|

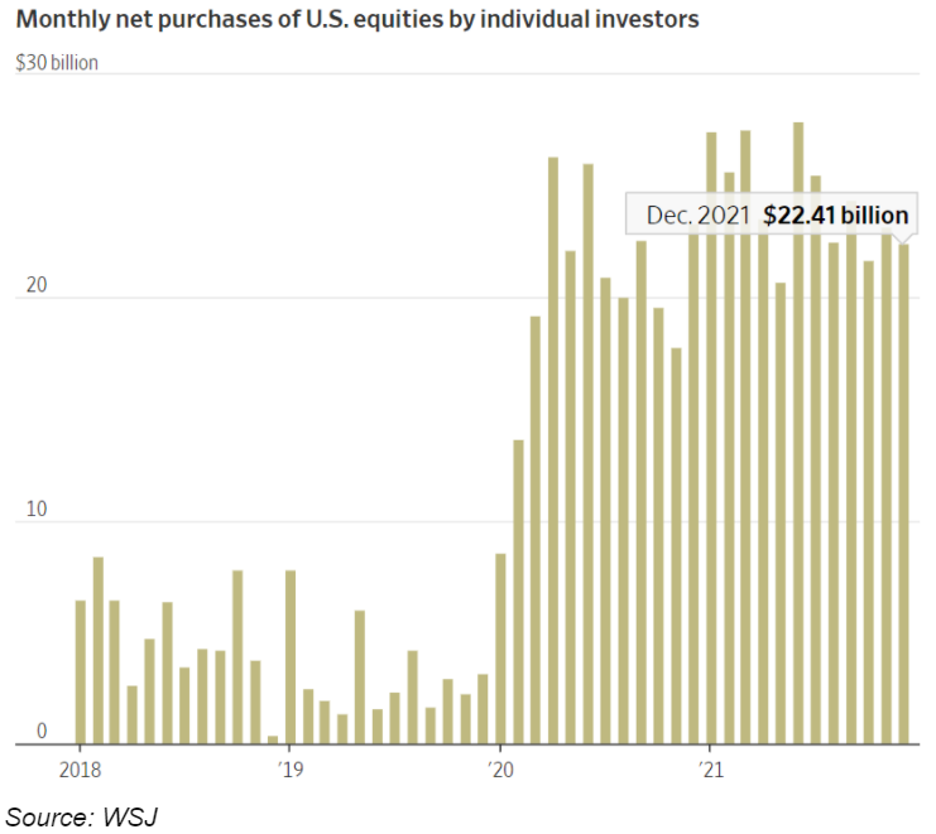

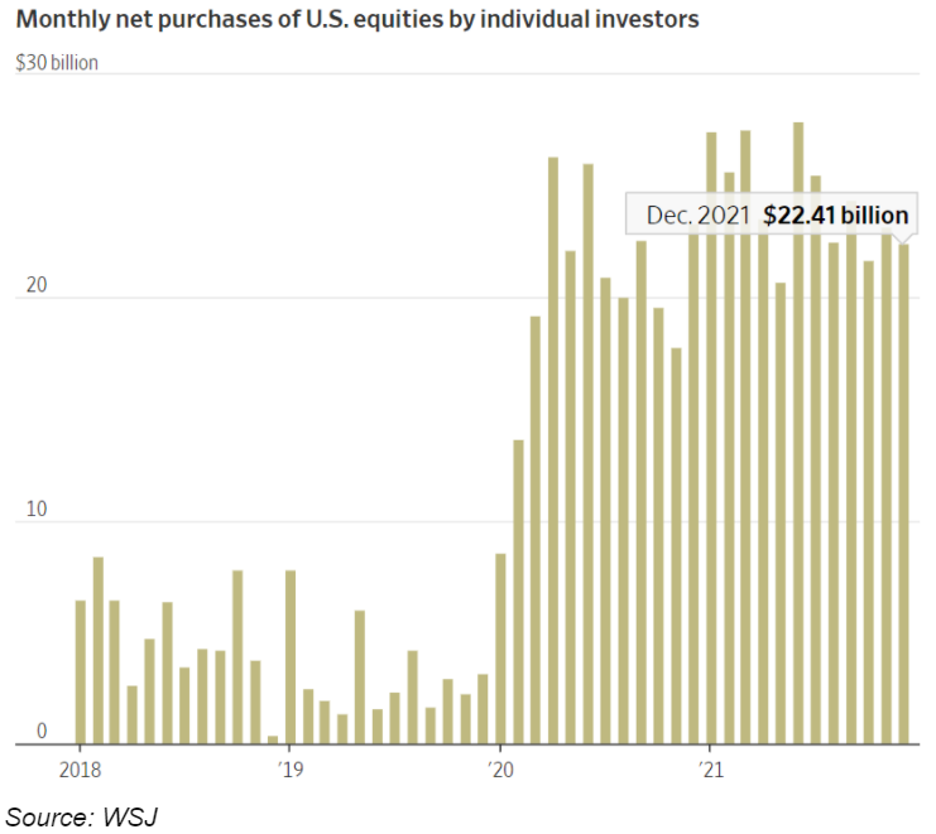

DeepF*ckingValue and His 25mm New Friends — Keith Gill, aka Roaring Kitty, aka DeepF*ckingValue, aka the King of Retail Traders, has amassed 25 million new friends since COVID-19 rolled up. That’s right, through a mix of volatility, boredom, excitement, and influencer inspiration, 25 million new brokerage accounts appeared in 2020 and 2021. From those, one thing is truer now than ever before: retail matters.

According to the WSJ and the analysis done by JMP Securities, an estimated 15 million new brokerage accounts were made in 2021. That’s a 33% increase from 2020 when everyone was debating if retail trading interest would last once more traditional forms of mass entertainment like sports and seeing friends were cool again. That debate was closed once Mr. Keith Gill and his legions of traders on r/WSB took centerstage.

One year ago, GameStop shares closed at $39.12 and would, in the next week, explode over 1,700% to a closing peak of $325. AMC sat at $2.97. Now, retail runs the market. Okay, not really, but compared to any other time in history, yes. On peak days in 2021, 40% of the daily equity volume was flows in and out of retail accounts. According to a Bloomberg survey, 85% of hedge funds and 42% of asset management firms analyze retail trading chat rooms to assess sentiment and attention and (probably) for some stock tips. J.P. Morgan, the suit-iest of banks, even said, “flow from retail is not something you can ignore.”

However, 2022 brings a different story. In addition to wondering whether retail would stick around when “real” entertainment came back, the question remains if retail traders can stomach a bear market. With the Nasdaq officially closing in correction territory on Wednesday (10% down from the recent high), we might find out soon.

The World Zigs, China Zags — While every other country and their mother is tightening monetary policy and raising rates, China just did the opposite. Never one to follow the crowd, the PBoC announced it had cut the nation’s 5-year loan prime rate, a benchmark for intermediate and longer-term rates like mortgages, to 4.6%. Granted, it was at 4.65% before, but hey, a cut is a cut.

And in this market, even a cut of 5bps will carry some large ripples. Other rates saw steeper cuts, like the 1-year loan prime rate, which was cut twice as much as the 5-year, going from 3.8% to 3.7%. It had been many moons since either rate was dropped by the PBoC, going back to April 2020 for the intermediate-term benchmark rate, but China is in a whole different ballpark than we in the US and other Western nations are.

For starters, growth is slowing. Thanks to property market troubles sparked by the infamous Evergrande, credit has been tighter, leading to a slowdown in the velocity of money and economic growth overall. A mild slowdown normally wouldn’t be too bad, but this is arguably the single most important year of President Xi’s rule. This fall, the National Congress of the CCP meets for the 20th time, with one of its main goals being to elect a leader as Xi’s second term will be up. Traditionally, Chinese leaders serve two terms of five years. In 2018, however, Xi conveniently removed the whole term limits thing, leading many to expect him to hold onto the reigns for a third term. Getting votes to do so will be a lot harder during an economic recession.

Don’t be surprised if China is a bit more relaxed than others when it comes to monetary and economic policy this year. Xi wants to remain at the helm of the CCP, and he wants it bad. Stay tuned to see how that plays out this fall.

|

A sed nostrum et vitae earum quibusdam. Enim eum ducimus quibusdam asperiores. Debitis eaque est et id quae. Ullam cum labore inventore nesciunt placeat quibusdam. Ea dolor voluptatem sit et.

Adipisci voluptate laborum vero ut consequatur sit. Aut dicta architecto nihil sit eius aspernatur. At ducimus ipsa laudantium eum. Reiciendis exercitationem nihil quis non sint id.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...