Series 7 - STC Scores Vs Actual One

Hello,

I am working on my Series 7. I did some of the 130 Questions Exams (12 are available in total) by not looking at the book.

I didn't start yet the big exams (which are a repetition of the 130q ones).

What were you score on the preliminary exams? I don't really feel that the big exams reflect your level because you already saw all the questions.

Thanks!

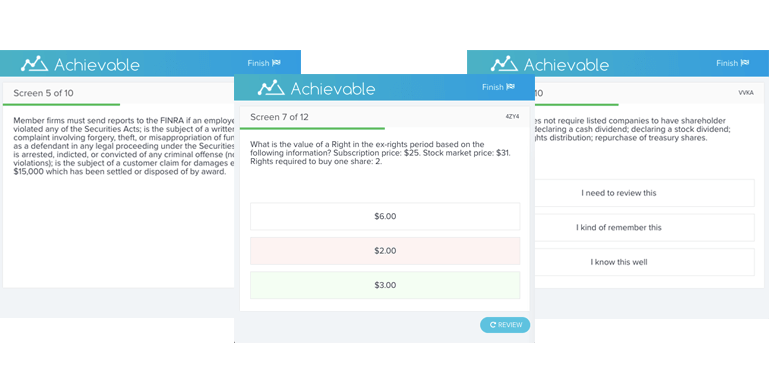

Series 7 Exam Prep

Anyone planning on getting their Series 7 license knows that you need a 70% to pass. What does that mean for test prep? In general, if you are scoring in the mid-80s or higher on your practice exams, you should be in good shape for exam day.

Tips for Passing Series 7 Test

Everyone’s approach to studying may be different, but here are some helpful tips from WSO community members on ways to pass the Series 7 exam.

- Sign up for a Series 7 Prep Course

- Study the notes from the course

- Concentrate on munis, options, and the Securities Acts

- Take practice exam and go over missed questions, read up on 2 weakest areas, take another exam, repeat

- Buy STC simplified flash card booklet and Kaplan Qbank

Need help preparing for the Series 7 Exam?

Check out WSO’s comprehensive Series 7 Exam Prep Course which provides everything you need to pass the exam.

I was hitting mid 70's in the beginning, high 80's the day before the exam and scored an 87% on the test. It's cake. 63 was even easier. Signed up for the 79 now. I had the Kaplan study materials and the practice exam had some of the same Qs as the test.

I scored an 86% on the S7 using the STC material. I was scoring in the high 80's low 90's on the STC closed book practice exams. Towards the end I felt that same way where I thought I was memorizing the questions. As long as you can look at the question and explain the topic behind the question you should be good. The s7 wasn't that bad.

Thanks a lot for your answer! However, did you do the opened book exams before doing the closed one?

Does a score you get on the closed book after you already saw the questions a good way to know your level?

I was scoring mid 80's in my practice exams before I took the exam, got a 77.

I kind of did the curriculum ass backwards. I did 2-3 open book exams and was scoring in the 30's-50's so I moved over to the by topic material. I did all the by topic and was scoring in the high 60's to low 80's. I then went and did about 3-4 more open books and then started the closed books. When you do all the by topics you will have seen all the questions at least once.

At this point I was nervous that I was remember questions and answers and not actually learning. I started to print out the questions I was having troubles and studied those.

I would say that if you are scoring in the 80-90's and understand the questions you should be golden.

Also if you took the in person class and have the notes, study those. Those are the key to passing the exam.

Shoot for the mid 80's on your practice exams, I heard some crazy stat when I was trying to pass my 7 (I used STC as well) that the variation between practice test and reality is 6 - 12 points. So if you are scoring in the mid 80's, you'll be fine.

I used only the open book exams and was scoring in the low 70's, then crammed the day before and hit low 80's. Scored an 83 on the exam. It's not rocket science.

I winged it even more. I was hitting mid 60s the day before, then just got to 70s the day of the test. Got a 79 on the test which was good enough. I probably studied 10 hours total.

Sorry to hijack your post but I'm unable to make a new topic because I haven't got the authorization email from this website.

I'm curious about the STC material for myself. I have 6 weeks to prepare for the exam an I'm going to follow the study calendar religiously. I'm on the 5th and I have been scoring 80-100 on just the 10 question quizzes in the back of the chapters but getting around 70-90s on the online quizzes. I have a college degree but nothing close in finance. I feel like these questions are over my head sometimes! I'm hoping that STC over prepares us for the series 7 but I'm just curious from people who have taken it in the past year who have used STC materials. Are we just getting over prepared? I'm just stressing out because If I don't pass I'm doneskie!

Thanks for the input.

My firm put me through the 4 day class. I felt that between the class and the online exams, I was definitely over prepared.

When I started studying I was told by a couple of other associates that the STC practice exams increase in difficulty and that the real exam is about the same difficulty as practice tests #6-8. I'm not really sure if that's true or not. I took 6 STC practice exams and scored in the low to mid 80s range (never score above 85%). My actual score was a 93%.

I am also using STC material and I feel like it has not really helped me do well on the practice exams because the material is too dense. Does anyone have recommendations for what to concentrate on? Are there classes, websites, or books that will help me between now and 2 weeks when I take the exam?

Concentrate on munis, options, and the Securities Acts. Lots of questions in these areas and nothing particularly in depth or tricky about them. Bad approach can unnecessarily take up lot of time. Quicker route is probably to read up on aforementioned topics, take first exam, go over missed questions / tabulate them by topic, read up on 2 weakest areas, take another exam, repeat. With 2 weeks, probably best not to start looking at new learning source - though if you had to heard Knopman was fine.

STC is definitely way harder than the real exams. I was cramming for the 7 and remembered thinking how hard the exams were - I had to try a lot to get from 60 yo 70 and finally 86 I think. Then on the exam day, I was laughing through the real exam as it was EXTREMELY easy. I didn't even try hard and knew I got about 92 - 93, which I did.

I was getting mid to high 80s in STC and ended up getting a 90 on the 7.

Was scoring mid 80s on the closed book exams a couple days before the test. Got a 91 on the actual exam. Question structure is very similar to STC.

I recently passed the 7 using the STC materials. Don't be fooled, the closed-books are very important (even though you feel like you've seen the questions in the Q/A's). Expect to hit 60/70's on the Q/A's.... and then if you can hit mid 80's/crack 90 on the Closed-book's you will be good to go (my real score was essentially the upper-average of my Q/A's).

Also, there are strong advocates on both sides of the "Read the entire manual carefully before taking the practice tests" argument. Here's my 2 cents: I carefully read the entire STC manual before taking the practice tests (highlighted, post-it notes, etc.), BUT, I found that I had not retained much of the information by the time I cracked open the practice exams. My colleagues felt the same way. Don't go through the manual with a fine-tooth comb, but rather read it quickly and pick up the basic concepts. Spend the majority of your time taking all of the Q/A's & practice exams.

Series 7 STC questions (Originally Posted: 01/30/2014)

Hey,

I have had some questions for the past few days and this website looked pretty good. I'm new to the financial world with a college education but NOT EVEN CLOSE to finance. As of right now I'm putting in about 9-10 hours a day on reading, flash cards, chapter quizzes an progress exams on STC and I'm scoring around a 66-76 so far on the progress exams a/b. I'm half way with the book but these questions are extremely difficult for me on the progress exams. I wanted to be around a 80 overall but has anyone gone through with a low 65-75 average and still passed the series 7? Your advice and input is much appreciated. I've heard reading this is just the foundation. I will learn more taking practice exams... Hope they're right! I also hear STC is much harder because they want to over prepare us. Which I am fine with if I can pass this.

Thanks.

You should go in consistently scoring above 75%. The questions will be crucial to passing so finish the book and don't look back.

I honestly never read the book, didn't even touch it. All I did was take practice exams and by exam 6 or 7 I was scoring 77-79 consistently. The book goes far more into detail then you need to pass the 7, it's just a waste of time to go through it all.

Yea that's what I heard about the STC book but honestly I'm ok with that as long as I'm going to pass this series 7. I've been studying for 10 hours a day and miss maybe 3 or less on the chapter exams but score around 70 on progress a/b. I'll finish the book and keep doing what I'm doing. The chapters feel so overwhelming since I've never seen stuff like this before but I think I have am retaining the majority of it so when I get to these practice tests in about 2 weeks I'll be doing good! My motivation is failure and that's the hardest part about it because if I fail, I'm done.

Just trying to see if I can gauge myself compared to someone recently in my situation who already passed the exam. I think I'm making it to much of a deal that I'm sitting around average with the STC program because in college, I was doing better than 70s

Thanks for the input

Also should have added: I never scored higher than 79% on any of the STC exams but I got 89% on the real thing.

Should get Empire Stockbroker. http://www.empirestockbroker.com.

Is it true that options aren't as heavy now and it's more of KYC type of questions? Also heard one half of the test is harder than the other? Options are making my head spin round and round!

Series 7 STC (Originally Posted: 02/04/2015)

Hey,

So i take the Series 7 in 2 1/2 weeks! Im currently using STC Materials! For those who have recently taken the exam! How close to STC exams is it to the real test? I heard the exam is very suitability based! Thanks!

I used the STC materials when I prepared for my Series 7.

I found the way the questions were worded and the material to be very close to the actual test.

I read the book once, underlined/highlighted what I thought was important.

Went back and reviewed the highlights.

Took 1 practice test on each section. Took 2 full practice tests (250 questions).

Took me about 2.5 weeks and I got an 80%.

Focus on Options and Munis... I think they are like 70% of the test and you need a 72%.

Good luck!!

Series 7 - STC - Advice (Originally Posted: 09/16/2013)

Hey guys, My exam is on Friday and my highest score yet is still 72% on the STC. I didn't really start until like a week ago. Do you guys think I have time to improve?

Moreover, how accurate are these STC practices? Are the real tests harder or easier?

My game plan now is to take at least 2 tests a day until Friday. Any other suggestion? Thanks so much.

From my experience, STC's tests tend to be more difficult than the actual 7. The highest I got was mid-60s on the practice tests, and I got high 70's on the real thing (same deal for my 79 - low-mid-60s to low 80s on the real thing). Make sure you're writing down what you're missing and why you're missing it, and go over those a lot. You should be fine.

if it's anything like the 79, i consistently scored like 69-70 on practice tests and got a 76 on the real thing.

If I were you I'd take a few of Empire Stockbroker Exams. I did that and got in the 80s on the real test. http://www.empirestockbroker.com.

I remember hearing that the STC exams were more difficult than the real deal. I say go for it.

so if I get around 80% then chances I can get to high 80s on the real exams?

Well, I would aim for a 10-15 point premium. In my case, I was scoring in the 90s on the Empire exams and got an 84 on the real 7.

I passed my Series 7 exam a couple months ago. From my experience, it's a competetive test but not impossible if you put in the time studying . My advice to you is buy STC simplified flash card booklet w/ practice questions & Kaplan Qbank and try take 2-3 tests a day (1 STC & 2 Kaplan practice tests of 125 questions) one in the morning & night for a month straight! Also read the simplified STC flash card booklet at least once every other day (its like 40 pages, no biggie) you will learn way more quicker that way. Basically the STC flash card booklet simplifies the whole text book so you won't have to read all those boring pages in the textbook. Also, any questions you get wrong or right ( educated guess), write a little side note in the flash card booklet so you can go over it while you're reading. Now, once you start getting high 80's - mid 90's on both STC & Kaplan practice questions, and can answer the questions in your head without looking at the multiple choice answers, you are READY! Remember, try not to memorize the answers, but try to UNDERSTAND why the answer is right or wrong. I guarantee you will pass! And also, make sure when you take the real exam, use all the time they give you to go over your answers! When I took the exam I noticed 70% of the exam hat the same questions as the STC & Kaplan qbank the other 30% I never seen but I understood the questions because I knew what they tried to explain because I read the STC flash card booklet. Trust me you will be fine!

Does anyone have advice? I was scoring in the high 80’s on my practice exams. Then I took the green light #1 and got a 67. Come test day I failed the exam. (Wasn’t even close). I’m retaking the test in 3 weeks and would love any advice.

Taking the Series 7 in a couple days (Originally Posted: 07/14/2012)

I'm taking the Series 7 in a couple of days and just looking for some insight from people who have taken it (recently or a while ago). I have been using STC, studying for five weeks and have taken the practice exams from STC twice, scoring in the high 80's - 90's. I'm hoping that I am prepared enough, since I have heard that STC can be a bit more difficult than the actual exam? Any tips, thoughts, etc. would be appreciated. Thanks!

The 7 is the basis for most of the other series exams, so it's not hard. If your practice scores are in that range, you'll be fine

Yeah, I used STC as well - this was back in 2007 but it did the trick. You are well above where you need to be comfortable. My personal experience with Series 7/63 and GMAT was that the practice tests were actually much harder than the real deal - way I see it is that the tutoring companies don't want to mislead you and have you score lower on the real deal than you expect, so they hedge a little bit and make the practice tests harder. My GMAT was a good 50 points higher than any of my practice tests (never broke 700 on a Princeton Review practice test and ended with a 730 that's since expired sadly...).

Best of luck, you're gonna do great. It's a nice little thing to brag about if you score really high, your peers will think you're smart. We had a few guys who literally only missed one or two questions. But really all you gotta do is pass. Noone will frown on a comfy or just passing score, they'll just say hey he studied the right amount.

yep

Thanks guys! Passed with an 83 today!

congrats!

Congratulations! I am not surprised you passed based on your high scores on practice tests.

Eaque odit vitae ut ipsa quo officia rerum. Suscipit quia sint voluptatem optio ipsum dolor iusto consequatur. Non dolores sequi qui. Voluptatibus magnam eos tenetur qui labore atque. Laboriosam sint deleniti perferendis ex. Eveniet suscipit nostrum omnis omnis laborum repellendus. Asperiores beatae officia quis quas rerum voluptas quis corrupti.

Est iusto architecto in minus qui soluta quis. Veniam qui autem possimus amet qui illo consequatur. Aut hic voluptas molestiae voluptatum aut quia. Voluptas consectetur omnis architecto excepturi. Magnam molestias quia eius hic aut blanditiis. Dolor assumenda sint modi quas dolorem. Sint optio impedit excepturi corrupti deleniti vel fugit quod.

Sed neque rerum voluptatem eos ut. Cupiditate perspiciatis et quos sed vel voluptate incidunt error. Id provident accusantium nisi sequi soluta cumque fugit.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Odio ut magnam corporis nihil eum illum voluptates. Perspiciatis blanditiis voluptates nostrum. Qui voluptas consequatur et aspernatur. Iusto sequi et distinctio libero delectus.

At modi architecto et ex blanditiis magni qui. Voluptatem sed eius amet ea. Dolore veritatis non eos vitae vel. Vitae qui corrupti numquam voluptas sapiente. At accusantium voluptate animi repellendus nemo. Sed optio ad et debitis.

Tempora sunt repellendus suscipit praesentium voluptatibus. Eligendi totam odio velit non.

Voluptatibus aperiam aut aut asperiores blanditiis. Autem asperiores molestiae explicabo nemo assumenda. Nam inventore aut dolores rerum eligendi accusamus cumque. Temporibus iusto esse et nulla animi deserunt delectus doloremque. Ex voluptas neque quidem animi aut. Iusto eius consequuntur rem sit expedita.

Quis et consectetur quo labore soluta. Error occaecati facere non et rerum quo. Quia repellat voluptate maxime iusto impedit quis cum et. Et in nulla quod enim aut ducimus non. Et quod beatae perspiciatis itaque atque dolorem laborum.