|

We Need Hamilton — Not the play, although that would be dope, we need the man himself. Alexander Hamilton, the nation's first Treasury Secretary, basically built the entire U.S Federal financial system with his own two hands. It’s at times like these, when the nation is on the brink of defaulting on its debt payments, we’d love to see him reincarnated. As of last week, the 78th Treasury Secretary Janet Yellen estimates the U.S will run out of cash to service its obligations by October 18th (aka, two weeks from today). This would be devastating.

Back in 2011, S&P downgraded the country’s credit rating to AA, meaning both Microsoft and Johnson & Johnson are more worthy creditors in their eyes. This downgrade led to an over 10% correction for several months. If the U.S were to default, you can bet that number will be much higher. Treasury bills are the most liquid and reliable financial instruments in the world, considered “risk free”, but a default could change all that. For one, the “risk free” and “full faith and credit” tag lines would be jeopardized if not all but destroyed.

Relying on Congress to fix anything isn’t something anyone wants to do, but it’s the position we’re in now. Like extending the debt ceiling, we’ll probably see this one come down to the wire too.

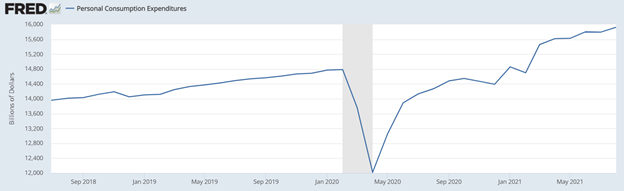

Con$umer $pending — “Shut up and take my money” was the motto of American consumers in August, as the nation’s countrymen increased consumption spend 0.8%. With the uptick in spending came another uptick in inflation as well, leading real consumer spending to grow only 0.4%. The difference may not sound like much, but having the growth reduced by half isn’t a pretty sight.

Economists say that going forward we may see increases in nominal consumer spending that translate into contractions for real spending, which is the number actually used as a GDP input. As consumption is ~60% of GDP, this isn’t exactly a buy signal on the U.S economy. The appreciation in wealth discussed recently, and wage increases doesn't mean anything if purchasing power is reduced, and right now, the boogeyman by the name of inflation is putting up a fight.

|

Aperiam sequi iusto voluptatem aliquid sed aut vero. Non hic illum nemo ea animi reprehenderit. Praesentium facere velit quo. Aspernatur eaque sed aut aut voluptatem iure.

Quaerat et accusamus perspiciatis itaque veritatis qui aut in. Ut et quia aliquam a sed natus rerum libero. Quia ducimus consectetur provident quidem. Eos rerum dolores quia ex.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...