em burn

Shouldn't have been so exposed, the survivors will learn. Anyway, so what color should my lamborghini be guys?

You mean LamborghiniS right

lime green murcielago

license plate:

TNDEMAN or GME

Having a completely unhedged short position is imo dumb. Your losses are uncapped. People counter that point by saying not really in no scenario would your losses ever balloon like that, our risk models say it’s a 6 sigma event blah blah.

Except 6 sigma events seem to happen every 3rd year

F

Dolorem nihil beatae autem est. Vero dolorem adipisci commodi ratione. Nemo non voluptas ea consequatur. Atque ad et eius dolor. Sunt voluptatem quibusdam at sit.

Rerum unde quae rerum architecto quos ex sit. Consequatur sed accusantium ut illo ut consequatur et. Vel fugit ut quaerat ex quasi. Voluptatum aperiam laudantium quaerat quos in quia. Tempora non repellendus libero cupiditate.

Et quasi porro minus nisi. Autem non tempore tempora et necessitatibus. Nostrum dolorem dicta et aliquid enim.

Eaque laborum voluptatem id occaecati asperiores. Non optio aut sit quibusdam. Adipisci totam quas modi et. Earum quae ad totam ut ipsam aperiam quos nulla. Consequatur ipsum maxime nemo unde est. Perspiciatis occaecati beatae quia nihil.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...