|

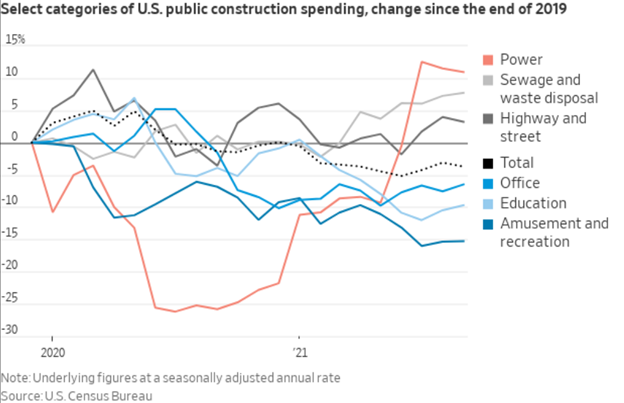

Infrastructure Week Forever — The need for improved American infrastructure has been discussed for decades, seemingly about as long as it took for the highly anticipated “bipartisan infrastructure bill” to pass through Congress. Officially titled the Infrastructure and Investment Jobs Act, colloquially referred to as “BIF”, and sometimes called “stupid and irresponsible” - whatever you want to call it - the passage of this bill through Congress means it will soon become law.

As a reminder, the total price tag for BIF comes in at $1.2tn, but does anyone remember what’s actually in it? I don’t, so let’s recap:

$150bn for roads, bridges, rail, public transit and other kinds of “traditional” infrastructure projects. According to the White House, this part of the bill alone is the largest investment in the interstate highway system since it began in the 1950s. Moreover, everyone in the country is all too aware of how sh*tty Amtrak and other rail systems are, so Biden is tossing them a quick $39bn to be able to manage and satisfy rider demand. Or, at least, to be less complete trash.

$65bn for improving American internet connection through broadband expansion. The bill requires internet service providers to offer low-cost options and will spur competition in underserved markets. Also notable, the White House included a permanent federal plan to ensure internet access for low-income households going forward.

$65bn to rebuild, revamp, and expand the national power grid.

$55bn to upgrade U.S. water infrastructure, with much focus around replacing currently existing lead pipe water delivery systems. Think about that - it’s 2021 and the world’s richest economy is still far too commonly drinking lead-laced water.

$25bn for airport improvement, $21bn in environmental cleanup, $17bn for other port upgrades, and $15bn to ready the nation for the EV age of the future. Phew, that’s a lotta cabbage.

|

Voluptas optio mollitia dolor aspernatur in ullam. Blanditiis eum eius exercitationem velit sunt.

Aut dolore vel eum accusamus quod deserunt id ut. Commodi dignissimos eum velit.

Consequatur quas eum tempore est quia et consequatur molestiae. Quis laboriosam porro vitae. Distinctio quibusdam ut et nesciunt tenetur est.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...