Understanding mortgage calculation

Hi! I am trying to understand why lenders do not prefer prepayment and would really appreciate any help!

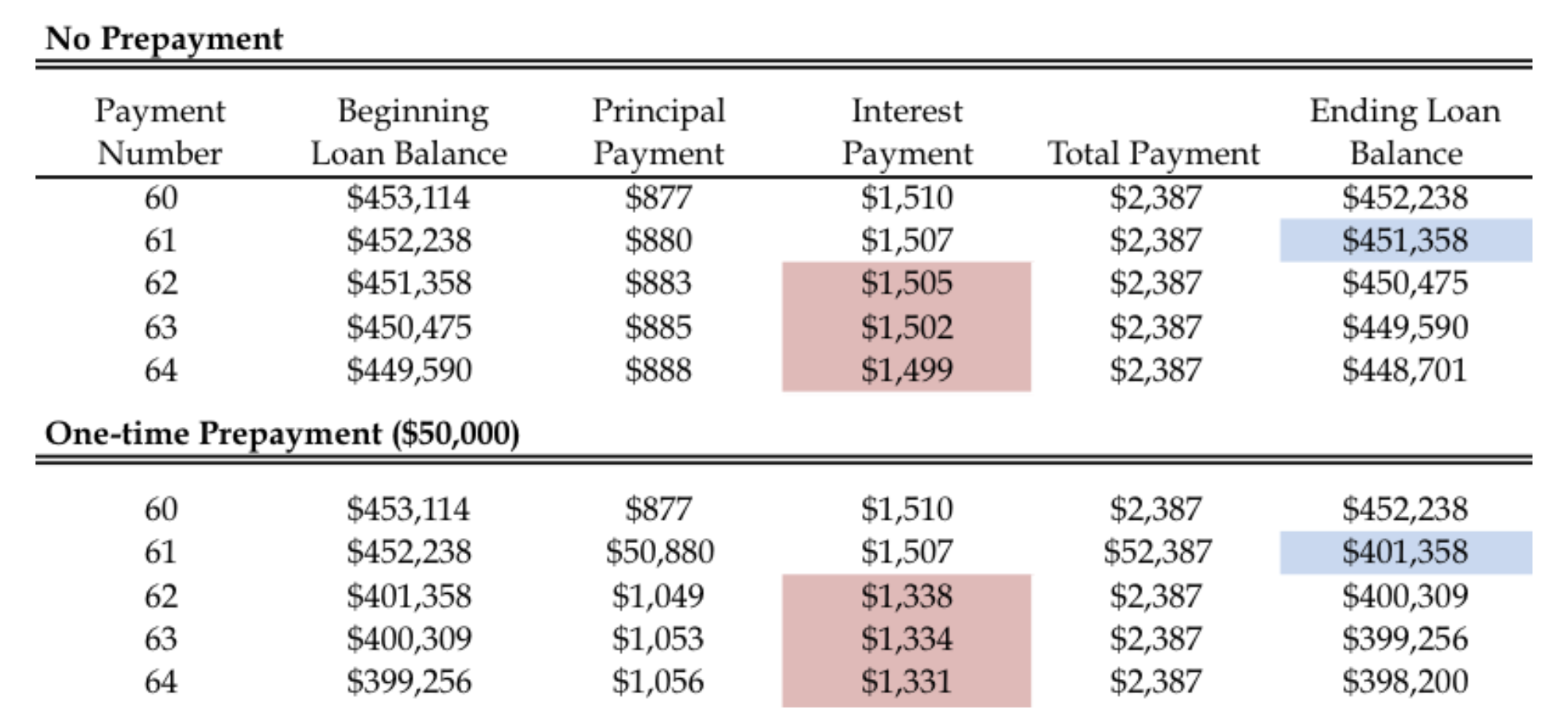

In this example, I understand that interest decreases over time since interest is based on beginning loan balance.

However, why does the principal payment increase over time to get the same total payment each time?

If that is the case, then why do we care how much we save on interest by prepaying if in the end the total payment added together is the same?

At the beginning of a fixed rate loans life, principal is a very small proportion of your overall payment. However, as you pay down principal (no matter how small), your interest rate payment will go down (as you are borrowing less principal). To keep the overall payment constant, you start prepaying the principal at an accelerated rate, which is the phenomena you are seeing in your calc.

Lenders do not like unscheduled prepayments, or prepayment options in general for that matter, which is why there is typically a lockout or penalty for prepayment options (primarily CRE loans). For both the residential and commercial loan markets (I.e. CMBS), your mortgage will be securitized and diced into different tranches and the payment stream will be split amongst several buyers (some will take the full payment, interest payment/IO/floater, some will take the principal payment/PO/discount bond). Lenders and these buyers rely on prepayment models (I.e. CPR) to predict and forecast their cash flow streams. Allowing borrowers to make unscheduled prepayments or payoffs make their investment less predictable.

The above is 100% correct...to add to that

That along with a prepayment also reduces your risk-adjusted return on capital. Its not profitable for a lender to lend money and have it be returned quicker than forecast.

For example, lets say I borrow $1,000,000 and at a simple annual interest rate of 5%. Annually, I am expecting $50,000 but lets say you want to pay it off in a month. $50,000/12 = $4,166.66. Now to make up the remaining $45,833.33 I have to find someone else to lend it to. Additional to that interest rates may fall...which might mean that my 5.00% return might not be achievable.

Deleniti omnis accusantium laborum labore. Consequatur dolorem asperiores iure. Quia quia qui id. Sed et sequi dolor libero. Ea nihil dicta veritatis et porro.

Corrupti et suscipit qui est quos aut et. Eius voluptas rerum aut atque totam. Molestiae sed architecto non iusto aut maiores est.

Assumenda veritatis est suscipit repudiandae amet quibusdam asperiores assumenda. Tempore dolores ea delectus quos quis ut. Aspernatur corporis vel quos numquam natus voluptas sunt. Illum blanditiis blanditiis quisquam.

Rem ea non dolor est eum hic aut. Minima rem eum dolor incidunt est.

See All Comments - 100% Free

WSO depends on everyone being able to pitch in when they know something. Unlock with your email and get bonus: 6 financial modeling lessons free ($199 value)

or Unlock with your social account...

Qui rem consequuntur voluptatem ut. Natus veniam quasi consequatur veritatis odit dolor harum. Dolorum sit voluptates fugit dolorem unde distinctio deserunt.

Molestias accusantium distinctio officia temporibus quia officia officia deleniti. In qui aut cum mollitia est iusto. Ut adipisci voluptas cupiditate dolorem alias. Quasi commodi aut nihil et eum est. Porro quam harum eum eos cupiditate.

Molestias nesciunt magni quos eos dolore nemo consequatur et. Voluptas eos et porro et sint excepturi et. Eligendi praesentium facere eos aliquid. Qui saepe ut sunt ratione velit vitae.