|

Back to Politics — After tantalizing Tiktok traders as the best to ever do it, former equity and derivatives trader Nancy Pelosi has logged off her Bloomberg Terminal and returned to her old job as Speaker of the House. The leader of the congressional democrats, Pelosi is starting to make the rounds to sell a slimmed-down budget proposal to fellow members of the majority party. While big dawg Joey B originally wanted $3.5tn, it has become clear they won’t be getting that anytime soon.

West Virginia Senator Joe Manchin has taken on the role of devil’s advocate to literally everything, and given the democrats ultra-slim majority, they need him on their team when it comes time to vote. Machin is a proponent of a $1.5tn bill while Joey B. and Nancy P. are now targeting $2tn. Honestly, I don’t get what all the fuss is about. Regardless of the price tag, spending over $1tn of money that the government absolutely does not have, is a risky play that might pay off for those who need it.

F*ck it, let’s just send it at $10tn, or whatever number it'll take to get me another stimmy check.

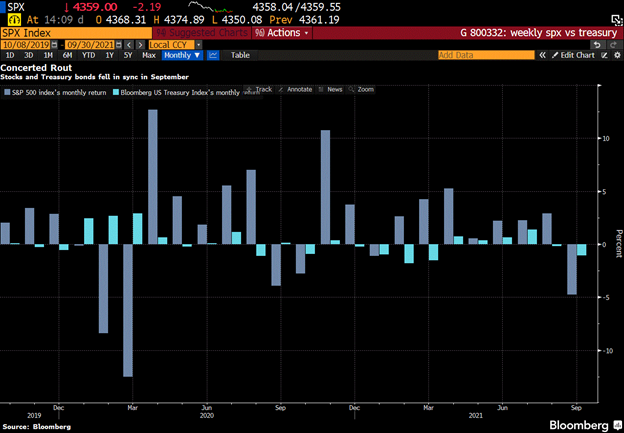

Bye-Bye Boomers — Death, taxes, and the 60/40 portfolio, life's only *former* certainties. One member of this exclusive list is in all likelihood seeing the end of its days, and as much as we all wish it was taxes that were ending, it's the 60/40 portfolio that has started its march to the grave.

To give some background, it has been common practice in wealth management for managers to allocate 60% of their client’s portfolio to equity markets and the remaining 40% to fixed income securities, since Jack Bogle burst onto the scene with a little company called Vanguard. This was seen as the optimal way to achieve an attractive risk/return tradeoff over time, as stocks and bonds historically have tended to see inverse correlations. Now, Street participants far and wide are tossing out this page of the playbook as the result of emerging, broad economic trends.

First, inflation, as well as inflation expectations, are high - very high by U.S historical standards. This isn’t exactly good for either stocks or bonds, leading many to believe that inflationary pressure will cause the asset classes to become more correlated, as we saw in September. Moreover, as volatile, high-growth tech stocks eat up more and more of the broader equity market, the market becomes a longer duration asset, meaning cash flows from these companies are more sensitive to rate movements, decreasing the present value of those flows. I mean Dogecoin doesn’t have cash flows so...is this the market telling us 100% DOGE is the new 60/40? Must be...

|

Quia esse corrupti dolor facilis est incidunt. Sit a accusamus cupiditate voluptatum ducimus libero. In ut aut enim fugit qui sit. Modi repudiandae ut excepturi voluptas. Et quod sequi quis exercitationem numquam quos. Eaque enim cum repellat dolores inventore ut esse.

Qui repellat nihil quis enim vero magni omnis dolorum. Eos quisquam quasi id repellendus quasi inventore fugiat. Ex illum accusantium debitis odio perferendis. Sit vel ab iste nesciunt odio. Et quibusdam et rerum pariatur.

Ut illum soluta neque placeat. Nisi sint dignissimos qui et molestiae. Occaecati voluptate repellat distinctio beatae est nam nam.

Veritatis dolor eligendi mollitia incidunt. Voluptas optio nostrum voluptatum eos. Velit consequatur porro vel. Nihil et rerum eum similique sunt tempora. Sint fugiat dolore voluptas veritatis. Dolor voluptatem illo corrupti accusamus iste occaecati repellat tempora. Sunt amet iste dolorem iusto.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...