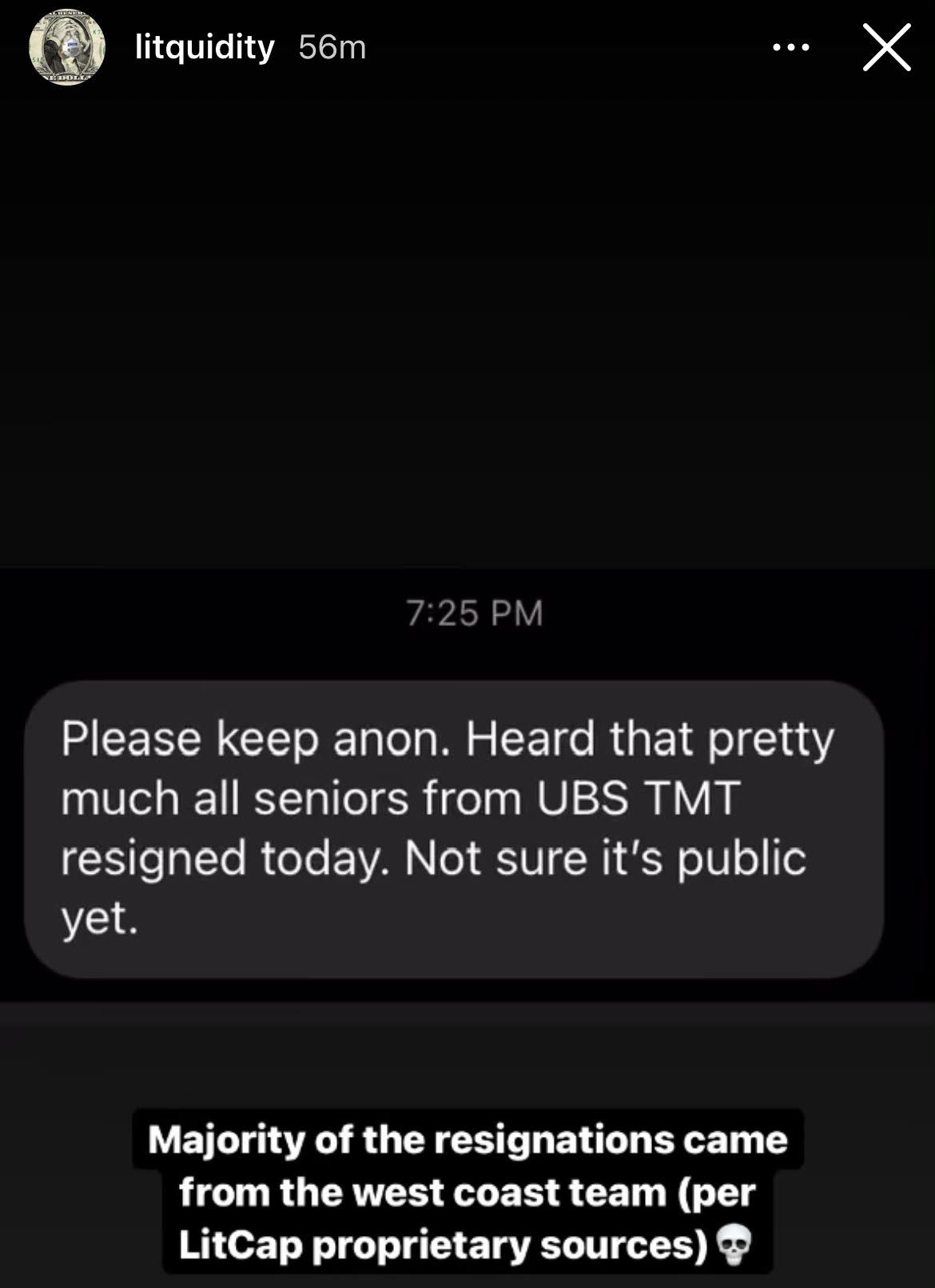

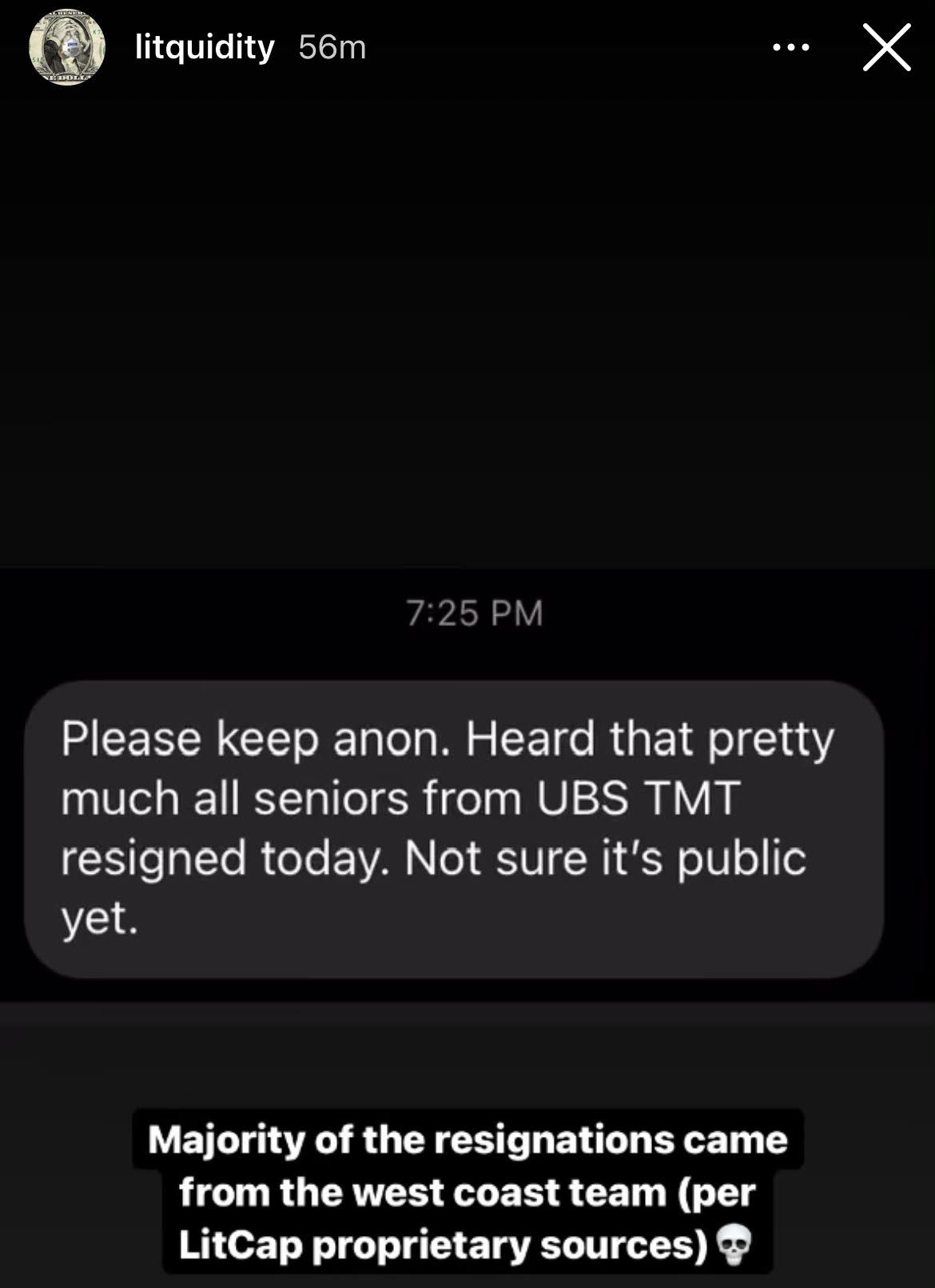

Senior resignations at UBS TMT?

Saw on litquidity. Can anyone confirm/add color about what might have gone down at UBS TMT group.

Saw on litquidity. Can anyone confirm/add color about what might have gone down at UBS TMT group.

| +120 | Is my life over after not getting GS? | 30 | 6m | |

| +70 | Best IB group on the Street | 34 | 23m | |

| +66 | Thoughts and tips on how to speak like an investment banker. | 25 | 18h | |

| +58 | BIG FOUR ARE PARADISE | 15 | 18h | |

| +48 | Tell me one good reason why Jefferies isn’t going to be a top bank in the next 5 years | 23 | 10h | |

| +41 | BEING WHITEGIRL IS PARADISE | 11 | 49m | |

| +36 | UBS Outlook | 28 | 1d | |

| +35 | How to deal with egotistical team? | 6 | 3d | |

| +33 | Highest Paid Bankers in Toronto? | 51 | 15h | |

| +29 | Are you “less ambitious” for having long term goals outside of NYC | 13 | 1h |

Career Resources

Litquidity becoming a legit source wow lmAo.

Also heard it was accurate from someone who’s living with an analyst at the bank, so I can confirm

i'm guessing they are all joining a boutique. But which?

might be forming their own boutique?

Seems unlikely they are joining another boutique just cuz that will be too many cooks in the kitchen for an existing boutique.

What if it is one that is weak in the space like PJT/Gugg/GHL?

Working at ubs is bad enough. Working at a boutique of ex ubs seniors? Kill me

I think you might have described Moelis (no offense to folks @ MOE) lol. Was founded by a bunch of ex-UBS (who were ex-DLJ) folks.

Blair Effron was also UBS.

haha yup Ken, Navid, and Jeff all worked at UBS back in the day

LionTree ex-UBS as well. Place used to be a powerhouse.

yea imagine working for no-name boutiques like Centerview and Moelis

Holy shit that was quick +1 legit

Does anyone know where they're going?

svb leerink

Tech is hot - BofA also loosing 3 MDs to CVP: https://www.bloomberg.com/news/articles/2021-05-13/centerview-is-said-t…

Rough... the SF TMT juniors are already getting worked hard, so hope they're adequately protected from this

are they just jobless now?

All MDs and most EDs from SF Tech are joining Silicon Valley Bank to start its IB business. Source: I work there

Oh wow

When I spoke with some of their senior folks earlier this year, they mentioned that the TMT group and tech specifically is doing super well. It's a $250mm revenue business for UBS, with a focus on UMM sponsor sell-sides in $1bn - $5bn range. Guess that $250mm is gonna drop to like $100mm soon...

I have 2 friends at SVB in their LevFin group and can confirm this is the case.

Dont they already have an IB practice in SVB Leerink? why do you say start?

They have a healthcare group and didn’t do tech before. So they are starting the tech group at SVB leerink.

Do you know if they are doing this through the Leerink platform or is it going to be it's own separate thing? SVB has tried to have an investment bank in the past with Alliant (or something that sounds like that) before they did Leerink, and Leerink has always been healthcare focused. This play makes sense to me to give the same level of support to clients in their tech venture debt pipeline that they gave to the lifesci side with the Leerink acquisition.

NVM read more of the comments and some stuff on google. Wild to see Leerink branching out from healthcare, which is all they've done for like 25 years. I know some guys there and really like them, so hope they succeed.

Most likely will be under the SVBL name. We talked about this one the past town hall, and we'll be making moves into the spaces this year.

Does anyone know what’ll happen to the remaining group now? I figure they are like headless chickens now.

Seems like also a talent drain at CS, article in WSJ

For those interested: https://www.wsj.com/articles/credit-suisse-faces-banker-talent-drain-af…

10+ MDs including soon to be group heads heading to Barclays, BofA, Goldman, PWP, Citi, and Jefferies

.

Hiring freeze across the bank. F in the chat

Hiring freeze across UBS because of this?

Announced job cuts across all departments a few days ago. Not sure if it's related. I was in a different coverage group's process and was told it's bank-wide.

That kinda blows, was in the interview process with them and guessing that’s why internal recruiter has been relatively silent since the last round..

Very funny but just last month, the head of the group sent an email about the variety of things they're doing to improve culture and hours like more than doubling the team, getting more resources abroad, etc. 1-2 of the EDs did not leave but I can bet you they already have plans elsewhere. HR said no junior jobs are at risk, but everyone is thinking they'll most likely be sent to a different coverage group.

UBS West Coast TMT has a curse or something. For the last 20ish years, the group has kept rising from the dead and dying again three different times. First death was during the dot com bubble in 2000. Then, in 2006ish, it came back, but then died again as the former bankers formed what is now Moelis (UBS LA). It came back for the third time in 2016-2017 with most of the bankers lateraling from Jefferies and RBC. And now it's dead again in 2021. I'm just going to put this out there for the future, but this group is going to come back probably in the mid to late 2020's and then die again by the early 2030's.

Btw, TMT is UBS's most profitable group by far so this is really bad for the IB side. It was the only IB group at the bank to not have a hiring freeze all of last year.

For anyone in the group who wants to start a new job, this is the perfect opportunity, especially if you're bottom bucket. You have a very valid excuse to leave your bank and do whatever the heck you want to do with your life.

Thanks for the insights, +1 SBed. Will UBS not have a west-coast TMT group anymore?

Considering the entire senior team left, and analysts to VPs are leaving every other week if not every week, I think the team is done. The thing is that juniors were already leaving so now, even the guys who liked banking because of the senior people they worked have no incentive to stay. Like I said, UBS West Coast is cursed.

Either way, this is going to be a great story to tell for the rest of my life haha.

Most profitable *coverage* group. Should clarify UBS is currently extremely sponsor driven. Sponsors/LF is still by far the largest chunk of the fees bank-wide, albeit sometimes hard to untangle fees between the sponsors group and the coverage groups given some co-dependence.

Everything else 100% accurate though. Its a bummer about the shakeup because UBS TMT was on fire lately.

Sure, I meant coverage group. Either way, very solid group

What does this really mean for juniors—do you expect a lot of them to jump ship?

They were already jumping ship like every other week if not more so now why should anyone stay? HR said jobs are not at risk, but do you really think that HR is somehow going to hire 10 new MDs and 5 EDs and everything will be back to normal in a month? Hiring senior people takes a lot of time given they're paid the most so the firm wants to make sure they hired the right people.

This is a bit bit though...levfin and fig were two of the most profitable groups, both had major hiring sprees (believe a few new came to levfin and the whole insurance / insurtech practice was added to fig). TMT was kind of just ok.

I don't know where you're hearing that FIG was more profitable than TMT. Analysts were asking for an updated creds page every couple weeks given how often we were closing deals. TMT and Industrials bring in the most revenue out of any coverage group. TMT just has half the people that Industrials does; hence, the most profitable coverage group. FIG is still doing great though.

Everyone is leaving ubs its crazy.

My group keeps saying they are hiring to alleviate staffing pressure, but people keep quitting so it doesn't actually improve anything (we hired like 8 laterals and 8 have left)

Now more are leaving. I'm trying to leave to.

Why are so many people leaving UBS? Restructuring and lower bonuses?

In an industry group at UBS and can confirm everyone wants to quit this job and will do so at the first opportunity. There's obviously a reason why people want to leave.

Big loss though - as much as Analysts & Associates are replaceable it still takes time to invest in developing them to so they know the nuances of working with certain people, know how to be efficient, know where all the resources are, etc. Especially as top performing Analysts & Associates quit and have to spend time training new joiners. But in an industry where everyone's goals are tied to themselves and no real broader mission or culture, what else do you expect?

It's unfortunate, really. From my interviews it sounded like they wanted people that would stick around. It's too bad because even if people want to stick around, people around them leaving and the firm failing makes life miserable no matter how much you like the group or want to stay.

Why are so many people leaving UBS? It isn’t rocket science. If you treat people like garbage, run a mismanaged operation (both group and firm wide) and then don’t pay - people will leave.

Think about it, these are facts:

UBS is laying employees off when the bank just had a great year and banks across Wall Street and crushing. To me, this makes zero sense and signals an operation in decline when everyone else around them is growing and hiring.

Despite being one of their “most profitable groups” the brain trust of their TMT group just all left. Do you think if the MDs got paid and were treated at least reasonably well they would have ALL jumped? I doubt that. They definitely got more $ from SVB, but it’s pretty clear that something was amiss from a senior level perspective there for just about every single one to leave.

The above didn’t mention that both their heads of Media and Telecom resigned simultaneously about two years ago. Plus their current head of Media resigned this year (I’m told he went back to his former bank). Again, it’s not rocket science to see why. The place is a circus and the TMT team is a never-ending shitshow.

My current group just interviewed a UBS ED (i.e. Director) for a VP position (step down). It seems people are desperate to get out of UBS.

Honestly, I’d rather be at DB right now than UBS. At least they are growing.

When you pay peanuts, you get monkeys. When you hire clowns, you get a circus.

Did the ED get the VP job?

Hiring decision hasn’t been made, but looks unlikely

UBS has been such a mess for quite a while now, management doesn’t know what they’re doing. One of my best friend’s dad was like vice chairman or some shit, had been at the bank for 25 years and was like top 5 guy in the firm. He got fired cuz his boss wanted to hire his own buddy to take his job. Talk about loyalty and getting f*cked in the ass.

Lol did he go to another bank?

Geez royally fucked. So sad definitely not somewhere I would want to work as a senior MD smh.

Probably leaving to finally get the yoga sessions elsewhere

HAHAH for real. As an ex-UBS analyst who just left for PE, I can tell you the only lifestyle imrovement was getting free headspace app...which is not an improvement. UBS decided to treat their analysts like shit and keep a toxic environment and this is what happens.

Ex sunt voluptatibus et delectus. Molestias omnis aut quas ut. Est explicabo quo est rerum non rem.

Adipisci itaque doloremque omnis impedit. Doloribus iusto sit iusto saepe atque. Nihil asperiores itaque quasi ut enim aperiam.

Voluptatem omnis eos explicabo. Dignissimos error aut soluta rerum reprehenderit fugit suscipit aliquid. Perferendis nobis est id quidem ex minus id ratione. Voluptate dicta ducimus voluptatem fugiat natus nam voluptate. Accusantium quia quibusdam iusto. Nulla nihil rerum nemo commodi.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Sunt voluptate et animi quae esse et. Et et saepe in aut aut nemo tenetur. Rem quis autem odio eum dignissimos error et adipisci. Alias assumenda corrupti modi est quia odio ea.

Consectetur velit qui non quo. Est eaque aut ut nisi nisi error voluptas ullam. Est hic incidunt id blanditiis iste aperiam qui. Temporibus nisi dolores repudiandae aliquid sequi ex. At voluptates id quis repellat nemo totam nostrum. Perspiciatis numquam qui neque culpa dolorem. Quibusdam animi beatae totam non ab non itaque.

Fugiat qui iste asperiores accusantium ullam sit atque. Non vitae enim est quam omnis consectetur doloremque repellat.

Sit nostrum et molestiae sunt tempora ut. Ratione doloremque ea architecto amet inventore nesciunt excepturi. Voluptates ullam molestiae sed est repudiandae et tempora. Unde voluptatum est vitae est. Sit ratione illum saepe iusto rerum a quis blanditiis. Omnis dolorem tempora corporis non veniam cum. Ut quas nemo autem sint et laboriosam voluptate.

Eveniet dignissimos nobis quod ut totam qui minus. Magnam debitis esse ducimus inventore at possimus. Facilis ea qui quaerat autem. Id repudiandae sequi sit quod. Eaque vitae nisi dolorem sint sint corporis aliquid.

Molestiae ea ut voluptatibus laborum voluptas quas doloremque. Molestiae sed repudiandae et enim molestias reprehenderit laboriosam reiciendis.